Some Medicare Advantage plans even cover:

- Virtual doctor visits and a 24-hour nurse hotline

- Behavioral health tools and resources

- Allowances for personal emergency devices

Full Answer

What exactly is the advantage of Medicare Advantage plans?

- Plan premium costs

- Plan deductibles

- Plan benefits and extras

- Copayment amounts

- Choosing healthcare providers who accept the plan

What do you need to know about Medicare Advantage plans?

Excellus BlueCross/BlueShield Medicare Sales Representative Elisa Brescia is an expert in all things Medicare, and she spoke with News10NBC's Emily Putnam about what you need to know if you're consdiering making a change. Emily Putnam: Who do you think ...

How does Medicare Advantage compare to Medicare?

Typically, studies have shown that Medicare Advantage plans cost no more than Original Medicare plans and still offer more freebies and extra services because private companies provide them.

What are the requirements for Medicare Advantage plans?

The Centers for Medicare & Medicaid Services yesterday released proposed regulations for the 2023 Medicare Advantage ... of health plans, including provisions to better monitor provider networks and compliance with the medical loss ratio requirements ...

What is included in a Medicare Advantage plan?

Medicare Advantage Plans must offer emergency coverage outside of the plan's service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs. Most Medicare Advantage Plans include Medicare prescription drug coverage (Part D).

What is not covered by Medicare Advantage?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to cover even more benefits.

Does Medicare Advantage pay 80%?

Under Medicare Part B, patients usually pay 20% of their medical bills and Medicare pays the remaining 80%. Medicare Advantage, however, can charge patients coinsurance rates above 20%.

Do Medicare Advantage Plans pay the 20 %?

In Part B, you generally pay 20% of the cost for each Medicare-covered service. Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.

Does Medicare cover eye exams?

Medicare doesn't cover eye exams (sometimes called “eye refractions”) for eyeglasses or contact lenses. You pay 100% for eye exams for eyeglasses or contact lenses.

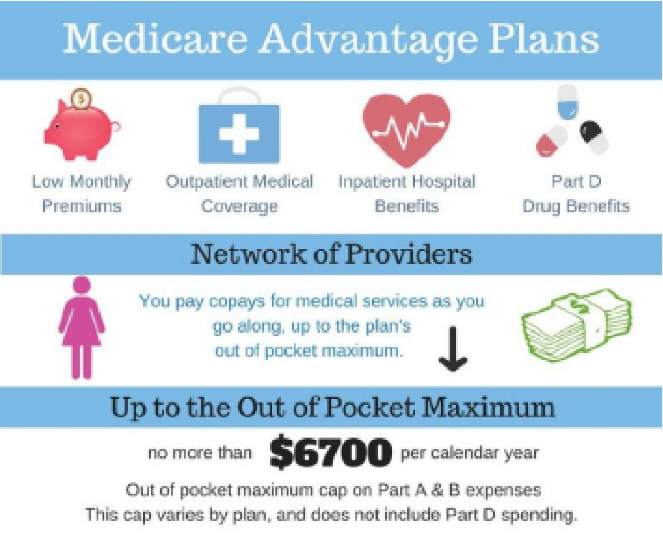

What is the maximum out-of-pocket for Medicare Advantage?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.

Do Medicare Advantage plans cover hospital stays?

Medicare Advantage plans typically cover hospital and medical benefits, as well as prescription drugs not generally covered by Original Medicare (Part A and Part B).

Does Medicare Advantage have copays?

Copays and coinsurance Our Medicare Advantage plans use copays for most services. You pay 20 percent coinsurance for most services with Original Medicare.

What percent of seniors choose Medicare Advantage?

[+] More than 28.5 million patients are now enrolled in Medicare Advantage plans, according to new federal data. That's up nearly 9% compared with the same time last year. More than 40% of the more than 63 million people enrolled in Medicare are now in an MA plan.

What does out-of-pocket mean with Medicare Advantage plans?

out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren't covered by Medicare or other insurance. in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare.

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Who sells Medicare Advantage plans?

Medicare Advantage is sold by private insurance companies. When purchasing a Medicare Advantage plan, your costs will depend on where you live and the specific plan you choose. If you’re in the market for a Medicare plan, you may be wondering what Medicare Advantage (Part C) plans cover. With a Medicare Advantage plan, ...

What are the benefits of Medicare Advantage?

What Do Medicare Advantage Plans Cover? 1 Medicare Advantage (Part C) combines Medicare Part A and Part B coverage with additional benefits like dental, vision, hearing, and others. 2 Medicare Advantage is sold by private insurance companies. 3 When purchasing a Medicare Advantage plan, your costs will depend on where you live and the specific plan you choose.

What is PFFS plan?

PFFS plans allow you to receive services from any provider as long as they accept the payment terms and conditions of your PFFS plan. Special Needs Plans (SNPs). SNPs are offered to certain groups of people who require long-term medical care for chronic conditions. Medicare savings account (MSA).

How is the cost of Medicare Advantage determined?

The total cost of a Medicare Advantage plan is generally determined by premiums, deductibles, copayments, how often and where you seek services, the types of services you need , and whether you receive Medicaid. Given all these factors, there’s no one specific cost for a Medicare Advantage plan.

Is Medicare Advantage a good plan?

Other Medicare Advantage considerations. You may benefit from a Medicare Advantage plan if you’re looking to receive full Medicare coverage, plus more. If you’re interested in prescription drug coverage and yearly dental and vision appointments, a Medicare Advantage plan is a great option.

Does Medicare Advantage have out of pocket costs?

While some Medicare Advantage plans have more out-of-pocket costs, others will help you save on long-term medical costs. Not everyone needs a Medicare Advantage plan, so consider your medical and financial needs before choosing what type of Medicare is best for you.

Does Medicare Advantage have a monthly premium?

A Medicare Advantage plan can come with its own monthly premium and yearly deductible, which is sometimes added on top of the Part B premium.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

What is a TAB plan?

#TAB#Medical Savings Account (MSA) plans—These plans combine a high-deductible health plan with a bank account. Medicare deposits money into the account (usually less than the deductible). You can use the money to pay for your health care services during the year. MSA plans don’t offer Medicare drug coverage. If you want drug coverage, you have to join a Medicare Prescription Drug Plan. For more information about MSAs, visit Medicare.gov/publications to view the booklet “Your Guide to Medicare Medical Savings Account Plans.”

Can you sell a Medigap policy if you already have a Medicare Advantage Plan?

If you already have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re disenrolling from your Medicare Advantage Plan to go back to Original Medicare.

First, what is Medicare Advantage?

Also known as Medicare Part C, Medicare Advantage is a more robust alternative to Original Medicare. These all-in-one plans cap the consumer’s annual health care spending and also offer more health benefits than Original Medicare.

Hospital Insurance (Part A)

Medicare Part A covers inpatient hospital visits and hospital-related services, short-term nursing facility care, certain home health care visits, along with end-of-life hospice care.

Medical Insurance (Part B)

Medicare Part B covers preventive, diagnostic, and treatment-related medical services. In all types of Medicare Advantage plans, you’re covered for emergency and urgently needed care.

Prescription Drug Coverage (Part D)

The vast majority of seniors take prescription drugs. Because this part of Medicare is so important, if you do not enroll on a Part D plan when you become eligible for Medicare, you could face a monthly penalty fee.

Vision, Hearing, and Dental Coverage

Vision: Most Medicare Advantage plans have some provisions for annual eye exams, and also offer allowances for eyeglasses and contact lenses.

Fitness and Wellness Resources

Many Medicare Advantage plans offer SilverSneakers®. This very popular program which helps encourage members to stay healthier through exercise by giving them access to fitness centers around the country.

Transportation

Because some older Americans have limited mobility, or have lost their driving privileges due to health concerns, it is very common for Medicare Advantage plans to offer transportation to and from primary care doctor appointments.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What is Medicare Advantage?

Medicare Advantage plans cover the same services as Original Medicare, provided those services are deemed medically necessary. If a service isn’t medically necessary, the insurance company that administers the Medicare Advantage plan may choose to deny coverage. Enrollees have the right to find out if a service or piece of medical equipment will be covered in advance. If there’s any question of whether something is covered by a Medicare Advantage plan, requesting this information can help seniors avoid unexpected out-of-pocket costs.Medicare Advantage plans cover all Part A and Part B services. Part A services include hospital care, home health care and care provided by a nursing home or skilled-nursing facility on a short-term basis. Part B services include preventive care, immunizations, durable medical equipment, ambulance services and mental health services.

Does Medicare cover eye exams?

Although Original Medicare may cover glaucoma testing or surgery to remove cataracts, it doesn’t cover eye exams for contact lenses and glasses. Medicare Advantage plans, on the other hand, may provide vision coverage and other services that aren’t covered by traditional Medicare. Regular Medicare also doesn’t cover routine dental care, such as cleanings, fillings, dentures or extractions. Because Medicare Advantage plans are provided by private insurers, each insurance company can choose whether to offer dental coverage to its subscribers. Comprehensive plans may also cover gym memberships and other wellness services, adult day care, transportation to medical appointments and over-the-counter medications.