What benefits are covered by Medicare?

Aug 10, 2020 · To be deemed creditable coverage, a health plan must provide coverage that is at least as good as what Medicare provides. When a person has creditable coverage, they may delay enrollment in Medicare without accruing penalties. Below, we review common forms of coverage and discuss their credtability with Medicare.

What does creditable coverage mean in health insurance?

Jan 20, 2022 · A certificate of creditable coverage is a document that insurance companies can issue to indicate that someone has terminated their coverage. It shows the insured person's name, the period they held insurance, and when they canceled their policy. Certificates of creditable coverage are no longer necessary. However, if you're enrolling in a Part D plan or a …

What does Medicare cover and what can you claim?

What Does Medicare Mean by Creditable Coverage? If your plan pays, on average, the same amount that Medicare does, it is said to offer creditable coverage. If you have an employer or union plan that provides prescription drug coverage, the Medicare Modernization Act requires your insurance carrier to notify you whether you have creditable coverage.

What if Medicare denies coverage?

Mar 07, 2022 · Medicare defines “creditable coverage" as coverage that is at least as good as what Medicare provides. Therefore, creditable drug coverage is as good as or better than Medicare Part D. Why Creditable Drug Coverage Matters in Medicare . Creditable drug coverage matters because it may allow you to delay enrolling in Medicare and avoid the Part D late …

What does Medicare considered creditable coverage?

Medicare defines “creditable coverage" as coverage that is at least as good as what Medicare provides. Therefore, creditable drug coverage is as good as or better than Medicare Part D.

What is not considered creditable coverage?

If your coverage is through an employer with at least 20 employees, it is considered creditable for Medicare. If the coverage is through an employer with fewer than 20 employees or through the Marketplace, it is not creditable.

What is the difference between credible and non creditable coverage?

A group health plan's prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage. Prescription drug coverage that does not meet this standard is called “non-creditable.”Sep 12, 2018

What is creditable coverage evidence?

Updated July 12, 2018. A certificate of Creditable Coverage (COCC) is a document provided by your previous insurance carrier that proves that your insurance has ended. This includes the name of the member to whom it applies as well as the coverage effective date and cancelation date.Jul 12, 2018

Is GoodRx creditable?

Let's go back to your initial question, “Why do I need insurance if I can use GoodRx?” GoodRx is NOT insurance. If you have Medicare you have a requirement to be enrolled in an approved (creditable) Prescription Drug Plan.May 23, 2019

Is Medicare Part A and B considered creditable coverage?

If you have health insurance through a large employer, it will qualify as creditable coverage for Medicare Part A and Part B, provided it covers as much as or more than original Medicare.Jan 5, 2021

What is the difference between creditable and credible?

Credible first appears in the late fourteenth century from the Latin credibilis, meaning worthy to be believed. Creditable is an adjective which means deserving of acknowledgement, praiseworthy. Creditable refers to one who deserves credit.

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

Who should receive the Medicare Part D creditable coverage notice?

Employers must provide creditable or non-creditable coverage notice to all Medicare eligible individuals who are covered under, or who apply for, the entity's prescription drug plan (Part D eligibles), whether active employees or retirees, at least once a year.

How is Medicare Part D creditable coverage calculated?

Prescription drug coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of standard prescription drug coverage under Medicare Part D, as demonstrated through the use of generally accepted actuarial principles and in accordance with Centers for Medicare and Medicaid Services ...

Can creditable coverage notice be emailed?

Creditable coverage disclosure notices may be sent electronically under certain circumstances. CMS has issued guidance indicating that health plan sponsors may use the electronic disclosure standards under Department of Labor (DOL) regulations in order to send the creditable coverage disclosure notices electronically.Aug 24, 2021

What is creditable coverage?

The most common type of creditable coverage is a large employer group plan. Meaning, a company that employs 20 or more people. When working for an employer, you likely receive health coverage through the company. If the company you work for has more than 20 employees, you have creditable coverage for Medicare.

How does a notice of creditable coverage work?

The Notice of Creditable Coverage works as proof that you obtained coverage elsewhere when you first became eligible for Medicare. Your Notice of Creditable Coverage comes in the mail each year for those who obtain drug coverage through an employer or union.

What is small group insurance?

An employer with small group insurance is a company with less than 20 employees and may not be creditable coverage under Medicare. Further, a variety of government programs are also considered creditable coverage. Examples of other types of coverage are individual, group, and student health plans.

Is VA coverage creditable?

VA benefits are only creditable coverage under Part D. VA benefits are NOT creditable under Part A and Part B. This is something that is HIGHLY miscommunicated to veterans. Even if you have medical coverage under the VA, there are still many reasons to enroll in Medicare coverage to work with your VA benefits.

Is Medicare coverage good for 2021?

Updated on July 12, 2021. Coverage that’s as good as Medicare is creditable coverage, meaning the plan benefits are up to the same standards as Medicare. When a person has creditable coverage, they may postpone enrollment in Medicare. Creditable coverage allows beneficiaries to delay enrolling without worrying about being late enrollment penalties.

Is Part D a creditable plan?

A plan is creditable for Part D as long as it meets four qualifications. Pays at least 60% of the prescription cost. Covers both brand-name and generic medications. Offers a variety of pharmacies. Does not have an annual benefit cap amount, or has a low deductible.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What Does Medicare Consider Creditable Health Insurance Coverage?

Medicare states that any health plan offering benefits equal to or greater than its own is creditable coverage. So if you have this level of coverage, you won't get penalized for delaying Medicare enrollment.

What's the Difference Between Creditable and Non-Creditable Coverage?

Unlike creditable coverage, non-creditable coverage has fewer benefits than Medicare.

Is a Medicare Advantage Plan Considered Creditable Coverage?

Medicare Advantage (Medicare Part C) plans are a private insurance alternative to the federal government's Original Medicare program (Medicare Part A and Part B). Part C plans bundle hospital and outpatient coverage and usually include prescription drug coverage.

How Do You Calculate Creditable Coverage?

There are penalties for late enrollment in Medicare Parts B and D, so it's essential to ensure you have creditable coverage for outpatient services and prescription drugs.

How Do You Prove Creditable Drug Coverage?

If you have creditable drug coverage, your plan provider will send you a Notice of Creditable Coverage .

Do I Need a Certificate of Creditable Coverage?

A certificate of creditable coverage is a document that insurance companies can issue to indicate that someone has terminated their coverage. It shows the insured person's name, the period they held insurance, and when they canceled their policy.

Deciding to Enroll in Medicare

Before deciding whether to enroll in Medicare or continue your existing health plan, make sure you know whether you have creditable coverage.

Creditable Coverage for Part B

Unlike Medicare Part A, Part B requires a monthly premium for most beneficiaries. If you have creditable coverage for Medicare Part B, you can delay starting your Part B and paying for it. If you don’t have creditable coverage, you’ll incur penalties for delaying Part B coverage.

Creditable Coverage for Part D

Medicare Part D covers your prescriptions — if you don’t take it when you’re first eligible, you’ll see penalties. However, you can delay Part D without a penalty with creditable coverage.

Creditable Coverage Notice

Some insurers are required by law to send a notice of creditable coverage. This was part of the Medicare Modernization Act. Companies that may or may not have creditable drug coverage must notify Medicare-eligible beneficiaries annually.

FAQs

Tricare isn’t considered creditable coverage for Medicare Part B but is for Medicare Part D.

What Does Medicare Mean by Creditable Coverage?

If your plan pays, on average, the same amount that Medicare does, it is said to offer creditable coverage.

What Employer Plans Qualify as Creditable Coverage?

Employer plans qualify as creditable coverage as long as the organization employs at least 20 people. You must also be an active employee. That means that your coverage ceases to be creditable as soon as you retire. If your group health plan is courtesy of your spouse's employer, then your spouse must be the active employee.

What Happens if You Have Creditable Coverage and Enroll in Medicare?

You may choose to enroll in Medicare even though you already have creditable coverage. In this case, your employer-sponsored plan is your primary insurance and Medicare is your secondary carrier.

Insurance Plans That Do Not Qualify as Medicare Creditable Coverage

Even though most of the following are considered high-quality insurance, they do not qualify as Medicare creditable coverage for Parts A and B. In some cases, though, they qualify as creditable coverage for Medicare Part D. Review your notice of creditable coverage to be sure.

Is Creditable Coverage Better than Medicare?

Creditable coverage doesn't mean better coverage. It doesn't even mean cheaper. You could have lower out-of-pocket costs AND better coverage with Medicare. It's always a good idea to weigh all of your options and see which choice offers the best coverage at the best price. Our Find a Plan tool lets you compare options easily.

Why does creditable drug coverage matter?

Creditable drug coverage matters because it may allow you to delay enrolling in Medicare and avoid the Part D late enrollment penalty. The penalty is charged if you enroll in a Medicare Part D plan after your Initial Enrollment Period (IEP) ends and don’t qualify for an exception.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is the late penalty for Medicare?

The late penalty for Medicare Part D is an additional 1 percent of the premium amount for each month you’re late. You pay the penalty for as long as you have Part D. For example, you enroll in a Part D plan that starts on November 1 but your IEP ended on June 30. As a result, you are four months late signing up for Part D.

What happens if you don't sign up for Part D?

If you don't sign up for Part D when you need to, you could get hit with substantial late enrollment penalties which you'd like to avoid.

How long do you have to enroll in a 401(k) plan?

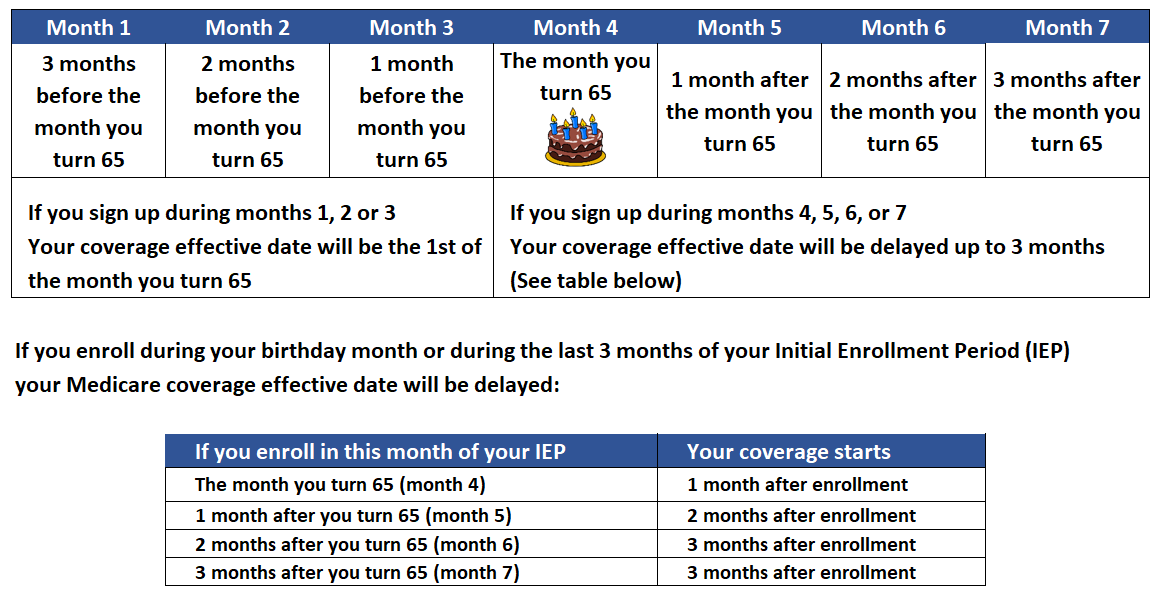

If that's the case, you have a seven-month initial enrollment period that three months before your 65th birthday and extends three months after. Even though you have seven months, I want to make sure you don't be in a situation where you're not covered at all.

Do you need Part A and Part B for Medicare?

You will need to have Part A and/or Part B to get a stand-alone Part D plan, and you will need both Parts A & B to get a Medicare Advantage plan.

What is it?

You'll get this notice each year if you have drug coverage from an employer/union or other group health plan. This notice will let you know whether or not your drug coverage is “creditable.”

What should I do if I get this notice?

Keep the notice. You may need it if you decide to join a Medicare drug plan later. (Don't send creditable coverage letters/certificates to Medicare.)

What is creditable coverage?

The takeaway. Creditable coverage refers to health insurance that covers at least as much as — or more than — Medicare. If you have creditable coverage, you may choose to keep it instead of or in addition to Medicare.

How long do you have to sign up for Medicare if you lose your credit?

If you lose your creditable coverage, you must sign up for Medicare within 8 months; otherwise, penalties and late fees may apply. If you’re eligible for Medicare but already have health insurance, you may be wondering whether you should keep it or switch.

What happens if you lose your Medicare?

If you lose your current coverage, this triggers a special enrollment period during which you can sign up for Medicare without penalty. If you don’t have creditable insurance coverage and delay signing up for Medicare, late fees and penalties may apply.

What happens if you enroll in Medicare and keep your insurance?

If you enroll in Medicare, have creditable coverage, and keep your insurance, your current provider would be your primary insurer. Medicare would be your secondary insurer. You may decide to let your current insurance lapse.

How long do you have to enroll in Medicare if you lose your current coverage?

If you lose your current coverage, you should enroll in Medicare within 8 months. This is known as a special enrollment period.

What is Cobra insurance?

COBRA (Continuation of Health Coverage). COBRA is designed to prolong your health insurance coverage if you’re no longer employed. It isn’t creditable coverage for original Medicare but may be creditable coverage for Part D.

How much is the late enrollment fee for Medicare Part B?

For Part B, you’ll be required to pay a late enrollment fee of an extra 10 percent of your monthly premium amount for each 12-month period you didn’t sign up. This penalty lasts for as long as you have Medicare Part B coverage.

What is creditable coverage?

Creditable coverage is a health benefit, prescription drug, or health insurance plan—including individual and group health plans—that meet a minimum set of qualifications . Creditable coverage is a measure used to figure out if policyholders must pay late enrollment penalties or, in some cases, coverage and costs associated ...

What are the requirements for a creditable drug plan?

In order to be considered creditable, a prescription drug plan must meet these four requirements: 4 . Provide coverage for both brand and generic prescription medication. Provide the policyholder with a reasonably broad option of medication providers, or a mail-order option.

What is FEHB in health insurance?

Federal Employee Health Benefits (FEHB) Program. Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) You also might have creditable coverage if you get health insurance coverage through your spouse's employer or if you’re on a COBRA plan. 6 .

What is grandfathered health insurance?

A grandfathered individual health insurance policy is one that you bought for yourself or your family on or before March 23, 2010, that has not been changed in certain ways that reduce benefits or increase costs to consumers. 8 .

Is Medicare Part D coverage creditable?

This disclosure provides Medicare-eligible beneficiaries with important information relating to their Medicare Part D enrollment and is mandatory whether the insurer is primary or secondary to Medicare. If the policyholder’s coverage is considered creditable, they may be eligible for subsidies.

Is pre-existing condition creditable?

Creditable Coverage and Pre-Existing Conditions. Some people with pre-existing conditions may find that their conditions are excluded from their health insurance plan coverage, although this is no longer the norm thanks to the Affordable Care Act (ACA).

Who is Julia Kagan?

Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014. The former editor of Consumer Reports, she is an expert in credit and debt, retirement planning, home ownership, employment issues, and insurance. She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction ...

Creditable Coverage For Part B

- Unlike Medicare Part A, Part B requires a monthly premium for most beneficiaries. If you have creditable coverage for Medicare Part B, you can delay starting your Part B and paying for it. If you don’t have creditable coverage, you’ll incur penalties for delaying Part B coverage. Coverage that qualifies as creditable for Medicare Part B includes large employer group plans, federal employ…

Creditable Coverage For Part D

- Medicare Part D covers your prescriptions — if you don’t take it when you’re first eligible, you’ll see penalties. However, you can delay Part D without a penalty with creditable coverage. Coverage considered creditable for Part D must offer a variety of pharmacies and cover both brand and generic drugs. In addition, the insurance must pay at least 60%of the drug costs, have a low ded…

Creditable Coverage Notice

- Some insurers are required by law to send a notice of creditable coverage. This was part of the Medicare Modernization Act. Companies that may or may not have creditable drug coverage must notify Medicare-eligible beneficiaries annually. These usually come out around September. If you plan on delaying coverage for Medicare, you must save this notice. Medicare can require a copy …

FAQs

- Is Tricare considered creditable coverage?

Tricare isn’t considered creditable coverage for Medicare Part B but it is forMedicare Part D. - Are VA benefits considered creditable coverage?

VA benefits are creditable coverage for Medicare Part D only.