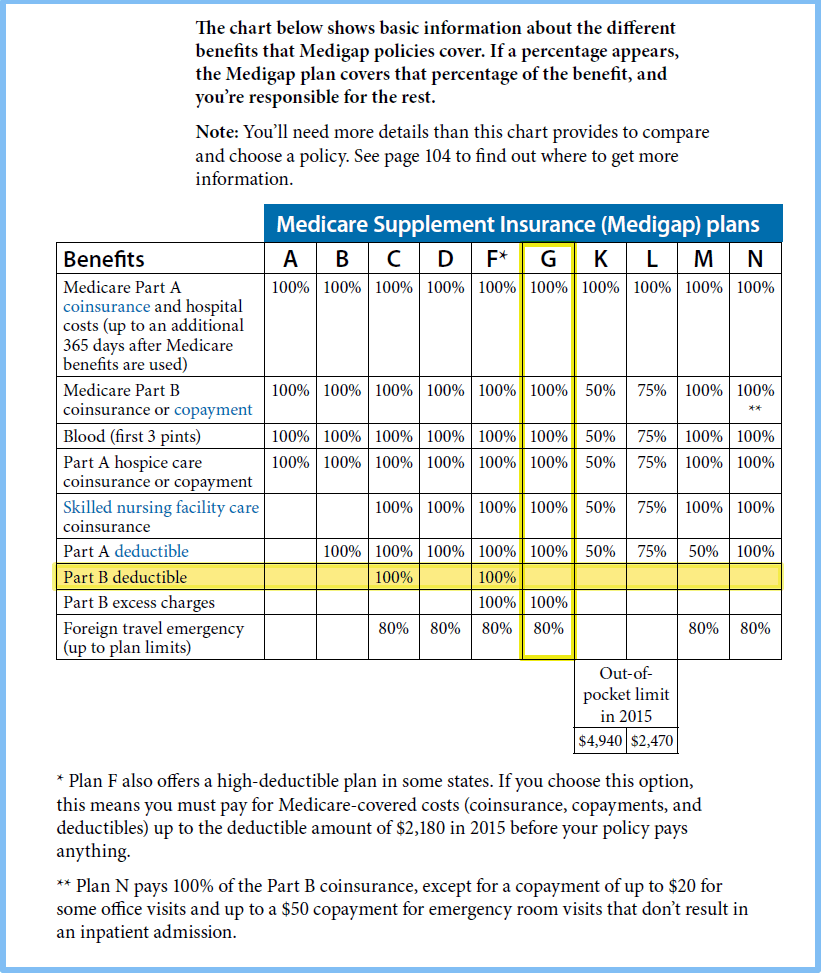

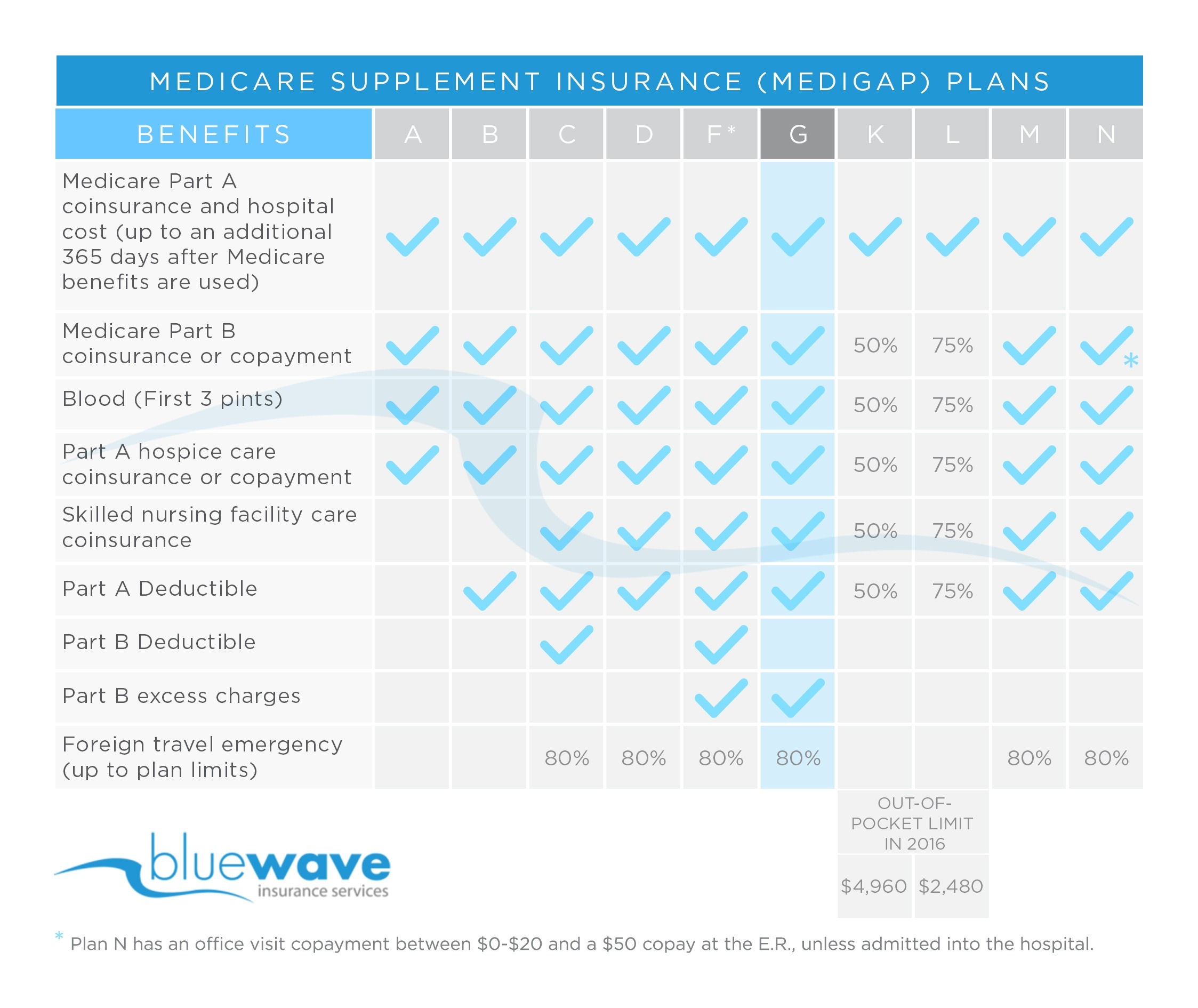

Medigap Plan G

| Benefit Area | Covered by Medigap Plan G |

| Medicare Part A coinsurance and hospital ... | ✔ |

| Medicare Part B coinsurance or copayment | ✔ |

| First 3 pints of blood | ✔ |

| Part A hospice care coinsurance or copay ... | ✔ |

Full Answer

What does plan G cover in Medicare?

9 rows · Dec 03, 2021 · Once you meet your Part B deductible, Plan G covers Part B outpatient medical services such as ...

Which Medicare supplement plan should I Choose?

Medicare Supplement Plan G covers your percentage of any medical benefit that Original Medicare covers, except for the outpatient deductible. So, it helps to pay for inpatient hospital costs, such as the first three pints of blood, skilled nursing facility care, and hospice care.

What are the top 5 Medicare supplement plans?

10 rows · Dec 12, 2019 · Plan G is a type of supplemental insurance for Medicare. Supplemental insurance plans help ...

Does plan G cover Medicare deductible?

Summary: Medicare Supplement Plan G is one of the most popular Medicare Supplement plans. This plan covers: Medicare Part A coinsurance and hospital costs; Medicare Part B coinsurance or copayment; Blood (first 3 pints) Part A hospice care coinsurance or copayment; Skilled nursing facility care coinsurance; Part A deductible; Part B excess charges

What does Medicare cover G?

Get online quotes for affordable health insurance Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

What are the advantages of a Medicare plan G?

The main benefit of Medicare Plan G is that it covers 100 percent of your Medicare Part A deductible, coinsurance, and copayments. In addition to that, Plan G also covers: 100 percent of Medicare Part B coinsurance, copayments, and excess charges. 100 percent of coinsurance at nursing facilities.Sep 29, 2021

Does Medicare supplement plan g cover prescriptions?

Medicare Plan G does not cover outpatient retail prescriptions that are typically covered by Medicare Part D. It does, however, cover the coinsurance on all Part B medications. These prescriptions are typically for medications used for treatment within a clinical setting, such as for chemotherapy.May 27, 2020

Is Plan G as good as Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the out-of-pocket maximum for Medigap Plan G?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year.Dec 12, 2019

What is the deductible for Medicare Plan G?

In 2022, some states also offer a high-deductible Plan G, which provides the same benefits, after a deductible of $2,490 is paid. Monthly premiums for the same 65-year-old nonsmoker in ZIP code 92589 range from $30 to $68. To find out the cost of Medigap Plan G in your area, visit Medicare.gov.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

Is Medigap plan G being phased out?

Medicare Plan G is not going away. There is a lot of confusion surrounding which Medigap plans are going away and which are still available. Rest assured that Plan G isn't going away. You can keep your plan.Feb 11, 2020

Does Plan G have copays?

Medicare Part G fully pays these healthcare costs: Medicare Part A deductible. Part A coinsurance and hospital costs up to an additional 365 days after your standard Medicare benefits end. Part A hospice care coinsurance or copayment.Nov 11, 2020

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What is Medicare Supplement Plan G?

Medicare Supplement Plan G – What does it cover? Plan G is a great option if you’re looking for a plan that has comprehensive benefits and low out of pocket costs.#N#All Medicare Supplement Insurance Plans are Standardized by the government. This means that the plan benefits are exactly the same from company to company.

What does Plan G cover?

Plan G covers Skilled Nursing and rehab facility stays and also Hospice care.

Does Plan G save you money?

Even though Plan F covers the Part B deductible, it’s usually at a much higher cost each month for Plan F premiums . The insurance company charges you much more to pay that deductible for you.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

Why is Medicare Supplement G more expensive than Plan N?

Medicare Supplement G usually costs more than Plan N, because it covers more. People seem to like the security and peace of mind that a comprehensive policy like Plan G seems to offer. Want to know which companies offer the best Medicare Plan G policies. Read our Plan G Reviews here or attend one of our free New to Medicare webinars ...

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

What is a small deductible for Medicare?

Medigap Plan G: A Small Deductible = Big Savings. Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, ...

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Does Medicare pay for inpatient hospital?

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay ...

Is there such a thing as Medicare Part G?

Only Original Medicare itself has Parts and there are only four parts – A, B, C and D. So there is no such thing as Medicare Part G! All Supplement insurances, on the other hand, are called Plans. So instead of saying Medicare Part G say Plan G, and you’ll be using the correct wording. Hope that helps you!

How much does Plan G cover?

Plan G also covers 80% of emergency health care costs while in another country. However, you must pay a $250 deductible first, and the care has to occur during the first 60 days of a trip. Also, the plan sets a lifetime limit of $50,000 on this type of coverage. 5.

What is the difference between Plan G and Plan F?

Plan G is most similar in coverage to Plan F. The only difference is that Plan F covers your Part B deductible, while Plan G does not. Plan F will have limited enrollment for some beneficiaries beginning in 2020.

What is the second most comprehensive Medicare supplement plan?

The plans are named by letter, ranging from A to N. Plan G is the second-most comprehensive Medicare supplement plan available, next to Plan F. Plan G is also growing in popularity. 1.

Why do people call Medicare Supplement Plans “Medigap”?

Some people call Medicare supplement plans “Medigap” because they “fill in the gaps” that exist in Medicare. Plan G is one of 10 major Medicare supplement plans currently offered to new Medicare enrollees. The plans are named by letter, ranging from A to N.

How to contact Debra from Medicare?

Call a Licensed Agent: 833-271-5571. Debra is 64 and plans to retire next year. She will apply for Medicare Part A and Part B. Debra loves to be outside, gardening or walking her dogs. She has had a few suspicious lesions removed recently by her dermatologist, who doesn’t accept Medicare assignment.

Does Debra have a Medigap Plan G?

After doing some research, Debra decided to purchase Medigap Plan G, as it will cover any Part B excess charges from her dermatologist and pay for emergency services abroad.

Does Plan G cover Medicare excess charges?

Part B excess charges. Unlike most Medicare Supplement plans, Plan G covers your Part B excess charges. That means you can see providers who don’t accept Medicare assignment (don’t participate in Medicare), but they can charge 15% more than standard Medicare rates. 4 Without coverage for excess charges, you pay that 15% difference.

What is the Medicare Supplement Plan G?

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible.

What is a G plan?

This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

Does Medicare pay your portion?

It is easy for you to use the coverage, and most people never see any paperwork. Once Medicare approves your claim, they will pay their portion and notify your provider of what they owe. The company must then pay the amount due per Medicare’s instructions.

Is Plan G more cost effective than Plan F?

Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option. Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F.

Does Medicare Supplement have a doctor network?

The benefits of a Plan G will be the same regardless of the company you select. Doctor’s Network – Medicare Supplement insurance companies don’t have their own doctor’s networks. Their plans are only supplements to your primary Medicare Parts A & B coverage.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G is a popular and comprehensive MedSup plan. Here's why it may be the best MedSup plan for you. Medicare Part G — or Plan G — is one of the most popular Medicare Supplement plans available. Plan G sits just behind Plan F in terms of popularity among American Medicare enrollees who want a bit more coverage.

How much does Medicare Supplement Plan G cover?

Up to three pints of blood for medical procedures each year. Medicare Supplement Plan G also covers 80% of medical care you receive while traveling outside the U.S., up to your plan’s limits.

What is the difference between Medicare Supplement Plan G and Plan F?

The main difference between Medicare Supplement Plan G and Plan F is that MedSup Plan F covers your Medicare Part B deductible. Plan G doesn’t cover that cost. Of course, the Part B deductible is just $198 this year, but a buck is a buck, right? However, MedSup Plan G premiums tend to be cheaper than Plan F premiums.

Why do people choose Medicare Supplement Plan G over Plan F?

One reason to choose Medicare Supplement Plan G over Plan F is that insurance companies no longer offer MedSup Plan F to new Medicare enrollees. Thanks to the Medicare Access and CHIP Reauthorization Act of 2015, insurers can’t sell MedSup Plan F to people who became eligible for Medicare on or after Jan. 1, 2020.

What is the deductible for Medicare Part B 2020?

For 2020, the Medicare Part B deductible is $198 per year. After your out-of-pocket costs hit that limit, you’ll pay 20% of the Medicare-approved amount for most of the services Part B covers. That includes care like doctor visits and outpatient therapy. Also, Plan G usually doesn’t cover prescription drugs.

How long after Medicare benefits end can you get a coinsurance?

Part A coinsurance and hospital costs up to an additional 365 days after your standard Medicare benefits end. Part A hospice care coinsurance or copayment. Part B coinsurance or copayment. Part B excess charge. Skilled nursing facility care coinsurance. Up to three pints of blood for medical procedures each year.

Does Medicare Supplement Plan G cover prescriptions?

Also, Plan G usually doesn’t cover prescription drugs. Some MedSup policies used to, but that’s no longer the case. For that, you need to enroll in Medicare Part D. Finally, Medicare Supplement Plan G also won’t cover any of these costs: Dental care. Eye care, including glasses. Hearing aids.

What is Plan G for Medicare?

Plan G covers nearly all out-of-pocket costs for services and treatment once you pay the Medicare Part B $198 deductible. This means you pay no copays or coinsurance. If you don’t need that level of coverage, though, you might want a plan with less coverage.

What does Plan G cover?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won’t pay anything out-of-pocket for covered services and treatments after you pay the deductible. Like Medigap Plan F, Plan G also covers “ excess charges .”.

Which is more comprehensive, Plan N or Plan F?

Plan F and Plan N are often chosen instead of Plan G. Plan F is the most comprehensive Medigap plan since it covers 100% of the gaps in Medicare coverage, so costs more than Plan G or N.

What is covered by Part B?

Part B services covered at 80% include outpatient care in an emergency room or hospital, and diagnostic tests such as X-rays. For many preventive services, the coinsurance and the deductible do not apply such as standard flu shots, mammograms, bone density tests, glaucoma tests, and many cancer screenings.

What is an excess charge for Medicare?

Doctors who don’t accept the full Medicare-approved amount as full payment can charge you up to 15% more than the Medicare-approved amount for services or procedures. This is known as the “excess charge.” 3 Most doctors accept the Medicare-approved payment and cannot bill you the extra amount.

Does Medicare cover travel?

The majority of doctors and hospitals in the U.S. take Original Medicare. 1 Six of the plans (C, D, F, G, M, N) cover foreign travel emergencies up to plan limits — typically $ 50,000-lifetime limit coverage after an initial $250 deductible in the first two months of travel . 2.

Does Plan G cover Part B?

Plan G’s coverage is nearly as good with one exception: Plan G does not cover the Part B deductible, which is $198 in 2020. Even with paying the Part B deductible, many Medicare enrollees find Plan G more cost-effective than Plan F when considering their respective premiums .

What is Medicare Supplement Plan G?

Takeaway. Medicare Supplement Plan G covers your portion of medical benefits (with the exception of the outpatient deductible) covered by original Medicare. It’s also referred to as Medigap Plan G. Original Medicare includes Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). Medigap Plan G is one of the most popular of 10 ...

What is Medicare Part G?

Medigap Plan G is one of the most popular of 10 available plans because of its broad coverage, including coverage for Part B excess charges. Keep reading to learn more about Medicare Part G and what it covers.

How to find a Medicare supplement?

One method of finding a Medicare supplement insurance plan that fits your needs is through the “Find a Medigap policy that works for you” Internet search application. These online search tools are set up by the U.S. Centers for Medicare & Medicaid Services (CMS).

What is a Medigap policy?

Medigap policies, such as Medicare Supplement Plan G, help cover healthcare costs that aren’t covered by original Medicare. These policies are: A Medigap policy is for only one person. You and your spouse each need an individual policy.

What is the cost sharing for Medigap in Minnesota?

In Minnesota, Medigap plans have Basic and Extended Basic benefit plans. In Wisconsin, Medigap plans have a Basic plan and 50 percent and 25 percent Cost-sharing plans. For detailed information, you can use the “Find a Medigap policy that works for you” search tool or call your state insurance department.

What states have Medigap?

Medigap in Massachusetts, Minnesota, and Wisconsin. If you live in Massachusetts, Minnesota, or Wisconsin, Medigap policies are standardized differently than in other states. The policies are different, but you have guaranteed issue rights to buy a Medigap policy.

Where is Medigap standardized?

Medigap policies are standardized differently in Massachusetts, Minnesota, and Wisconsin. If you live in one of those states, you’ll have to review their Medigap offerings to get a policy similar to Medicare Supplement Plan G.

Supplemental Insurance: 3 Crucial Things To Know

If you are early in your journey towards understanding Medicare (or in need of a refresher), this section is for you.

Medicare Supplement Plan G Vs. Plan F

Medicare Supplement Plan G 2022 is the most popular Plan among new enrollees (likely because it offers the most comprehensive Coverage).

Lab & X-Ray

Medicare Supplement Plan G is one of the most popular Medigap plans on the market. Next to Plan F (not available to new Medicare enrollees), Plan G covers the most comprehensive range of benefits. Additionally, Plan G premiums tend to be lower than premiums for Plan F.