Which type of coverage may be excluded from a Medicare Advantage plan? Non-medical services, including a private hospital room, hospital television and telephone, canceled or missed appointments, and copies of x-rays. Most non-emergency transportation, including ambulette services.

What items are excluded from Medicare coverage?

Which type of coverage may be excluded from a Medicare Advantage plan? Non-medical services, including a private hospital room, hospital television and telephone, canceled or missed appointments, and copies of x-rays. Most non-emergency transportation, including ambulette services. Certain preventive services, including routine foot care.

What is the preclusion list for Medicare Advantage?

Services excluded from Medicare coverage include but are not limited to: Alternative medicine, including experimental procedures and treatments, acupuncture, and chiropractic services, except... Most care received outside of the United States Cosmetic surgery, unless needed to improve the function ...

What are the pitfalls of Medicare Advantage plans?

except hospice care. Original Medicare covers hospice care even if you’re in a Medicare Advantage Plan. In all types of Medicare Advantage Plans, you’re always covered for emergency and urgent care. Medicare Advantage Plans must offer emergency coverage outside of the plan’s service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra …

Do all Medicare Advantage plans include drug coverage?

May 15, 2020 · Supplements and over-the-counter medications are usually excluded from Part D coverage. These products may qualify, however, for benefits or discounts under a Medicare Advantage plan. To learn more, you will need to contact your plan manager directly to discuss your options and needs. Lifestyle Drugs Excluded.

What are Medicare exclusions?

Does Medicare Advantage pay for everything?

What is included in a Medicare Advantage plan?

Can you switch back and forth between Medicare and Medicare Advantage?

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

What is the most popular Medicare Advantage plan?

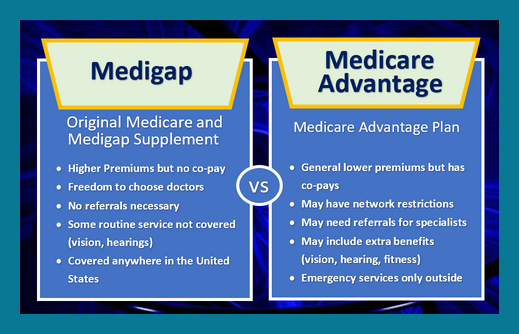

What is the difference between Medicare Supplement and Medicare Advantage plans?

What is the highest rated Medicare Advantage plan?

What is Medicare Part D?

Medicare Part D provides a cost-saving benefit to recipients in the form of discounts on many common prescription medications, and since 2006, it has been utilized by millions of Medicare recipients across the country.

Is a drug not listed in the formulary?

If a drug is not listed in your formulary, it is not covered, but you may be able to work with your doctor and plan manager to file an exemption for special coverage.

Is a hospital pharmacy covered by Medicare?

Thankfully, if a medication needs to be administered by a healthcare professional or needs to be obtained through a hospital pharmacy for use while admitted to a healthcare facility, it may be covered through Medicare Part A or Medicare Part B, depending on the circumstances.

Do people on Medicare take prescription drugs?

Whether you take medication on a daily basis to manage symptoms of a chronic medical condition or you occasionally need prescription drugs to treat acute healthcare concerns, there’s no denying that medications are an important part of the US healthcare system. As a result, many people who receive Medicare benefits opt to take part in Medicare Part D prescription drug plans. Medicare Part D provides a cost-saving benefit to recipients in the form of discounts on many common prescription medications, and since 2006, it has been utilized by millions of Medicare recipients across the country.

Can lifestyle medications be excluded from Medicare?

To learn more, you will need to contact your plan manager directly to discuss your options and needs. Many drugs that are considered lifestyle medications are usually excluded from Part D coverage despite otherwise meeting all of the requirements for Medicare’s guidelines.

Is Part D covered by Part D?

Although Part D prescription drug plans offer benefits for a large number of prescription medications, not all drugs are covered. In order to get help paying for a particular medication, the drug must be included in your plan’s formulary.

Does Medicare cover erectile dysfunction?

An example of this may be where an erectile dysfunction drug is used to address blood flow issues and cardiovascular health. If the medication is prescribed simply to treat erectile dysfunction, it may not be covered, but if it is prescribed for “off-label” use, Medicare Part D may cover it. To be sure that your prescription drugs will qualify, you should work with your doctor to see if any alternatives exist, and then contact your plan manager or administrative office before attempting to fill the prescription to receive a definitive answer.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

Why is Medicare Advantage so expensive?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, the plan only offers a limited network of doctors, which can interfere with a patient's choice. It's not very easy to change to another plan; if you decide to switch to Medigap, there are often lifetime penalties.

How to see how a Medicare Advantage Plan cherry picks its patients?

To see how a Medicare Advantage Plan cherry-picks its patients, carefully review the copays in the summary of benefits for every plan you are considering. To give you an example of the types of copays you may find, here are some details of in-network services from a popular Humana Medicare Advantage Plan in Florida:

What is Medicare Supplement?

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, such as copayments, deductibles, and healthcare when you travel abroad.

What should prospective Medicare Advantage customers research?

Prospective Medicare Advantage customers should research plans, copays, out-of-pocket costs, and eligible providers.

Can you sell a Medigap plan to a new beneficiary?

But as of Jan. 2, 2020, the two plans that cover deductibles—plans C and F— cannot be sold to new Medigap beneficiaries.

Does Medicare Advantage cover gaps?

Medicare Advantage covers some of the gaps of original Medicare (Part A and Part B), and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or requiring intense medical care. If a patient's situation worsens later on, it might be difficult or expensive to switch plans.

What is a preclusion letter?

The letter will contain the reason you are precluded, the effective date of your preclusion, and your applicable rights to appeal.

Is Medicare revoked under an active reenrollment bar?

Are currently revoked from Medicare, are under an active reenrollment bar, and CMS has determined that the underlying conduct that led to the revocation is detrimental to the best interests of the Medicare program.

What is a Medicare deductible?

A Medicare deductible is the amount you must pay for health care services (excluding premiums) before your coverage begins to kick in.

How much can you save if you don't accept Medicare?

If you are enrolled in Original Medicare, avoiding health care providers who do not accept Medicare assignment can help you save up to 15 percent on excess charges. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is a Medigap plan?

These plans, also known as “ Medigap ,” provide coverage for some of Medicare’s out-of-pocket costs, such as deductibles, coinsurance and copayments. Some Medigap plans even include annual out-of-pocket spending limits. Sign up for a Medicare Advantage plan.

How much is Medicare Part B?

Part B. The standard Medicare Part B premium is $148.50 per month. However, the Part B premium is based on your reported taxable income from two years prior. The table below shows what Part B beneficiaries will pay for their premiums in 2021, based off their 2019 reported income. Medicare Part B IRMAA.

What is Medicare Part D based on?

Part D premiums also come with an income-based tier system that uses your reported income from two years prior, similar to how Medicare Part B premiums are calculated. Part D premiums for 2021 will be based on reported taxable income from 2019, and the breakdown is as follows: Medicare Part D IRMAA. 2019 Individual tax return.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for a Medicare Advantage plan that includes prescription drug coverage is $33.57 per month. 1

How often is Medicare paid?

Premiums exist for each part of Medicare. Premiums are typically paid monthly, but in some cases, they may be paid quarterly or yearly.