Full Answer

What is Medicare primary insurance and how does it work?

As we mentioned above, Medicare Primary insurance simply means that Medicare pays first and any other insurance pays secondary. Medicare pays first or second depending on what types of other health coverage you have. Some people have no other coverage so Medicare becomes primary by default.

How does secondary insurance pay for Medicare?

Usually, secondary insurance will only pay if the primary insurance paid its portion first. Listen to this Podcast Episode Now! If your employer has fewer than 20 employees, Medicare will be your primary coverage and the employer coverage will be your secondary coverage.

Which health insurance plans are considered primary?

Medicare and a private health plan -- Medicare would be considered primary if the employer has 100 or fewer employees. A private insurer is primary if the employer has more than 100 employees.

What is the difference between primary insurance and secondary insurance?

The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

Is Medicare considered primary or secondary?

Even if you have a group health plan, Medicare is the primary insurer as long as you've been eligible for Medicare for 30 months or more.

How do you determine which health insurance is primary?

If you have Medicare and other health insurance or coverage, each type of coverage is called a "payer." When there is more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" to pay.

Is Medicare considered primary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Is my insurance primary or secondary?

Primary insurance: the insurance that pays first is your “primary” insurance, and this plan will pay up to coverage limits. You may owe cost sharing. Secondary insurance: once your primary insurance has paid its share, the remaining bill goes to your “secondary” insurance, if you have more than one health plan.

Does Medicare automatically forward claims to secondary insurance?

If a Medicare member has secondary insurance coverage through one of our plans (such as the Federal Employee Program, Medex, a group policy, or coverage through a vendor), Medicare generally forwards claims to us for processing.

What primary insurance means?

Primary insurance is health insurance that pays first on a claim for medical and hospital care. In most cases, Medicare is your primary insurer.

Is Medicare Part D always primary?

Usually Medicare Part D coverage pays first. For example: Are you retired and have prescription drug coverage through your or your spouse's former employer's or union's retiree Group Health Plan and Medicare Part D coverage? If so, your Medicare Part D coverage is primary and the Group Health Plan is secondary.

How do you make Medicare primary?

Making Medicare Primary. If you're in a situation where you have Medicare and some other health coverage, you can make Medicare primary by dropping the other coverage. Short of this, though, there's no action you can take to change Medicare from secondary to primary payer.

Does Medicare Secondary cover primary copays?

Medicare is often the primary payer when working with other insurance plans. A primary payer is the insurer that pays a healthcare bill first. A secondary payer covers remaining costs, such as coinsurances or copayments.

How does it work when you have two insurances?

When you have two forms of health insurance coverage, your primary insurance pays the first portion of the claim up to your coverage limits. Your secondary insurance may pick up some or all of the remaining costs. However, you still might be responsible for some cost-sharing.

Can I have 2 health insurance policies?

Individuals can buy multiple health insurance plans from different service providers. This is a great way to diversify across insurers and benefit from their coverage policies. Moreover, claims are settled as per the contribution clause, when the claim is higher than the sum insured for one policy.

When a patient is covered through Medicare and Medicaid which coverage is primary?

Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. pays second. Medicaid never pays first for services covered by Medicare. It only pays after Medicare, employer group health plans, and/or Medicare Supplement (Medigap) Insurance have paid.

What is the difference between Medicare and Medicaid?

Eligible for Medicare. Medicare. Medicaid ( payer of last resort) 1 Liability insurance only pays on liability-related medical claims. 2 VA benefits and Medicare do not work together. Medicare does not pay for any care provided at a VA facility, and VA benefits typically do not work outside VA facilities.

Is Medicare a secondary insurance?

When you have Medicare and another type of insurance, Medicare is either your primary or secondary insurer. Use the table below to learn how Medicare coordinates with other insurances. Go Back. Type of Insurance. Conditions.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

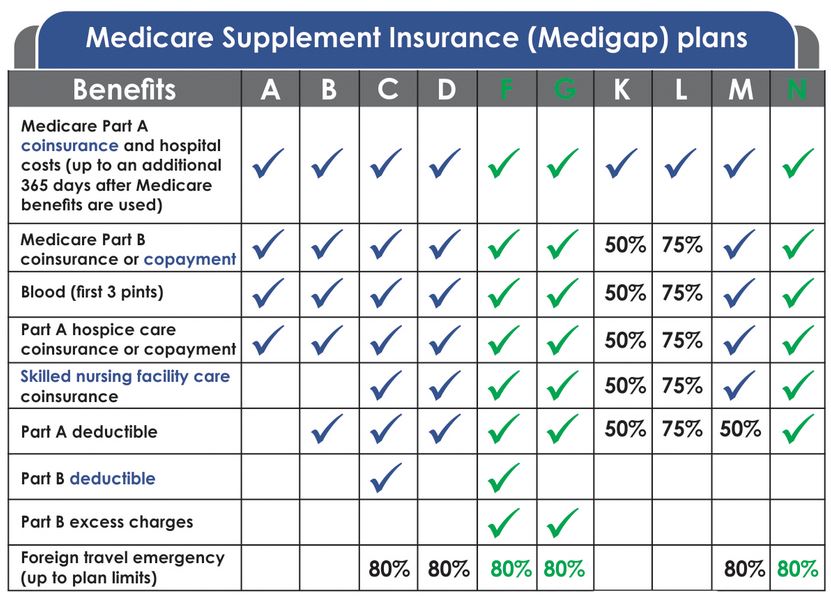

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What does primary and secondary payer mean?

Each type of coverage you have is called a “payer.” When you have more than one payer, there are rules to decide who pays first, called the coordination of benefits. The “primary payer” pays what it owes on your bills first and sends the remaining amount to the second or “secondary payer.” There may also be a third payer in some cases. 1

When is Medicare primary or secondary?

A number of things can affect when Medicare pays first. The following chart explains some common scenarios. 3 For information on several other scenarios, check out how Medicare works with other insurance , opens new window .

How does Medicare know if I have other coverage?

Medicare doesn’t automatically know if you have other coverage. But your insurers must report to Medicare when they’re the primary payer on your medical claims.

Where to get more details

If you have additional questions about who pays your Medicare bills first, contact your insurance provider or call Medicare’s Benefits Coordination & Recovery Center (BCRC) at 855-798-2627 (TTY: 855-797-2627).

What does it mean when Medicare is primary?

When Medicare is Primary. Primary insurance means that it pays first for any healthcare services you receive. In most cases, the secondary insurance won’t pay unless the primary insurance has first paid its share. There are a number of situations when Medicare is primary.

What is secondary insurance?

Secondary insurance pays after your primary insurance. It serves to pick up costs that the primary coverage didn’t cover. For example, if your primary insurance has a $1000 deductible, but your secondary insurance has a $500 deductible, your secondary would kick in to pay $500 of that $1000 bill.

What is the term for a former employer providing health insurance for you after you are no longer working?

You Have Retiree Coverage or COBRA. Sometimes a former employer provides group health insurance coverage for you AFTER you are no longer working. This is called retiree coverage. Medicare is primary and your providers must submit claims to Medicare first. Your retiree coverage through your employer will pay secondary.

How long does employer insurance last?

Your employer insurance from any current job is primary for the first 30 months. This applies to current employer coverage as well as retiree insurance and COBRA. Medicare will pay secondary in all of these situations if you have ESRD.

When does Medicare end for ESRD?

You would then re-enroll when you turn 65. Typically Medicare due to ESRD will end 36 months after you’ve had your kidney transplant unless you also qualify for Medicare due to age or other disability.

Does Medicare expect you to know who is primary?

Medicare Expects YOU to Know Who is Primary. In our example above, Patricia didn’t realize that since her employer has less than 20 employees, Medicare would be her primary coverage. By failing to enroll in Medicare, she was now responsible for paying for the cost of that MRI.

Is Medicare primary or secondary?

Then of course there is employer coverage. If you have active employer coverage, whether Medicare is primary or secondary also depends on the size of the insurance company.