Receive full Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Full Answer

What is the Medicare savings program?

The Medicare Savings Programs are a specific sub-set of Medicaid benefits that help pay for the costs of Medicare. What is Medicaid? Medicaid is a state-run health insurance program that pays for a broad range of medical services for people with low income and resources.

What is the Medicare savings program and/or extra help?

If you qualify for a Medicare Savings Program and/or Extra Help, you'll save money on your out-of-pocket Medicare costs. To save even more, you can add supplemental coverage to your Medicare coverage.

What are the monthly income limits for Medicare savings programs?

2021 Monthly Income Limits for Medicare Savings Programs Medicare Savings Program Monthly Income Limits for Individual Monthly Income Limits for Married Couple QMB $1,084 $1,457 SLMB $1,296 $1,744 QI $1,456 $1,960 3 more rows ...

What does Medicare Part B cover?

Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. deductibles, coinsurance, and copayments if you meet certain conditions. These conditions are listed below under "How do I apply for Medicare Savings Programs?"

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How much money can you have in the bank if your on Medicare?

You may have up to $2,000 in assets as an individual or $3,000 in assets as a couple. As of July 1, 2022 the asset limit for some Medi-Cal programs will go up to $130,000 for an individual and $195,000 for a couple. These programs include all the ones listed below except Supplemental Security Income (SSI).

What is the income limit for QMB in CT?

Medicare Savings ProgramsMedicare Savings Programs Effective March 1, 2022Qualified Medicare Beneficiary Program (QMB)Monthly income limit for one person Monthly income limit for a couple$2,390 $3,220Asset limit for one person Asset limit for a coupleno limit no limit

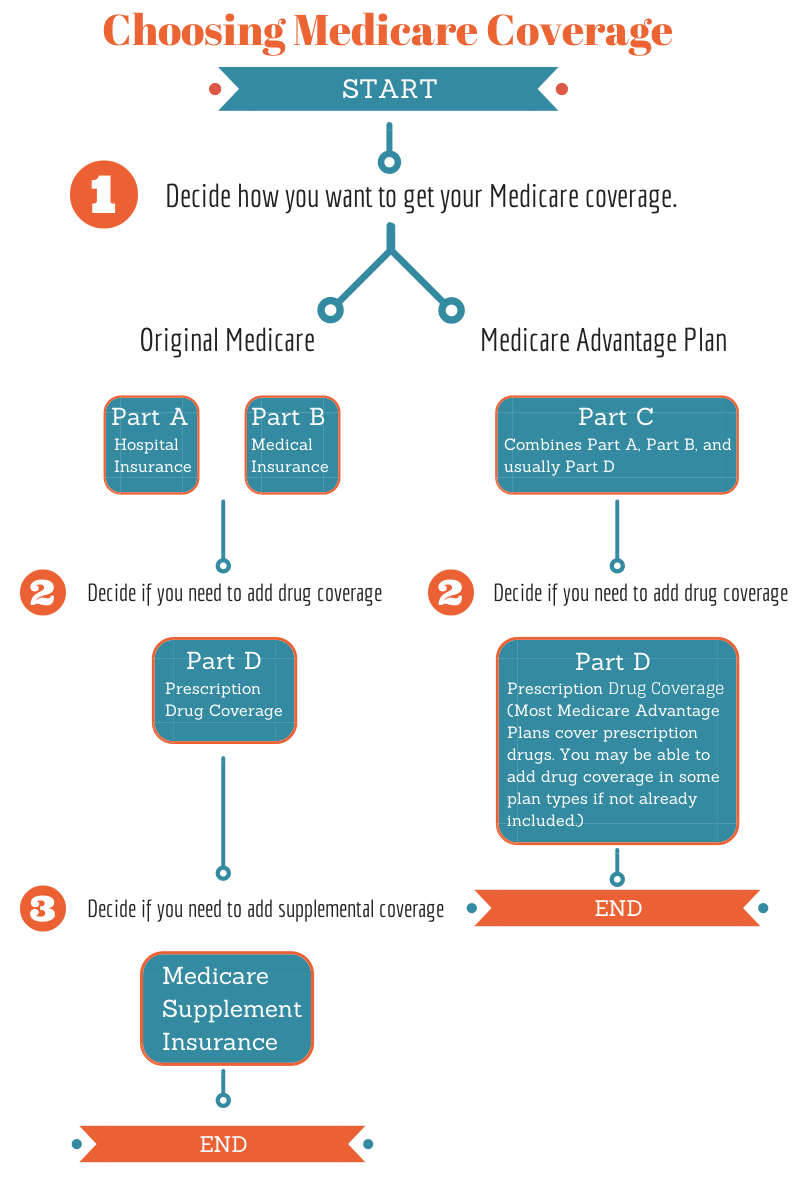

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Does Medicare look at your bank account?

Medicare will usually check your bank accounts, as well as your other assets when you apply for financial assistance with Medicare costs. However, eligibility requirements and verification methods vary depending on what state you live in. Some states don't have asset limits for Medicare savings programs.

Does Medicare look into your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

Does Social Security count as income for QMB?

An individual making $1,000 per month from Social Security is under the income limit. However, if that individual has $10,000 in savings, they are over the QMB asset limit of $8,400.

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

What does Social Security Extra Help pay For?

In some cases, MSPs may also pay Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) deductibles, coinsurance, and copayments if you meet certain conditions. If you qualify for certain MSPs, you automatically qualify to get Extra Help paying for Medicare prescription drug coverage.

What parts of Medicare are free?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) is designed to cover all or part of Medicare out-of-pocket expenses that encumber Medicare recipients who live within limited financial means.

What is a Medicare summary notice?

You will also receive a Medicare Summary Notice (MSN), which is proof of being in the program and shows the healthcare provider you should not be billed for services, deductibles, coinsurance or copayments. An exception is outpatient prescriptions.

What is QDWI in Medicare?

Qualified Disabled and Working Individuals (QDWI) Program for Part A premiums. If your application for the QMB Program is accepted, you will receive a QMB card. Be sure to show this card along with your Medicare or Medicaid card every time you receive healthcare services. You will also receive a Medicare Summary Notice (MSN), ...

Is Medicare cost prohibitive?

The cost of Medicare benefits in the form of premiums, coinsurance, copayments and deductibles can raise concerns about affordability, especially when you are on a limited income. For Medicare recipients under a certain income and asset level, Medicare benefits can be cost prohibitive.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

Does Medicare savers have a penalty?

Also, those that qualify for a Medicare Savings Program may not be subject to a Part D or Part B penalty. Although, this depends on your level of extra help and the state you reside in. Call the number above today to get rate quotes for your area.

What is Medicare Part A?

Entitled to Medicare Part A, eligible for Medicaid under mandatory or optional pathway in addition to MSP, and qualify for Medicaid payment of: •Medicare Part B premiums. •At state option, certain premiums charged by Medicare Advantage plans. •Medicare deductibles, coinsurance, and copayments (except nominal copayments in Part D);

What is partial benefit dually eligible?

Individuals who only receive assistance through the MSPs, but do not receive full Medicaid benefits, are referred to as partial-benefit dually eligible beneficiaries. Individuals who qualify for full Medicaid benefits through other pathways, known as full-benefit dually eligible beneficiaries, may also receive assistance through the MSPs.

What is a dually eligible beneficiary?

Under mandatory Medicaid eligibility pathways referred to as Medicare Savings Programs (MSPs), dually eligible beneficiaries may qualify for assistance with payment of Medicare premiums and, in some cases, Medicare cost sharing. Individuals who only receive assistance through the MSPs, ...

Does Medicare cost sharing increase dually eligible beneficiaries?

MACPAC’s analysis found that paying a higher percentage of Medicare cost sharing increases dually eligible beneficiaries’ likelihood, relative to that of non-dually eligible Medicare beneficiaries, of using selected Medicare outpatient services and decreases the use of safety net provider services.

How many types of Medicare savings programs are there?

There are four types of Medicare Savings Programs. Depending on your individual circumstances, you may qualify for one or more of the following programs. But before we go any further, let’s quickly look at the three overall questions you must answer “Yes” to before even being eligible to explore a Medicare Savings Program.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Medicaid

The Medicaid program helps with medical costs and other services for some people with limited income and resources.

Qualified Medicare Beneficiary (QMB)

The QMB program serves as a free Medicare supplement policy. QMB pays:

Specified Low Income Medicare Beneficiary (SLMB)

The SLMB program has higher limits than QMB. Once you qualify, SLMB pays:

Qualified Individual (QI)

Medicaid, QMB and SLMB are guaranteed for those who qualify, but QI benefits are limited.

Qualified Disabled and Working Individuals (QDWI)

successfully returned to work, you may be eligible for a program that helps pay your Medicare Part A monthly premium.

Applying for Benefits

The Medicaid application determines eligibility to receive benefits from any of the programs listed on this brochure.