Medicare is the federal health insurance program for:

- People who are 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is Medicare, and what does it cover?

Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Medicare Part D (prescription drug coverage)

What is the difference between Medicare and medical insurance?

Medicare ensures that older Americans and people with disabilities have access to health care. It protects against illness-related financial insecurity. It is “insurance” because it pools risk. It is “social” because it protects members of society who …

What are the types of Medicare insurance?

Nov 16, 2021 · Medicare Part A. This is considered hospital insurance and covers inpatient stays in hospitals and nursing facilities. Medicare Part B. …

Is Medicare a good insurance?

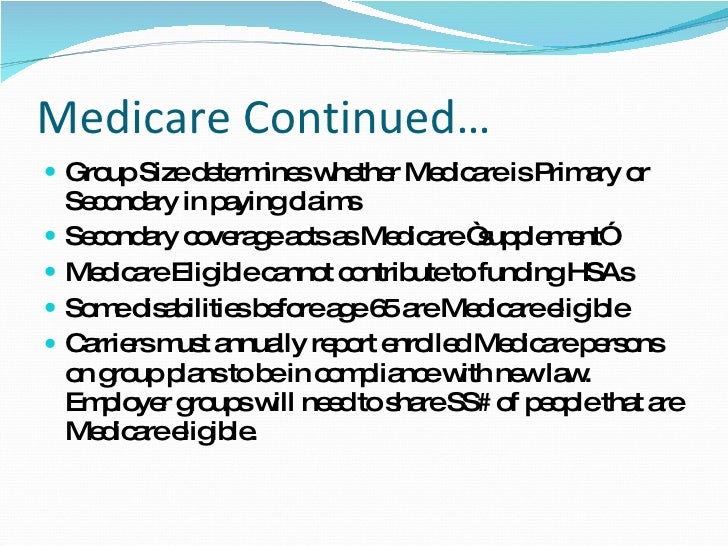

Sep 13, 2021 · Whether you have group insurance through the company you work for or your spouse’s employer, Medicare is your secondary coverage when the employer has more than 20 employees. Some Medicare beneficiaries will choose to delay their Part B enrollment if their group coverage is cheaper.

What kind of insurance is Medicare?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

How do I know if my insurance is Medicare?

You will know if you have Original Medicare or a Medicare Advantage plan by checking your enrollment status. Your enrollment status shows the name of your plan, what type of coverage you have, and how long you've had it. You can check your status online at www.mymedicare.gov or call Medicare at 1-800-633-4227.

Is Blue Shield Medicare?

Blue Shield of California is an HMO and PDP plan with a Medicare contract. Enrollment in Blue Shield of California depends on contract renewal.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is Medicare Part A and B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers. Outpatient care.

What is not covered by Medicare?

Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.Jun 24, 2021

What is plan G extra?

Plan G Extra provides members with up to $100 off of CVS Health over-the-counter products each quarter. Eligible items include cold and allergy medicines, first-aid products, and pain relievers.Sep 23, 2019

What is Blue Shield plan G extra?

Effective 1/1/2020, Blue Shield of California will introduce a new Medicare Supplement plan – Plan G Extra. This plan includes four new supplemental benefits: Hearing Aid, Vision (non-Medicare-covered), Telehealth, and Over-the-Counter (OTC) items.

Which company has the best Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

Are there different levels of Medicare?

There are four types of Medicare: A, B, C, and D. Part A covers payments for treatment in a medical facility. Part B covers medical services including doctor's visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatments.

What is the difference between Medicare Part C and Part D?

Medicare part C is called "Medicare Advantage" and gives you additional coverage. Part D gives you prescription drug coverage.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How Do Medicare Supplement (Medigap) Plans Work With Medicare?

Medigap plans supplement your Original Medicare benefits, which is why these policies are also called Medicare Supplement plans. You’ll need to be...

What Types of Coverage Are Not Medicare Supplement Plans?

As a Medicare beneficiary, you may also be enrolled in other types of coverage, either through the Medicare program or other sources, such as an em...

What Benefits Do Medicare Supplement Plans Cover?

Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible vers...

What Benefits Are Not Covered by Medicare Supplement Plans?

Medigap policies generally do not cover the following health services and supplies: 1. Long-term care (care in a nursing home) 2. Routine vision or...

Additional Facts About Medicare Supplement Plans

1. You must have Medicare Part A and Part B to get a Medicare Supplement plan. 2. Every Medigap policy must be clearly identified as “Medicare Supp...

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.

What is a small employer?

Those with small employer health insurance will have Medicare as the primary insurer. A small employer means less than 20 employees in the company. When you have small employer coverage, Medicare will pay first, and the plan pays second. If your employer is small, you must have both Part A and Part B. Having small employer insurance without ...

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Does tricare cover prescriptions?

But, Part D isn’t a requirement. Also, TRICARE covers your prescriptions. Your TRICARE will be similar to a Medigap plan; it covers deductibles and coinsurances. You have 90 days from your Medicare eligibility date to change your TRICARE plan.

Is Medicare hard to understand?

Medical billing personnel can always help you figure it out if you're having trouble. While it's not hard to understand primary insurance, Medicare is its own beast. If you're sick of being alone in trying to figure out the difference in plan options, give us a call at the number above.

Is Medicare a primary or secondary insurance?

Mostly, Medicare is primary. The primary insurer is the one that pays the claim first, whereas the secondary insurer pays second. With a Medigap policy, the supplement is secondary. Medicare pays claims first, and then Medigap pays. But, depending on the other policy, you have Medicare could be a secondary payer.

What is Medicare Part A coinsurance?

Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood. Medicare Supplement Plan A is the most basic of the standardized, ...

What are the benefits of Medicare Supplement?

All Medicare Supplement plans typically cover: 1 Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted 2 Some or all of your Medicare Part B coinsurance 3 Some or all of your Part A hospice coinsurance 4 Some or all of your first three pints of blood

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are optional plans sold by private insurers that offer some coverage for certain out-of-pocket Medicare costs , such as coinsurance, copayments and deductibles.

What is coinsurance in Medicare?

Coinsurance is the percentage of a medical bill that you (the Medicare beneficiary) may be responsible for paying after reaching your deductible. Coinsurance is a form of cost-sharing; it's a way for the cost of care to be split between you and your provider. The deductible is the amount you are required to pay in a given year or benefit period ...

How much is Medicare Part B 2021?

Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth of Part B-covered services for the year. After reaching his Part B deductible, the remaining $97 of his bill is covered in part by Medicare, though John will be required to pay a coinsurance cost. Medicare Part B requires beneficiaries ...

Does Medigap cover coinsurance?

In exchange for paying a monthly premium to belong to the plan, a Medigap plan can help cover the cost of your Medicare coinsurance and/or your deductibles. If John from our above example had a Medigap plan that covered his Part B deductible and coinsurance, he may have owed nothing for his doctor’s appointment.

What is a copayment in Medicare?

Copayment, or copay, is another term you’ll see used in relation to Medicare cost-sharing . A copay is like coinsurance, except for one difference: While coinsurance typically involves a percentage of the total medical bill, a copayment is generally a flat fee. For example, Part B of Medicare uses coinsurance, which is 20 percent in most cases.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. , and the Part B.

What is Medicare assignment?

assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance. you pay 20% of the. Medicare-Approved Amount.

What are the requirements for DME?

DME meets these criteria: 1 Durable (can withstand repeated use) 2 Used for a medical reason 3 Not usually useful to someone who isn't sick or injured 4 Used in your home 5 Generally has an expected lifetime of at least 3 years

What percentage of Medicare payment does a supplier pay for assignment?

If your supplier accepts Assignment you pay 20% of the Medicare-approved amount, and the Part B Deductible applies. Medicare pays for different kinds of DME in different ways. Depending on the type of equipment:

What happens if you live in an area that's been declared a disaster or emergency?

If you live in an area that's been declared a disaster or emergency, the usual rules for your medical care may change for a short time. Learn more about how to replace lost or damaged equipment in a disaster or emergency .

Does Medicare cover DME equipment?

You may be able to choose whether to rent or buy the equipment. Medicare will only cover your DME if your doctors and DME suppliers are enrolled in Medicare. Doctors and suppliers have to meet strict standards to enroll and stay enrolled in Medicare.

What is commercial health insurance?

Commercial health insurance is health insurance provided and administered by non-governmental entities. It can cover medical expenses and disability income for the insured.

Is health insurance a non profit?

Some insurance programs are operated as non-profit enti ties, often as an affiliated or regional operation of a larger, for-profit enterprise. Health insurance in the commercial market is commonly obtained through an employer. Since employers typically cover at least a portion of the cost, this is often a cost-effective way for employees ...

How is health insurance funded?

Health insurance provided and/or administered by the government is mainly funded through taxes and is geared towards the disadvantaged (e.g., low-income people and disabled persons), seniors, military personnel, and federally recognized Native American tribal members.

Who is Tom Catalano?

Tom Catalano holds the coveted CFP® designation from The Certified Financial Planner Board of Standards in Washington, DC, and is a Registered Investment Adviser with the state of South Carolina.

What is creditable coverage?

Creditable coverage is a health benefit, prescription drug, or health insurance plan—including individual and group health plans—that meet a minimum set of qualifications . Creditable coverage is a measure used to figure out if policyholders must pay late enrollment penalties or, in some cases, coverage and costs associated ...

What is grandfathered health insurance?

A grandfathered individual health insurance policy is one that you bought for yourself or your family on or before March 23, 2010, that has not been changed in certain ways that reduce benefits or increase costs to consumers. 8 .

What are the benefits of a syringe?

You may have creditable coverage through a current or former employer, trade union, or one of the following: 6 1 Federal Employee Health Benefits (FEHB) Program 2 Veterans' Benefits 3 TRICARE (military health benefits) 4 Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) 5 Indian Health Services

What is FEHB in health insurance?

Federal Employee Health Benefits (FEHB) Program. Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) You also might have creditable coverage if you get health insurance coverage through your spouse's employer or if you’re on a COBRA plan. 6 .

Can pre-existing conditions be excluded from health insurance?

Some people with pre-existing conditions may find that their conditions are excluded from their health insurance plan coverage, although this is no longer the norm thanks to the Affordable Care Act (ACA). Some policies still allow insurers to apply an exclusion period to these conditions, which increase the costs for which you are responsible.

Is Medicare Part D coverage creditable?

This disclosure provides Medicare-eligible beneficiaries with important information relating to their Medicare Part D enrollment and is mandatory whether the insurer is primary or secondary to Medicare. If the policyholder’s coverage is considered creditable, they may be eligible for subsidies.

How long will Medicare be cut?

Per the Budget Control Act, $1.2 trillion in federal spending cuts must be achieved over the period of nine years. Unless changes are made by Congress, Medicare Sequestration will limit federal spending until 2022. Only time will tell if the cuts made to Medicare reimbursement will continue until 2022.

What was the Medicare cut in 2013?

Under these budget cuts, any claim received by Medicare after April 1, 2013 was subject to a 2 percent payment cut. Any drugs that were administered as part of the claim were also reimbursed with a 2 percent cut implemented.

What is Medicare sequestration?

Medicare sequestration is a penalty created during The Budget Control Act of 2011. Medicare sequestration was made to create savings and prevent further debt, but it had some negative repercussions on hospitals, physicians, and health care. Beneficiaries are not responsible for the price difference caused by the sequestration.

What was the budget control act?

The Budget Control Act required half of the budget savings must be acquired through defense spending cuts. Providers were limited to a 2 percent reduction in reimbursement. This meant that most money needed to meet budget needs had to be obtained through domestic discretionary programs.

Is chemo covered by Medicare?

Chemo is administered in a clinical setting by a physician, so it is a covered charge under Medicare Part B. Part B drugs are subject to a 2 percent reduction, which made it impossible for some expensive chemotherapy sessions to be canceled or moved to facilities that could absorb the loss in payment.