What is guaranteed issue in health insurance?

- Guaranteed issue health insurance is coverage that accepts every qualified applicant

- Guaranteed issue health insurance does not consider medical history or any individual trait

- Guaranteed issue health insurance applies to individual and group insurance

- Obamacare is guaranteed issue for all eligible US citizens and residents

What does guaranteed issue mean?

“Guaranteed issue” means that the health insurance coverage is guaranteed to be issued to applicants, regardless of their medical history, their age, their gender, or any other factors that might increase their likelihood of using health services. In most states, guaranteed issue doesn’t limit what you can be charged when you enroll in a plan.

What are guaranteed issue rights?

You will typically qualify for guaranteed issue rights in the following circumstances:

- Your Medicare Advantage plan leaves Medicare.

- Your Medicare Advantage plan stops coverage in your area.

- You move out of the service area for your Medicare Advantage plan.

- You have Original Medicare and an employer group health plan (including retiree or COBRA plans) or union coverage which ends.

What is guaranteed issue term life insurance?

In most cases, guaranteed issue life insurance policies are the best option if you’re facing a serious medical condition. The coverage amounts are generally lower than other types of insurance policies, but the coverage can be used to help your family cover end-of-life expenses such as medical bills and funeral expenses.

What is the difference between open enrollment and guaranteed issue?

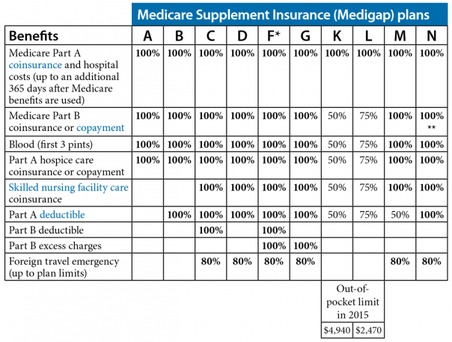

Whereas in open enrollment, you can choose any Medigap plan that is offered in your state, during a guaranteed issue you can typically only choose Medigap Plans A, B, C, F, K or L that's sold in your state by any insurance company.

What is a guaranteed issue situation?

You have a guaranteed issue right (which means an insurance company can't refuse to sell you a Medigap policy) in these situations: You're in a Medicare Advantage Plan, and your plan is leaving Medicare or stops giving care in your area, or you move out of the plan's service area. You have the right to buy.

What does guaranteed issue mean in health insurance?

Guaranteed issue laws require insurance companies to issue a health plan to any applicant – an individual or a group – regardless of the applicant's health status or other factors.

What is a guaranteed issue basis?

Guaranteed issue is a term used in health insurance to describe a situation where a policy is offered to any eligible applicant without regard to health status.

What does guaranteed issue amount mean?

A plan's guaranteed issue (GI) is the amount of life insurance available to an employee without having to provide Evidence of Insurability, or EOI.

What is the major problem with guaranteed issue?

Except for the waiting period, guaranteed issue policies might sound too good to be true. Unhealthy people take out policies, pay their premiums, and die in a few months or a few years. The insurance company has to either return their money or pay a death benefit. How can insurers even afford to offer these policies?

Why is guaranteed issue beneficial?

Guaranteed issue life insurance is a policy you can't be turned down for. It's appealing because there's no life insurance medical exam needed to qualify, and no health questions. The downside is that it generally has high costs and only low amounts of coverage available.

What does guaranteed issue mean and why is this potentially very beneficial?

A requirement that health plans must permit you to enroll regardless of health status, age, gender, or other factors that might predict the use of health services.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is Medicare Part D guaranteed issue?

For most of the events, you are only guaranteed the right to buy plans A, B, D, G (including G with a high deductible), K, L, M or N.

Is Medicare plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is guaranteed issue rights?

Guaranteed issue rights are also known as Medigap protections. If you qualify, a private insurance company must abide by government regulations to give you access to certain Medicare Supplement plans, it must offer coverage for all pre-existing health conditions, and it cannot charge you a higher premium for the insurance plan due ...

How long do you have to have a trial right to buy Medicare?

In some cases, if you are in your “trial right” period for a Medicare Advantage (Part C) plan, which is up to 12 months after initial enrollment, you also have guaranteed issue rights to purchase a private supplemental health insurance plan during this special enrollment period. Federal law allows 63 days of guaranteed issue rights ...

Does Medicare Supplement cover coinsurance?

A Medicare Supplement plan pays for coinsurance, copayments, and some of the deductibles that Original Medicare insurance does not cover. It also provides extended benefits in many cases.

Can you sell a Medicare Supplement policy?

Understanding Guaranteed Issue Rights. Private insurance companies are lawfully obligated to sell you a Medicare Supplement policy if you enroll during your initial enrollment period you qualify for guaranteed issue rights. Guaranteed issue rights are also known as Medigap protections.

What is a guaranteed issue right?

A Medigap guaranteed issue right allows you to purchase a Medicare Supplement insurance policy from any company without regard to your health condition. You only have a guaranteed issue right in certain situations. When you have a Medigap guaranteed issue right, insurance companies are lawfully required to sell or offer you a Medicare Supplement ...

What is Medicare Advantage?

You have a Medicare Advantage plan & you are moving out of the plan’s service area. You have Medicare Parts A and B (Original Medicare) & you need to replace an employer health plan that will soon be discontinued. You have Original Medicare and a Medicare SELECT policy & you move out of the policy’s service area.

What happens if you don't buy a Medigap policy?

If you do not buy a policy during your Medigap open enrollment period or a situation in which you have a guaranteed issue right, you will likely be required to go through medical underwriting. Medical underwriting could lead to a coverage denial or higher premiums.

Can I enroll in Medicare Supplement?

Enrolling in Medicare Supplement Insurance. If you get a Medicare Supplement insurance policy through a Medigap guaranteed issue right, you will have guaranteed access only to certain standardized Medicare Supplement Insurance plans. 1 You will be able to enroll in one of the following Medigap plans sold in your state: Plans A, B, C, F, K, or L.

Can you drop a Medigap policy to join Medicare?

You dropped a Medigap policy to join a Medicare Advantage plan for the first time & within the first year of joining you want to switch back to Medigap. Your Medigap insurance company goes bankrupt or ends your policy through no fault of your own.

Can I buy Medicare Supplement after open enrollment?

The following 8 situations may provide you with a guaranteed issue right that allows you to buy a Medicare Supplement insurance policy after your open enrollment period ends. An insurance company cannot refuse to sell you a Medicare Supplement insurance policy in the following situations: You have a Medicare Advantage plan & it is leaving Medicare ...

Can you get Medicare Supplement if you have pre-existing conditions?

When you have a Medigap guaranteed issue right, insurance companies are lawfully required to sell or offer you a Medicare Supplement insurance policy even if you have pre-existing conditions. In these situations, insurers cannot charge you more because of past or present health problems.

When will health insurance be guaranteed?

Under the Affordable Care Act, all individual major medical health insurance policies with effective dates of January 2014 or later must be sold on a guaranteed issue basis. Insurers can no longer base eligibility for coverage on the applicant's medical history, and pre-existing conditions can no longer be excluded from new plans. 1

What is guaranteed issue in 2021?

In health insurance, guaranteed issue refers to a circumstance in which a healthcare policy is offered to any and all eligible applicants regardless of health status. Guaranteed issue rules allow individuals with pre-existing medical issues to obtain health insurance, as their medical history is not taken ...

What is exempt from the ACA?

Coverage That's Exempt From ACA Rules. There are still a variety of types of coverage that aren't regulated by the ACA and don't have to be sold on a guaranteed-issue basis. This includes things like short-term health insurance, critical illness plans, healthcare sharing ministry coverage, and individual life insurance policies.

Is Medicare a guaranteed issue?

Medicare, Medicaid, and CHIP. Government-issued health insurance, including Medicare, Medicaid, and the Children's Health Insurance Program (CHIP), is guaranteed issue. Applicants have to otherwise be eligible for the coverage, but their medical history is not a factor. The same is true for most of the private supplemental coverage offered ...

Is a guaranteed issue good for pre-existing conditions?

Guaranteed issue and modified community rating are certainly good news for those with pre-existing medical conditions. However, it's still important to discuss your pre-existing conditions with a broker, enrollment assister, or the person who handles your employer's human resources department, before you pick a plan.

Do large employers have to offer coverage?

Large employers are required to offer coverage to their employees under the ACA. To facilitate this, insurers are no longer allowed to impose minimum participation requirements when large employers seek coverage for their employees. 6 Most very large group self-insure, however, making this a moot point. 7

Does large group insurance have to follow the community rating rules?

Although insurers must offer large group coverage on a guaranteed issue basis (ie, the group cannot be rejected altogether), large group coverage does not have to follow the modified community rating rules that apply to small group and individual plans.

What are guaranteed issue rights for Medicare?

All Medicare beneficiaries are protected by law from unfair medical underwriting. Guaranteed issue rights prohibit insurance companies from denying or overcharging you a Medigap policy, regardless of any pre-existing health conditions.

What is trial rights in Medicare?

Trial rights when you enroll in Medicare Advantage or drop your Medigap coverage. Your Medicare Advantage plan is leaving your specific area or leaving Medicare. You decide to move out of the plan’s service area. An employer plan that supplements Medicare ends. The Medicare company did not follow the rules.

How long do you have to go back to Medicare if you change your mind?

The same rule applies if you enroll in a Medicare Advantage plan after turning 65. If you start with Original Medicare and a Medigap plan, you have 12 months to try Medicare Advantage.

What happens if you move out of your Medicare Advantage plan?

If you move out of your plan’s service area, you will lose coverage. As a result, you will be given a guaranteed-issue right to purchase a Medicare supplement plant in your NEW area. Your second option: choose a new Medicare Advantage plan. Another common situation is a Medicare Advantage plan folding or being terminated in your area.

How long is Medicare trial?

Medicare Advantage Trial Rights. Once you become eligible for Medicare at 65, you are given a 12 month trial with Medicare Advantage. If you change your mind, you can return back to Original Medicare. The same rule applies if you enroll in a Medicare Advantage plan after turning 65.

Which states have birthday rules for Medicare?

Medicare Supplement Guaranteed Issue States with The Birthday Rule. Oregon and California have “ Birthday Rules ,” allowing Medigap enrollees 30-days to change plans. The rule allows a switch to another Medigap plan with the same or lesser benefits, without medical underwriting.

What does it mean when you lose group insurance?

If you involuntary lose group coverage, this means your insurer is dropping your plan, although it is not your fault. This also includes the insurance company filing for bankruptcy. Involuntary means you did not cancel the coverage; nor are you losing coverage for non-payment. If you are losing group coverage involuntarily, ...

What is guaranteed issue?

Guaranteed issue refers to health insurance coverage that is guaranteed to be issued to applicants regardless of their health status, age, or income.

When did the Affordable Care Act change?

But that changed when the bulk of the Affordable Care Act’s provisions were implemented in 2014. All individual-market major medical plans in all states are now guaranteed issue, and applicants’ medical history is no longer a factor in their eligibility.

What is guaranteed issue for Medicare?

A different type of eligibility for Medicare Supplement coverage is called Medicare Supplement guaranteed issue. Guaranteed issue periods have the same basic implications as the Medigap open enrollment period, in that you cannot be turned down for coverage or made to pay more based on your health. However, there are some additional considerations.

What is the difference between open enrollment and guaranteed issue?

One of the big differences between open enrollment and guaranteed issue is which plans are offered . Whereas in open enrollment, you can choose any Medigap plan that is offered in your state, during a guaranteed issue you can typically only choose Medigap Plans A, B, C, F, K or L that’s sold in your state by any insurance company.

How long do you have to be in Medicare before you can enroll?

Additionally, most insurance companies allow you to enroll in a Medigap plan up to 6 months before your Medicare coverage starts. When you do that, the coverage does not start ...

What is Medicare Supplement?

A Medicare Supplement gives you predictable out of pocket costs once you are on Medicare and limits, or eliminates, your exposure to potentially high medical costs. But, if you don’t sign up for one when you are eligible to do so, you may have difficulty getting a plan at a later time. Because of this, it’s important to understand ...

How long is Medicare Supplement Open Enrollment?

What is Medicare Supplement Open Enrollment? Open enrollment, as it pertains to Medicare Supplement plans, is a 6 month period that begins the first day of the month that you are both 65 or older and enrolled in Medicare Part B (see page 14 of the “Choosing a Medigap” booklet ).

What is 65Medicare.org?

65Medicare.org is a leading, independent Medicare insurance agency for people turning 65 and going on Medicare. If you have any questions about this information, you can contact us online or call us at 877.506.3378.

What are insurance companies asking about?

Generally speaking, most insurance companies are asking about the last 2-3 years and asking about things like cancer, heart attacks, stroke, insulin-dependent diabetes, COPD, multiple hospitalizations, and known/upcoming medical tests/procedures.

What is guaranteed issue life insurance?

Guaranteed issue life insurance, or guaranteed acceptance life insurance, is a type of whole life insurance policy that does not require you to answer health questions, undergo a medical exam, or allow an insurance company to review your medical and prescription records. You may also see it referred to as “no questions life insurance” ...

How old do you have to be to get a guaranteed issue policy?

The typical age range to qualify is 50 to 80 years old. If you are outside of this age range, you may still be able to get a guaranteed issue policy with some insurance companies, but you will have fewer options. 1 .

How long does it take to die from a guaranteed issue?

Unhealthy people take out policies, pay their premiums, and die in a few months or a few years. The insurance company has to either return their money or pay a death benefit.

Can you get life insurance if you have congestive heart failure?

People can get life insurance with underwriting even if they have congestive heart failure, have had a heart attack in the last 12 months, or have had a stroke in the last 12 months, among other health conditions. 1.

Can you get insurance with guaranteed issue?

Despite these factors, guaranteed issue can be a valuable financial asset for people who can’t otherwise get insurance. And those people aren’t always seniors; they may be younger or middle-aged adults in poor health who want to leave money for their families.

Does a guaranteed issue policy pay off?

There are two scenarios in which a guaranteed issue policy might not pay off or be the best option. These are if the insured lives long enough that the premiums paid exceed the death benefit, or if the insured buys a guaranteed issue policy when they could have qualified for a policy that has medical underwriting.