How much does Medicare Part a cost per month?

If you paid Medicare taxes for fewer than 30 quarters, your premium will be $471 per month. If you are admitted to a hospital for inpatient treatment, Medicare Part A helps cover your hospital costs once you reach your Medicare Part A deductible.

How do I qualify for premium-free Medicare Part A?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters). Those 40 quarters do not have to be consecutive.

What is the average monthly premium for Medicare Advantage?

In 2019, the average monthly premium for Medicare Advantage plans was $35.55 per month. 1 Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How much does Medicare Part B cost?

Because of the cost sharing, the premium is reasonable without watering down the benefits. Once you meet the Part B deductible, you may have a copay up to $20 for doctor visits and up to $50 for ER visits. Otherwise the coverage is predictable and comprehensive.

What is the monthly cost of a Plan F?

The plan's average cost is around $230.00 per month. However, many factors impact the premium price. Premium costs for Medigap Plan F can range from as low as $150.00 per month to as high as $400.00 per month or more. Factors that determine your cost include your ZIP Code, gender, age, tobacco use, and more.

How much does AARP Plan F Cost?

Below are the average AARP Medicare Supplement costs in each of these three categories....1. AARP Medigap costs in states where age doesn't affect the price.Plan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$2567 more rows•Jan 24, 2022

Is Medicare Plan G cheaper than Plan F?

Even though it has similar coverage, Medigap Plan G's monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

Is Medicare Plan F being discontinued in 2020?

It's been big news this year that as of Jan. 1, 2020, Medigap plans C and F will be discontinued. This change came about as a part of the Medicare Access and CHIP Reauthorization legislation in 2015, which prohibits the sale of Medigap plans that cover Medicare's Part B deductible.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Should I switch from F to G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.

Can I switch back to plan F?

You pay for Medicare-covered costs up to the $2,490 deductible (as of 2022) before the plan begins to pay for anything. If you currently have Medicare Supplement Plan F, you can switch to high-deductible Plan F by contacting your insurance provider.

What is the deductible for plan F in 2022?

Effective January 1, 2022, the annual deductible amount for these three plans is $2,490.

Is plan F still available in 2022?

However, this plan is now being phased out. As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020. If you were already enrolled in Medigap Plan F, you can keep the plan and the benefits.

Will plan F premiums rise after 2020?

This is good for the long-term rate picture, because insurance companies will still compete for your Plan F business. However, over time we can probably expect Plan F premiums to slowly rise, since the total number of people enrolled will be shrinking annually.

What is Medicare Plan F being replaced with?

No plan completely replaces Medicare Part F, but the closest available is Medicare Supplement Plan G. Like Plan F, Plan G covers 100% of many benefits, including: Part A coinsurance and hospital costs. Part B copays/coinsurance (not deductibles)

Does Medicare Plan F cover cataract surgery?

Also good: Plan A, B, D, G, M and N pay 100% of Part B coinsurance, which is your portion of cataract procedure costs. Best plans if you're eligible: Plan C and Plan F pay 100% of the Medicare Part B coinsurance and the Part B deductible.

When will Medicare Plan F be available?

It’s currently the most comprehensive Medicare supplement on the market and most insurance companies sell it. But that’s about to change. You won’t be able to buy Plan F beginning January 1, 2020.

When will Medicare Supplement Plan F go through the roof?

Medicare Supplement Plan F Rates may go through the roof beginning January 2020. Legislation to eliminate Medigap Plan F passed in 2015. Medicare Plan Review. The Information and Answers to Make Sense of it All. Call (888) 310-0376 For a Quote. Home. About Us.

What is the difference between Medicare Supplement Plan F and Supplement Plan G?

The only difference between Medicare supplement Plan F and Medicare supplement Plan G is the Part B deductible. The Part B deductible for 2011 is $162. Whether you pay the higher premium for Plan F or the Part B deductible with Plan G it is probably a wash.

What is a plan F?

Plan F is a Medigap policy and is designed to cover your share of Medicare covered expenses such as hospital deductible and the 20% coinsurance for outpatient services. Since gym memberships are not part of original Medicare Plan F will not be of any help.

How many standardized plans are there in Medicare Supplement?

Because Medicare supplemental coverage consists of 10 standardized plans (and high deductible Plan F) is easy to compare supplements onlineand get rates from several companies. If you are interested in the plan that will be the most comprehensive beginning in January 2020 take a look atMedicare Supplement Plan G.

When did Medicare drop Supplement Plan J?

When Medicare Supplement Plan J was dropped from the list of standardized supplements in 2010 many people just kept the plan. The choice is yours.

How long does Plan F last?

If a supplement is affordable to you, the good news is that you will only have the higher premium for two years. Once you turn 65 you will be treated the same as anyone turning 65 no matter what your health.

What is Medicare Plan F?

Medicare Plan F, Plan G and Plan N are Medicare Supplement Insurance plans that can be purchased to help supplement your Original Medicare benefits. These popular plan options can help you cover the extra out-of-pocket costs that Original Medicare doesn’t cover.

Is Medicare Plan F still available?

Medicare Plan F is no longer available to new enrollees as of 2020, though it is still an option for people who were eligible for Medicare before 2020. People who already are enrolled in this plan are also able to keep it. It is also the only plan which covers the yearly Part B deductible (which is $198 in 2020).

Is Medicare Plan G the same as Medicare Plan F?

For new enrollees looking for a comprehensive plan that is very similar to Medicare Plan F, Medicare Plan G is a great option. This plan covers everything that Plan F covers EXCEPT the $198 Part B annual deductible that may need to be paid out-of-pocket. Because Plan G offers slightly less coverage than Plan F, it will usually have a less expensive monthly premiums, though these prices will vary depending on the insurance company offering the plan.

Why do I give Medicare Supplements an A+?

I give them all an A+ because Medicare supplements are standardized by the federal government. That means if you buy a Plan F, no matter which company you choose, the benefits are exactly the same. The same goes for Plan G and Plan N and all the others. The benefits are standardized and the carrier cannot change them.

When you enroll in Medicare Supplement, is it important to answer health questions?

When you are enrolling in your Medicare supplement is important. If you are enrolling during your one-time Medicare supplement open enrollment period, then you don't have to answer health questions. Pretty much any plan or carrier is fair game.

Does Medicare pay its share of the bill?

When Medicare pays its share of a bill, it sends the remainder on to your Medicare supplement company to pay the rest. The Medicare supplement company does NOT get to decide which benefits they will honor and which benefits they won’t. So on the question of who has the best Medicare supplement plans for benefits – they all get an A+.

Does Medicare deny a bill?

None of them will deny any bill that Medicare has already approved. They will pay promptly because Medicare passes the claim on to your supplement company after Medicare pays its share. The supplement company cannot pick and choose which claims to pay. If Medicare covers its share, then your supplement will as well.

Does Medicare pay for original Medicare?

Doctors that take Original Medicare don't care which Medicare supplement you are enrolled in. Medicare is the primary payer and pays its share of your benefits, and then sends the rest on to your secondary payer (your supplement company) to pay the rest.

Hotels.com won't refund prepaid booking at a hotel that is closed for business

Last month my wife booked a room at a hotel in Portland OR for this past weekend. She prepaid the booking because it gave a nice discount on the room. When we arrived the hotel doors were locked, and a security guard came out to tell us the hotel had been closed for almost a year.

What are the risks of buying an overpriced home right now?

I bought my first home in 2017 as a fixer-upper. I spent about 50k modernizing it and about 2 years of my time. It was in a rural area, and I wasn't really prepared for country life, so my wife and I became rather miserable being so far from our families.

Mattress store pulled hard credit and opened an unauthorized credit line. Can I take action?

I went to a mattress store and spoke with a salesman who offered me financing and to apply. He assured me it would not be a hard pull on my credit.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

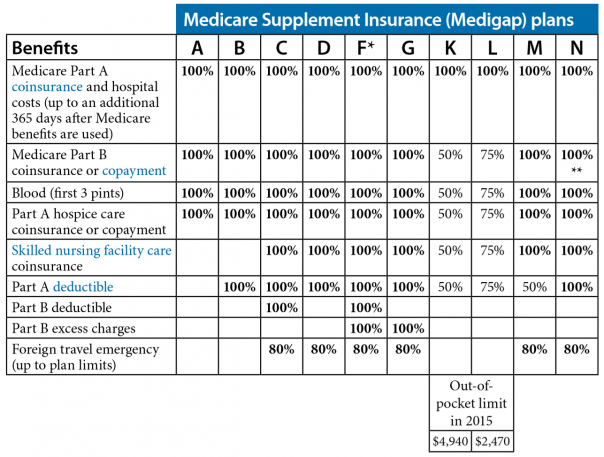

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much is Medicare Part A deductible?

Your Medicare Part A Hospital deductible: Medigap Plan F pays 100% of your Part A deductible. Those with just Original Medicare have to pay $1,484 for each 60 day benefit period. This means that if you enter the hospital for a second time after 60 days, you would have to pay that same $1,484 deductible again.

Which is better, Medicare Supplement Plan G or Medigap Plan F?

Medigap Plan G is usually a better deal than Popular Medicare Supplement Plan F. Medigap Plan F was once the most popular, most comprehensive (and often most expensive) Medigap plan available. This has recently changed as Medigap Plan G is now a better deal in almost every market.

What is Plan F and Plan G?

Plan F and Plan G pays that 20% for you and will pay 100% of any fees your doctor may charge beyond the Medicare reimbursement rate.This is called Part B excess fees and, without this Medigap benefit, if a doctor wanted more than the reimbursement rate you would have to pay for it out of your own pocket.

How much would Plan G save?

Plan F or Plan G would save you up to $50,000 of foreign medical expenses. Total up all the above additional costs covered by Medigap Plan F and Plan G and you have nearly 1 million dollars in cost not covered by Traditional Medicare.

How many days can you get without Medicare Supplemental?

You only get 60 lifetime reserve days without a Medicare Supplemental plan.Medigap Plan F and Plan G would pay the $742 benefit which would save you 60 days x $742 immediately. Also it would extend hospital coverage for an additional 365 days.

Can I switch to Medigap F if I turned 65?

If you turned 65 after 2020 and are unable to purchase Medigap F due to the new law, just know that Plan G will always be available to you and, as we explained above, is almost always a better deal. Call us at 800-930-7956 to get prices and apply.

Is Medicare Supplemental Plan F worth it?

Medicare Supplemental Plan F is expensive but if you cannot switch to G, it is still worth it. Until recently, Plan F is the best coverage for seniors considering Medicare Supplement insurance (aka Medigap). While we know it can be expensive, no one really explains how much Plan F or Plan G could save you…until now.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.