Copayment

A copayment or copay is a fixed amount for a covered service, paid by a patient to the provider of service before receiving the service. It may be defined in an insurance policy and paid by an insured person each time a medical service is accessed. It is technically a form of coinsurance, but is defined differently in health insurance where a coinsurance is a percentage payment after the deductible up to a ce…

What is the difference between Medicare coinsurance and copays?

The primary difference between coinsurance vs. copays is that copayments are a flat fee amount instead of a percentage. One way you can get some coverage for Medicare coinsurance is by purchasing Medicare Supplement Insurance.

Do you have to pay coinsurance for Medicare Part A?

You will have no copay for outpatient services that Medicare covers. But you will have to pay coinsurance of 20 percent of the Medicare-approved costs for services after you meet your yearly deductible – $233 in 2022. Medicare Advantage plans have to cover everything Medicare Part A and Part B cover.

What is copayment/coinsurance in drug plans?

Copayment/coinsurance in drug plans. Some Medicare Prescription Drug Plans have levels or " Tiers " of copayments/coinsurance, with different costs for different types of drugs. Usually, the amount you pay for a covered prescription is for a one-month supply of a drug. However, you can request less than a one-month supply for most types of drugs.

What is a Medicare copayment?

A Medicare copayment is a fixed, out-of-pocket expense that you have to pay for each medical service or item — such as a prescription you receive if you have a Medicare Advantage plan or a Medicare prescription drug plan. Your Medicare plan pays the rest of the cost for the service. Copayments are different from coinsurance.

What is the difference between a copayment and coinsurance?

Key Takeaways. A copay is a set rate you pay for prescriptions, doctor visits, and other types of care. Coinsurance is the percentage of costs you pay after you've met your deductible. A deductible is the set amount you pay for medical services and prescriptions before your coinsurance kicks in fully.

How does coinsurance work with Medicare?

Coinsurance is when you and your health care plan share the cost of a service you receive based on a percentage. For most services covered by Part B, for example, you pay 20% and Medicare pays 80%.

What is a Medicare copayment?

When you enroll in Medicare, you will owe various out-of-pocket costs for the services you receive. A copayment, or copay, is a fixed amount of money that you pay out-of-pocket for a specific service. Copays generally apply to doctor visits, specialist visits, and prescription drug refills.

What is the coinsurance amount for Medicare?

20 percentMedicare Part B coinsurance With Medicare Part B, after you meet your deductible ($203 in 2021), you typically pay 20 percent coinsurance of the Medicare-approved amount for most outpatient services and durable medical equipment.

Does Medicare pick up copays?

Medicare will normally act as a primary payer and cover most of your costs once you're enrolled in benefits. Your other health insurance plan will then act as a secondary payer and cover any remaining costs, such as coinsurance or copayments.

What happens when you meet your Medicare deductible?

After meeting the deductible, you'll usually have to pay 20 percent of the Medicare-approved costs for most doctor services, outpatient care and durable medical equipment — things such as wheelchairs or walkers your doctor may order for you.

What does the word coinsurance mean?

The percentage of costs of a covered health care service you pay (20%, for example) after you've paid your deductible. Let's say your health insurance plan's allowed amount for an office visit is $100 and your coinsurance is 20%. If you've paid your deductible: You pay 20% of $100, or $20.

What is the meaning of copayment?

What Is Copay or Copayment? A copay is a fixed out-of-pocket amount paid by an insured for covered services. It is a standard part of many health insurance plans. Insurance providers often charge co-pays for services such as doctor visits or prescription drugs.

What is the Medicare coinsurance rate for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61 st through 90 th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020).

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What percentage of coinsurance is required?

An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20% ). , these amounts may vary throughout the year due to changes in the drug’s total cost. The amount you pay will also depend on the.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay . (if the plan has one). You pay your share and your plan pays its share for covered drugs. If you pay. coinsurance. An amount you may be required to pay as your share ...

How much is Medicare Part B coinsurance?

With Medicare Part B, after you meet your deductible ( $203 in 2021), you typically pay 20 percent coinsurance of the Medicare-approved amount for most outpatient services and durable medical equipment.

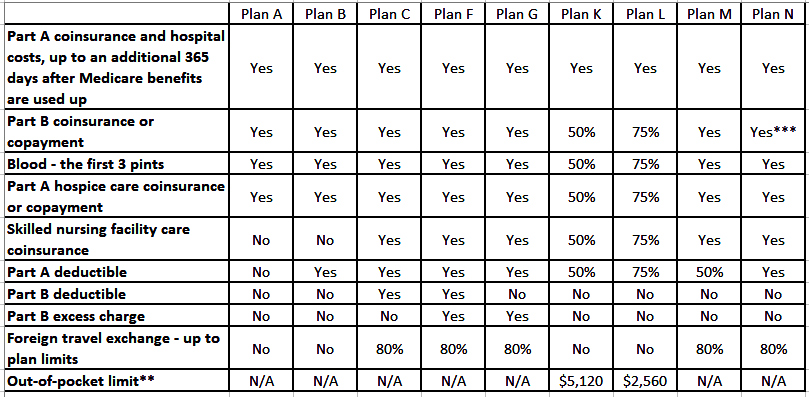

What is Medicare supplement?

Medicare supplement or Medigap plans cover various types of Medicare coinsurance costs. Here’s a breakdown of what Medigap plans cover in terms of Part A and Part B coinsurance. Plan A and Plan B cover: Part A coinsurance and hospital costs up to 365 days after you’ve used up your Medicare benefits. Part A hospice coinsurance.

How much will Medicare pay in 2021?

If you have Medicare Part A and are admitted to a hospital as an inpatient, this is how much you’ll pay for coinsurance in 2021: Days 1 to 60: $0 daily coinsurance. Days 61 to 90: $371 daily coinsurance. Day 91 and beyond: $742 daily coinsurance per each lifetime reserve day (up to 60 days over your lifetime)

What is Medicare Part B?

Medicare Part B. Medigap. Takeaway. Medicare coinsurance is the share of the medical costs that you pay after you’ve reached your deductibles. Although original Medicare (part A and part B) covers most of your medical costs, it doesn’t cover everything. Medicare pays a portion of your medical costs, and you’re responsible for the remaining amount.

What is coinsurance in Medicare?

Coinsurance. Unlike flat-fee copays, coinsurance is a percentage of the price of service you’ll pay. For example, after you have paid the Medicare Part B (medical insurance) deductible for the year ($198 in 2020), you will be required to pay 20 percent of each service covered by Part B, and Medicare pays the remaining 80 percent.

How much is Medicare coinsurance?

For Medicare Part A (hospital insurance), coinsurance is a set dollar amount that you pay for covered days spent in the hospital. Here are the Part A coinsurance amounts for 2020: Days 1 – 60: $0. Days 61 – 90: $352. Days 90 – lifetime reserve days: $704 per day until you have used up your lifetime reserve days ...

What is the copay for Part D?

Copays in Part D are when you pay a flat fee (for example, $10) for all drugs in a certain tier. Generic drugs usually have a lower copay amount than brand-name drugs. Coinsurance in Part D means that you pay a percentage of the drug’s cost (for example, 25 percent). Catastrophic coverage in Part D for 2020 is $6,350.

How much can you pay out of pocket with Medicare?

Original Medicare – No out-of-pocket limit. Medicare Advantage – No Medicare Advantage plan can have a maximum out-of-pocket limit higher than $6,700, but many plans charge the full $6,700 amount. Medigap – Some Medigap plans pay the Part A deductible and coinsurance so that your out-of-pocket costs don’t get too high.

What is the maximum out of pocket limit for healthcare?

The maximum out-of-pocket limit (MOOP) is the dollar amount beyond which your plan will pay for 100 percent of your healthcare costs. Copays and coinsurance payments go toward this limit, but monthly premiums do not. The 2020 maximum out-of-pocket limits are:

How much is catastrophic coverage for 2020?

Catastrophic coverage in Part D for 2020 is $6,350. Once you pay this amount out of pocket, you will pay the copay on your prescription drugs, or 5 percent coinsurance, whichever is greater. Read your benefits summary carefully to see how your plan handles copays, coinsurance, and deductibles so you won’t be hit with any surprises.

How much is Medicare Part B deductible?

A deductible is the money you will pay before your benefits kick in. For 2020, the Medicare Part B deductible is $198. This amount will be paid only once per year.

What is the difference between coinsurance and copays?

A deductible is a set amount you pay each year for your healthcare before your plan starts to share the costs of covered services . For example, if you have a $3,000 deductible, you have to pay $3,000 before your insurance kicks in fully.

Why are copays and coinsurance important?

Coinsurance and copays are both important terms for understanding the costs of health insurance. These and other out-of-pocket costs affect how much you'll pay for the healthcare you and your family receive.

What is copay deductible?

Coinsurance is the percentage of costs you pay after you've met your deductible. A deductible is the set amount you pay for medical services and prescriptions before your coinsurance kicks in. Out-of-pocket expenses are ...

How much is deductible for health insurance?

Health care costs such as copays, coinsurance, and premiums may be tax-deductible if they exceed 7.5% of your adjusted gross income. If your health care expenses exceed that threshold, the amount over 7.5% can be deducted.

How much does a copay cost?

Copays (or copayments) are set amounts you pay to your medical provider when you receive services. Copays typically start at $10 and go up from there, depending on the type of care you receive. Different copays usually apply to office visits, specialist visits, urgent care, emergency room visits, and prescriptions.

What is 80/20 coinsurance?

Your health insurance plan pays the rest. For example, if you have an "80/20" plan, it means your plan covers 80% and you pay 20%—up until you reach your maximum out-of-pocket limit. Still, coinsurance only applies to covered services.

What is out of pocket medical expenses?

Out-of-Pocket expenses are health care costs that are not covered by insurance, for example, if your spending has not yet reached your plan deductible. The out-of-pocket maximum is the maximum amount of out-of-pocket expenses you will have to pay in one year.

What is coinsurance insurance?

Coinsurance is your portion of costs for health care services after you’ve met your deductible. Once you reach the deductible, your health insurance plan will pick up a percentage of the health care costs and you’ll pay for the rest. An example is Affordable Care Act (ACA) plans.

What is copay in health insurance?

Copay is the amount you have to pay for every visit, such as a doctor's office or pharmacy. Health insurance plans charge lower rates for primary care physician than a specialist visit. Coinsurance is the amount that you and your insurance plan pay for the covered medical expenses until you reach out-of-pocket maximum.

What is premium insurance?

Premiums are what you pay to have health insurance, but out-of-pocket costs when you need health care services, including copays and coinsurance, can also reach into the thousands each year. Understanding copays, coinsurance, deductibles and out-of-pocket maxes can help you avoid unexpected medical bills. It can also help you budget ...

How much is a high deductible health plan?

Point of service (POS) health plans: $1,714. The IRS defines an HDHP as a plan with a deductible of at least $1,400 for an individual and $2,800 for a family. However, HDHP deductibles can be much higher.

How much does a copay cost?

Both copays for primary care and specialists usually cost well under $100.

What is 20% coinsurance?

Let’s say your health plan has 20% coinsurance. That portion of the bill is your responsibility. The insurer pays the other 80% of the coinsurance. So, if you’re hospitalized and the bill is $10,000, the health plan would pick up $8,000 and you’d be on the hook for $2,000.

When deciding on a health plan, do you want to review all costs?

When deciding on a health plan, you want to review all costs. Don’t just look at copays. You’ll want to also take into account a plan’s deductibles, coinsurance and out-of-pocket maximum.

What is coinsurance in Medicare?

Coinsurance is when you and your health care plan share the cost of a service you receive based on a percentage. For most services covered by Part B, for example, you pay 20% and Medicare pays 80%.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What would happen if Joe had a Medicare Advantage plan?

So, if Joe had a Medicare Advantage plan rather than Original Medicare in the example above, he might pay a $30 copay when he visited the doctor. Medicare Advantage is an alternative to Original Medicare (Parts A & B). It’s another way to get your Medicare benefits.

How much does Medicare pay for Joe?

Medicare pays 80% of the cost, which is $176. Joe pays 20% of the cost, which is $44. If Joe has a Medicare supplement insurance plan, his share of the cost might be covered by the plan.

Does Medicare Advantage have an out-of-pocket limit?

Medicare Advantage plans are required to set an out-of-pocket limit for plan members. There’s no out-of-pocket limit with Original Medicare. It’s your money, and it’s important to understand your Medicare costs and how they are calculated.

Does Joe have Medicare?

Joe has Original Medicare (Parts A & B), and he has already met his Part B deductible for the year. Joe’s doctor “accepts assignment,” meaning that she agrees to take the Medicare-approved amount—what Medicare says is appropriate—as full payment for her services.