Is FICA the same as Medicaid tax?

What is FICA? FICA is a U.S. federal payroll tax. It stands for the . Federal Insurance Contributions Act. and is deducted from each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self-employment. As you work and pay FICA taxes, you earn credits for Social Security benefits. How much is coming out of my check?

Who pays FICA employer or employee?

Feb 16, 2022 · The Federal Insurance Contributions Act (FICA) implemented a tax that employers have to withhold from employee pay. This law came about in 1935, and it has helped fund programs such as Social Security.

What does FICA stand for in health care?

Sep 17, 2020 · FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA. In 2019, the tax rate for employees was …

What is FICA tax and how is it calculated?

Why is FICA and Medicare taken out of paycheck?

Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act. The funds are used to pay for both Social Security and Medicare. If you own a business, you're responsible for paying Social Security and Medicare taxes, too.Jan 12, 2022

Are FICA and Medicare the same?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes.

What is the difference between FICA and Social Security?

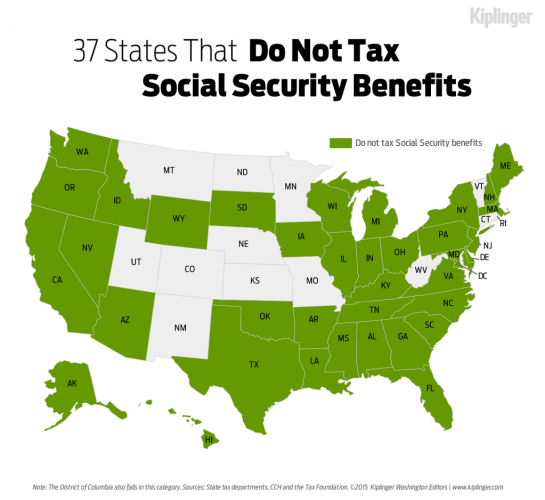

Is FICA the same as Social Security? No, but they are closely connected. FICA, the Federal Insurance Contributions Act, refers to the taxes that largely fund Social Security retirement, disability, survivor, spousal and children's benefits. FICA taxes also provide a chunk of Medicare's budget.

Does everyone pay FICA Medicare?

Both you and your employer pay the Medicare Tax as a part of FICA. Your total FICA taxes equal 15.3 percent of your wages — 2.9 percent for Medicare and 12.4 percent for Social Security. But if you are an employee, you only pay half of that. Your employer pays the other half.

What are Medicare wages?

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax.

What are the two portions of FICA?

FICA taxes have two elements that are withheld from employee paychecks and paid by employees: Social Security (Old-Age, Survivors and Disability Insurance or OASDI) and. Medicare. 1May 28, 2020

Does FICA include Medicare?

Unlike federal income tax, FICA tax is a percentage of each employee's taxable wages. It consists of two types of taxes: Social Security and Medicare. Part of the FICA percentage goes toward Social Security and the other part goes toward Medicare.Oct 21, 2020

Why is FICA important?

FICA helps fund both Social Security and Medicare programs, which provide benefits for retirees, the disabled, and children.

Can I deduct Medicare and Social Security?

Social Security and Medicare taxes of most wage earners are figured by their employers. Also, you can deduct the employer-equivalent portion of your SE tax in figuring your adjusted gross income. Wage earners cannot deduct Social Security and Medicare taxes.

Is FICA required?

FICA contributions are mandatory, and rates are set annually, although not necessarily changed every year—they have remained stable between 2020 and 2022, for example. The amount of the FICA payment depends on the income of the employee: the higher the income, the higher the FICA payment.

Is FICA paid on all income?

If the employee earns more than $137,700, then the Social Security portion of FICA (6.2% each from both the employer and employee) only applies to the first $137,700 of their wages....How much is FICA tax?Employee – Wages of $65,000Employer PaysEmployee PaysTotal:$4,972.50$4,972.502 more rows•May 12, 2020

Does FICA apply to all income?

Usually, FICA applies to all taxable compensation (salary, wages, commissions, bonuses, tips), including taxable fringe benefits (e.g., reimbursement for moving expenses, taxable prizes and awards) and salary reduction amounts for contributions to 401(k)s and similar plans.Apr 21, 2021

Is FICA tax the same as Social Security?

Since Social Security is a part of the FICA tax, the money from your FICA contribution goes toward Social Security programs, including retirement,...

How much is the FICA tax rate for 2020?

The current FICA tax rate is 7.65% of your employees’ incomes, plus an employer match of 7.65%. This tax is broken up into 6.2% for Social Security...

What tax forms do employers need to file for FICA taxes?

You need to submit the IRS Form 941 (The Employer’s Quarterly Federal Tax Return) to report your business’ contributions to Medicare and Social Sec...

What is Medicare?

Medicare is a federal health insurance program for people who qualify, including: People 65 years and older People with certain disabilities People...

What happens if employees overpay FICA taxes?

If your employees overpay on FICA taxes, they’ll get a refund once they file their taxes. Employees who have a second job on the side or who recent...

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

What is the most important tax to stay on top of and get correct?

FICA taxes are the most important tax to stay on top of and get correct. Not withhold or paying the correct amount of FICA taxes will result in serious consequences for the employer. All businesses must report FICA taxes quarterly to the IRS using Form 941.

What happens if you don't pay Social Security taxes?

If an employee makes more than the set $132,900, Social Security tax should not be withheld from their pay for any earning made above this amount. If you do not follow Social Security, Medicare, or FICA instruction carefully, you may end up either not deducting enough or too much.

What is the Medicare tax rate if you make more than the threshold?

The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional Medicare tax of 0.9%.

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...

Do self employed pay Social Security taxes?

Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900. The employer must match the amount paid by the employee.

How does FICA tax work?

FICA taxes come out of your employee’s paychecks, and as an employer, you typically must match what your employees contribute. So, how much are FICA taxes? The FICA rate is set annually, although it doesn’t always change each year. For instance, the FICA rate stayed the same from 2019 to 2020.

What is FICA payroll tax?

What Is FICA? What Employers Should Know About FICA Taxes. Most employers and their employees are required to pay FICA taxes, a type of payroll tax , to the Internal Revenue Service (IRS). The payment amount for these taxes varies based on how much your employees make. Learn more about what these taxes entail, including how much to withhold ...

How to calculate FICA taxes?

Calculate how much your employees owe in FICA taxes by multiplying their gross pay by the Social Security and Medicare tax rates. Once you calculate this total, match how much your employee pays. Follow these general equations: 1 Social Security calculation: Gross pay x 6.2% = Social Security contribution 2 Medicare calculation: Gross pay x 1.45% = Medicare contribution 3 Total FICA taxes calculation: Social Security contribution + Medicare contribution = Total FICA taxes

What is the current FICA tax rate?

The current FICA tax rate is 7.65% of your employees’ incomes, plus an employer match of 7.65%. This tax is broken up into 6.2% for Social Security and 1.45% for Medicare. The combined contribution, including the tax on your employees’ incomes and the amount you have to match, is 15.3%.

When did FICA start?

Introduced in the 1930s, FICA, or the Federal Insurance Contribution Act, is a U.S. law that requires employers and their employees to make contributions to fund Medicare and Social Security programs. FICA taxes come out of your employee’s paychecks, and as an employer, you typically must match what your employees contribute.

What is the maximum wage for Social Security 2020?

Although there’s no wage limit for Medicare, the maximum taxable earnings for employees in 2020 is $137,700 for Social Security. Once an employee makes over $200,000 ...

Why is Social Security important?

The government designed Social Security as a way for current employees to support current retirees’ and other beneficiaries’ benefits. When employees and employers pay into this system, they eventually get to reap the benefits later on in life. It’s a way for the workforce to provide retirement funds for all employees.