Creditable coverage for Part B is limited to enrollment in:

- Group health insurance plan at work through your employer or your spouse 's employer.

- Group health insurance from a union.

- Federal Employees Health Benefits.

Full Answer

What are the rules for Medicare Part B?

Mar 22, 2022 · If you are approaching Medicare eligibility and wish to delay your Medicare Part B without penalty, you must have creditable coverage. Some of the most common types of creditable coverage are: Large employer group plans Union-sponsored health plans Federal Employee Health Benefits (FEHB)

How to determine creditable coverage?

Jan 20, 2022 · A certificate of creditable coverage is a document that insurance companies can issue to indicate that someone has terminated their coverage. It shows the insured person's name, the period they held insurance, and when they canceled their policy. Certificates of creditable coverage are no longer necessary.

What is considered creditable coverage?

Creditable coverage refers to health insurance that covers at least as much as — or more than — Medicare. If you have creditable coverage, you may choose to keep it instead of or in addition to...

Does Medicaid cover part B premium?

Jun 15, 2005 · Creditable Coverage. The Medicare Modernization Act (MMA) requires entities (whose policies include prescription drug coverage) to notify Medicare eligible policyholders whether their prescription drug coverage is creditable coverage, which means that the coverage is expected to pay on average as much as the standard Medicare prescription drug coverage.

What does it mean to have creditable coverage?

Creditable coverage is a health insurance, prescription drug, or other health benefit plan that meets a minimum set of qualifications. Types of creditable coverage plans include group and individual health plans, and student health plans, as well as a variety of government-sponsored or government-provided plans.

How do you prove creditable coverage?

The Notice of Creditable Coverage works as proof of your coverage when you first become eligible for Medicare. Those who have creditable coverage through an employer or union receive a Notice of Creditable Coverage in the mail each year. This notice informs you that your current coverage is creditable.

What does creditable coverage mean in Medicare?

Medicare defines “creditable coverage" as coverage that is at least as good as what Medicare provides. Therefore, creditable drug coverage is as good as or better than Medicare Part D.

What is not creditable coverage?

Non-creditable coverage: A health plan's prescription drug coverage is non-creditable when the amount the plan expects to pay, on average, for prescription drugs for individuals covered by the plan in the coming year is less than that which standard Medicare prescription drug coverage would be expected to pay.Oct 1, 2021

What is considered creditable coverage for Medicare Part D?

Under §423.56(a) of the final regulation, coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of standard prescription drug coverage under Medicare Part D, as demonstrated through the use of generally accepted actuarial principles and in accordance with CMS actuarial ...

Is GoodRx considered creditable drug coverage?

Let's go back to your initial question, “Why do I need insurance if I can use GoodRx?” GoodRx is NOT insurance. If you have Medicare you have a requirement to be enrolled in an approved (creditable) Prescription Drug Plan.May 23, 2019

Who gets Medicare creditable coverage notice?

You'll get this notice each year if you have drug coverage from an employer/union or other group health plan. This notice will let you know whether or not your drug coverage is “creditable.”

When should I send a creditable coverage notice?

At a minimum, the CMS creditable coverage disclosure notice must be provided at the following times: Within 60 days after the beginning date of the plan year for which the entity is providing the form; Within 30 days after the termination of the prescription drug plan; and.Aug 24, 2021

What does non creditable mean?

A group health plan's prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage. Prescription drug coverage that does not meet this standard is called “non-creditable.”Sep 12, 2018

Is Fehb creditable coverage for Part B?

Because all FEHB Program plans have as good or better coverage than Medicare, they are considered to offer “creditable coverage.” So, if you decide not to join a Medicare drug plan now, but change your mind later and you are still enrolled in FEHB, you can do so without paying a late enrollment penalty.

What is creditable coverage?

The takeaway. Creditable coverage refers to health insurance that covers at least as much as — or more than — Medicare. If you have creditable coverage, you may choose to keep it instead of or in addition to Medicare.

How much is the late enrollment fee for Medicare Part B?

For Part B, you’ll be required to pay a late enrollment fee of an extra 10 percent of your monthly premium amount for each 12-month period you didn’t sign up. This penalty lasts for as long as you have Medicare Part B coverage.

What is a large employer for Medicare?

Medicare defines a “large employer” as any company that has 20 or more full-time employees. You may be covered through your own large employer or through your spouse’s large employer.

What is Cobra insurance?

COBRA (Continuation of Health Coverage). COBRA is designed to prolong your health insurance coverage if you’re no longer employed. It isn’t creditable coverage for original Medicare but may be creditable coverage for Part D.

Can Medicare and VA work together?

Keep in mind that your VA coverage and your Medicare coverage can work together, if you choose to have both. The VA pays for services you receive at a VA facility, and Medicare pays for services you receive at a non-VA facility.

What happens if you lose your Medicare?

If you lose your current coverage, this triggers a special enrollment period during which you can sign up for Medicare without penalty. If you don’t have creditable insurance coverage and delay signing up for Medicare, late fees and penalties may apply.

What is VA health insurance?

Veterans Affairs (VA) health insurance is available for people who served in the active military, naval force, or air service and didn’t receive a dishonorable discharge. There are minimum duty requirements that apply. Family members may receive these benefits as well.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Eligibility for Medicare Part B?

Depending on which enrollment period you choose, you can enroll in a Part B plan at any time. Even if you feel as though you don’t need Part B, think carefully about neglecting to sign up. The late penalty for Medicare Plan B can result in both higher payments and premiums.

When to enroll in Medicare Part B?

The actual Medicare application process also parallels that of Part A. However, your decision about signing up for Part B can depend on personal preferences or other health insurance plans.#N#One of the biggest factors for Part B enrollment is private insurance.

How to apply for Medicare Part B

If you're nearing 65 and you're not receiving Social Security or Railroad Retirement Board (RRB) benefits, you'll want to apply for Part B (if you need it) as soon as you can. Similar to Part A, you can apply doing any of the following:

What is covered under Medicare Part B?

Part B covers medical insurance components such as lab tests, surgeries and doctor visits.

What is Medicare Part B deductible?

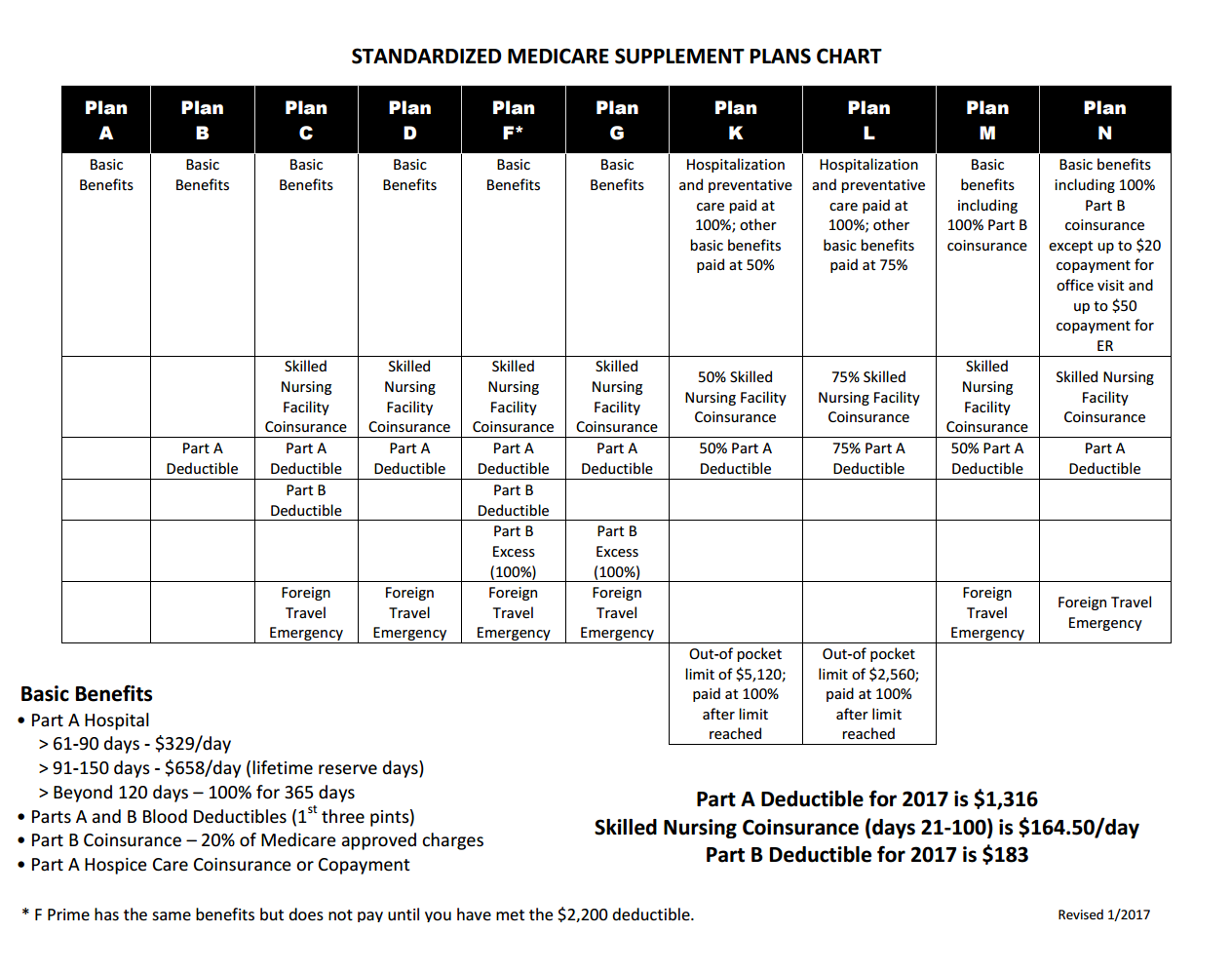

Your first deductible under Part B is $203, which helps cover 80% of the aforementioned services.

What is the cost of Medicare Part B?

Medicare prices can vary for everyone. However, with the Priority Health Cost Estimator tool, you can find out what plans like Part A can cost for you.

What is Medicare Part B premium?

The standard monthly premium for Part B tends to be around $148.50, dependent on your yearly income.

What is CMS in healthcare?

The Centers for Medicare & Medicaid Services (CMS) facilitates health care for American Indians and Alaskan Natives who are eligible for such government health programs. Eligibility requirements for those who have Indian Health Services (IHS) are the same as for those who do not; the program covers people over 65, disabled under 65, ...

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Does IHS accept Medicare?

Your provides who accept IHS will also accept Medicare. Almost one-quarter of American Indian and Alaska Native Medicare beneficiaries also rely on IHS for health care. With Medicare and other federal health programs, Native communities benefit from more health care resources. Additionally, Medicare is beneficial to have alongside IHS ...

Is IHS creditable for Medicare?

Unlike the case with Part B, IHS is creditable coverage for Part D prescription drug coverage. This means that if you enroll in Medicare but delay enrollment in a Part D prescription drug plan, you can avoid the penalty for late enrollment.

Do Native Americans qualify for Medicare?

For Native Americans who become eligible for Medicare, it’s important to understand how Medicare works with Indian Health Services. Medicare allows access to and helps pay for a broader range of care for eligible Native people.

Creditable Coverage For Part B

- Unlike Medicare Part A, Part B requires a monthly premium for most beneficiaries. If you have creditable coverage for Medicare Part B, you can delay starting your Part B and paying for it. If you don’t have creditable coverage, you’ll incur penalties for delaying Part B coverage. Coverage that qualifies as creditable for Medicare Part B includes la...

Creditable Coverage For Part D

- Medicare Part D covers your prescriptions — if you don’t take it when you’re first eligible, you’ll see penalties. However, you can delay Part D without a penalty with creditable coverage. Coverage considered creditable for Part D must offer a variety of pharmacies and cover both brand and generic drugs. In addition, the insurance must pay at least 60%of the drug costs, have a low ded…

Creditable Coverage Notice

- Some insurers are required by law to send a notice of creditable coverage. This was part of the Medicare Modernization Act. Companies that may or may not have creditable drug coverage must notify Medicare-eligible beneficiaries annually. These usually come out around September. If you plan on delaying coverage for Medicare, you must save this notice. Medicare can require a copy …

FAQs

- Is Tricare considered creditable coverage?

Tricare isn’t considered creditable coverage for Medicare Part B but it is forMedicare Part D. - Are VA benefits considered creditable coverage?

VA benefits are creditable coverage for Medicare Part D only.