Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

What is GAP insurance and should I get It?

Gap insurance—also known as guaranteed auto protection—reimburses a car owner when the payment for a total loss is less than the outstanding loan or lease balance. Gap insurance makes the most sense for people who put no money down and choose a long payoff period. For a couple of years, they may owe more on the car than its current value.

What is medical GAP insurance and is it worth it?

The short answer is that no, gap health insurance is not worth the money. But let us look at the statistics to better understand this. The Brooking Institute has helped us out with their report on A Dozen Facts About the Economics of the U.S. Healthcare System.

What if I have a gap in health insurance coverage?

What if your health insurance lapses?

- You Have Several Options if Your Health Insurance Lapses

- COBRA Coverage is Available for 60 Days After Leaving a Job

- Insurance Cancellation Due to Non-Payment of Policy Does Not Qualify you for Special Enrollment

What does no gap coverage mean Medicare?

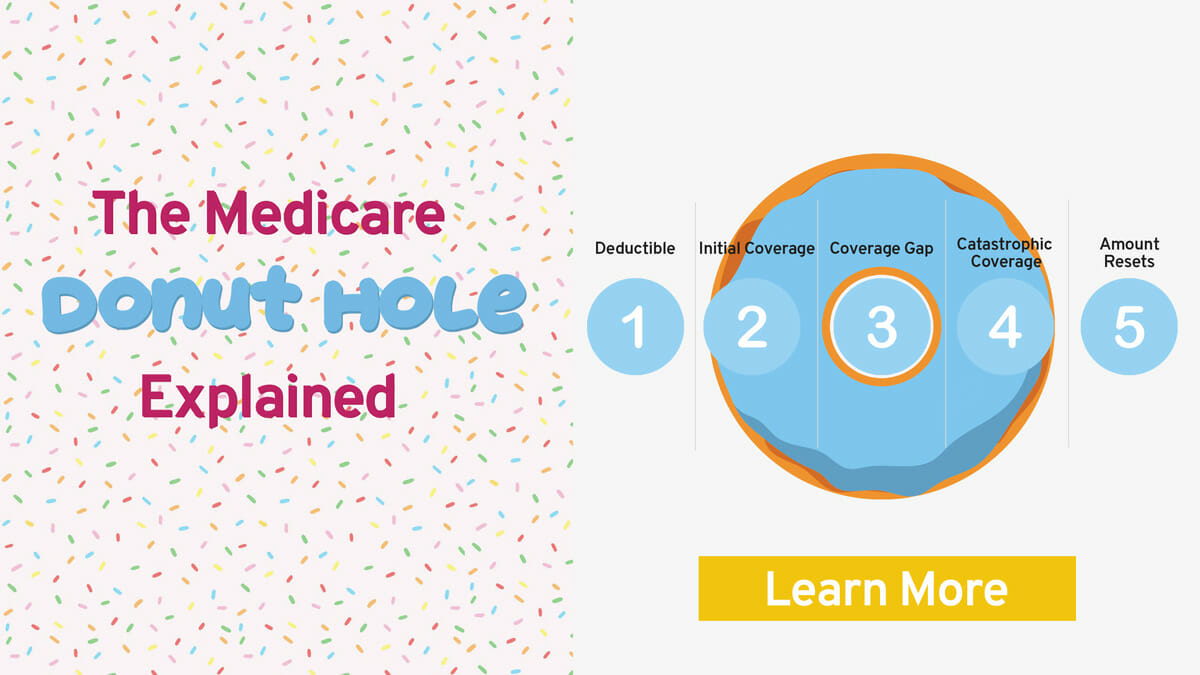

The Medicare coverage gap, or “donut hole,” is a temporary limit on what drug plans will pay for eligible medications. Each year, Medicare Part D beneficiaries may enter the prescription drug coverage gap if they and their drug plan have paid a specified amount on covered drugs. Once in the Medicare coverage gap, beneficiaries must pay a percentage of their drug cost.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

How do I avoid the Medicare Part D donut hole?

Here are some ideas:Buy Generic Prescriptions. ... Order your Medications by Mail and in Advance. ... Ask for Drug Manufacturer's Discounts. ... Consider Extra Help or State Assistance Programs. ... Shop Around for a New Prescription Drug Plan.

What is the difference between Medicare Advantage and Medicare gap?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

What is the Medicare Coverage Gap Discount Program?

The Medicare Coverage Gap Discount Program (Discount Program) makes manufacturer discounts available to eligible Medicare beneficiaries receiving applicable, covered Part D drugs, while in the coverage gap.

How much is the donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

Is Medicare going to do away with the donut hole?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

What is the Medicare donut hole for 2022?

$4,430You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430.

What is the maximum out-of-pocket for Medicare Part D?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.

What are My Costs in the Coverage Gap?

Once you reach $4,430 in total spending on your covered drugs, you’re responsible for a certain percentage of the costs. When you enter the coverage gap, you’ll pay no more than 25% of the actual drug cost.

What Plans Provide Gap Coverage?

A Part D drug plan or Part C Medicare Advantage plan may include gap coverage, though these plans aren’t available everywhere and may have a higher premium. Plans are available by location, if you don’t live in the service area, you’re not eligible for that policy.

Is the Medicare Coverage Gap Going Away?

While the coverage gap has closed, it doesn’t mean that it goes away. After the Initial Coverage Period, people with Medicare will pay a higher portion of their drug costs.

Which Plan Covers My Medications at the Lowest Cost?

There is not one specific plan that suits everyone’s needs. Most of the time spouses will find they have different plan needs. Perhaps you have a brand-name medication that fewer plans cover, or maybe there is a plan option that allows you to avoid the donut hole.

What are the gaps in Medicare?

What are gaps in coverage with Medicare? 1 Original Medicare doesn't cover some essentials. For instance, it does not pay for most prescription drug costs. 2 Even when Medicare covers a treatment, you still have to pay copays (a fixed amount you pay for some services) and coinsurance (a percentage share of the medical bills not covered by Medicare). 3 Most people have to pay a monthly fee, called a premium, for Medicare Part B.

What is Medicare for 65?

Medicare is a federal health insurance plan for people 65 and older, or with certain disabilities. The main Medicare plans are called A, which covers hospital services, and B, which pays for doctor visits, lab tests, and other outpatient services. Original Medicare doesn't cover some essentials.

Does Medicare pay for prescription drugs?

For instance, it does not pay for most prescription drug costs. Even when Medicare covers a treatment, you still have to pay copays (a fixed amount you pay for some services) and coinsurance (a percentage share of the medical bills not covered by Medicare). Most people have to pay a monthly fee, called a premium, for Medicare Part B.

Why do people get gap insurance?

Employers often pay or allow their employees to pay for GAP coverage to supplement their health insurance deductibles. Many Americans are settling for insurance policies with large deductibles because they can’t afford anything more.

Why is gap insurance so popular?

GAP health insurance is rising in popularity with those that don’t qualify for a subsidy because health insurance costs are growing. People who are faced with high deductibles are eyeing GAP insurance as a way to reduce their financial risk in case they have to use their medical insurance.

What do you need to know before buying a gap?

What You Need to Know Before You Buy GAP Insurance. Before you buy GAP health care coverage, there are a few things you need to know. First, GAP insurance is not the same thing as health insurance. GAP insurance is a “limited benefit” policy.

Why do you need a gap policy?

For those without a savings account or funds to cover a large medical bill, a GAP policy could be what helps them avoid bankruptcy or financial distress. If you have medical procedures or services scheduled, it’s important to realize whether the service will be covered by your GAP policy before you attempt to use it.

Can gap insurance replace primary insurance?

GAP insurance won’t replace your primary health insurance. GAP insurance claims are the insured’s responsibility. GAP health coverage can provide affordable peace of mind. su_box] GAP insurance is designed to help the insured manage the gaps in their health insurance coverage. GAP insurance is most popular with individuals who have insurance ...

Does gap insurance cover a foot fracture?

For example, if someone purchases GAP insurance simply for the peace of mind, they will be grateful they have it if their appendix decides to erupt or they fracture a foot while walking the dog. While GAP insurance isn’t designed to cover every gap a person may incur with their health insurance, it is designed to reduce ...

Is gap insurance the same as mini med insurance?

GAP insurance coverage is not the same as a mini-med policy. Before the Affordable Care Act, mini-med policies were very popular. After the Affordable Care Act was put into effect, mini-med policies were determined to be illegal. Buying a GAP insurance policy alone does not satisfy the Affordable Care Act requirements for coverage.