| Modified Adjusted Gross Income (MAGI) | Part B monthly premium amount |

|---|---|

| Individuals with a MAGI above $170,000 and less than $500,000 Married couples with a MAGI above $340,000 and less than $750,000 | Standard premium + $374.20 |

What is the maximum income taxed for Medicare?

- When it comes to receiving Medicare benefits, there are no income restrictions.

- You may be asked to pay more money for a premium depending on your income.

- If you have a minimal income, you may be eligible for Medicare premium assistance.

How does Medicare calculate income?

How does Medicare calculate income? The majority of Medicare beneficiaries qualify for Medicare Part A coverage at no cost, depending their contribution through taxes while working over a period of time. For those who have paid Medicare taxes for under 40 quarters, a monthly premium is charged. In 2020, the premium may be as low as $252 for ...

What do I count as income for Medicaid?

- Your adjusted gross income (AGI) on your federal tax return

- Excluded foreign income

- Nontaxable Social Security benefits (including tier 1 railroad retirement benefits)

- Tax-exempt interest

- MAGI does not include Supplemental Security Income (SSI)

What income is used to determine Medicare premiums?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

What counts as income for Medicare premiums?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is Medicare calculated on gross or net income?

The adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.

What income is exempt from Medicare tax?

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

What is Medicare's look back period?

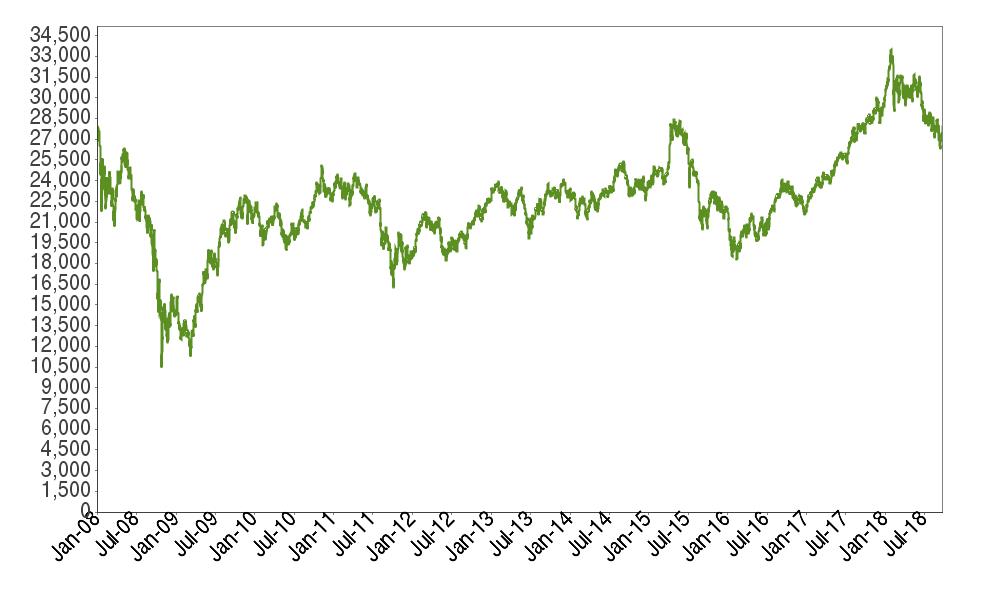

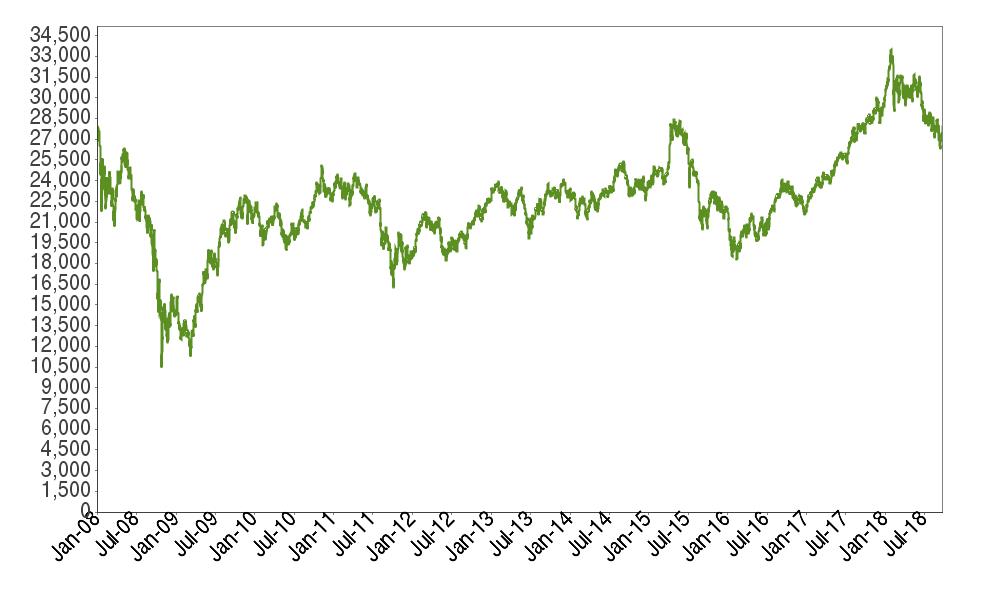

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, people with tax-reported incomes over $88,000 (single) and $176,000 (joint) must pay an income-related monthly adjustment amount for Medicare Part B and Part D premiums. Below are the set income limits and extra monthly costs you could pay for Medicare Part B and Part D based on your tax-reported income.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.

Do you have to factor in Medicare tax?

When you become eligible for Medicare and look at how much to budget for your annual health care costs, you’ll need to also factor in your tax-reported income.

Although Medicare eligibility has nothing to do with income, your premiums may be higher or lower depending on what you claim on your taxes

Unlike Medicaid, Medicare eligibility is not based on income. However, the income you report on your taxes does play a role in determining your Medicare premiums. Beneficiaries who have higher incomes typically pay a premium surcharge for their Medicare Part B and Medicare Part D benefits.

Who Has to Pay the Medicare Surcharge?

Higher-income beneficiaries face the IRMAA surcharge. In this case, "high earner" refers to anyone who claimed an income greater than $91,000 per year (filing individually OR married filing separately) or $182,000 per year (married filing jointly).

The Medicare Part B Premium

Medicare Part B covers inpatient services like doctor visits and lab work. The standard monthly Part B premium in 2022 is $170.10. This accounts for around 25 percent of the monthly cost for Part B, with the government (i.e. the Medicare program) paying the remaining 75 percent.

The Medicare Part D Premium

Original Medicare (Parts A and B) does not include prescription drug coverage. These benefits are available via a Medicare Part D prescription drug plan.

How Does Social Security Determine Whether You Pay Extra?

The Social Security Administration bases the IRMAA determination on federal tax return information received from the IRS. The adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.

What Does Modified Adjusted Gross Income Include?

According to Investopedia, your modified adjusted gross income is "your household's adjusted gross income with any tax-exempt interest income and certain deductions added back."

What If Your Income Went Down?

Income levels often fluctuate due to life-changing events, particularly once we retire. If one of the following applies to you AND it caused a permanent reduction in income, inform Social Security. (Temporary changes do not qualify as "life-changing events.")

Can you use federal taxable wages on a pay stub?

Notes. Federal Taxable Wages (from your job) Yes. If your pay stub lists “federal taxable wages,” use that. If not, use “gross income” and subtract the amounts your employer takes out of your pay for child care, health insurance, and retirement plans. Tips.

Does MAGI include SSI?

Tax-exempt interest. MAGI does not include Supplemental Security Income (SSI) See how to make an estimate of your MAGI based on your Adjusted Gross Income. The chart below shows common types of income and whether they count as part of MAGI.

Do you have to report health insurance changes to the marketplace?

Report income changes to the Marketplace. Once you have Marketplace health insurance, it’s very important to report any income changes as soon as possible. If you don’t report these changes, you could miss out on savings or wind up having to pay money back when you file your federal tax return for the year.

Is Marketplace Savings based on income?

Marketplace savings are based on total household income, not the income of only household members who need insurance. If anyone in your household has coverage through a job-based plan, a plan they bought themselves, a public program like Medicaid, CHIP, or Medicare, or another source, include them and their income on your application.

How much does Medicare pay for Part D?

If you earn more than $88,000 but less than $412,000, you’ll pay $70.70 on top of your plan premium. If you earn $412,000 or more, you’ll pay $77.10 in addition to your plan premium. Medicare will bill you for the additional Part D fee every month.

How much do you have to pay for Part B?

If this is the case, you must pay the following amounts for Part B: If you earn less than $88,000 per year, you must pay $148.50 per month. If you earn more than $88,000 but less than $412,000 per year, you must pay $475.20 per month.

What is SLMB in Medicare?

SLMB, or Specified Low-Income Medicare Beneficiary. If you earn less than $1,296 per month and have less than $7,860 in assets, you may be eligible for SLMB. Married couples must make less than $1,744 per month and have less than $11,800 in debt to qualify. This plan covers your Part B premiums.

What happens if you retire in 2020 and only make $65,000?

Loss of income from another source. If you were employed in 2019 and earned $120,000 but retired in 2020 and now only make $65,000 from benefits, you may want to challenge your IRMAA. To keep track of your income fluctuations, fill out the Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event form.

How much do you have to pay in taxes if you make more than $412,000 a year?

If you earn more than $412,000 per year, you’ll have to pay $504.90 per month in taxes. Part B premiums will be cut off directly from your Social Security or Railroad Retirement Board benefits. Medicare will send you a fee every three months if you do not receive either benefit.

What is the income limit for QDWI?

You must meet the following income criteria if you want to enroll in your state’s QDWI program: Individuals must have a monthly income of $4,339 or less and a $4,000 resource limit. A married couple’s monthly income must be less than $5,833. A married couple’s resource limit must be less than $6,000.

Is there a higher income limit for Medicaid in Hawaii?

The income limits are higher in Alaska and Hawaii for all programs. Furthermore, even if your income is slightly above the cap, you may be eligible for these programs if it comes from a job and benefits. If you believe you may qualify for Medicaid, contact the Medicaid office in your state.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

How much is Medicare Part B?

As of 2019, individuals who report earning more than $85,000 were required to pay more for Medicare Part B (Medical Insurance) premiums. This equates to $170,000 per year for married couples filing jointly. As income levels continue to rise above either $85,000 or $170,000, there is an increase in premium payments for Part B.

What other sources of income count as income?

These forms of income may include capital gains, revenue from a rental property or residual payments for previous works.

Is Social Security income taxed?

In simple cases, Social Security benefits are not taxed and are not counted as income by the Internal Revenue Service (IRS). This means that if Social Security payments are the only means by which an individual subsides, he or she does not need to report the payments as income, and these payments should not effect eligibility for medical benefit ...