Assignment means that your doctor, provider, or supplier agrees (or is required by law) to accept the Medicare-approved amount as full payment for covered services. Make sure your doctor, provider, or supplier accepts assignment Most doctors, providers, and suppliers accept assignment, but you should always check to make sure.

Full Answer

What is a Medicare refund agreement?

Find more information about Medicare Secondary Payer (MSP) overpayments . when Medicare isn’t the patient’s primary health insurance coverage on the Coordination of Benefits & Recovery Overview webpage. Overpayment Definition. A Medicare overpayment exceeds regulation and statute properly payable amounts. When Medicare

How does Medicare pay for care?

People representing Medicare plans aren't allowed to: Ask for your personal information (like your Medicare, Social Security, bank account, or credit card numbers) over the phone unless it’s needed to verify membership, determine enrollment eligibility, or process an enrollment request. Plans don't need your personal information to give a quote.

How long does it take for Medicare to pay a provider?

Nov 04, 2021 · The stolen information can then be used to file fraudulent Medicare claims. One of the ways scammers get this information is to pose as Medicare and call people to tell them they’re getting a ...

What does it mean when a provider accepts Medicare assignments?

Jul 27, 2021 · Medicare Reimbursement may be necessary if you pay a claim that should’ve otherwise had coverage. While it’s not common to need reimbursement, things happen. Mostly, doctors handle the Medicare billing process for you. But in a few situations, you may have to pay for your care up-front and file a claim asking Medicare to reimburse you.

What must be in a credit agreement?

What do credit agreements look for?

What are the Medicare regulations?

Is credit granted based on a signed credit agreement?

What are the types of credit agreements?

- A pawn transaction.

- A discount transaction.

- An incidental credit agreement.

- An instalment agreement.

- A mortgage agreement.

- A secured loan.

- A lease of movable property and.

- Any other agreement where payment of an amount owed is deferred and interest or fees are charged.

What are the 4 types of Medicare?

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.

Can you be refused Medicare?

Do Medicare patients get treated differently?

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

How long does interest accrue?

Interest accrues from the date of the demand letter, but is only assessed if the debt is not repaid or otherwise resolved within the time period specified in the recovery demand letter. Interest is due and payable for each full 30-day period the debt remains unresolved; payments are applied to interest first and then to the principal. Interest is assessed on unpaid debts even if a debtor is pursuing an appeal or a beneficiary is requesting a waiver of recovery; the only way to avoid the interest assessment is to repay the demanded amount within the specified time frame. If the waiver of recovery or appeal is granted, the debtor will receive a refund.

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

How long does it take to appeal a debt?

The appeal must be filed no later than 120 days from the date the demand letter is received. To file an appeal, send a letter explaining why the amount or existence of the debt is incorrect with applicable supporting documentation.

What happens if you don't respond to a debt recovery?

Failure to respond within the specified time frame may result in the initiation of additional recovery procedures, including the referral of the debt to the Department of Justice for legal action and/or the Department of the Treasury for further collection actions.

When can a WC appeal a demand?

Insurer/WC entity debtors may only appeal demands issued on or after April 28, 2015.

What would happen if you paid back money?

Paying back the money would cause financial hardship or would be unfair for some other reason.

How long does it take for Medicare to process a claim?

Medicare claims to providers take about 30 days to process. The provider usually gets direct payment from Medicare. What is the Medicare Reimbursement fee schedule? The fee schedule is a list of how Medicare is going to pay doctors. The list goes over Medicare’s fee maximums for doctors, ambulance, and more.

What is Medicare reimbursement form?

The Medicare reimbursement form, also known as the “Patient’s Request for Medical Payment, ” is available in both English and Spanish on the Medicare website.

What if my doctor doesn't bill Medicare?

If your doctor doesn’t bill Medicare directly, you can file a claim asking Medicare to reimburse you for costs that you had to pay.

What happens if you see a doctor in your insurance network?

If you see a doctor in your plan’s network, your doctor will handle the claims process. Your doctor will only charge you for deductibles, copayments, or coinsurance. However, the situation is different if you see a doctor who is not in your plan’s network.

Does Medicare cover out of network doctors?

Coverage for out-of-network doctors depends on your Medicare Advantage plan. Many HMO plans do not cover non-emergency out-of-network care, while PPO plans might. If you obtain out of network care, you may have to pay for it up-front and then submit a claim to your insurance company.

Do participating doctors accept Medicare?

Most healthcare doctors are “participating providers” that accept Medicare assignment. They have agreed to accept Medicare’s rates as full payment for their services. If you see a participating doctor, they handle Medicare billing, and you don’t have to file any claim forms.

Do you have to pay for Medicare up front?

But in a few situations, you may have to pay for your care up-front and file a claim asking Medicare to reimburse you. The claims process is simple, but you will need an itemized receipt from your provider.

What is Medicare Summary Notice?

Where beneficiaries have medical insurance coverage, the provider asks the beneficiary if he/she has a Medicare Summary Notice (MSN) showing his/her deductible status. If a beneficiary shows that the Part B deductible is met, the provider will not request or require prepayment of the deductible.

Why are Medicare benefits incorrectly collected?

Amounts are considered to have been incorrectly collected because the provider believed the beneficiary was not entitled to Medicare benefits but:

What happens if you pay less than the amount on your Medicare summary notice?

If you paid less than the amount listed on your Medicare Summary Notice, the hospital or community mental health center may bill you for the difference if you don’t have another insurer who is responsible for paying your deductible and copayments.

What is a provider refund?

Provider Refunds to Beneficiaries . In the agreement between CMS and a provider, the provider agrees to refund as promptly as possible any money incorrectly collected from Medicare beneficiaries or from someone on their behalf. Money incorrectly collected means any amount for covered services that is greater than the amount for which ...

Why should a notice be posted prominently in the admitting office or lobby?

For this purpose, and for the benefit of the provider and the public, it is desirable that a notice be posted prominently in the admitting office or lobby to the effect that no patient will be refused admission for inability to make an advance payment or deposit if Medicare is expected to pay the hospital costs.

Is Medicaid deductible for MSP?

MEDICAID DEDUCTIBLE BENEFICIARIES AND MSP. Beneficiaries may be a MSP and also a Medicaid deductible beneficiary. The beneficiary will have a Benefit Plan ID of QMB until the deductible amount has been met. The Benefit Plan ID will change to MA once the deductible amount is met.

Does the MA benefit plan change to MA?

The Benefit Plan ID will change to MA once the deductible amount is met. For this Medicaid eligibility period, Medicaid reimburses the provider for Medicaid-covered services, as well as the Medicare coinsurance and deductible amounts up to the Medicaid allowable.

What is Medicare approved amount?

The Medicare-approved amount is the amount that Medicare pays to a healthcare provider or medical supplier who accepts assignment for Medicare-covered services. If a person visits a healthcare provider or supplier who does not accept assignment, they may have to pay an additional amount for the services or items.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is a non-participating provider?

A nonparticipating provider is a supplier or doctor who has not signed an agreement with Medicare to accept assignment for all Medicare-covered services.

How much is the deductible for Medicare?

They must also meet the annual deductible of $203 before Medicare funds any treatment. If a person chooses to go to a nonparticipating healthcare provider, they may have to pay an additional amount for the services or items. For example: A person visits their Medicare-participating doctor about a pain in their ankle.

How much can a non-participating provider charge for Medicare?

A nonparticipating provider can charge up to 15% more than the Medicare-approved amount, although there is a limit to the charges. A person is then responsible for the difference in cost between the amount that their healthcare provider charges and the Medicare-approved amount. The cost difference is called the Medicare Part B excess charge.

How much is Medicare Part A in 2021?

Medicare Part A has an annual deductible, which is $1,484 in 2021, and a fee schedule for hospitalization. Medicare pays approved costs above a person’s coinsurance amount. These apply as follows for each benefit period in 2021: $0 coinsurance for days 1–60. $371 coinsurance per day for days 61–90.

Does Medicare cover ankle pain?

A person visits their Medicare-participating doctor about a pain in their ankle. Medicare Part B covers the appointment. The person has already met their annual Part B deductible, so they will pay 20% coinsurance of the Medicare-approved amount. The doctor then refers the person to a specialist.

What to ask for when signing a document?

As with any document you sign, ask for a copy of any notice you sign.

Why is it important to eliminate payment by check?

Eliminating payment by check will save the government millions of dollars and be a much safer way to receive benefits.

Do doctors ask Medicare to pay for medical care?

A: Doctors’ offices often ask Medicare beneficiaries to sign a form agreeing to pay for medical care if the provider thinks Medicare does not cover the treatment being provided.

Is it acceptable for a health care provider to issue a general notice saying Medicare denial of payment is possible

It also is unacceptable for a health care provider to issue a general notice saying Medicare denial of payment is possible or that the provider is never sure whether Medicare will cover the prescribed service.

Can you give a Medicare beneficiary a notice?

Providers should not give such notice unless they have genuine doubt about the likelihood of coverage. Giving such notice to all Medicare beneficiaries is unacceptable. If you get such a notice and don’t understand the reasons, ask for a detailed explanation.

How many states have electronic asset verification?

However, most states implement asset verification programs and periodically reverify beneficiary resources, including assets, when determining eligibility. As of 2021, 46 states have implemented electronic asset verification systems.

What is extra help for Medicare?

This program is designed to help with paying for your prescription drugs. The good news is you don’t have to be in a state-run Medicare assistance program to qualify for help paying for your prescriptions under Extra Help. You can qualify as long as your annual income in 2021 as an individual is below $19,320 ($26,130 for married couples); you may be eligible. Asset limits in 2021 are up to $14,790 for an individual or $29,520 for a couple.

How many digits are on Medicare check?

Medicare will need to know your bank’s routing transit number — the first 9 numbers at the bottom of a check — and your account number — the second set of numbers at the bottom of your check (10 to 12 digits).

Is Medicare financial assistance easier to qualify for?

If you qualify for those programs, qualifying Medicare Savings Programs can be much easier.

When do you qualify for medicare?

Most people qualify for Medicare when they reach 65, but only those with low incomes and limited assets will qualify for financial assistance with their Medicare premiums, deductions, or prescription costs. Unfortunately, the income and asset limits to qualify for financial assistance with Medicare are rather low, which is why many may be tempted to fudge or not disclose the balance in their accounts. Moral considerations aside, is that a good idea? Does Medicare check your bank accounts?

Does Medicare check your bank account?

Some states don’t have asset limits for Medicare savings programs. Find out what Medicare checks (and doesn’t check) when determining eligibility for financial assistance programs.

Where are property checks sent?

The requests are sent to large, national banks, banks within a set distance of the applicant’s address, and specific banks identified by the applicant in their application. Some states also perform property checks through their AVS.

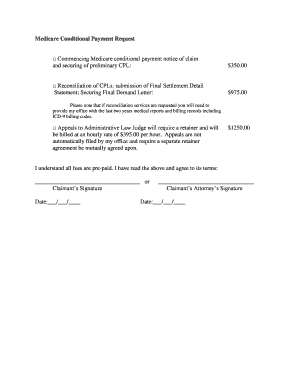

Medicare’s Demand Letter

- In general, CMS issues the demand letter directly to: 1. The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. 2. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals ...

Assessment of Interest and Failure to Respond

- Interest accrues from the date of the demand letter, but is only assessed if the debt is not repaid or otherwise resolved within the time period specified in the recovery demand letter. Interest is due and payable for each full 30-day period the debt remains unresolved; payments are applied to interest first and then to the principal. Interest is assessed on unpaid debts even if a debtor is pu…

Right to Appeal

- It is important to note that the individual or entity that receives the demand letter seeking repayment directly from that individual or entity is able to request an appeal. This means that if the demand letter is directed to the beneficiary, the beneficiary has the right to appeal. If the demand letter is directed to the liability insurer, no-fault insurer or WC entity, that entity has the ri…

Waiver of Recovery

- The beneficiary has the right to request that the Medicare program waive recovery of the demand amount owed in full or in part. The right to request a waiver of recovery is separate from the right to appeal the demand letter, and both a waiver of recovery and an appeal may be requested at the same time. The Medicare program may waive recovery of the amount owed if the following con…