Full Answer

What is the difference between social security and Medicare?

And because each program offers unique benefits, it’s important to know the differences between the two. SS and Medicare are similar, but not the same. The SSA determines who’s eligible for Medicare and handles some of Medicare’s administrative duties, like enrollment.

What is the difference between Medicare and medical in California?

• Medicare is a federally funded program whereas Medical is an insurance program started by the State of California with funds shared by state and federal governments. • People in the state of California qualifying for both Medical and Medicare are called ‘dual eligible’.

Can medical assistance be used to pay premiums of Medicare?

In some instances, assistance under Medical is used to pay premiums of Medicare. What is the difference between Medical and Medicare? • Medicare is not a dependent upon the needs of an individual whereas Medical is a need based insurance program.

How are Medicare prescription drug premiums determined?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

Does your Medicare premium come out of your Social Security check?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Social Security insurance the same as Medicare?

Are Social Security and Medicare the same thing? A: They're not the same thing, but they do have many similarities, and most older Americans receive benefits simultaneously from both programs.

Do Social Security and Medicare have different rates?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How much is deducted from Social Security each month for Medicare?

Medicare Part B If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30. If you receive Social Security benefits, your monthly premium will be deducted automatically from that amount.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

At what age is Social Security no longer taxed?

between 65 and 67 years oldHowever once you are at full retirement age (between 65 and 67 years old, depending on your year of birth) your Social Security payments can no longer be withheld if, when combined with your other forms of income, they exceed the maximum threshold.

Why is my Medicare premium so high?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

At what income level do my Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

What deductions are taken out of Social Security checks?

Enforcement of child, spousal or family support obligations. Court-ordered victim restitution. Collection of unpaid federal taxes. Withholding to satisfy a current year federal income tax liability.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

How much are Medicare premiums for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is Social Security?

Social Security. A federal program that provides benefits for retirees who have worked and paid Social Security taxes for at least ten years. Social Security also provides benefits to individuals with a disability, and survivor benefits to wage earners and their spouses, former spouses, widows, widowers and children.

What is Medicare for disabled?

Medicare. A federal health insurance program that provides health care benefits to individuals ages 65 and older; individuals with certain disabilities that are under the age of 65 years ; disabled children of certain low-income wage earners; individuals with permanent kidney failure.

How many credits do I need to get Social Security?

To be eligible for Social Security, workers must earn enough credits while they are employed. The minimum number of credits for most workers is 40 credits. The youngest age you can apply is 61 years and nine months old.

Who runs Medicare?

Medicare is run by the Centers for Medicare and Medicaid Services. Designed to provide health insurance coverage for anyone 65 or older who has worked – and paid Medicare taxes – for at least ten years. The Medicare program consists of different parts.

Does Medicare cover dental care?

Medicare does not provide coverage for certain health expenses, including long-term care, dental visits, eye exams and hearing aids. However, these can be found in certain Medicare Part C plans through private-insurance companies for an additional cost. If you have any questions, give us a call.

How are Social Security and Medicare funded?

Funding for Social Security and Medicare. Both programs are primarily funded by payroll taxes, which are split evenly between employees and employers (self-employed workers pay both portions, but can deduct half of the self-employment tax from their business income).

What is Medicare payroll tax?

Together, Medicare and Social Security payroll taxes are known as FICA taxes (Federal Insurance Contributions Act taxes). Lawmakers on both sides of the aisle have proposed a variety of reforms for both Social Security and Medicare, but Republicans are much more likely to focus on privatization, means testing, and increasing ...

What is the Medicare eligibility age?

Congressman Paul Ryan has proposed various Medicare reforms in budget proposals over the last few years, including privatization, means testing, and raising the eligibility age to 67. Not surprisingly, Ryan’s proposals have failed to gain bipartisan support, but have been quite popular with Republicans. Similar proposals have been advanced ...

When did Medicare start?

Medicare, enacted in 1965, is also a government-run program for older Americans, designed to provide health insurance coverage for anyone 65 or older who has worked – and paid Medicare taxes – for at least ten years. (You can purchase Medicare coverage if the work history is less than ten years, and coverage can also be obtained based on ...

When do you qualify for Medicare?

Beneficiaries qualify for Medicare when they turn 65, with a seven-month enrollment window that straddles the month they turn 65. But there’s significantly more flexibility in terms of eligibility for Social Security.

Who is responsible for Medicare eligibility?

But some of the confusion stems from the fact that the Social Security Administration (SSA) is responsible for determining eligibility for Medicare and handling many of the program’s administrative functions, including enrollment. The SSA also handles the administration of Social Security benefits.

When was Social Security enacted?

Social Security, which was enacted in 1935 , is a government-run income benefit for retirees who have worked – and paid Social Security taxes – for at least ten years. Social Security also provides spousal and survivor benefits, and people under 65 are eligible for benefits if they’re disabled.

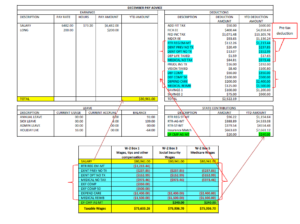

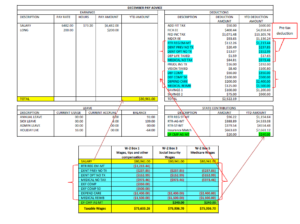

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

Is Medi Cal Medicaid

Californias Medicaid program is known as Medi-Cal. This comprehensive program provides free or low-cost health coverage to California residents through 21 different managed care plans for. The coverage plans that are available may depend on which county you live in. Californias State-based Marketplace is called Covered California.

Medicare Vs Medicaid: Cost

Medicare: People who have worked 40 qualifying quarters , and their spouses or qualifying ex-spouses, pay no premiums for Medicare Part A, which covers hospitalization. But Medicare recipients typically do have out-of-pocket costs, including deductibles and copays.

Whats The Difference Between Medicare And Medicaid

The difference between Medicaid and Medicare is that Medicaid is managed by states and is based on income.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

Medicare Parts A And B

The premium for Part A is determined by the number of quarters you paid Medicare taxes through employment. Individuals who paid Medicare taxes for 30 or fewer quarters pay a higher premium than those who paid Medicare taxes for 30-39 quarters.

Dual Eligibility: Qualifying For Medicare And Medicaid

Some individuals are considered dual-eligible when they qualify for both Medicare and Medicaid. The benefit of dual eligibility is zero cost-share for covered medical services and prescription drugs.

Who Is Eligible For Medicaid

You may qualify for free or low-cost care through Medicaid based on income and family size.