- Doctor and nursing care services

- Medical equipment such as walkers, wheelchairs, or portable toilet and medical supplies like catheters

- Prescription drugs needed for symptom or pain relief

- Special services such as: hospice aide, physical or occupational therapy, social work, nutritionist counseling, grief counseling

Full Answer

Is PFFS the same as Medicare Part A?

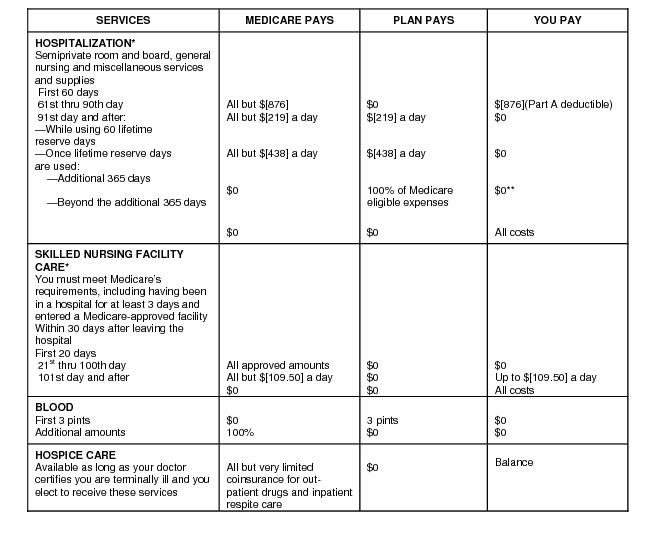

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or Medigap.

What is an example of a fee-for-service Medicare plan?

Apr 06, 2022 · More information about FFS billing; Telehealth codes covered by Medicare. Medicare added over one hundred CPT and HCPCS codes to the telehealth services list for the duration of the COVID-19 public health emergency. Telehealth visits billed to Medicare are paid at the same Medicare Fee-for-Service (FFS) rate as an in-person visit during the COVID-19 public …

How is the Medicare FFS program engaged with its partners?

Apr 01, 2010 · CMS' Medicare FFS program is underway with implementation activities to convert from Health Insurance Portability and Accountability Act (HIPAA) Accredited Standards Committee (ASC) X12 version 4010A1 to ASC X12 version 5010 and National Council for Prescription Drug Programs (NCPDP) version 5.1 to NCPDP version D.0.

Do PFFS plans cover prescription drugs?

Sep 08, 2021 · We allow Medicare payment for replacement prescription fills (for a quantity up to the amount originally dispensed) of covered Part B drugs in circumstances where dispensed medication has been lost or otherwise unusable by damage due to the disaster or emergency. X Hospitals Classified as Sole Community Hospitals (SCHs)

What does FFS Medicare cover?

It is sometimes called Traditional Medicare or Fee-for-Service (FFS) Medicare. Under Original Medicare, the government pays directly for the health care services you receive. You can see any doctor and hospital that takes Medicare (and most do) anywhere in the country.

What is original FFS Medicare?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

What does private fee-for-service mean?

A Private Fee-For-Service (PFFS) plan is a Medicare Advantage (MA) health plan, offered by a State licensed risk bearing entity, which has a yearly contract with the Centers for Medicare & Medicaid Services (CMS) to provide beneficiaries with all their Medicare benefits, plus any additional benefits the company decides ...Dec 1, 2021

What are FFS claims?

Fee for service (FFS) is the most traditional payment model of healthcare. In this model, the healthcare providers and physicians are reimbursed based on the number of services they provide or their procedures. Payments in an FFS model are not bundled.

Is Medicare Advantage an FFS?

Almost one-third of the Medicare population, approximately 19 million beneficiaries, receive their benefits through a Medicare Advantage (MA) plan. MA plans are private plans that provide Medicare benefits as an alternative to traditional Medicare, also known as Medicare fee-for-service (FFS).

What are the 4 types of Medicare?

What Are The Four Types Of Medicare?There are four parts of Medicare: Part A, Part B, Part C and Part D.Medicare Part A is hospital insurance, and Part B is medical insurance. ... Medicare Part C, or Medicare Advantage, is an alternative to Original Medicare that is offered through private insurance companies.More items...•Dec 27, 2021

What is original fee-for-service?

Fee-for-service is a system of health care payment in which a provider is paid separately for each particular service rendered. Original Medicare is an example of fee-for-service coverage, and there are Medicare Advantage plans that also operate on a fee-for-service basis.

What is Medicare fee-for-service vs managed care?

Under the FFS model, the state pays providers directly for each covered service received by a Medicaid beneficiary. Under managed care, the state pays a fee to a managed care plan for each person enrolled in the plan.

How many number of plans does Medicare have?

There are four types of Medicare: A, B, C, and D. Part A covers payments for treatment in a medical facility. Part B covers medical services including doctor's visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatments.

What are FFS beneficiaries?

A beneficiary, who was previously enrolled in a Medicare /Managed Care program, returning to traditional Fee-For-Service (FFS) Medicare, is subject to the same benefits, rules, requirements, and coverage criteria as a beneficiary who has always been enrolled in Medicare.Oct 15, 2021

How many Medicare FFS beneficiaries are there?

With over 6.2 million, California was the state with the highest number of Medicare beneficiaries.Feb 16, 2022

Is FFS the same as PPO?

An FFS plan usually contracts with a preferred provider organization (PPO) for network discounts. You may choose any doctor or hospital, but may have lower out-of-pocket expenses with PPO providers. An HMO plan provides care through a network of physicians, hospitals and other providers in a particular geographic area.

How much is Medicare reimbursement for 2020?

Reimbursements match similar in-person services, increasing from about $14-$41 to about $60-$137, retroactive to March 1, 2020. In addition, Medicare is temporarily waiving the audio-video requirement for many telehealth services during the COVID-19 public health emergency. Codes that have audio-only waivers during the public health emergency are ...

What is the CPT code for Telehealth?

Medicare increased payments for certain evaluation and management visits provided by phone for the duration of the COVID-19 public health emergency: Telehealth CPT codes 99441 (5-10 minutes), 99442 (11-20 minutes), and 99443 (20-30 minutes)

Does Medicare cover telehealth?

Telehealth codes covered by Medicare. Medicare added over one hundred CPT and HCPCS codes to the telehealth services list for the duration of the COVID-19 public health emergency. Telehealth visits billed to Medicare are paid at the same Medicare Fee-for-Service (FFS) rate as an in-person visit during the COVID-19 public health emergency.

The Medicare FFS Approach

The purpose of this message is to clearly communicate the approach that Medicare Fee-For-Service (FFS) is taking to ensure compliance with the Health Insurance Portability and Accountability Act's (HIPAA's) new versions of the Accredited Standards Committee (ASC) X12 and the National Council for Prescription Drug Programs (NCPDP) Electronic Data Interchange (EDI) transactions..

CMS HETSHelp site

The CMS HETSHelp site provides information specific to the HIPAA Eligibility Transaction System (HETS) for 270/271 Medicare eligibility transactions. Please visit the HETSHelp site at: http://www.cms.hhs.gov/HETSHelp/ for details about the changes being made to HETS to support the X12 5010 standard.

When did the HHS declare a PHE?

The Secretary of the HHS declared a public health emergency (PHE) in the entire United States on January 31, 2020. On March 13, 2020, HHS authorized waivers and modifications under Section 1135 of the Social Security Act (the Act), retroactive to March 1, 2020.

When will the GE modifier be added to CPT?

Teaching physicians and residents: Expansion of CPT codes that you may bill with the GE modifier under 42 CFR 415.174 on and after March 1, 2020, for the duration of the PHE:

What is 1135 waiver?

These waivers help prevent gaps in access to care for patients affected by the emergency. In prior emergencies, we issued waivers for the Medicare Fee-for-Service program. To allow us to assess the impact of prior emergencies, we needed modifier “CR” and condition code “DR” for all services provided in a facility operating per CMS waivers that typically were in place, for limited geographical locations and durations of time.

Can you renew SNF benefits?

Patients who exhaust their SNF benefits can get a renewal of SNF benefits under the waiver except in one particular scenario: that is, those patients who are receiving ongoing skilled care in a SNF that is unrelated to the emergency, as discussed below. To qualify for the benefit period waiver, a patient’s continued receipt of skilled care in the SNF must in some way be related to the PHE. One example would be when a patient who had been receiving daily skilled therapy, then develops COVID-19 and requires a respirator and a feeding tube. We would also note that patients who don’t themselves have a COVID-19 diagnosis may nevertheless be affected by the PHE (for example, when disruptions from the PHE cause delays in obtaining treatment for another condition).

What is the main feature of a PFFS plan that distinguishes it from other types of Medicare Advantage plans

The main feature of a PFFS plan that distinguishes it from other types of Medicare Advantage plans is the latitude it may give Medicare beneficiaries and health-care providers.

What is a PFFS plan?

A Medicare Private Fee-For-Service (PFFS) plan is a type of Medicare Advantage health plan offered by a private insurance company under contract to the Medicare program. The PFFS plan, rather than Medicare, largely determines how much it will pay for covered health-care services ...

What to do if you don't know if your PFFS plan will pay for a service?

If you don’t know whether your PFFS plan will pay for a service, you can call your plan and ask for confirmation that the plan will cover the service. Note: You have the right to receive medically necessary emergency care anytime and anywhere in the United States without any prior approval from your PFFS plan.

How much does a PFFS plan charge?

Some PFFS plans may allow doctors and hospitals to charge you up to 15% over the plan’s payment amount for services. The plan will inform you if this is the case. Health-care providers: PFFS plans do not require you to select a primary care physician (PCP) to coordinate your care or to use a network of hospitals and doctors contracted with ...

Does PFFS charge a premium?

Costs: PFFS plans may charge you a premium amount above the Medicare Part B premium. (You typically pay your Part B premium no matter what type of Medicare Advantage plan you may have, as well as any plan premium.) PFFS plans may charge deductible, copayment and/or coinsurance amounts. PFFS plans may charge a premium for extra benefits like ...

Does PFFS cover dental?

Some PFFS plans may have extra benefits – for example, prescription drug coverage, routine dental care and/or routine vision care coverage. If you choose to enroll in a PFFS plan that does not offer Medicare Part D prescription drug coverage, you may be able to enroll in a stand-alone Medicare Part D Prescription Drug Plan offered ...

Does Medicare have a provider network?

Some Medicare PFFS plans have provider networks. Before enrolling in a PFFS plan, you may want to consider carefully the following features of this type of Medicare Advantage plan. Benefits: PFFS plans provides all medically necessary health care services covered by Medicare Part A (hospital care) and Part B (medical care).

What is fee for service?

Fee-for-service is a system of health care payment in which a provider is paid separately for each particular service rendered. Original Medicare is an example of fee-for-service coverage, and there are Medicare Advantage plans that also operate on a fee-for-service basis. Alternatives to fee-for-service programs include value-based ...

What are some alternatives to fee for service?

Alternatives to fee-for-service programs include value-based or bundled payments, in which providers are paid based on outcomes and efficiency, rather than for each separate procedure that they perform.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.