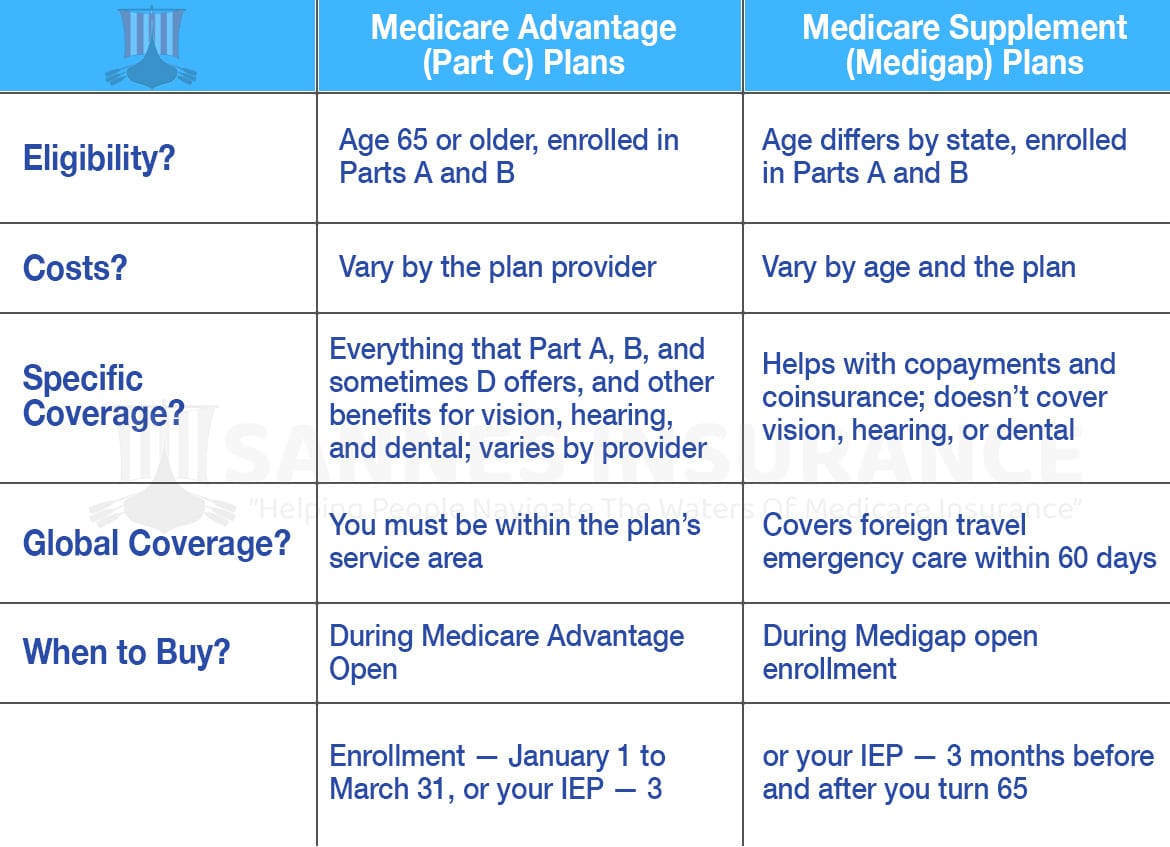

Here are the main differences between Medicare Supplement and Medicare Advantage:

| Plan Features | Medicare Advantage (Part C) | Medicare Supplement |

| Medicare Part A Hospital Coverage | Yes | No, but it provides out-of-pocket expens ... |

| Medicare Part B Medical Coverage | Yes | No, but it provides out-of-pocket expens ... |

| Medicare Part D Prescription Drug Covera ... | Usually included | No, but you can buy separate coverage |

| Out-of-pocket expenses covered (deductib ... | No | Yes—how much coverage you have depends o ... |

Full Answer

Are Medicare Advantage plans the same as Medicare supplements?

6 rows · Nov 03, 2021 · What is the difference between Medicare Supplement and Medicare Advantage plans? Both ...

Which Medicare Advantage plan is the best?

11 rows · May 05, 2021 · Medicare Advantage plans can include prescription drug coverage, while Medicare Supplement ...

Which is better Medicare Advantage or Medicare supplement?

Aug 01, 2019 · To improve options for Medicare coverage, The Centers for Medicare and Medicaid Services (CMS) contracts with private insurance companies to offer Medicare Advantage plans. Medicare Supplement insurance plans are also available from private insurance companies. However, Medicare Advantage and Medicare Supplement insurance plans are …

Is Medicare supplement better than advantage?

9 rows · Oct 01, 2021 · Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You ...

Is it better to have a Medicare Supplement or an Advantage plan?

Is a Medicare Supplement plan the same as a Medicare Advantage plan?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

Can I switch from a Medicare Supplement to an Advantage plan?

Can you be denied a Medicare Supplement plan?

What is the average cost of supplemental insurance for Medicare?

Can I drop my Medicare Advantage plan and go back to original Medicare?

Who is the largest Medicare Advantage provider?

Is Medicare Advantage too good to be true?

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

Do you have to renew Medicare Supplement every year?

You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.May 16, 2018

Can Medicare Supplement plans be changed at any time?

What Is Medicare Advantage?

Also called Medicare Part C, Medicare Advantage plans provide coverage through private insurance companies approved by Medicare. These companies pr...

What Is Medicare Supplement?

Also known as Medigap, Medicare Supplement plans are offered by private insurance companies and can take care of certain health care costs not cove...

What If I Choose Medicare Advantage?

If you decide to enroll in a Medicare Advantage plan after being in Original Medicare (Part A and Part B) for some time, you may want to cancel you...

What is Medicare Advantage?

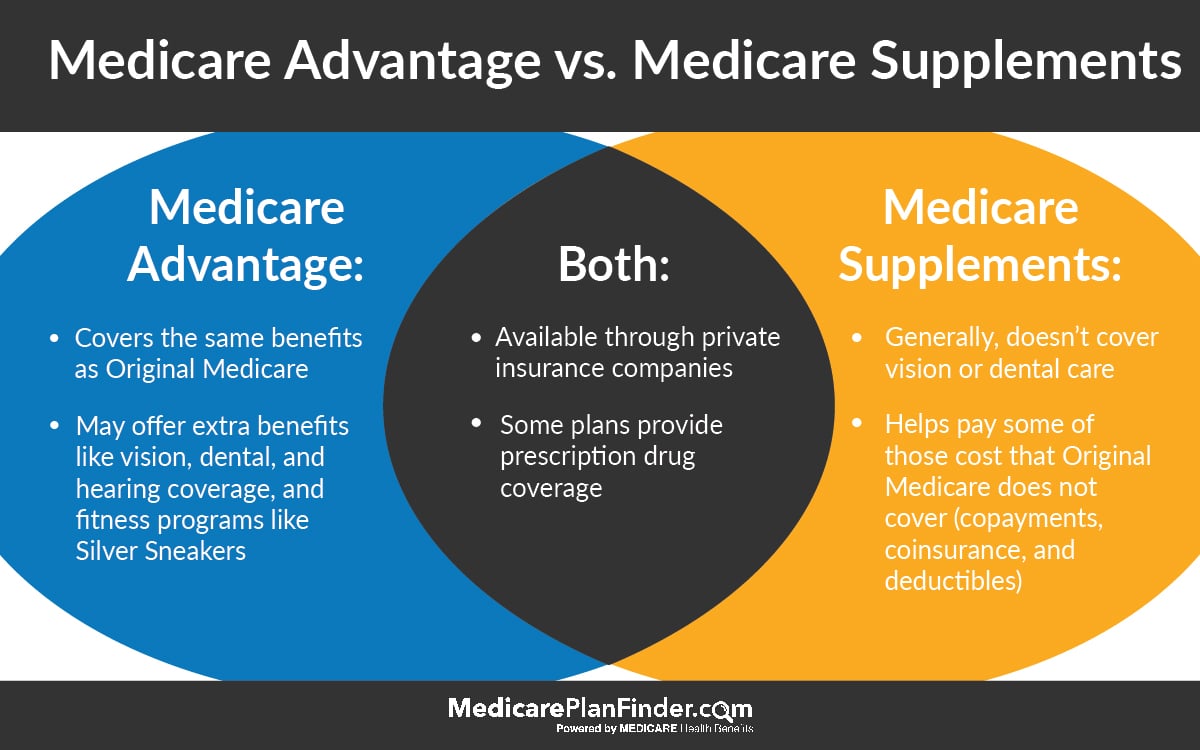

Unlike Medicare Supplement plans, Medicare Advantage plans give you a way to get your Medicare Part A and Part B benefits through a private insurance company that contracts with Medicare. (Hospice benefits are still covered under Part A.) Medicare Advantage plans often provide coverage beyond that of Original Medicare –most of them include prescription drug benefits, and some include extra benefits such as routine dental services or membership in fitness programs.

How many Medicare Supplement plans are there?

Medicare Supplement plans are standardized with lettered in many states, such as Plan A, Plan B, and so on up to Plan N. There are 10 plans available in most states (Plans E, H, I, and J are no longer sold). Wisconsin, Minnesota, and Massachusetts have their own standardized plans.

When is the best time to buy a Medicare Supplement Plan?

Perhaps the best time to buy a Medicare Supplement plan is during your Medicare Supplement Open Enrollment Period, which starts the month that you’re both 65 or more years old and enrolled in Medicare Part B.

Is Medicare Supplement coverage guaranteed?

Not guaranteed, unless you buy the plan during your Medicare Supplement Open Enrollment Period or in another “guaranteed issue” period. Yes. Includes emergency medical coverage out of the country. Yes, with some plans (80% up to plan limits) Not in most cases, with some exceptions.

Do you have to be enrolled in Medicare Supplement?

You must be enrolled in Part A and Part B to be eligible for a Medicare Supplement plan, but you’re still getting those benefits directly through the Medicare program (compared with Medicare Advantage, which provides Part A and Part B benefits through a private, Medicare-approved insurance company).

Can you see a doctor who accepts Medicare?

Find Plans. Both types of plans are available from private insurance companies. With most Medicare Supplement plans, you can see any doctor who accepts Medicare assignment. Some Medicare Supplement plans may cover emergency medical care when you’re out of the country. Medicare Advantage plans can include prescription drug coverage, ...

Is Medicare Advantage the same as Medicare Supplement?

Medicare Advantage and Medicare Supplement insurance are not the same. But each type of insurance may have features you might like, as well as some you might not. This table lists the main differences between these types of plans. Yes (different plans may cover different portions of certain out-of-pocket costs).

What is the difference between Medicare Advantage and Medicare Supplement?

Medicare Advantage vs Medicare Supplement: the basics. Medicare Supplement insurance plans go alongside Original Medicare and help pay for out-of-pocket costs not typically covered by Original Medicare. Since Original Medicare has no out-of-pocket maximum, a Medicare Supplement plan could give you a safety net against high medical costs ...

What are the benefits of Medicare Advantage?

When it comes to bonus benefits, Medicare Advantage plans more commonly include them. Medicare Advantage plans may cover the following benefits Medicare Part A and Part B typically don’t cover: 1 Routine vision, including eye glasses, contacts, and eye exams 2 Routine hearing, including hearing aids 3 Routine dental care 4 Prescription drugs and some over the counter medications 5 Fitness classes and gym memberships 6 Meal delivery to your home 7 Transportation to doctor visits 8 Other benefits

What is Medicare premium?

Premiums: A premium is an amount you pay monthly to have insurance, whether or not you use covered services. Some Medicare Advantage plans have premiums as low as $0 a month. However, you still must pay your Medicare Part B premium. Most Medicare Supplement insurance plans also have monthly premiums.

Does Medicare cover out of pocket expenses?

Medicare Supplement insurance plans generally only cover out-of-pocket costs, such as copayments, coinsurance, and deductibles, for services that Original Medicare already covers.

Do you have to pay deductible for Medicare Part B?

This combination of insurance is fairly comprehensive. You may have to pay deductible and copayment/coinsurance amounts. You generally pay separate premiums for Medicare Part B and for your Medicare Advantage plan, if it charges a premium.

Do you pay Medicare out of pocket?

You still may have some out-of-pocket Medicare costs. You generally pay separate premiums for Medicare Part B, Medicare Supplement insurance, and Medicare prescription drug coverage. If the above equation seems like too many pieces to put together, you may appreciate the simplicity of a Medicare Advantage plan.

Does Medicare Supplement cover prescription drugs?

Neither Original Medicare nor Medicare Supplement insurance plans typically cover the prescription drugs you take at home. If you want coverage for most prescription drugs, you will generally need to combine Original Medicare and a Medicare Supplement insurance plan with a stand-alone Medicare Part D prescription drug plan.

What is Medicare Advantage?

Medicare Advantage combines Medicare Part A and B for comprehensive coverage, all in one plan. It often includes Part D Prescription Drug coverage, too. These are also called Part C plans.

Which states have Medicare Supplement Plans?

In the following states, all Medicare Supplement plans are available to persons eligible for Medicare because of disability: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, Missouri, Montana, New Hampshire, Oregon, Pennsylvania, South Dakota, Tennessee, Vermont, and Wisconsin.

Is Medicare Advantage better than Medicare Supplement?

Considering Medicare Advantage vs. Medicare Supplement? One is not better than the other. They provide different types of coverage. Finding the right fit for you depends on what kind of Medicare coverage you’re seeking, as well as your health care needs. Review all details of plans when shopping and be open to considering alternatives when your needs change.

Does Medicare Supplement work with Original Medicare?

Do you want financial protection from unexpected out-of-pocket costs, such as deductibles, copays, and coinsurance? If yes, Medicare Supplement plans work with Original Medicare and can help cover some of the remaining out-of-pocket expenses that Original Medicare doesn’t cover.

What Are The Main Differences Between A Medicare Advantage Plan And A Medicare Cost Plan

The table below helps illustrate the main differences between a Medicare Advantage plan and a Medicare cost plan.

What Are Medicare Advantage Plans

If you have a Medicare Advantage plan, youre still enrolled in the Medicare program in fact, you must sign up for Medicare Part A and Part B to be eligible for a Medicare Advantage plan. The Medicare Advantage plan administers your benefits to you.

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility.

Just What Are Medicare Supplement Plans Anyhow

The first thing to do is understand the different options available to you. Medicare is available for people over 65, or who have certain types of conditions and receive Social Security Disability Insurance. They’re divided into three parts: A, B, and C.

What Is A Medicare Advantage Plan

Medicare Advantage is also called Medicare Part C. With Medicare Advantage, youll get your Medicare Part A and Medicare Part B through a private company and not through Original Medicare. Medicare Advantage plans also often provide coverage for Medicare Part D, prescription drugs, which Original Medicare usually doesnt cover.

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

Learn About Medicare Supplement Plans Available Where You Live

1 Freed M. et al. . Medicare Advantage 2022 Spotlight: First Look. Kaiser Family Foundation. https://www.kff.org/medicare/issue-brief/medicare-advantage-2022-spotlight-first-look.

How much is Medicare Supplement vs Advantage?

Choosing Medicare Supplement vs. Advantage. $3,400 to $6,700 a year in deductibles and co-pays, depending on the plan. Most or all Part A & B out-of-pocket costs are covered. Part A & B benefits covered in place of Original Medicare. Most plans have Part D coverage.

What is Medicare Advantage?

Medicare Advantage refers to Medicare Part C and provides the same benefits as Part A and B, except for hospice care, a service covered by Part A. Under this plan, members would continue paying their Part B premium. Many Advantage plans offer Part D, which covers prescription drugs.

How many states have Medicare Supplement?

Medicare Supplement or Medigap, is private plan coverage that pays for most of your out-of-pocket costs like co-pays, deductibles, and premiums and picks up where Original Medicare stops. Medicare Supplement has 10 sub-plans in 47 states, while three states—Wisconsin, Minnesota, and Massachusetts have their own customized plans.

What is Medicare Supplement?

Currently, there are two options available: Medicare Supplement (also known as Medigap) and Medicare Advantage. These plans assist in covering non-covered expenses beneficiaries must pay out-of-pocket like deductibles and co-pays.

What is a private supplemental plan?

Private supplemental coverage that pays all or most Part A & B out-of-pocket costs. Private health plan that provides Part A & B benefits directly in place of Original Medicare. 1st 6 months after enrolling in Part B and being 65 years old, as a minimum age. One Medicare Advantage card.

What are the letters on a Medigap plan?

The 10 standard Medigap plans are marked by the letters A, B, C, D, F, G, K, L, M, N . Once enrolled in Medigap, your plan will cover the portion of your bill, once Original Medicare has paid its claims.

Does Medicare Advantage have co-pays?

Medicare Advantage usually requires co-pays and deductibles. However, unlike Original Medicare, these payments put annual limits on how much you pay out-of-pocket. Once you’ve reached that limit, the plan will cover your medical bills for the remainder of the year.

What is the difference between Medicare Advantage and Medicare Supplement?

The main difference between Medicare Advantage plans and Medicare supplement plans is that with a Medicare supplement plan, you have the ability to see any provider in the country that accepts Medicare. There are no networks you are restricted to, and you never have to choose a primary care doctor. Unlike Medicare Advantage plans you have ...

What are the different types of Medicare Advantage plans?

Medicare Advantage plans, also referred to as “MA” or “Part C”, are Medicare health plans offered by private insurance companies that combine all of your Part A and Part B benefits. Some plans may have prescription drug coverage as well (MAPD). The most common forms of Medicare Advantage plans are the following: 1 Health Maintenance Organization (HMO) 2 Preferred Provider Organization (PPO) 3 Private Fee for Service Organization (PFFS)

What is a Medigap plan?

A Medigap plan is meant to pay what Part A and Part B of Medicare plans do not cover in full. There are 10 standardized Medigap plans and they are offered in every state except Massachusetts, Wisconsin and Minnesota. The ten plans range from Plan A to Plan N. Each plan is different and offers a unique combination of coverage and deductibles.

How much is Medicare deductible?

These deductibles are often $5,000 to $10,000. Medicare supplement plans are not subsidized by the government, therefore they are not subject to any budget cuts. As a result of the budget cuts, many doctors have stopped accepting Medicare Advantage plans.

Which is better, a PPO or a Medigap?

PPO plans offer more flexibility and freedom than an HMO plan but still have a lot more restrictions and less benefits then a Medigap plan. PFFS plans are less common and you must find out ahead of time if the facility you want to go to accepts the particular PFFS plan that you have.

Why is Plan F the same as Plan F?

Because the plans are standardized, any given plan (e.g. Plan F) will have the same exact benefits regardless what company is offering the plan. The only difference is the price you pay in premium. When comparing plans, make sure you compare the premium cost for the same plan from company to company.

Do you have to answer health questions when applying for Medicare Advantage?

I would also like to add something that companies and agents offering Medicare Advantage plans will never tell you. That is, you never have to answer health questions when applying for a Medicare Advantage plan. You do, however, have to answer health questions to get a Medicare supplement plan; unless you are turning 65, new to Medicare, or in a Guarantee issue scenario. Because of this it is also a good idea to get a Medicare supplement while you are healthy or when you aren’t subject to the health questions as mentioned previously. You can always go from a Medicare supplement to a Medicare Advantage plan regardless of your health but not vice-versa.

What is a Medigap plan?

Medigap Plans. Doctors and hospitals. You may be required to use doctors and hospitals in the plan network. You can select your own doctors and hospitals that accept Medicare patients. Referrals. You may need referrals and may be required to use network specialists, depending on the plan.

How much does Medicare pay monthly?

Generally, you pay a low or $0 monthly plan premium (in addition to your Part B premium). When you use services, you pay copays, coinsurance, and deductibles up to a set out-of-pocket limit. For Medicare-approved doctor and hospital services, you’ll pay a monthly plan premium in addition to your Part B premium.

Is prescription drug coverage included in most insurance plans?

Prescription drug coverage is included with most plans .

Is non emergency care covered by Medicare?

Non-emergency care might depend on your plan’s service area. Emergency care is generally covered for travel within the United States and sometimes abroad. Enrollment. Generally, there are specific periods during the year when you can enroll in or switch to a different Medicare Advantage plan.

Do you have to use doctors in a health insurance plan?

You may be required to use doctors and hospitals in the plan network.

Do you have to be an AARP member to enroll in Medicare Supplement Plan?

You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

What is Medicare Advantage?

The first thing to do is understand the different options available to you. Medicare is available for people over 65, or who have certain types of conditions and receive Social Security Disability Insurance. They're divided into three parts: A, B, and C. Part A covers approved inpatient costs, and Part B focuses on providing approximately 80% of your outpatient costs. Part C (also called Medicare Advantage), isn't really separate health insurance, but rather allows private health insurance companies to provide Medicare benefits.

How many Medicare Supplement Plans are there?

Medicare Supplement Plans, also called Medigap Plans, are standardized across most of the United States, though there are some exceptions. Each of the ten plans is designated a letter: A, B, C, D, F, G, K, L, M, and N. Though these plans are provided by private insurance companies, all plan types with the same letter must offer the same set ...

What does Medicare plan N cover?

Though both plans cover all of Medicare Part A coinsurance and hospital costs, as well as Part B coinsurance or copayments, Plan N may have copayments of up to $20 for some office visits, and some emergency room visits that don't result in hospital admissions may charge $50 in copayments. Other than that, both plans also cover the first three pints of blood, Part A hospice care copayments or coinsurance, and skilled nursing facility care coinsurance. However, Plan M only covers half of Part A's deductible, though Plan N covers it completely. Both M & N cover 80% of foreign travel emergencies.

What is the difference between Medicare Part A and Part B?

As mentioned above, they offer 100% coverage of Medicare Part A coinsurance and hospital costs, Part B coinsurance or copayments, the first three pints of blood, and Part A hospice care or copayments. The only difference between Plans A and B is that Plan B also covers Medicare Part A's deductible.

Does Medicare cover 80% of Part B?

Likewise, since Medicare typically only covers 80% of Part B coinsurance or copayments, all Medigap plans pay for some or all of the remaining 20% cost. This is also true for the first three pints of blood needed, and for Part A hospice care coinsurance or copayments.

Does Medicare cover coinsurance?

After that period, beneficiaries are charged ever-increasing fees until the 151st day, after which Medicare coverage ends. All Medigap plans pay for those copay fees, as well as 100% of an additional 365 days. Likewise, since Medicare typically only covers 80% of Part B coinsurance or copayments, all Medigap plans pay for some or all of the remaining 20% cost . This is also true for the first three pints of blood needed, and for Part A hospice care coinsurance or copayments.

Do all insurance plans have the same letter?

Though these plans are provided by private insurance companies, all plan types with the same letter must offer the same set of basic benefits, regardless the location. You'll see that there are some elements which are always covered, no matter what.