What is the Fed med/EE tax?

Written by J. Hirby and Fact Checked by The Law Dictionary Staff. One withholding employees see listed on their earnings statements is the Fed MED/EE Tax. This stands for Federal Medicare/Employer-Employee and is a tax that funds the Medicare Health Insurance program.

Do you have to pay the Med/EE tax to get Medicare?

It is available to any American who has paid the tax throughout their life after they turn 65 years old. If you sought and got an exemption from paying the Fed MED/EE tax, then you will not have access to the Medicare health insurance program in your later years. Jim Treebold is a North Carolina based writer.

What is the Medicare/employer-employee tax?

This stands for Federal Medicare/Employer-Employee and is a tax that funds the Medicare Health Insurance program. This tax is a part of FICA, the Federal Insurance Contributions Act, which consists of both Medicare and Social Security Tax.

What are fed/med EE and Medicare credits?

Employees can earn Medicare and Social Security credits to be eligible for the programs when they come to retirement age. These credits essentially keep track of the number of years they have worked and paid FICA taxes to the government. Can you deduct FED/Med EE from your income taxes?

Why do I pay additional Medicare tax?

The Additional Medicare Tax helps to fund some elements of the Affordable Care Act. This includes the premium tax credit and other features. Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans.

Can you opt out of paying Medicare tax?

To do that, you'll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits.

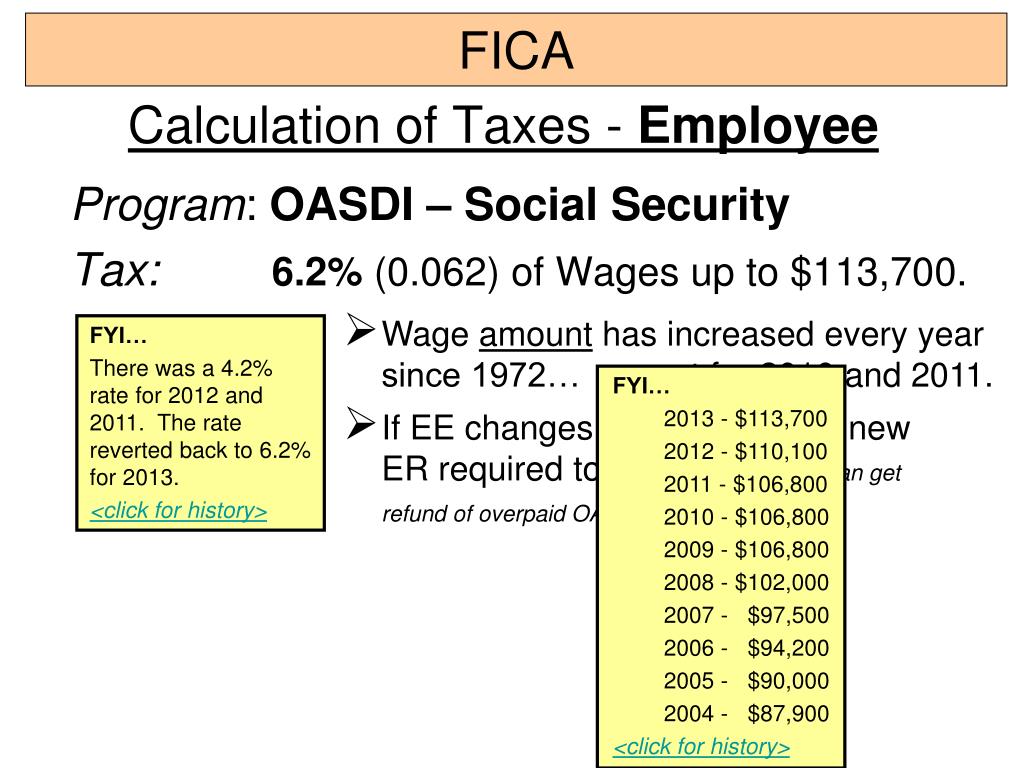

What is EE Social Security tax?

SS EE is an acronym for federal Social Security taxes paid by employees. All employees in the United States pay these taxes out of every pay check, at least up to a certain amount of income. The employer has the obligation to withhold those taxes from each paycheck, and pay the taxes to the IRS.

Who is exempt from EE Med?

The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 status.

Do I get Medicare tax back?

No, you can not get the Social Security and Medicare taxes refunded.

Is it mandatory to pay Medicare tax?

Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.

Why is Medicare taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

Who pays Social Security and Medicare taxes?

Employees, employers, and self-employed persons pay social security and Medicare taxes. When referring to employees, these taxes are commonly called FICA taxes (Federal Insurance Contributions Act).

Why is my SS tax so high?

Why the substantial increase? The increase in the wage base reflects any real wage growth. The maximum Social Security tax per worker will be $17,707.20—or a maximum $8,853.60 withheld from a highly paid employee's 2021 paycheck.

What does EE mean in health insurance?

Eligible EmployeeEE (Eligible Employee): An employee who is eligible for insurance coverage based upon the stipulations of the group health insurance plan. EE Cost: Full premium cost for an Eligible Employee. DEP (Eligible Dependent): A dependent (usually spouse or child) of an insured person who is eligible for insurance coverage.

What does EE mean in payroll?

When used in the context of HR, or human resources, EE stands for “equal employment,” better known as “equal employment opportunity,” or “EEO,” catch-all terms that describe the various laws, regulations and jurisprudence that prohibit specific categories of discrimination in employment practices within the U.S.

Does Fed Med EE count as federal withholding?

The abbreviation "Fed Med/EE" most likely stands for the amount withheld from your paycheck for Medicare (the "EE" usually refers to the "employee" rather than the "employer"). Federal Medicare withholding is not deductible nor creditable on your Federal income tax return and is NOT your Federal withholding.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

What is the Medicare tax rate for a person earning $225,000 a year?

However, the additional 0.9% only applies to the income above the taxpayer’s threshold limit. 8 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45% and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

How much does a W-2 pay?

W-2 employees pay 1.45% and their employer covers the remaining 1.45%. Self-employed individuals, as they are considered both an employee and an employer, must pay the full 2.9%. Unlike Social Security tax, there is no income limit to which Medicare tax is applied. 7. An individual’s Medicare wages are subject to Medicare tax.

Where are Medicare and Social Security taxes put?

Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury . Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are covered by the Supplemental Medical Insurance Trust Fund, ...

Is Medicare income taxable?

An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

Do employers have to pay Medicare taxes?

Under the Federal Insurance Contributions Act (FICA ), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks. Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. ...

Will the Hospital Insurance Trust Fund be exhausted?

However, the Hospital Insurance Trust Fund has been facing solvency and budget pressures and is expected to be exhausted by 2026, according to the 2019 Trustees Report. 5 If this happens, then Medicare services may be cut, or lawmakers may find other ways to finance these benefits.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How much Medicare tax do self employed people pay?

Self-employed workers must calculate and pay the full 2.9 percent Medicare tax. Technically speaking, a self-employed person is both employer and employee, so the self-employed person must pay the employee's 1.45 percent and the employer's 1.45 percent.

How much of your paycheck is Medicare taxed?

Employers, though, are required to withhold 1.45 percent of each paycheck. While you are responsible for paying the tax, your employer is responsible for making sure the correct amount is withheld and paid. Unlike federal income taxes, you do not need to file a tax return for the Medicare tax.

What is the Medicare tax rate for C corp?

The Medicare tax is collected on all wages earned in the United States, with only a few rare exceptions. The Medicare tax is 2.9 percent of all wages.

What is the purpose of Medicare tax?

The purpose of the Medicare tax is to provide funding for the U.S. Medicare health insurance program. Medicare is a form of health insurance for people age 65 and older (and also for people under age 65 with certain disabilities) and provides for all kinds of medical care, including hospital visits and treatment, as well as prescription medications.

How much tax do you have to pay on a paycheck?

Employers are required to withhold 1.45 percent of each paycheck. In addition to that withholding, employers are required to pay an additional 1.45 percent from their own pocket for a total tax of 2.9 percent.

Can self employed claim Medicare?

The good news, though, is that self-employed people can claim an income tax deduction for half of all Medicare taxes paid , so the cost of the tax is minimized at least a little. Self-employed people report their Medicare tax by filing IRS Schedule SE.

Is Medicare tax the same as Social Security?

Medicare tax is similar to the Social Security tax (Fed OASDI/EE Tax). The Social Security tax is higher (12.4 percent in 2013) but is collected in the same way as the Medicare tax. Many people refer to the Social Security Tax and the Medicare tax collectively as the FICA tax, or the Social Security tax or payroll taxes.

What is the EE tax?

The Fed MED/EE tax stands for Federal Medicare/Employer-Employee tax and it is used to fund the federal Medicare insurance program. Every American is allowed to access the Medicare health insurance program, which includes many basic services for free. While there are parts of Medicare that the subscriber must pay for, ...

What are the programs that get funded directly from your paycheck?

There are very few federal government programs that get funded directly out of your paycheck. The most common program is the federal Medicare health program. It is available to any American who has paid the tax throughout their life after they turn 65 years old.

Can you write off half of the Fed MED/EE tax?

For people who are employed by a company , the employee pays half of the tax and the company pays the other. If you are self-employed, then you pay the entire 2.9 percent on your own. The good news is that self-employed people can write off half of the Fed MED/EE tax as a business expense.

Do you have to pay EE or MED tax?

Every American taxpayer is required to pay the Fed MED/EE tax, unless they offer a qualified exception. If you are part of a religion that does not believe in health insurance, then you can petition the IRS to be exempt from the Fed MED/EE tax.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

How much Medicare do self employed people pay in 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

How much tax do you pay on income above the threshold?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000.

Does RRTA count toward income tax?

Incomes from wages, self-employment, and other compensation, including Railroad Retirement (RRTA) compensation, all count toward the income the IRS measures. If you’re subject to this tax, your employer can withhold it from your paychecks, or you can make estimated payments to the IRS throughout the year.

What is Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What happens if an employee does not receive enough wages for the employer to withhold all taxes?

If the employee does not receive enough wages for the employer to withhold all the taxes that the employee owes, including Additional Medicare Tax, the employee may give the employer money to pay the rest of the taxes.

How much did M receive in 2013?

M received $180,000 in wages through Nov. 30, 2013. On Dec. 1, 2013, M’s employer paid her a bonus of $50,000. M’s employer is required to withhold Additional Medicare Tax on $30,000 of the $50,000 bonus and may not withhold Additional Medicare Tax on the other $20,000.

How much is F liable for Medicare?

F is liable to pay Additional Medicare Tax on $50,000 of his wages ($175,000 minus the $125,000 threshold for married persons who file separate).

Where are uncollected taxes reported on W-2?

Uncollected taxes are not reported in boxes 4 and 6 of Form W-2. Unlike the uncollected portion of the regular (1.45%) Medicare tax, the uncollected Additional Medicare Tax is not reported in box 12 of Form W-2 with code B. The employee may need to make estimated tax payments to cover any shortage.

Do you have to include fringe benefits in wages?

The value of taxable noncash fringe benefits must be included in wages and the employer must withhold the applicable Additional Medicare Tax and deposit the tax under the rules for employment tax withholding and deposits that apply to taxable noncash fringe benefits.

What is EE rate?

Though business health insurance quotes come in various formats, most insurance providers use the same abbreviations. The EE Rate is the employee rate. This is usually placed in the column to the far left, on that same line. This is the rate of the employee’s insurance, regardless of whether they have dependents or not.

Can an employer self-insure a group health plan?

The employer chooses the plan that best fits the company’s needs and workers can either accept enrollment or seek other alternatives for health insurance. Most group health plans are underwritten by a health insurance company, though some very large businesses can choose to self-insure health care coverage for employees.

What does EE stand for in Fed Med?

Fed Med EE: What is EE? "EE" is a two-letter abbreviation for a single word: "employee.". The abbreviation is usually used only in payroll accounting. The "e" at the end of "employee" is added to the "e" at the front to eliminate confusion as to other things that "e" could stand for, notably "expense.". So when you see EE on your pay stub, it's ...

What does EE mean on a pay stub?

How EE Might Appear on Your Pay Stub. EE is a standard code for the employee's share of certain Federal taxes. For instance, "FICA/EE," meaning the amount deducted from your paycheck for Social Security. The deduction for Medicare is coded "Fed MED/EE.".