A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met.

What is a medicare copay?

Jan 20, 2022 · A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met.

Does Medigap have a copay?

Jul 07, 2021 · Medicare copays are extra fees you pay to healthcare providers. We explain when you may have a copay, where to find help paying for these fees, and more.

Can I get financial assistance to pay my Medicare copays?

Nov 17, 2021 · Medicare copay. Many Medicare Advantage plans require that you pay a copay when you see a doctor. This is a fixed cost — and an alternative to Original Medicare’s 20 percent coinsurance. Premiums. As noted above, the average monthly premium for Medicare Advantage plans with drug coverage is $60.96 per month in 2022.

How much do Medicare copayments cost?

A Medicare copayment is a fixed, out-of-pocket expense that you have to pay for each medical service or item — such as a prescription you receive if you have a Medicare Advantage plan or a Medicare prescription drug plan. Your Medicare plan pays the rest of the cost for the service. Copayments are different from coinsurance. If you have Original Medicare, you typically don’t …

Does Medicare supplement pay copays?

What is your copay with Medicare?

What does Medicare supplemental coverage cost?

Do Medicare Advantage plans cover the 20% copay?

Is there a copay for Medicare Part B?

What does Rx copay mean?

What is the difference between a Medicare Supplement and a Medicare Advantage Plan?

Why are Medicare Supplement plans so expensive?

What is the deductible for Plan G in 2022?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What are the negatives of a Medicare Advantage plan?

What is the Medicare Part B premium for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is a copay in Medicare?

A copayment, or copay, is a fixed amount of money that you pay out-of-pocket for a specific service. Copays generally apply to doctor visits, specialist visits, and prescription drug refills. Most copayment amounts are in ...

What is Medicare Supplement?

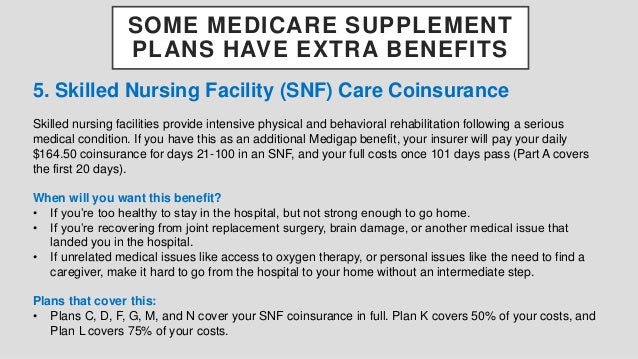

Medicare supplement (Medigap) Under Medigap, you are covered for certain costs associated with your Medicare plan, such as deductibles, copayments, and coinsurance amounts . Medigap plans only charge a monthly premium to be enrolled, so you will not owe a copay for Medigap coverage.

Who wrote the 2021 Medicare update?

Medically reviewed by Ayonna Tolbert, PharmD — Written by Eleesha Lockett, MS — Updated on July 7, 2021. Medicare parts and copays. Cost. Eligibility. Enrollment. Takeaway. Medicare is a government-funded health insurance option for Americans age 65 and older and individuals with certain qualifying disabilities or health conditions.

What is Medicare for 65?

Cost. Eligibility. Enrollment. Takeaway. Medicare is a government-funded health insurance option for Americans age 65 and older and individuals with certain qualifying disabilities or health conditions. Medicare beneficiaries are responsible for out-of-pocket costs such as copayments, or copays for certain services and prescription drugs.

What is Medicare for seniors?

Takeaway. Medicare is a government-funded health insurance option for Americans age 65 and older and individuals with certain qualifying disabilities or health conditions . Medicare beneficiaries are responsible for out-of-pocket costs such as copayments, or copays for certain services and prescription drugs.

How much is Medicare Part A 2021?

You’ll have the following costs for your Part A services in 2021: monthly premium, which varies from $0 up to $471. per benefits period deductible, which is $1,484. coinsurance for inpatient visits, which starts at $0 and increases with the length of the stay.

Does Medicare Part A have coinsurance?

coinsurance for inpatient visits, which starts at $0 and increases with the length of the stay. These are the only costs associated with Medicare Part A, meaning that you will not owe a copay for Part A services.

What are the out-of-pocket costs of Medicare?

Medicare Advantage out-of-pocket costs can include: 1 Medicare Part B premium#N#Even under Medicare Advantage, you must still pay your Part B premium (unless your plan helps pay for it). The standard Part B premium in 2021 is $148.50 per month. 2 Deductibles#N#Some plans require you to meet a deductible when seeing doctors, visiting hospitals, or getting your drugs filled. 3 Medicare copay#N#Many Medicare Advantage plans require that you pay a copay when you see a doctor. This is a fixed cost — and an alternative to Original Medicare’s 20 percent coinsurance. 4 Premiums#N#As noted above, the average monthly premium for Medicare Advantage plans with drug coverage is $33.57 per month in 2021.

What are the benefits of Medicare Advantage?

Many are likely drawn to the unique benefits of Medicare Advantage, as compared with Original Medicare: 1 Medicare Advantage plans may often include additional benefits for prescription drugs, dental care, and vision care. 2 The average premium for a Medicare Advantage plan that offers prescription drug coverage is $33.57 per month in 2021. 2 Some plans may not have a monthly premium, and some may even help pay you back for your Medicare Part B premium. 3 Medicare Advantage, unlike Original Medicare, comes with an out-of-pocket limit, which means your out-of-pocket spending will be capped. 4 While plans are offered by private insurers, you are still guaranteed the benefits of Original Medicare.

Does Medicare Advantage pay copays?

People enrolled in Medicare Advantage or Medicare Part D prescription drug plans may pay copayments, but the amount will depend on the plan provider’s rules. Each private insurer can determine the amount of copayment they will charge. Medicare Advantage policies have an out-of-pocket maximum, which means that once a person has paid ...

What is a copay?

A copayment, which people sometimes refer to as a copay, is a specific dollar amount that a person must pay directly to a healthcare provider at the time of receiving a service.

Do Medicare copayments change?

Do copayments change? All Medicare parts have out-of-pocket costs, which may include copayments. Other out-of-pocket costs may also apply, but some people will be eligible for help with covering these expenses. People enrolled in Medicare will have some out-of-pocket costs for treatments and services.

Does Medicare have out-of-pocket costs?

Summary. All Medicare parts have out-of-pocket costs, which may include copayments. Other out-of-pocket costs may also apply, but some people will be eligible for help with covering these expenses. People enrolled in Medicare will have some out-of-pocket costs for treatments and services. For example, Medicare Part A has a copayment ...

What is Medicare Parts and Plans?

Medicare parts and plans have out-of-pocket costs that a person must pay toward eligible healthcare treatments, services, and items.

What is a deductible for Medicare?

A deductible is a set amount that a person must pay before their plan starts to cover expenses. A person must pay the plan deductible in full before coinsurance and copayments apply to eligible costs. Medicare Part A and Part B have deductibles. Other Medicare plan options may also have a deductible, but these can vary depending on ...

What is the maximum out of pocket limit for Medicare 2021?

The maximum out-of-pocket limit in 2021 is $7,550. After a person has paid this much in deductibles, copayments, and coinsurance, the plan pays 100% of the costs. Original Medicare has no out-of-pocket maximum.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What is a copay for emergency room?

What is the Copay for Medicare Emergency Room Coverage? A copay is the fixed amount that you pay for covered health services after your deductible is met. In most cases, a copay is required for doctor’s visits, hospital outpatient visits, doctor’s and hospital outpatients services, and prescription drugs. Medicare copays differ from coinsurance in ...

What are the services covered by Medicare?

Most ER services are considered hospital outpatient services, which are covered by Medicare Part B. They include, but are not limited to: 1 Emergency and observation services, including overnight stays in a hospital 2 Diagnostic and laboratory tests 3 X-rays and other radiology services 4 Some medically necessary surgical procedures 5 Medical supplies and equipment, like splints, crutches and casts 6 Preventive and screening services 7 Certain drugs that you wouldn't administer yourself

Does Medicare cover hospital stays?

If you are admitted for inpatient hospital services after an emergency room visit, Medicare Part A does help cover costs for your hospital stay. Medicare Part A does not cover emergency room visits that don't result in admission for an inpatient hospital stay.

What is the OPPS payment?

The OPPS pays hospitals a set amount of money (or payment rate) for the services they provide to Medicare beneficiaries. The payment rate varies from hospital to hospital based on the costs associated with providing services in that area, and are adjusted for geographic wage variations.

How much is the deductible for Medicare Part B?

In most cases, if you receive care in a hospital emergency department and are covered by Medicare Part B, you'll also be responsible for: An annual Part B deductible of $203 (in 2021). A coinsurance payment of 20% of the Medicare-approved amount for most doctor’s services and medical equipment.

What is a Medigap plan?

Medigap is private health insurance that Medicare beneficiaries can buy to cover costs that Medicare doesn't, including some copays. All Medigap plans cover at least a percentage of your Medicare Part B coinsurance or ER copay costs.

Does Medicare cover emergency room visits?

Medicare does cover emergency room visits. You'll pay a Medicare emergency room copay for the visit itself and a copay for each hospital service. It is important to remember, however, that your actual Medicare urgent care copay amount can vary widely, depending on the services you require and where you receive care.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay . (if the plan has one). You pay your share and your plan pays its share for covered drugs. If you pay. coinsurance. An amount you may be required to pay as your share ...

What is coinsurance in Medicare?

The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (if the plan has one). You pay your share and your plan pays its share for covered drugs. If you pay. coinsurance. An amount you may be required to pay as your share of the cost for services ...

How much does a lower tier drug cost?

Generally, a drug in a lower tier will cost you less than a drug in a higher tier. level assigned to your drug. Once you and your plan spend $4,130 combined on drugs (including deductible), you’ll pay no more than 25% of the cost for prescription drugs until your out-of-pocket spending is $6,550, under the standard drug benefit.

What percentage of coinsurance is required?

An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20% ). , these amounts may vary throughout the year due to changes in the drug’s total cost. The amount you pay will also depend on the.

Co-pay vs. Co-insurance

Copays and coinsurance fees are often discussed when you hear about your medical insurance plan. Most of the time, a copay or copayment refers to a single fee that you will have to pay when you receive health care.

Does Medicare Use Co-pays?

Yes and no. Importantly, Part B of Medicare never uses copays. Part B has a deductible of $233 per benefit period, and after this, you will pay 20 percent of your costs, which is your coinsurance.

Mental Health Services -- The Exception

Mental health services are the one regular exception to this rule. There may be some instances in which you don't have to pay a copay for these services, but most of the time that is the arrangement that Medicare will use. Make sure to check the details with the office you are dealing with and with Medicare.

What About Part A?

Medicare Part A does not technically use a copayment, but the fees are very similar to what most people associate with copays. Part A hospital insurance uses a so-called coinsurance fee, but this fee is not percentage-based and is pre-set with a few tiers depending on the length of your skilled nursing facility or hospital stay.

Copays with Medicare Advantage

When it comes to copays, Medicare Advantage is a whole other story. Medicare Advantage, or Part C, refers to a way of receiving your Medicare coverage through a private health insurance company. If you have a Medicare Advantage plan, many of the associated fees will be set by that insurance company, rather than Medicare.

How do Part D Prescription Drug Plans Fit In?

Although Part D plans usually won't apply to your actual doctor visit, they are still very relevant to the process. If your doctor prescribes you medication during your visit, it will usually be covered by a Part D plan.

Can Medigap Plans Help?

Medigap plans, or Medicare Supplement Plans, are plans that cover some of your Medicare out-of-pocket costs. With these plans, you will only pay a monthly premium, with no other out-of-pocket costs. As an example, these plans can cover your Part B coinsurance, and cover many other out-of-pocket fee categories.

What is a copayment in Medicare?

Copayment, or copay, is another term you’ll see used in relation to Medicare cost-sharing . A copay is like coinsurance, except for one difference: While coinsurance typically involves a percentage of the total medical bill, a copayment is generally a flat fee. For example, Part B of Medicare uses coinsurance, which is 20 percent in most cases.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are optional plans sold by private insurers that offer some coverage for certain out-of-pocket Medicare costs , such as coinsurance, copayments and deductibles.

What is coinsurance in Medicare?

Coinsurance is the percentage of a medical bill that you (the Medicare beneficiary) may be responsible for paying after reaching your deductible. Coinsurance is a form of cost-sharing; it's a way for the cost of care to be split between you and your provider. The deductible is the amount you are required to pay in a given year or benefit period ...

Does John have Medicare?

John has Original Medicare (Part A and Part B) and goes to the doctor for outpatient treatment. John’s doctor appointment is covered by Medicare Part B, and his doctor bills Medicare for $300. Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth of Part B-covered services for the year.

What is John's Medicare deductible?

John’s doctor appointment is covered by Medicare Part B, and his doctor bills Medicare for $300. Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth of Part B-covered services for the year. After reaching his Part B deductible, the remaining $97 of his bill is covered in part by Medicare, ...

How much is Medicare Part B 2021?

Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth of Part B-covered services for the year. After reaching his Part B deductible, the remaining $97 of his bill is covered in part by Medicare, though John will be required to pay a coinsurance cost. Medicare Part B requires beneficiaries ...

What percentage of Medicare coinsurance is covered by Part B?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items. The Medicare-approved amount is a predetermined amount ...