Full Answer

What are the exclusions for the SSI program?

Income Exclusions for SSI Program 1 The first $20 per month 2 Income set aside or being used to pursue a plan for achieving self-support by a disabled or blind individual 3 State or local assistance based on need that is wholly funded by the state or local area in the state More items...

What are the general exclusions in Chapter 16 of Medicare?

Medicare Benefit Policy Manual Chapter 16 - General Exclusions From Coverage . Table of Contents (Rev. 198, 11-06-14) Transmittals for Chapter 16 . 10 - General Exclusions from Coverage 20 - Services Not Reasonable and Necessary 30 - Foot Care 40 - No Legal Obligation to Pay for or Provide Services 40.1 - Indigence

What is an income exclusion rule?

In general, an income exclusion rule applies to laws or policies that let taxpayers not count certain types of payments as taxable income.

What is an OIG exclusion?

OIG has the authority to exclude individuals and entities from Federally funded health care programs for a variety of reasons, including a conviction for Medicare or Medicaid fraud. Those that are excluded can receive no payment from Federal healthcare programs for any items or services they furnish, order, or prescribe.

What is general income exclusion?

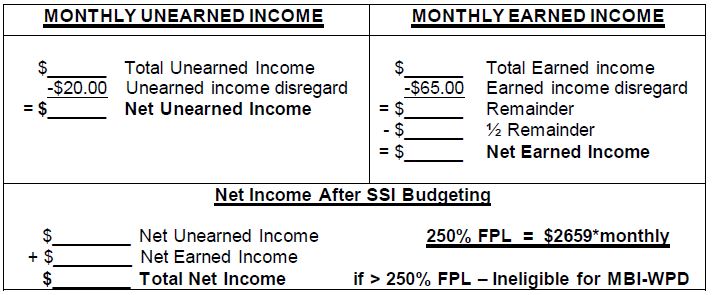

Your unearned income generally reduces your SSI check dollar for dollar. The first $20 per month of your total unearned income, however, is usually not counted. This first $20 is called your General Income Exclusion.

What income is excluded from Social Security?

This exclusion includes all State payments used to supplement SSI; Any portion of a grant, scholarship, fellowship, or gifts used for paying tuition, fees or other necessary educational expenses (effective 6/1/04).

What income reduces Social Security benefits?

If you are younger than full retirement age and earn more than the yearly earnings limit, we may reduce your benefit amount. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2022, that limit is $19,560.

How much unearned income is excluded by the SSI program?

In 2022, a person must have less than $861 a month in unearned income to receive SSI. A couple can get SSI if they have unearned income of less than $1,281 a month in 2022.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

Does 401k distribution count as income for Social Security?

Are 401k Withdrawals Considered Income for Social Security? No. Social Security only considers “earned income," such as a salary or wages from a job or self-employment.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

At what age is Social Security not affected by income?

You can earn any amount and not be affected by the Social Security earnings test once you reach full retirement age, or FRA. That's 66 and 2 months if you were born in 1955, 66 and 4 months for people born in 1956, and gradually increasing to 67 for people born in 1960 and later.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

Does unearned income affect Social Security benefits?

Unearned income we do not count. (a) General. While we must know the source and amount of all of your unearned income for SSI, we do not count all of it to determine your eligibility and benefit amount. We first exclude income as authorized by other Federal laws (see paragraph (b) of this section).

Does Social Security count as income on taxes?

If you file as an individual, your Social Security is not taxable only if your total income for the year is below $25,000. Half of it is taxable if your income is in the $25,000–$34,000 range. If your income is higher than that, then up to 85% of your benefits may be taxable.

What kind of money counts as income?

Generally, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

What is mandatory exclusion in Medicare?

With mandatory exclusions, the OIG is required by law to exclude from participation in Medicare/Medicaid programs certain types of criminal offenses such as: fraud as well as any other offenses related to the delivery of items or services under Medicare/Medicaid or other State programs ;

What is the OIG exclusion list?

So, what is the exclusion list? The Office of the Inspector General (“OIG”) is responsible for maintaining this exclusion list. When the OIG is considering excluding an individual or entity, the process varies depending on the basis for the proposed exclusion. There are two types of exclusions: mandatory and permissive.

What are permissive exclusions?

Under permissive exclusions, the OIG has discretion to exclude individuals for: 1 misdemeanor convictions relating to health care fraud other than Medicare or a State health program; 2 misdemeanor convictions relating to the unlawful manufacture, distribution, prescription of controlled substances; 3 suspension, revocation or surrender of a license to provide health care for reasons bearing on professional competence, professional performance or a financial integrity provision of 4 unnecessary or substandard services; 5 defaulting on health education loan or scholarship obligations.

What is a suspension of a license to provide health care?

suspension, revocation or surrender of a license to provide health care for reasons bearing on professional competence, professional performance or a financial integrity provision of. unnecessary or substandard services; defaulting on health education loan or scholarship obligations.

What is impairment related work expenses?

Impairment-related work expenses of the disabled and work expenses of the blind. Income set aside or being used to pursue a plan for achieving self-support by a disabled or blind individual. The first $30 of infrequent or irregularly received income in a quarter.

Is medical bill considered income?

For example, if someone pays an individual's medical bills, or offers free medical care, or if the individual receives money from a social services agency that is a repayment of an amount he/she previously spent, that value is not considered income to the individual. In addition, some items that are considered to be income are excluded ...

Is SSI income?

SSI Annual Report. SSI payment standard. Not everything an individual receives is considered to be income for SSI purposes. Generally, if the item received cannot be used as, or to obtain, food or shelter, it will not be considered as income .

Income Exclusion Rules Explained in Less than 4 Minutes

Jake Safane is a freelance writer with more than 10 years of experience in the journalism industry. He writes about investing, assets, markets, and more. Jake has been published in a variety of publications that focus on finance and sustainability.

Definition and Examples of Income Exclusion Rules

In general, an income exclusion rule applies to laws or policies that let taxpayers not count certain types of payments as taxable income.

How Do Income Exclusion Rules Work?

Income exclusion rules are a result of laws and policies implemented by tax jurisdictions that allow some types of income to be excluded from income taxes. With this rule, certain types of income are considered non-taxable.

Income Exclusion Rules and Social Security

The Supplemental Security Income (SSI) program from the Social Security Administration (SSA) is a needs-based program that benefits individuals over the age of 65 who meet certain financial limits, as well as disabled and blind individuals. The goal of the program is to pay for an individual’s most basic needs, such as food and shelter.

What Do Income Exclusion Rules Mean for Individuals?

Individuals may want to research what counts as taxable and nontaxable income within the various tax jurisdictions they fall under, such as the federal and state levels.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Can I qualify for QI if I have medicaid?

You can’t qualify for the QI program if you have Medicaid. If you have a monthly income of less than $1,456 or a joint monthly income of less than $1,960, you are eligible to apply for the QI program. You’ll need to have less than $7,860 in resources. Married couples need to have less than $11,800 in resources.

What are excluded from Medicare coverage?

Charges for special items requested by the patient such as radio, television, telephone, and air conditioner, and beauty and barber services are excluded from coverage. The patient may be charged for such a service if they requested it with knowledge that they will be charged. To avoid misunderstanding and disputes, the provider informs the individual upon request for such an item or service that there is a specified charge (not exceeding the customary charge). Thereafter, the provider may not charge the patient more for the item or service than the charge specified. A provider may not require a beneficiary to request noncovered items or services as a condition of admission or of continued stay.

What are the exclusions for eyeglasses?

The exclusions apply to eyeglasses or contact lenses, and eye examinations for the purpose of prescribing, fitting, or changing eyeglasses or contact lenses for refractive errors. The exclusions do not apply to physicians’ services (and services incident to a physicians’ service) performed in conjunction with an eye disease, as for example, glaucoma or cataracts, or to post-surgical prosthetic lenses which are customarily used during convalescence from eye surgery in which the lens of the eye was removed, or to permanent prosthetic lenses required by an individual lacking the organic lens of the eye, whether by surgical removal or congenital disease. Such prosthetic lens is a replacement for an internal body organ - the lens of the eye. (See the Medicare Benefit Policy Manual, Chapter 15, “Covered Medical and Other Health Services,” §120).

What are non-covered services?

Medical and hospital services are sometimes required to treat a condition that arises as a result of services that are not covered because they are determined to be not reasonable and necessary or because they are excluded from coverage for other reasons. Services "related to" non-covered services (e.g., cosmetic surgery, non-covered organ transplants, non-covered artificial organ implants, etc.), including services related to follow-up care and complications of non-covered services which require treatment during a hospital stay in which the non-covered service was performed, are not covered services under Medicare. Services "not related to" non-covered services are covered under Medicare.

What form do you attach to Medicare claim?

Beneficiaries must attach to the Medicare claim form a copy of VA form 10-9014 (Statement of Charges for Medical Care) showing the VA copayment amount for authorized services, when requesting Medicare payment toward that amount or in order to have their Part B deductible credited.

Can a federal provider participate in Medicare?

Generally, Federal providers are excluded from participation in the Medicare program. However, Federal hospitals, like other nonparticipating hospitals, may be paid for emergency inpatient and outpatient hospital services. Additionally, payment is precluded for items and services rendered by a federally operated nonprovider, e.g., Veterans Administration clinics. A provider or other facility acquired by the Department of Housing and Urban Development (DHUD) in the administration of an FHA mortgage insurance program is not considered to be a Federal provider or agency and this exclusion is not applicable to services furnished by such facilities. The law provides exceptions to this exclusion which permits the following categories of Federal providers to participate in Medicare:

Is Medicare a precluded payment?

Payment is not precluded under Medicare if the patient is covered by another health insurance plan or program, which is obligated to provide or pay for the same services.

Does the Medicare exclusion apply to indigent individuals?

This exclusion does not apply where items and services are furnished to an indigent individual without charge because of their inability to pay, if the provider, physician, or supplier bills other patients to the extent that they are able to pay.

What is the authority of OIG?

OIG has the authority to exclude individuals and entities from Federally funded health care programs for a variety of reasons , including a conviction for Medicare or Medicaid fraud. Those that are excluded can receive no payment from Federal healthcare programs for any items or services they furnish, order, or prescribe.

Can you receive federal health benefits if you are excluded?

Those that are excluded can receive no payment from Federal healthcare programs for any items or services they furnish, order, or prescribe. This includes those that provide health benefits funded directly or indirectly by the United States (other than the Federal Employees Health Benefits Plan).

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.