Medicare Part B coverage provides beneficiaries with two basic services, medically necessary services and preventative services. Part B covers health services and the supplies necessary to diagnose and combat certain diseases. Medicare will only help pay for services deemed medically necessary.

Full Answer

What is the difference between Medicare Part an and Part B?

Summary:

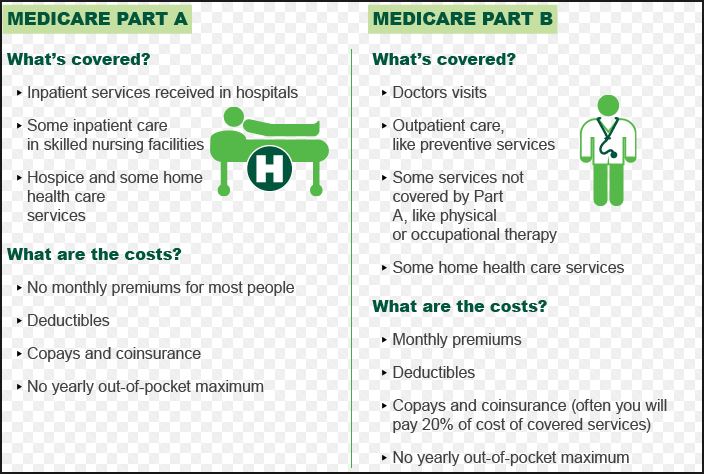

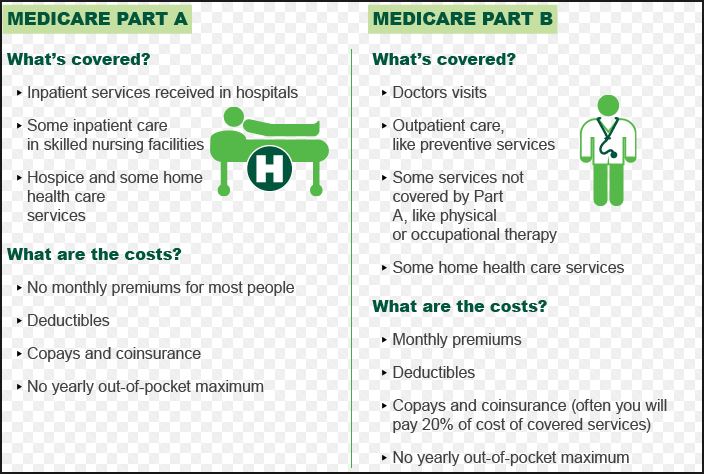

- Both Medicare Part A and B are federally funded plans that come with different coverages.

- Part A is free, and the patients need not pay a premium for the coverage. People have to pay some premium for availing themselves of the Part B coverage.

- Part A can be called hospital insurance whereas Part B can be termed as medical insurance.

What are the rules for Medicare Part B?

Fact sheet FACT SHEET: Most Favored Nation Model for Medicare Part B Drugs and Biologicals Interim Final Rule with Comment Period

- Background. High drug prices are impacting the wallets of Medicare beneficiaries through increased premiums and out-of-pocket costs.

- Model Design

- Participants. ...

What drugs does Medicare Part B and Part D cover?

Transplant / immunosuppressive drugs. Medicare covers transplant drug therapy if Medicare helped pay for your organ transplant. Part D covers transplant drugs that Part B doesn't cover. If you have ESRD and Original Medicare, you may join a Medicare drug plan.

Does Medicaid cover Medicare Part B?

Medicaid reimbursement methodology for practitioner claims for Medicare/Medicaid dually eligible individuals. Medicaid will no longer reimburse partial Medicare Part B coinsurance amounts when the Medicare payment exceeds the Medicaid fee or rate for that service. This article clarifies that this change applies to Part B services, including ...

What does Medicare Part B only mean?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

What expenses will Medicare Part B pay for?

Medicare Part B offers comprehensive coverage for outpatient services, durable medical equipment, and doctor visits. The two main types of coverage this part of Medicare includes are medically necessary and preventive. The medically necessary coverage encompasses a variety of tests, procedures, and care options.

Does Medicare Part B cover 100 percent?

Generally speaking, Medicare reimbursement under Part B is 80% of allowable charges for a covered service after you meet your Part B deductible. Unlike Part A, you pay your Part B deductible just once each calendar year. After that, you generally pay 20% of the Medicare-approved amount for your care.

Which type of care is not covered by Medicare Part B?

Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing. Long-term supports and services can be provided at home, in the community, in assisted living, or in nursing homes.

Does Medicare Part B pay for prescriptions?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers a limited number of outpatient prescription drugs under certain conditions.

Does Medicare Part B cover doctor visits?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment.

Is there a max out of pocket for Medicare Part B?

Medicare Part B out-of-pocket costs You will also pay an annual deductible in addition to the monthly premiums, and you must pay a portion of any costs after you meet the deductible. There is no out-of-pocket maximum when it comes to how much you may pay for services you receive through Part B.

Does Medicare Part B pay 80% of covered expenses?

After the deductible has been paid, Medicare pays most (generally 80%) of the approved cost of care for services under Part B while people with Medicare pay the remaining cost (typically 20%) for services such as doctor visits, outpatient therapy, and durable medical equipment (e.g., wheelchairs, hospital beds, home ...

Does Medicare Part B cover 80 %?

Medicare Part B pays 80% of the cost for most outpatient care and services, and you pay 20%. For 2022, the standard monthly Part B premium is $170.10. You'll pay the standard amount if: You enroll for the first time in 2022.

What is not covered by Part B?

But there are still some services that Part B does not pay for. If you're enrolled in the original Medicare program, these gaps in coverage include: Routine services for vision, hearing and dental care — for example, checkups, eyeglasses, hearing aids, dental extractions and dentures.

Is Medicare Part B worth the cost?

Is Part B Worth it? Part B covers expensive outpatient surgeries, so it is very necessary if you don't have other coverage coordinating with your Medicare benefits.

What's the difference between Part A and Part B in Medicare?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

What does Medicare Part B cover?

Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, ...

What is Part B insurance?

Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is Medicare Part A and Part B?

Enrollment. Takeaway. Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor’s visits and other aspects of outpatient medical care. These plans aren’t competitors, but instead are intended to complement each other ...

How much does Medicare Part B cost?

If you enrolled in Medicare during the open enrollment period and your income did not exceed $88,000 in 2019, you’ll pay $148.50 a month for your Medicare Part B premium in 2021.

What are the expenses for Medicare 2021?

For 2021, these expenses include: Quarters worked and paid Medicare taxes. Premium. 40+ quarters.

What is the Medicare deductible for 2021?

The annual deductible for 2021 is $203.

What is the deductible for Medicare Part B 2021?

The annual deductible for 2021 is $203. If you do not sign up for Medicare Part B in your enrollment period (usually right around when you turn age 65), you may have to pay a late enrollment penalty on a monthly basis.

How much is the 2021 Medicare premium?

Costs in 2021. most pay no monthly premium, $1,484 deductible per benefit period, daily coinsurance for stays over 60 days. $148.50 monthly premium for most people, $203 annual deductible, 20% coinsurance on covered services and items.

How old do you have to be to qualify for Medicare?

Eligibility. For Medicare Part A eligibility, you must meet one of the following criteria: be age 65 or older. have a disability as determined by a doctor and receive Social Security benefits for at least 24 months. have end stage renal disease.

How long do you have to be a resident to be eligible for Medicare?

And, a U.S. citizen or a legal resident who has lived in the U.S. for at least five years. Note, however, that if you do not enroll in Part A when you are first eligible for Medicare and you have to pay a premium for Part A, you can only enroll later if you have a Special Enrollment Period, or during the General Enrollment Period .

How to contact Medicare in New York?

If you live in New York and have questions about cost-saving programs, call the Medicare Rights Center’s free national helpline at 800-333-4114.

When do you have to take Part B?

You have to take Part B once your or your spouse’s employment ends. Medicare becomes your primary insurer once you stop working, even if you’re still covered by the employer-based plan or COBRA. If you don’t enroll in Part B, your insurer will “claw back” the amount it paid for your care when it finds out.

What is a Part B SEP?

The Part B SEP allows beneficiaries to delay enrollment if they have health coverage through their own or a spouse’s current employer. SEP eligibility depends on three factors. Beneficiaries must submit two forms to get approval for the SEP. Coverage an employer helps you buy on your own won’t qualify you for this SEP.

How long can you delay Part B?

You can delay your Part B effective date up to three months if you enroll while you still have employer-sponsored coverage or within one month after that coverage ends. Otherwise, your Part B coverage will begin the month after you enroll.

What is a SEP for Medicare?

What is the Medicare Part B Special Enrollment Period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isn’t through a current job – such as COBRA benefits, ...