Medicare pays secondary to your large group employer health insurance. It will cover 80% of any outpatient costs you incur. Medicare Secondary Payer rules for group health Medicare are complicated, so check with your group benefits specialist for guidance.

Full Answer

What is a Medicare supplement plan?

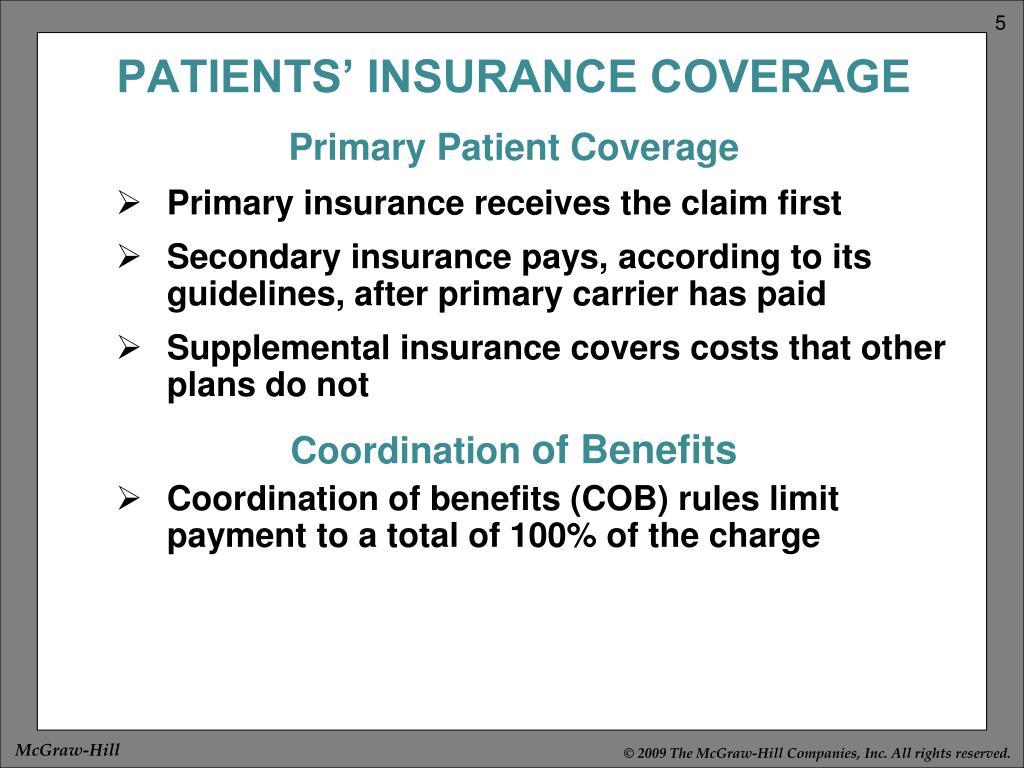

Medicare supplement plans are supplemental plans, as the name suggests. So are cancer policies, accidental death and dismemberment insurance, and hospital indemnity plans . How Does Supplemental Health Insurance Work? Supplemental health plans may pay benefits to either the insured person or to the health care provider.

What does supplemental health insurance cover?

Supplemental health insurance covers costs above and beyond what traditional health plans will pay for. Examples of supplemental health insurance include dental plans, critical illness plans, and hospital indemnity plans.

How does Medicare pay for group health insurance?

Medicare may pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim. You may have to pay any costs Medicare or the group health plan doesn’t cover. I'm under 65, disabled, retired and I have group health coverage from my former employer.

What is the difference between Medicare and Medicare supplement insurance (Medigap)?

Original Medicare and is sold by private companies. Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like:

Does Medicare supplement pay hospital deductible?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.

What is the difference between Medicare and a supplemental plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

What does Group Medicare mean?

Group Medicare Advantage plans are insurance plans offered by employers or unions to their retirees. EGWPs are provided by private insurance companies who manage your company's retiree Medicare benefits. Under EGWPs, Medicare pays the insurance company a fixed amount to provide benefits.

What is the purpose of Medicare supplemental insurance?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

How do I choose a Medicare Supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What happens if you don't have health insurance and you go to the hospital?

However, if you don't have health insurance, you will be billed for all medical services, which may include doctor fees, hospital and medical costs, and specialists' payments. Without an insurer to absorb some or even most of those costs, the bills can increase exponentially.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What does a Medicare Supplement plan cost?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.

What are Medicare covered services?

Medicare-covered hospital services include: Semi-private rooms. Meals. General nursing. Drugs as part of your inpatient treatment (including methadone to treat an opioid use disorder) Other hospital services and supplies as part of your inpatient treatment.

What does Medicare Part B cover?

If you also have Part B, it generally covers 80% of the Medicare-approved amount for doctor’s services you get while you’re in a hospital. This doesn't include: Private-duty nursing. Private room (unless Medically necessary ) Television and phone in your room (if there's a separate charge for these items)

What is an inpatient hospital?

Inpatient hospital care. You’re admitted to the hospital as an inpatient after an official doctor’s order, which says you need inpatient hospital care to treat your illness or injury. The hospital accepts Medicare.

How many days in a lifetime is mental health care?

Things to know. Inpatient mental health care in a psychiatric hospital is limited to 190 days in a lifetime.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is a health care provider?

Tell your doctor and other. health care provider. A person or organization that's licensed to give health care. Doctors, nurses, and hospitals are examples of health care providers. about any changes in your insurance or coverage when you get care.

What is hospital indemnity insurance?

Hospital indemnity insurance is coverage you can add to your existing health insurance plan. This form of supplemental insurance pays you a predetermined benefit amount per day for each hospital confinement. They usually pay you this daily benefit amount for up to a year.

Do you have to pay coinsurance with health insurance?

With a comprehensive health insurance plan, you are still responsible for copays and coinsurance. On top of that, you are still required to pay your annual deductible before your plan will start covering the cost of your care.

Is there a waiting period for hospital indemnity insurance?

However, there may not be a waiting period for accidental injuries that land you in the hospital. Make sure to ask your agent about waiting periods before purchasing a hospital indemnity insurance policy.

What is supplement insurance?

Supplemental health insurance helps to pay for healthcare costs that aren't typically covered by traditional health insurance. Some cover specific situations, like hospital or disability insurance, while others cover specific health conditions like cancer. Learn more about these policies and how they work.

What are some examples of supplemental health insurance?

Examples of supplemental health insurance include dental insurance, critical illness insurance, and hospital indemnity insurance. Whether a supplemental health insurance plan is right for you depends on your health, the costs of the plan, and the benefits of the policy you're considering. Many of these plans are inexpensive, ...

What is cash benefit insurance?

This type of insurance provides a cash benefit paid directly to you if you require treatment for a specific disease such as cancer. You can typically spend the cash any way you choose, and getting your benefit has nothing to do with how much your insurance pays for your medical costs. 2

Do you have to stay in hospital before getting cash benefits?

There is often a minimum hospital stay before benefits are paid. The cash benefit is paid directly to you and is in addition to any other insurance you may have. 4 . Private insurers sell supplemental health plans.

What is Medicare Advantage PPO?

Medicare Advantage PPO plans with or without prescription drug coverage. Nationwide access to providers who accept Medicare, including when traveling, with no referrals needed. One plan for all retirees simplifies enrollment and billing administration by eliminating the need for out-of-area medical plans.

What is Cigna's commitment to whole person health?

Cigna's commitment to whole-person health means taking care of your retirees and helping them feel secure–physically, emotionally, socially, and financially. Cigna Group Medicare solutions help you deliver flexible health care options that meet the evolving needs of your retirees and your organization.

Is Cigna a Medicare Supplement?

In Arizona, Connecticut, and Oregon, the insured Cigna group medical plans that supplement Medicare are referred to as the Cigna Indemnity Medical Plan for Retirees, and are not considered a Medicare Supplement policy.

What is a gap in medical insurance?

Supplemental Medical Expense (GAP) insurance helps with coverage gaps in major medical insurance and has the flexibility to help meet employers' unique goals and challenges. It helps cover out-of-pocket expenses such as deductibles, co-insurance, and co-pays, so employees don’t dip into savings or increase their credit card debt.

What does cancer insurance cover?

Cancer insurance can help employees cope with out-of-pocket expenses following the diagnosis and treatment of cancer. It can help cover costs associated with hospital benefits, surgery, radiation and chemotherapy treatments, and ongoing maintenance therapy.

What is critical illness insurance?

Critical illness insurance pays a lump-sum cash benefit that can be used to cover expenses such as out-of-pocket medical bills or time lost from work. checklist-alternate.

What is long term disability insurance?

It can provide a steady stream of income to help pay expenses for an employee who is unable to work for an extended period due to an illness or injury.

Is executive health insurance a GAP?

Employer-paid executive health insurance can be a premier supplemental health insurance with more benefits at higher limits than traditional supplemental medical expense (GAP) insurance.

Does hospital indemnity insurance cover out of pocket expenses?

Even with a great major medical plan, out-of-pocket costs from an unexpected hospital stay can add up fast. The way this coverage often works is that for each day an employee is in the hospital (up to specific maximum limits), hospital indemnity insurance pays a cash benefit that can be used to cover anything from medical bills to everyday expenses.

How much is Medicare Part A deductible for 2021?

Here’s how that works: Part A – If you have a hospital stay, Medicare Part A has a deductible of $1,484 in 2021. If your employer’s plan deductible is $2,000, then Medicare pays the difference. The hospital will bill your group insurance after it receives Medicare’s payment.

When is Medicare primary?

Medicare is Primary when your Employer Has Less than 20 People. Since Medicare will be primary, most people should enroll in both Medicare Part A and Part B at age 65. Your group insurance will pay secondary to Medicare. Here’s how that works:

Does Medicare accept late enrollment?

On the other hand, there is no guarantee that the insurance company will continue this. It could change at any time, without warning. Furthermore, there is no rule that says that Medicare has to accept that coverage as creditable coverage for the late enrollment penalty.

Is it worth having Medicare and group insurance?

Having both Medicare and your group insurance will mean less out of pocket costs for you, so it is generally worth the expense of the monthly Part B premium. Working with an agent to help you analyze all the costs, pros and cons for your particular situation can also help you arrive at the right decision.

Does Medicare pay after you enroll in Part B?

By law, your employer group insurance only has to pay after Medicare first pays as your primary insurance. So if you fail to enroll in Part B, you could be responsible for the first 80% of the bills that Medicare would normally pay. Your group insurance only has to pay what would be leftover IF you had been enrolled in Part B.