Is Medicare Advantage good or bad?

You may want to choose between Original Medicare and Medicare Advantage for financial reasons, but you may also want to consider access to certain healthcare services. The important thing is to understand the differences between each type of Medicare before you commit yourself to a plan for the coming year.

When to choose Original Medicare vs. Medicare Advantage?

With this Medigap plan option, you typically pay a lower premium in exchange for a higher deductible. The average premium for high deductible Plan F in 2018 was $57.16 per month, or roughly one-third of the average monthly cost of the traditional Plan F. 2

How much does Medigap insurance cost on average?

disadvantage of medicare advantage plans

- Networks

- Referrals

- Prior Authorizations

- Frequent Expenses

- Out-of-Pocket Maximums

- Plan Changes

- Medicare is no longer managing your healthcare

Why Advantage plans are bad?

Is a Medigap plan better than an Advantage plan?

A Medicare Advantage plan may be a better choice if it has an out-of-pocket maximum that protects you from huge bills. Regular Medicare plus a Medigap insurance plan generally allows you more choice in where you receive your care.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the downside to Medigap plans?

Because Medigap plans are sold by private insurance companies, they can charge different monthly premiums. While plans are standardized in regard to coverage and benefits, they are not standardized in regards to cost. Cost can even increase over time based on inflation, your age and other factors.

What is the difference between plan G and an Advantage plan?

Costs for a Medicare Advantage plan and a Medicare Supplement Plan G differ substantially in both premium costs and potential out-of-pocket costs. A Medicare Advantage plan often has no monthly premium, while a Medicare Supplement Plan G always has a monthly premium.

Can I switch from Medicare Advantage to Medigap?

Most Medicare Advantage Plans offer prescription drug coverage. , you may want to drop your Medigap policy. Your Medigap policy can't be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What are the pros and cons of Medigap?

Medigap Pros and ConsMedigap ProsMedigap ConsAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductibleSome plans offer extras like excess charges, foreign travel, and Silver Sneakers programDoes not include drug coverageNationwide coverageDoesn't cover acupuncture3 more rows•Jun 4, 2015

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Why should I choose a Medigap plan?

Medigap policies are sold by private companies, and can help pay for some of the costs that Original Medicare doesn't, like copayments, coinsurance, and deductibles. Some Medigap policies also cover certain benefits Original Medicare doesn't cover, like emergency foreign travel expenses.

What is the most popular Medigap plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan.

What is the monthly premium for plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

What is the deductible for plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

What is Medicare Advantage?

Medicare Advantage is private health insurance through Medicare that often also includes prescription drug coverage, or Medicare Part D. The plans usually provide coverage for things like vision, dental, disability services, home health, and other health care needs not covered by original Medicare.

What is Medigap?

Medigap, also known as Medicare Supplement Insurance, adds to original Medicare by filling in gaps where you aren’t covered. Medigap plans usually don’t cover vision, hearing, long-term care or at-home care. However, they're useful for specific types of coverage, such as health insurance while traveling or frequent emergency care.

Which one is better?

Both Medicare Advantage and Medigap provide advantages and disadvantages.

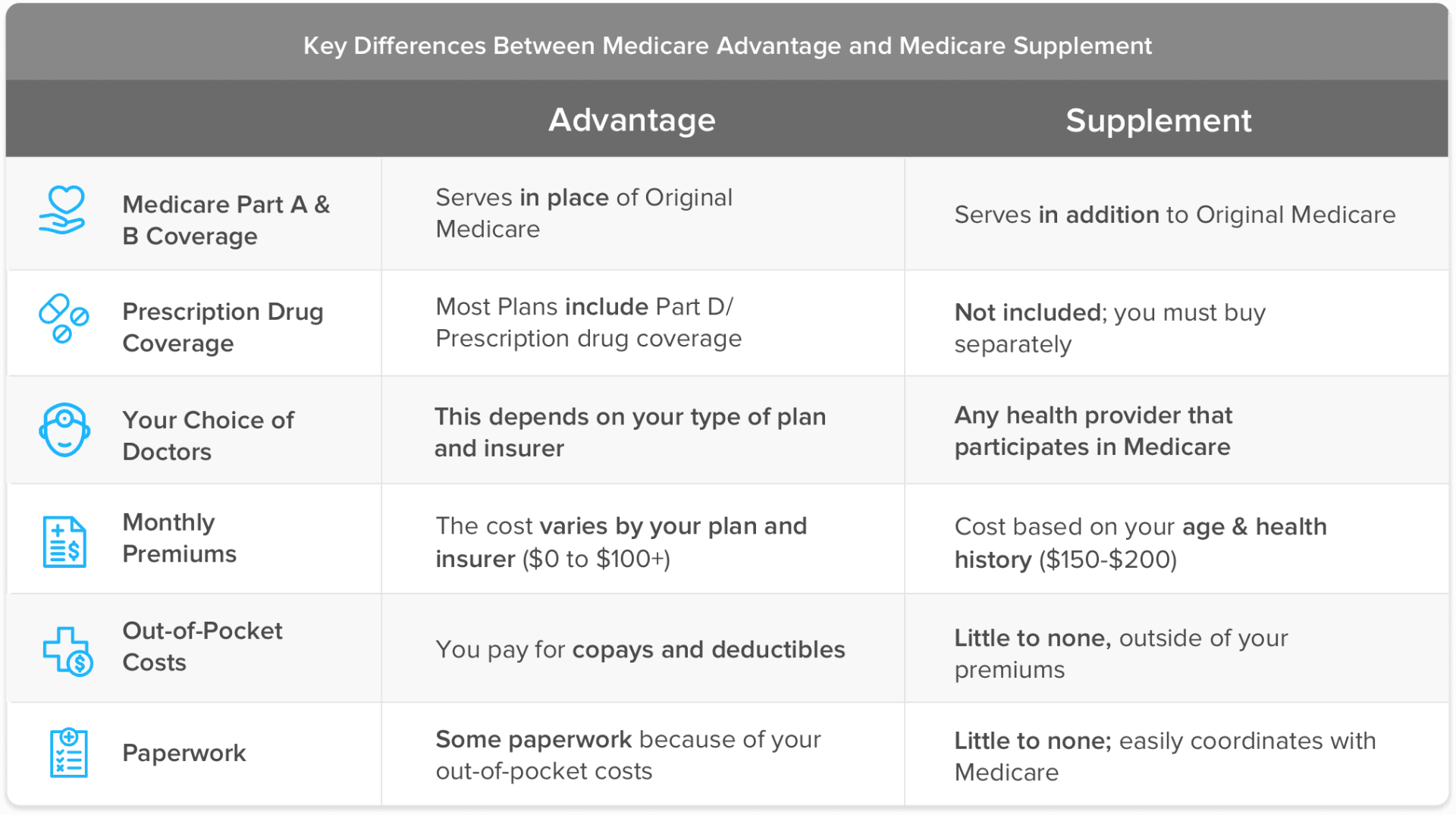

What is the difference between Medicare Advantage and Medigap?

The main difference between the two is how they work alongside original Medicare. Medigap plans work alongside original Medicare’s Part A and Part B to help with out-of-pocket expenses, such as deductibles, coinsurance, and copayments.

How does Medicare Advantage work?

Medicare Advantage plans work in different ways, so it is advisable for people to compare all the available plans in their area. They can do this using Medicare’s find-a-plan tool. After deciding on a specific plan, a person can enroll by doing one of the following: enrolling through the company’s website.

How long does it take to switch from Medicare Advantage to Medigap?

Switching between plan types. There are three opportunities for a person to switch from Medicare Advantage to Medigap. During the initial enrollment period (IEP): This 7-month period begins the month before a person reaches 65 years of age.

What is a Medigap plan?

Medigap plans are standardized, which means that they all provide the same basic benefits. However, some plans may offer additional benefits. Once a person decides on a plan, Medicare will provide contact information for the company administering the plan.

How long do you have to switch back to Medicare after enrolling?

Shortly after enrolling: When a person first becomes eligible for Medicare and enrolls in a Medicare Advantage plan, they have 3 months in which they can switch back to original Medicare and enroll with Medigap.

What are the parts of Medicare Advantage?

Medicare Advantage plans combine original Medicare’s parts A and B, and the majority include coverage for prescription drugs . Advantage plans often also include other benefits not available with original Medicare, including vision, dental, or hearing coverage.

When does Medicare Advantage OEP end?

During the Medicare Advantage OEP: This OEP runs from January 1 to March 31 each year. Between these dates, a person can drop their Medicare Advantage plan, return to original Medicare, or enroll in a Medigap plan.

What is Medicare Advantage Plan?

If you know you want an alternative to Original Medicare, you may be wondering: what is a Medicare Advantage plan? A Medicare Advantage plan offers the same amount of coverage as Original Medicare, but through a private company approved by Medicare.

What is the best Medicare supplement plan?

Although Medicare Supplement plans tend to have higher premiums, many people favor them because of the peace of mind they offer. If you’re looking for the following features in your insurance, a Medicare Supplement plan may be the best choice: 1 Broad doctor and hospital network 2 Low and predictable out-of-pocket costs 3 Claims paid that are paid on time and in full, without hassle or risk of denial

How much is Medicare Part B in 2021?

For most people in 2021, the Medicare Part B premium is $148.50 Your Medicare Advantage plan may have a premium as well, but it will most likely be lower than your Part B premium. When you compare Medicare Advantage plans, you should be sure to review the deductible and copayments for medical services and prescription medications.

Why do people choose Medicare Supplement?

Although Medicare Supplement plans tend to have higher premiums, many people favor them because of the peace of mind they offer . If you’re looking for the following features in your insurance, a Medicare Supplement plan may be the best choice: Ultimately, it’s up to you to determine which type of insurance you prefer.

Does Medicare Supplement Plan F select have a limited network?

An important exception to note is that if you choose a Select plan, such as Medicare Supplement Plan F Select, your hospital network will be limited. Medicare Supplement plans are guaranteed renewable, so you don’t have to worry about your coverage ending at the end of the year.

Does Medigap work with Cigna?

Medigap plans, also known as Medicare Supplement plans, work with Original Medicare and are available in a range of coverage options. While these plans are also offered from various carriers, they are standardized based on the plan letter. So, for instance, Medicare Supplement Plan G with Cigna will offer the same benefits ...

Can you change your Medicare Advantage plan at the end of the year?

However, Medicare Advantage plans aren’t guaranteed renewable, and your coverage could be discontinued at the end of the year. Your benefits may also change from year to year as well.

Medicare plan options can be confusing. Medigap and Medicare Advantage are not the same. Know the differences before you choose

Medicare Advantage and Medigap are both supplemental options to your Original Medicare plan. They are similar in some respects and quite different in others. This can make it challenging to decide which is the best option for you.

How much does each plan cost?

Medicare Advantage plans typically have lower monthly premiums, but you may pay more out-of-pocket at the time you receive care.

What about prescription drug coverage?

Many Medicare Advantage plans include prescription drug coverage (Part D), appropriately named Medicare Advantage Prescription Drug (MAPD) plans MAPD plans are usually the lowest cost way to bundle Original Medicare (Parts A, B) and prescription coverage (Part D).

How and when should I enroll?

If you’re looking to enroll in a Medicare Advantage plan, you should do so during your initial enrollment period, the period of time that starts three months before your birthday month and ends three months after. Each year after that, you have the option to change your plan during the Anuual Enrollment Period (AEP), which runs from Oct. 15 to Dec.

What is the difference between Medicare Advantage and Medigap?

While both options can offer more coverage than Original Medicare alone, they’re designed very differently. Medicare Advantage functions as an alternative to Original Medicare, while Medigap offers supplemental coverage for Original Medicare plans. Know the differences between Medicare Advantage and Medigap before you choose which option will best serve you.

Does Medicare Advantage cover vision?

Medicare Advantage acts as an extension of Original Medicare, offering more coverage than Medicare Parts A and B. If you need extra benefits such as dental, hearing, and vision services, these are often covered by Medicare Advantage plans but not Medigap. Most Medicare Advantage plans also offer prescription drug coverage, but Medigap plans do not. If you have Original Medicare and need drug coverage, you have to enroll in a Medicare Part D plan.

Is Medicare Advantage or Medigap?

If and when you need medical care, you’ll generally pay much lower out-of-pocket costs with Original Medicare plus Medigap than you would with a Medicare Advantage plan. However, the average total premium for Medicare Advantage (including prescription drug coverage) is lower than the average total premium for Original Medicare plus Medigap and Medicare Part D (the Medicare Prescription Drug Plan). So while a Medigap plan will help offset some out-of-pocket costs, such as coinsurance and co-pays, your premiums will likely be higher compared to Medicare Advantage premiums.

What is the advantage of Medigap?

The main advantage of Medigap is the larger selection of healthcare providers from which to choose. And, it will save you money if you have long-term treatment. If you are considering purchasing a Medicare Advantage or Medigap Plan, feel free to explore this website, HealthNetwork.com.

What are the benefits of Medicare Advantage?

Medicare Advantage health plans are offered by private insurance companies. They include the standard medical and hospitalization coverage of Medicare Part A and Part B, respectively. Additional benefits may also be included, such as prescription drug coverage. The benefits are delivered through: 1 A health maintenance organization (HMO), where you can select a primary care physician 2 A preferred provider organization (PPO), where you have more options for out-of-network physicians 3 A Private Fee-for-Service (PFFS) plan, where you are not limited to a network,, but there is no guarantee your hospital or doctor will accept the plan

What is a Medigap plan?

Medigap introduction. This is an additional insurance policy with Medicare Part A and Part B. It pays for certain medical expenses that are not covered by Medicare. Except for Massachusetts, Wisconsin and Minnesota, every other state has 10 standardized Medigap Plans; A through N.

What age can you get Medicare meds?

The benefits. Prescription drug coverage and cost sharing for your specific medications. For those who have Medicare because of a disability, Medigap policies may not be available to beneficiaries under the age of 65 .

Does Medigap have more benefits than MA?

However, any standard Medigap plan with Original Medicare (Parts A and B) will have more benefits than any standard MA plan. This is because standard MA plans are only required to offer the same Medicare Part A and B benefits. Prescription drug coverage may be included in some MA plans, with an additional cost.

Does Medigap have prescription coverage?

All Medigap plans have more benefits than Medicare Part A and Part B. But they don’t have prescription coverage. However, it can be added with Medicare Part D plan. Medigap can only be used by people who are enrolled in the conventional Medicare. Medigap is not run by the government, but by private insurance companies.

Is Medigap the same as insurance?

The law standardizes each of the 10 Medigap policies. So, the benefits are the same from any insurance company. However, insurance companies charge widely different prices for Medigap. As such, you should do some research to find the least expensive.