What are the Disadvantages of Choosing Medicare Advantage Part C? Although private insurance companies must offer the same benefits as what’s offered by the federal government, there are rules and guideline that are flexible. This can mean several restrictions. For instance, the out-of-pocket expense might be much higher.

Full Answer

What are the advantages and disadvantages of Medicare?

What Are the Pros of a Medicare Advantage Plan?

- Additional Benefits. As mentioned above, Medicare Advantage plans can provide additional benefits that are not found in Original Medicare.

- Out-Of-Pocket Protection. ...

- Coordinated Care. ...

- Plan Selection. ...

- Customized Coverage. ...

How to appeal a denial of Medicare Part C?

To increase your chance of success, you may want to try the following tips:

- Read denial letters carefully. ...

- Ask your healthcare providers for help preparing your appeal. ...

- If you need help, consider appointing a representative. ...

- Know that you can hire legal representation. ...

- If you are mailing documents, send them via certified mail. ...

- Never send Medicare your only copy of a document. ...

- Keep a record of all interactions. ...

What do you need to know about Medicare Part C?

Part C is also known as Medicare Advantage. These are private plans that cover everything Original Medicare does plus prescription drugs and other extras. You’re responsible for: Monthly premiums, Copays, Deductibles, Coinsurance.

Which is better humana or Medicare?

While both insurers are good options, Humana stands out for its Medicare Advantage Special Needs Plans for people with chronic illnesses or dual Medicare and Medicaid eligibility. Its prescription drug plans are remarkable for the Medication Therapy Management support program.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the advantage of having Medicare Part C?

One of the advantages of enrolling in Medicare Part C is that many plans offer prescription coverage in addition to coverage for inpatient and outpatient care. With Original Medicare, most prescriptions aren't covered, which means beneficiaries must purchase a prescription drug plan known as Medicare Part D.

Can Medicare Part C be free?

Premiums. Some Medicare Part C plans are “free,” meaning they don't have a monthly premium. Even with a zero-premium Medicare Advantage plan, you may still owe the Part B premium. Deductibles.

What does Medicare c take care of?

Medicare Part C inpatient coverage inpatient hospital care. inpatient mental health services. inpatient rehabilitation services. hospice care.

How much does Medicare Part C cost monthly?

For 2022, the average cost of a Medicare Part C plan with prescription drug coverage is $33 per month....What's the average cost of Medicare Part C?Medicare Part C plan type# of plans offeredAverage monthly costRegional PPO29$805 more rows•Jun 7, 2022

Does Medicare C cover prescriptions?

Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the plan's formulary.

Does Medicare Part C replace A and B?

Part C (Medicare Advantage) Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

Is Medicare C the same as Medicare Advantage?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

How is Medicare Part C funded?

Medicare Part C, also known as Medicare Advantage, is a private alternative to the traditional Medicare. Part C is funded separately from the rest of Medicare by the premiums that enrollees pay for Medicare Advantage health care plans.

What are some items that Medicare Part C offers that are not covered in Original Medicare?

does not cover:Routine dental exams, most dental care or dentures.Routine eye exams, eyeglasses or contacts.Hearing aids or related exams or services.Most care while traveling outside the United States.Help with bathing, dressing, eating, etc. ... Comfort items such as a hospital phone, TV or private room.Long-term care.More items...

What is the difference between Medicare Part C and Part D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

Does Medicare come out of your Social Security check?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

What is the difference between Medicare Part C and Part D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

Is Medicare Part C the same as supplemental insurance?

These are also called Part C plans. Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare (Part A and B). It is not part of the government's Medicare program, but provides coverage in addition to it.

What is the difference between Medicare Part B and Part C?

Part B covers doctors' visits, and the accompanying Part A covers hospital visits. Medicare Part C, also called Medicare Advantage, is an alternative to original Medicare. It is an all-in-one bundle that includes medical insurance, hospital insurance, and prescription drug coverage.

Is Medicare C the same as Medicare Advantage?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What is Medicare Part A?

Original Medicare. Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, ...

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

Can you sell a Medigap plan to a new beneficiary?

But as of Jan. 2, 2020, the two plans that cover deductibles—plans C and F— cannot be sold to new Medigap beneficiaries.

Do I have to sign up for Medicare if I am 65?

Coverage Choices for Medicare. If you're older than 65 (or turning 65 in the next three months) and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn't happen automatically.

Does Medicare cover vision?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare Advantage Plan.

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

Do I need Part D if I don't have Medicare?

Be aware that with Original Medicare and Medigap, you will still need Part D prescription drug coverage, and that if you don't buy it when you first become eligible for it—and are not covered by a drug plan through work or a spouse—you will be charged a lifetime penalty if you try to buy it later. 5.

What are the advantages of Medicare Part C?

Although Medicare Advantage plans must provide the same benefits as Original Medicare , some of them provide additional benefits such as dental, vision and prescription drug coverage.

What are the advantages and disadvantages of Medicare?

The Advantages and Disadvantages of Medicare. The advantages of Medicare include cost savings and provider flexibility. Among the disadvantages are potentially high out-of-pocket costs. Once you qualify for Medicare, you have several options when it comes to enrolling in a plan. You can enroll in Original Medicare, ...

What is Medicare Part A?

Medicare Part A (hospital insurance) covers inpatient care, including care received in a hospital and skilled nursing facility.

How many Medigap plans are there?

Numerous plan options. In most states, there are 10 standardized Medigap plans to choose from, each providing a different level of basic benefits. This means there are plenty of options to ensure you find a Medigap plan that provides the level of coverage you need.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

How much is Medicare Part A in 2021?

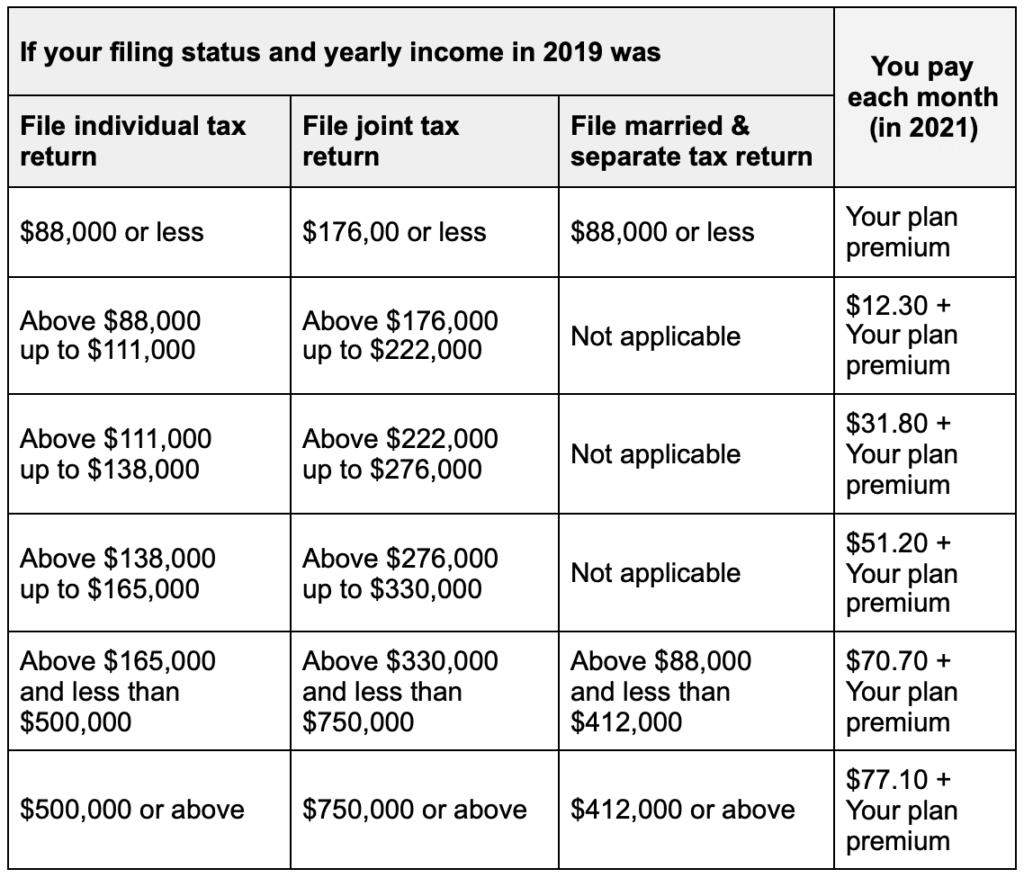

Medicare Part A is usually premium free for most people, and the standard premium for Part B starts at $148.50 per month in 2021 (but can be higher based on your income). Medicare offers a wide range of flexibility when it comes to choosing a healthcare provider.

When will Medicare plan F and C be available?

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare.

What is Medicare Advantage Part C?

Medicare Advantage Part C plans offer everything that is covered by traditional Medicare (Part A and B). However, it is offered by private insurance companies rather than the federal government. Also, it may also include other benefits, such as hospice care, dental, vision, prescription drugs, and even hearing.

Can you go to a doctor with Medicare?

With Traditional Medicare, you can go to whatever doctor you choose. Sometimes the insurance company you’re covered by will not renew their contract with Medicare. Medicare Advantage insurance companies receive a fixed amount of money from the government. This might result in a limitation of services.

Is Medicare Advantage less expensive than Medicare Advantage?

Typically Medicare Advantage costs less than traditional Medicare. However, that depends on an individual’s circumstances. There are zero-premium plans, and nearly half of those with Medicare Advantage are enrolled in plans with no premium. There can be additional costs, including drug expenses.

Do you have to submit a claim to Medicare Advantage?

There is no need to submit claims, and there is a greater emphasis on preventative care. Plan members don’t have to purchase supplemental prescription drug or Medigap coverage, which covers costs such as deductibles and copays. Medigap.com Medicare Advantage will give you more information about the different types of Medicare Advantage plans, ...

What are the pros and cons of Medicare Advantage?

There are many people that a Medicare Advantage plan really works well for. For them, these pros outright the cons: 1 Medicare Advantage plans are more affordable#N#The number one pro of a Medicare Advantage plan is that it is the most affordable option for Medicare coverage. Most Medicare Advantage plans have either zero or a low monthly premium. As a comparison, a Medicare Supplement costs around $100-$200/month.There are deductibles and co-payments, but there is a yearly out-of-pocket maximum.#N#Most people who choose this either cannot afford a Medicare Supplement or consider themselves really healthy and do not want to pay for a Medicare Supplement when they only go to the doctor once per year. 2 Medicare Advantage plans include drug coverage#N#Unlike a Medicare Supplement, where you have to get a separate drug plan, almost all Medicare Advantage plans are going to include drug coverage.That means you do not have to go out and purchase a separate plan just to cover your drugs. 3 Medicare Advantage plans include extras like dental, vision, hearing, and wellness benefits#N#Many Medicare Advantage plans include extra benefits. This includes limited dental, vision, and hearing coverage. If you are on a Medicare Supplement, you are going to have to buy coverage for these in a separate plan.#N#Some Medicare Advantage plans include wellness benefits, such as SilverSneakers, or an equivalent, that will pay for your gym membership.#N#While we don’t advocate for making a decision about your Medicare coverage based solely on these extra benefits, they are great additions to any plan.

What is Medicare Advantage Plan?

Medicare Advantage plans, also referred to as Part C of Medicare, is the name of an insurance plan which is offered by private insurance companies. When you elect to have a Medicare Advantage plan, the private insurance company replaces your Medicare coverage from the government.

What are the advantages and disadvantages of Medicare Advantage Plans?

Advantages and disadvantages of Medicare Advantage plans. Medicare Advantage plans are an alternative to Medicare Part A and Part B. Medicare Advantage plans must cover at least the same benefits as Original Medicare. One advantage of joining a Medicare Advantage plan is that some plans also cover things like prescription drugs ...

What are the advantages and disadvantages of Medigap?

Another advantage of Medigap plans is that they are accepted by every doctor and health care provider who accepts Medicare. One disadvantage of Medicare Supplement insurance is that insurance companies aren’t required to sell Medigap policies to people younger than 65.

How much will Medicare pay in 2021?

You could potentially pay additional coinsurance costs of up to $742 per day in 2021 for inpatient hospital stays of over 90 days. Though this is a rare situation, it’s worth considering. Medicare Part B includes a deductible of $203 per year in 2021.

What percentage of Medicare deductible is covered by Part B?

After you meet your Part B deductible, you are typically responsible for paying 20 percent of the Medicare-approved cost for your covered services or items. There is no cap on this 20 percent coinsurance or copayment, which means you could potentially face high out-of-pocket costs for your Part B medical care services.

Does Medicare have an out-of-pocket limit?

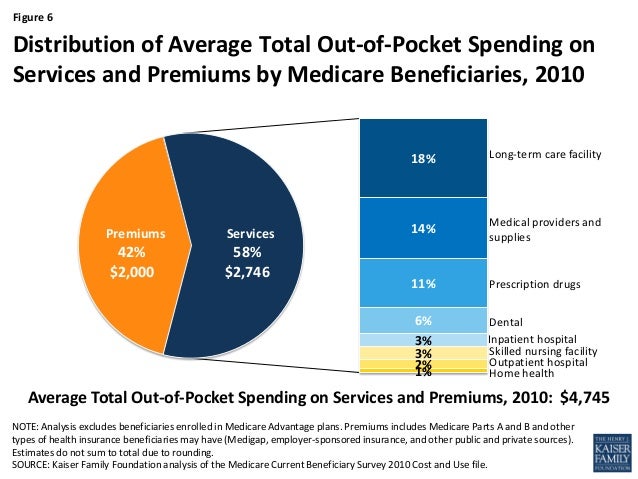

Original Medicare does not have an out-of-pocket limit. This means that Medicare beneficiaries have no limit to the amount of money they may be required to pay out of their own pocket for covered health care services in a single year.

Does Medicare Part A cover hospital care?

Medicare Part A and Part B cover a wide range hospital and medical benefits, but they still leave many things not covered. In order to get coverage for some of the benefits listed above, Medicare beneficiaries can consider enrolling in a Medicare Advantage plan that includes some or all of these benefits.

Does Medigap cover Part B?

One advantage of Medigap plans is that all 10 standardized Medigap plans that are sold in most states cover Medicare Part B coinsurance or copayments, at least partially. Depending on the types of Part B services you receive and how often you need them in a year, this could help save you money.

What Does a Medicare Advantage Plan Cover?

Medicare Advantage plans are sold by private insurance companies and are required by law to provide all of the same coverage included in Original Medicare ( Medicare Part A and Medicare Part B ).

Is a Medicare Advantage Plan Worth It?

A Medicare Advantage plan may be worth it to some beneficiaries and perhaps not worth it to others. A Medicare Advantage plan may be worth it if:

How Do You Choose a Medicare Advantage Plan?

One way to shop for a Medicare Advantage plan is to work with a licensed insurance agent. This is also a great way to learn more about the advantages and disadvantages of these plans and determine if one may be worth it for you. You can also compare plans online for free to get a better idea of the advantages and disadvantages of each plan.