How do I prove Medicare Part D creditable coverage?

Under §423.56(a) of the final regulation, coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of standard prescription drug coverage under Medicare Part D, as demonstrated through the use of generally accepted actuarial principles and in accordance with CMS actuarial ...

How can I avoid Medicare Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

Who should receive the Medicare Part D creditable coverage notice?

Employers must provide creditable or non-creditable coverage notice to all Medicare eligible individuals who are covered under, or who apply for, the entity's prescription drug plan (Part D eligibles), whether active employees or retirees, at least once a year.

What is not creditable coverage?

Non-creditable coverage: A health plan's prescription drug coverage is non-creditable when the amount the plan expects to pay, on average, for prescription drugs for individuals covered by the plan in the coming year is less than that which standard Medicare prescription drug coverage would be expected to pay.Oct 1, 2021

When did Part D become mandatory?

Medicare Part D Prescription Drug benefit Under the MMA, private health plans approved by Medicare became known as Medicare Advantage Plans. These plans are sometimes called "Part C" or "MA Plans.” The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.Dec 1, 2021

Is Part D of Medicare mandatory?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

Which of the following are creditable coverage?

Creditable coverage is a health insurance or health benefit plan that meets a minimum set of qualifications. Some examples include group and individual health plans, student health plans, and government-provided plans.

What is considered creditable coverage?

If your employer or union covers more than 20 people, your health plan is creditable coverage for Medicare. Additionally, the same is true when you are on your spouse's union or large group health plan. Thus, you will have creditable coverage for Medicare as well.

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

Is GoodRx considered creditable drug coverage?

Let's go back to your initial question, “Why do I need insurance if I can use GoodRx?” GoodRx is NOT insurance. If you have Medicare you have a requirement to be enrolled in an approved (creditable) Prescription Drug Plan.May 23, 2019

When should I send a creditable coverage notice?

The Disclosure should be completed annually no later than 60 days from the beginning of a plan year (contract year, renewal year), within 30 days after termination of a prescription drug plan, or within 30 days after any change in creditable coverage status.Dec 1, 2021

Can creditable coverage notice be emailed?

Notices of creditable/non-creditable coverage may be included in annual enrollment materials, sent in separate mailings or delivered electronically.

What is creditable coverage?

The most common type of creditable coverage is a large employer group plan. Meaning, a company that employs 20 or more people. When working for an employer, you likely receive health coverage through the company. If the company you work for has more than 20 employees, you have creditable coverage for Medicare.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Is FEHB considered creditable?

No, FEHB is NOT considered creditable coverage. However, some beneficiaries choose to still delay enrolling in Medicare when they have FEHB benefits. Some may find the FEHB benefits to be more cost-effective and vice versa.

What is small group insurance?

An employer with small group insurance is a company with less than 20 employees and may not be creditable coverage under Medicare. Further, a variety of government programs are also considered creditable coverage. Examples of other types of coverage are individual, group, and student health plans.

What is creditable drug coverage?

In simplest terms, creditable drug coverage is when a person’s insurance coverage for prescription drugs matches or exceeds the standard set by Medicare. The designation is made by the Centers for Medicare and Medicaid Services (CMS).

When do you get a letter from Medicare?

Assuming you have Medicare eligibility, your health insurance plan will send you a letter every year, usually around September. 1 Keep this letter, also known as a notice of creditable coverage or certificate of creditable coverage. It will say clearly whether you have creditable drug coverage or non-creditable drug coverage.

Who is Kathryn Stewart?

Kathryn Anne Stewart. Kathryn Anne Stewart is a freelance writer who covers the intersection of health and money. She has written for Johns Hopkins Medicine, Weight Watchers, Newsmax Magazine, Franklin Prosperity Report, and the National Hemophilia Foundation, often crafting clear explanations of complex topics.

Can I get Medicare if I have non-Medicare?

If you are on a non-Medicare plan that includes prescription drug coverage but you are also eligible for Medicare, it’s important to know if your current health plan provides creditable drug coverage. Not having it could mean you’ll pay penalties down the road.

What is a large employer for Medicare?

Medicare defines a “large employer” as any company that has 20 or more full-time employees. You may be covered through your own large employer or through your spouse’s large employer.

How much is the late enrollment fee for Medicare Part B?

For Part B, you’ll be required to pay a late enrollment fee of an extra 10 percent of your monthly premium amount for each 12-month period you didn’t sign up. This penalty lasts for as long as you have Medicare Part B coverage.

Is prescription drug coverage creditable?

Most large employers include prescription drug coverage in their health insurance plan. If you have prescription drug coverage through a large employer, it will qualify as creditable Part D coverage, provided it covers as much as or more than Medicare Part D.

What is Cobra insurance?

COBRA (Continuation of Health Coverage). COBRA is designed to prolong your health insurance coverage if you’re no longer employed. It isn’t creditable coverage for original Medicare but may be creditable coverage for Part D.

Can Medicare and VA work together?

Keep in mind that your VA coverage and your Medicare coverage can work together, if you choose to have both. The VA pays for services you receive at a VA facility, and Medicare pays for services you receive at a non-VA facility.

What is creditable coverage?

The takeaway. Creditable coverage refers to health insurance that covers at least as much as — or more than — Medicare. If you have creditable coverage, you may choose to keep it instead of or in addition to Medicare.

What happens if you lose your Medicare?

If you lose your current coverage, this triggers a special enrollment period during which you can sign up for Medicare without penalty. If you don’t have creditable insurance coverage and delay signing up for Medicare, late fees and penalties may apply.

Creditable Coverage For Part B

Creditable Coverage For Part D

- Medicare Part D covers your prescriptions — if you don’t take it when you’re first eligible, you’ll see penalties. However, you can delay Part D without a penalty with creditable coverage. Coverage considered creditable for Part D must offer a variety of pharmacies and cover both brand and generic drugs. In addition, the insurance must pay at least...

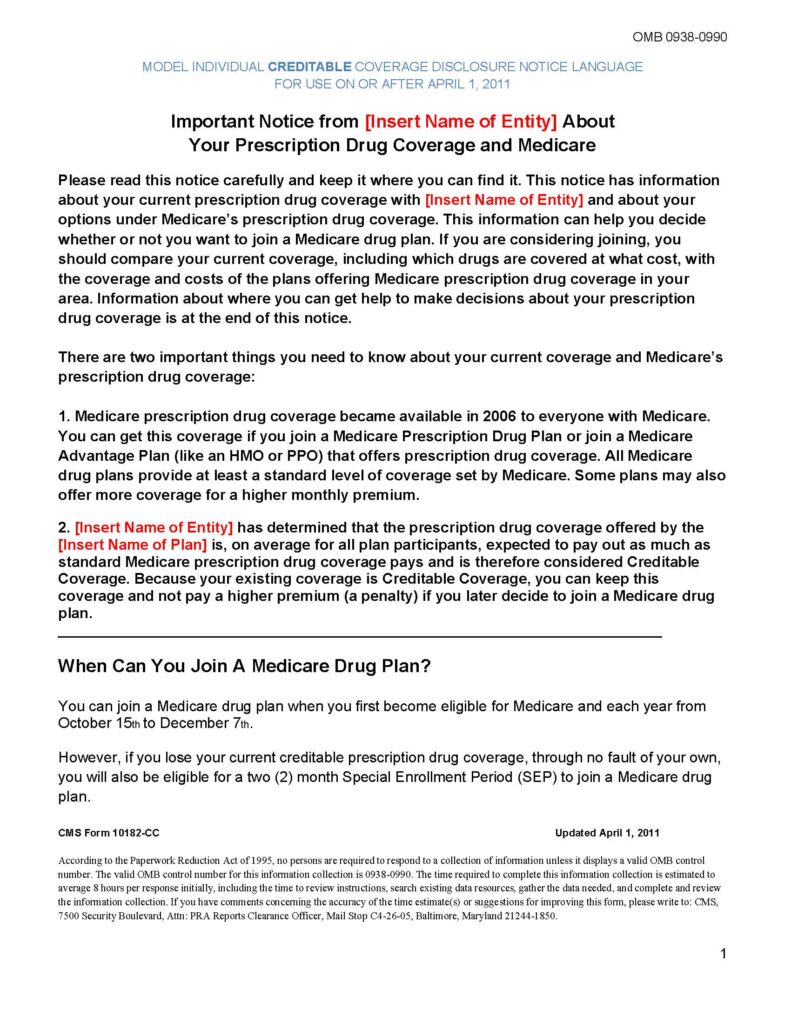

Creditable Coverage Notice

- Some insurers are required by law to send a notice of creditable coverage. This was part of the Medicare Modernization Act. Companies that may or may not have creditable drug coverage must notify Medicare-eligible beneficiaries annually. These usually come out around September. If you plan on delaying coverage for Medicare, you must save this notice. Medicare can require a copy …

FAQs

- Is Tricare considered creditable coverage?

Tricare isn’t considered creditable coverage for Medicare Part B but it is forMedicare Part D. - Are VA benefits considered creditable coverage?

VA benefits are creditable coverage for Medicare Part D only.