Is the Flex card real for seniors?

Jan 25, 2022 · Now, we will clear the air about one – the flex card for seniors on Medicare. What is a Medicare Flex Card? Flex cards are debit cards used to purchase medical equipmentand items. Typically linked to a flexible spending account, these cards are a benefit qualifying health plans include throughout the nation.

Is the Flex card for seniors legit?

What is a Medicare flex card? The Centers for Medicare and Medicaid Services (CMS) has allowed private insurance companies to offer a new benefit-like-debit card (flex card). This card would allow beneficiaries to use funds from the private insurance carrier for medical services. Only private insurance carriers offer Medicare flex cards, not the federal government.

Where can I use my flex card?

Jan 28, 2022 · Flex Card for seniors is a prepaid debit card offered by private Medicare Plans, used to pay for Dental, Vision, Hearing, and other benefits. USA Medicare Plan Medicare Supplement Insurance

What is a WellCare flex card?

Dec 14, 2021 · The name flex card harkens to what some of us know as a flexible spending account that reimburses for medical expenses. This card, though, has to be linked with a Medicare Advantage Plan that does actually cost money. As a senior who has qualified for Medicare, you must choose a Medical Insurance Plan.

What is senior flex card?

Senior citizens qualify for a Medicare “flex card” that pays for groceries, dental costs and prescriptions. Medicare.Jan 12, 2022

How does a flex card work?

With the Flex Card, you simply swipe your Card and the payment is automatically deducted from your benefit account. The Card reduces the amount of paperwork, as well as the need to wait for reimburse- ment checks.

Is Flex card free?

The first two cards are free. There is a $5.00 fee for each additional or replacement card, which will be debited from your flex account.

Who qualifies for the Flex card?

In order to qualify for a flex card, you must qualify for a health insurance plan with a flexible spending account. The flex card for seniors offer is typically tied to a Medicare Advantage plan.Nov 22, 2021

Who is eligible for a flex card?

To be eligible for a health care flexible spending account, you must be: Employed by an agency that participates in FSAFEDS; and. Be eligible to enroll in the Federal Employees Health Benefits Program (FEHB), though you do not actually need to be enrolled in FEHB.

Can you buy food with a flex card?

Yes! You can use your Health Savings Account (HSA) or Flexible Spending Account (FSA) to purchase any Ready, Set, Food! subscription.Mar 29, 2021

What can you use your flex card for?

A: You can use your debit card at the doctor's office, pharmacy, and hospital for eligible health care expenses, such as co-pays, deductibles, certain over-the-counter drugs and products (including feminine care products), and other out-of-pocket expenses.

What is Social Security Flex card?

A Flex Card is a stored value card that reflects the balance of your medical and/or dependent care reimbursement account or flexible spending account. Since there are no transaction fees or pin numbers, the card should be swiped through the provider location scanner using the “credit/credit card” option.

What Is The Flex Card For Seniors?

You’ve probably seen TV commercials and ads online promoting a free Flex Card for seniors or “Medicare Flex Card”. And you’re wondering – is it real or is it a scam?

Where To Get A Flex Card

The Flex card for seniors is not something that’s offered by Medicare. It’s offered through private Medicare Advantage plans and only available in specific areas around the country.

Extra Benefits In Some Plans

You can’t use the Flex card for seniors by spending on anything you want. It can be used in addition to the basic benefits that are already provided in the plan.

Medical Benefits Vs. Flex Card Benefits

Extra benefits are a good thing, but you don’t want to sacrifice important medical benefits to get a Flex Card allowance. That just doesn’t make sense for most people.

Who Can Get a Flex Card ?

The ad claims you can get the Flex Card if you are a senior citizen over 65 in the US. And you can get it for free, and get up to $2,800.

The Flex Card Is Linked to a Medicare Advantage Plan

The name flex card harkens to what some of us know as a flexible spending account that reimburses for medical expenses.

A Few Words About Advantage Plans

You don’t have to get an advantage plan. But you will be encouraged to do so. Why? Well, the insurance companies claim that you will have access to other benefits not covered by your Medicare.

My Experience With An Advantage Plan

I’m going to vent here, so if you aren’t interested, skip to the next section. I am not going to use the name of the company. But I’m pretty sure they are all very similar.

So Beware!

This flex card isn’t what it claims to be. The insurance companies want to make money off of you.

Bottom Line

The Flex card isn’t what it’s advertised to be. It is not free, you probably can’t recover $2,800.00, or anything near that.

What is a Seniors Flex Card?

Starting in late summer 2021, advertisements started to appear everywhere offering a senior flex card. Depending on the advertisement, some claimed these cards could be worth $2,880 or more!

What is a flex card?

Flex cards are tied to health insurance, and these flex card for seniors are actually a health insurance marketing tactic designed to lure seniors into switching to specific Medicare Advantage plans.

What does a flex card pay for?

According to Healthcare.gov, a flex card can be used to pay for certain out-of-pocket health care costs. These costs may include:

Who qualifies for the flex card?

Flex cards are typically offered alongside health insurance plans. In order to qualify for a flex card, you must qualify for a health insurance plan with a flexible spending account.

Is the flex card real?

I was able to identify many flex cards from legitimate insurers like Humana but I could not find any that offered as much money as the advertisements claimed. The largest legitimate flex plan I found included a $1,000 flex card and a $50 monthly debit card for other out-of-pocket costs, for a total of $1,600 per year.

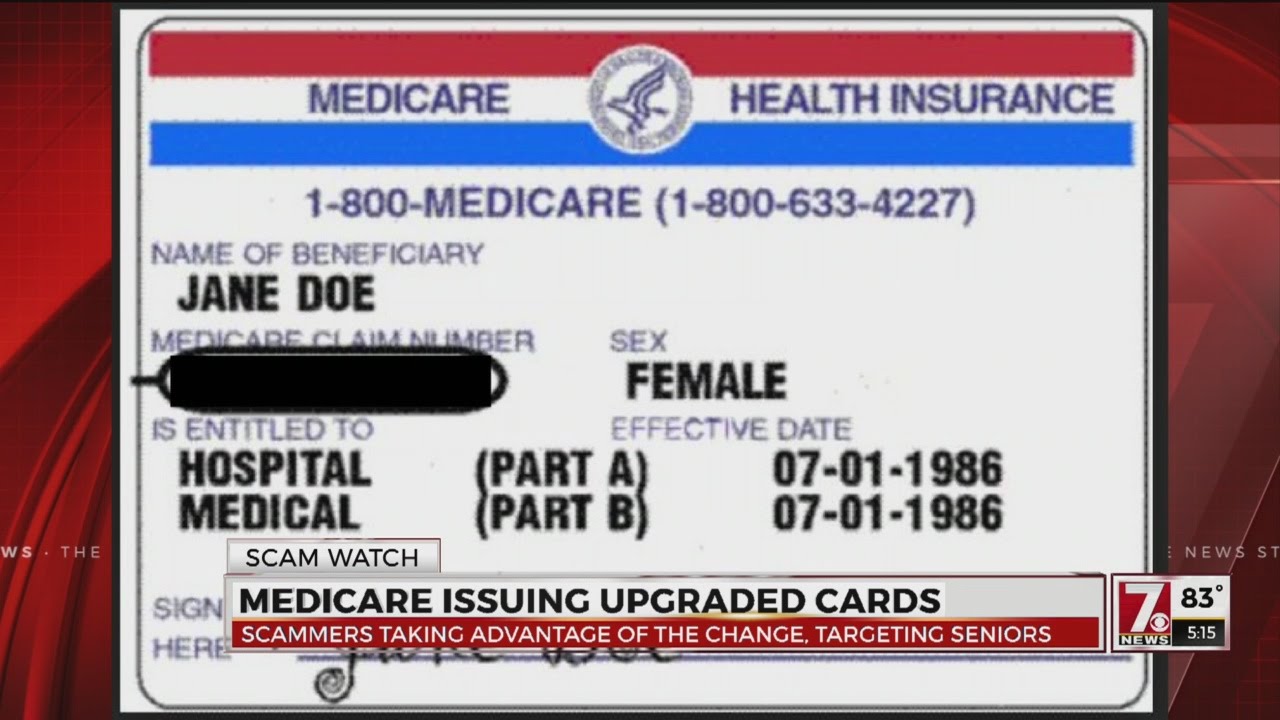

Why are there so many Medicare scams?

Scammers love Medicare open enrollment season. Historically, the open enrollment period between October and December is a prime time for scammers who want to prey on seniors because this is when seniors can change their health care plans.

How can you protect yourself from Medicare scams?

The whole point of the flex card for seniors is to lure seniors into enrolling in new Medicare Advantage plans while it’s open enrollment season. As you may know from our previous video on Medicare benefits, Medicare has many parts and is very complicated.