Is Medicare paid for by FICA?

Feb 16, 2022 · If you work for yourself, you’ll be responsible for the employee and employer portions of FICA and Medicare taxes. The tax rates will technically stay the same at 6.2% and 1.45% for the taxes. However, because you pay the employer portion, you will owe 12.4% of your income in FICA taxes.

What is the current tax rate for FICA?

What is FICA? FICA is a U.S. federal payroll tax. It stands for the . Federal Insurance Contributions Act. and is deducted from each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self-employment. As you work and pay FICA taxes, you earn credits for Social Security benefits. How much is coming out of my check?

What is FICA tax and how is it calculated?

Federal Medicare tax rates increased from 0.35% in 1966 (when they were first executed) to 1.35% in 1985. FICA Tax Rates 2021. The two workers and employers pay FICA taxes at a similar rate. The Social Security tax rate is 6.2% of wages, and the Medicare tax rate is 1.45% of wages.

How do you calculate FICA tax?

Jun 04, 2021 · FICA stands for the Federal Insurance Contributions Act, and it’s a federal tax that employers and employees pay. FICA tax includes two taxes: Medicare tax and Social Security tax. The 2022 tax rates for employers are 6.2% for Social Security and 1.45% for Medicare. Run payroll and benefits with Gusto.

Is FICA and Medicare tax the same?

FICA stands for the Federal Insurance Contributions Act, and it's a federal tax that employers and employees pay. FICA tax includes two taxes: Medicare tax and Social Security tax. The 2022 tax rates for employers are 6.2% for Social Security and 1.45% for Medicare.Jun 4, 2021

Why is FICA and Medicare taken out of paycheck?

Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act. The funds are used to pay for both Social Security and Medicare. If you own a business, you're responsible for paying Social Security and Medicare taxes, too.Jan 12, 2022

Do you get FICA tax back?

The FICA tax is a way of life for working American citizens, but many immigrants may be surprised to learn that they don't need to pay the tax depending on their immigration status. If they are exempt, they qualify for what is known as a FICA tax refund.Mar 21, 2022

Who is exempt from FICA taxes?

International students, scholars, professors, teachers, trainees, researchers, physicians, au pairs, summer camp workers, and other aliens temporarily present in the United States in F-1,J-1,M-1, or Q-1/Q-2 nonimmigrant status are exempt from FICA taxes on wages as long as such services are allowed by USCIS.

Is FICA Social Security?

Is FICA the same as Social Security? No, but they are closely connected. FICA, the Federal Insurance Contributions Act, refers to the taxes that largely fund Social Security retirement, disability, survivor, spousal and children's benefits. FICA taxes also provide a chunk of Medicare's budget.

Why did I get a FICA Refund?

Is There a FICA Tax Refund? There is a FICA tax refund for immigrants who are exempt from the tax as well as for anyone required to pay FICA, yet who overpay. This usually happens if you change employers.

Does everyone pay Medicare tax?

Who pays the Medicare tax? Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.Feb 18, 2022

Do you get Social Security and Medicare tax back?

If your employer refuses to refund the taxes, you can file Form 843 (for instructions see here) and the IRS will refund the money to you. The IRS will then send a request to the employer to correct their social security and Medicare reporting and the employer will have to send you a corrected W2c.

How does FICA show on my paycheck?

If you see “FICA” on your pay stub, this is the amount you are contributing to these funds. Some pay stubs will break down your contribution to the two funds separately, and some will not.

Is FICA mandatory?

FICA contributions are mandatory, and rates are set annually, although not necessarily changed every year—they have remained stable between 2020 and 2022, for example. The amount of the FICA payment depends on the income of the employee: the higher the income, the higher the FICA payment.

What income is subject to FICA?

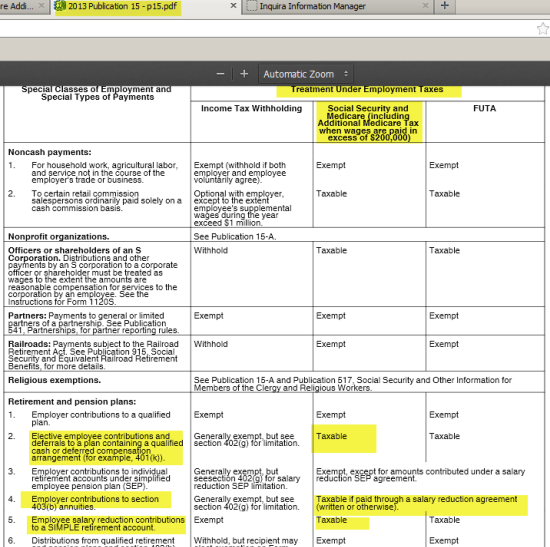

Usually, FICA applies to all taxable compensation (salary, wages, commissions, bonuses, tips), including taxable fringe benefits (e.g., reimbursement for moving expenses, taxable prizes and awards) and salary reduction amounts for contributions to 401(k)s and similar plans.Apr 21, 2021

Do I need to pay FICA?

Yes. There is no exemption for paying the Federal Insurance Contribution Act (FICA) payroll taxes that fund the Social Security and Medicare systems. As long as you work in a job that is covered by Social Security, FICA taxes will be withheld from your paycheck. The same goes if you remain actively self-employed.

What is Medicare tax?

What is the Medicare tax? This tax supports the Medicare program, which provides federal health insurance for Americans who are 65 and older. Both employers and employees must pay the Medicare tax. (Self-employed people pay both the employer and employee portions of the Medicare tax as part of the self-employment tax .)

What is the FICA rate for 2021?

FICA tax includes two taxes: Medicare tax and Social Security tax. The 2021 tax rates for employers are 6.2% for Social Security and 1.45% for Medicare. Get the latest articles, info, and advice to help you run your small business.

What is the Medicare tax rate for 2021?

The 2021 rate for the Medicare tax is set at 1.45% of an employee’s gross earnings, and the employer portion matches that 1.45%. The employee’s portion is deducted from their wages while the employer pays their share directly. Some employees may also have to pay an Additional Medicare Tax. This 0.9% tax applies to individuals who make more ...

What is the tax threshold for 2021?

The 2021 thresholds are: $125,000 for those who are Married Filing Separate. $200,000 for those who file their taxes as Single or Head of Household. $250,000 for those who are Married Filing Jointly. Got it.

What is the Social Security tax rate for 2021?

The 2021 rate for the Social Security tax is 6.2% of an employee’s gross earnings up to $132,900, with a matching 6.2% from the employer. The employee’s portion is deducted from their wages while the employer pays its share directly.

Do self employed people pay Social Security taxes?

And, just like Medicare, self-employed folks pay both shares—employer and employee—as part of the self-employment tax.

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

Do self employed pay Social Security taxes?

Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900. The employer must match the amount paid by the employee.

What happens if you don't pay Social Security taxes?

If an employee makes more than the set $132,900, Social Security tax should not be withheld from their pay for any earning made above this amount. If you do not follow Social Security, Medicare, or FICA instruction carefully, you may end up either not deducting enough or too much.

Do employers have to pay FICA taxes?

In addition, employers must also pay their own employer FICA taxes and report both these and their employees’ portions to the IRS. FICA taxes are the most important tax to stay on top of and get correct. Not withhold or paying the correct amount of FICA taxes will result in serious consequences for the employer.

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...

How much is FICA tax?

If you earn a wage or a salary, you’re likely subject to FICA taxes. (FICA stands for Federal Insurance Contributions Act.) Not to be confused with the federal income tax, FICA taxes fund the Social Security and Medicare programs and add up to 7.65% of your pay (in 2020). The breakdown for the two taxes is 6.2% for Social Security (on wages up to $137,700) and 1.45% for Medicare (plus an additional 0.90% for wages in excess of $200,000). Also known as payroll taxes, FICA taxes are automatically deducted from your paycheck. Your company sends the money, along with its match (an additional 7.65% of your pay), to the government. In this article we’ll discuss what FICA taxes are, how they’re applied and who’s responsible for paying them.

How much does each party pay for FICA?

Employers and employees split the tax. For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

What is SECA tax?

For self-employed workers, they’re referred to as SECA taxes (or self-employment taxes) based on regulations included in the Self-Employed Contributions Act.

When are Social Security taxes due?

For employers’ share of Social Security taxes, they have until the end of 2021 to pay half of what’s due for 2020 and until the end of 2022 to pay the second half. If you’d like to know more, read our article, Payroll Tax Delay for Coronavirus-Impacted Businesses.

What is the maximum amount of Social Security income?

A wage base limit applies to employees who pay Social Security taxes. This means that gross income above a certain threshold is exempt from this tax. The wage limit changes almost every year based on inflation. For 2019, it was $132,900. For 2020, it’s $137,700. This income ceiling is also the maximum amount of money that’s considered when calculating the size of Social Security benefits.

What is the Medicare tax rate?

The Additional Medicare Tax rate is 0.90% and it applies to employees’ (and self-employed workers’) wages, salaries and tips. So any part of your income that exceeds a certain amount gets taxed for Medicare at a total rate of 2.35% (1.45% + 0.90%).

What happens if you overpay Social Security?

If you overpaid Social Security and you only have one job, you’ll need to ask your employer for a refund. Excess Medicare tax repayments are nonrefundable since there’s no wage base limit. If you have more than one job, you may underpay the amount of FICA taxes you owe.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.