Other extra benefits may include:

- Meal delivery for beneficiaries with chronic illnesses

- Transportation for non-medical needs like grocery shopping

- Carpet shampooing to reduce asthma attacks

- Transport to a doctor appointment or to see a nutritionist

- Alternative medicine such as acupuncture

Full Answer

What do Medicare Advantage plans cover?

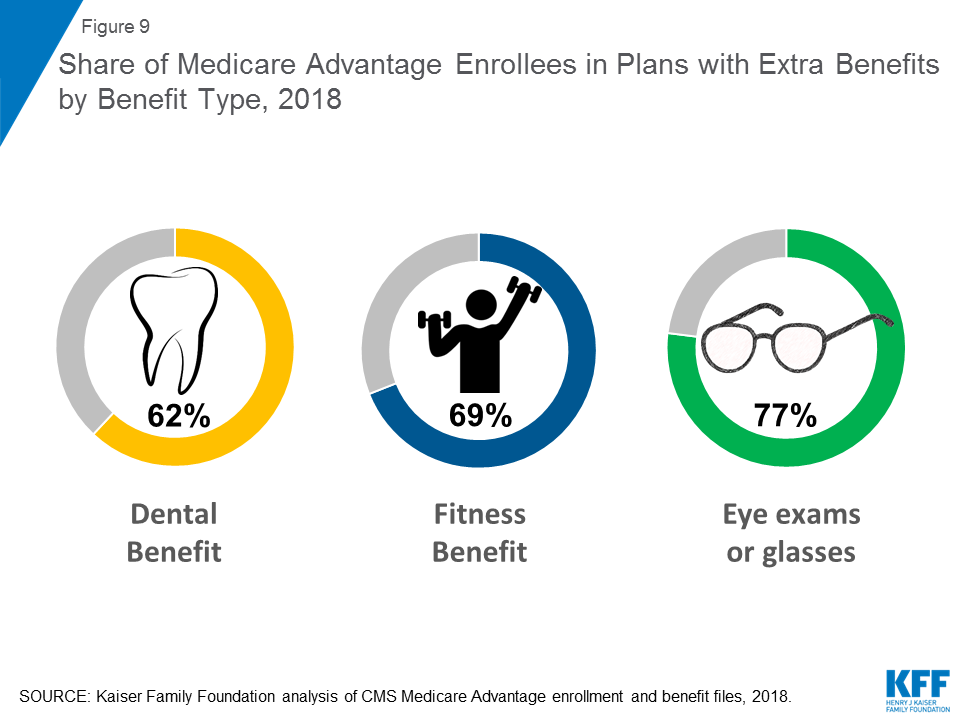

Advantage Plan. In all types of Medicare Advantage Plans, you’re always covered for emergency and urgent care. Medicare Advantage Plans must offer emergency coverage outside of the plan’s service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs. Most Medicare Advantage Plans …

What are the requirements to join a Medicare Advantage plan?

Covered services in Medicare Advantage Plans. Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to …

What is the difference between Original Medicare and Medicare Advantage?

Most Medicare Advantage Plans include Medicare drug coverage (Part D). In certain types of plans that don’t include Medicare drug coverage (like Medical Savings Account Plans and some Private-Fee-for-Service Plans), you can join a separate Medicare drug plan. However, if you join a Health Maintenance Organization or Preferred Provider

Do I still have Medicare if I have Medicare Advantage?

Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage (Part D). In most cases, you’ll need to use health care providers who participate in the plan’s network.

What is included in a Medicare Advantage plan?

Medicare Advantage Plans must offer emergency coverage outside of the plan's service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs. Most Medicare Advantage Plans include Medicare prescription drug coverage (Part D).

What is not covered by Medicare Advantage plans?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to cover even more benefits.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What is the difference between Medicare and Medicare Advantage plans?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of- pocket costs than Original Medicare. In many cases, you'll need to use doctors who are in the plan's network.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Can I switch from a Medicare Advantage plan back to Original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Is it worth getting a Medicare Advantage plan?

In general, though, Medicare Advantage costs less upfront and potentially more overall if you need lots of medical care. Many Medigap plans have higher upfront costs but cover most if not all of your expenses when you need care.Sep 17, 2020

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

Do Medicare Advantage plans have a lifetime limit?

Medicare Advantage plans have no lifetime limits because they have to offer coverage that is at least as good as traditional Medicare, says Vicki Gottlich, senior policy attorney at the Center for Medicare Advocacy in Washington, D.C. “There has never been a cap on the total amount of benefits for which Medicare will ...Aug 23, 2010

What is Medicare Advantage Plan?

Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are an “all in one” alternative to Original Medicare. They are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have. Medicare.

Can't offer drug coverage?

Can’t offer drug coverage (like Medicare Medical Savings Account plans) Choose not to offer drug coverage (like some Private Fee-for-Service plans) You’ll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply: You’re in a Medicare Advantage HMO or PPO.

What happens if you don't get a referral?

If you don't get a referral first, the plan may not pay for the services. to see a specialist. If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care. These rules can change each year.

Does Medicare cover dental?

Covered services in Medicare Advantage Plans. Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like some vision, hearing, dental, and fitness programs (like gym memberships or discounts). Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like ...

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Why do you keep your Medicare card?

Keep your red, white, and blue Medicare card in a safe place because you’ll need it if you ever switch back to Original Medicare. Below are the most common types of Medicare Advantage Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

Medicare Advantage

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

Medicare Advantage

Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Medicare Advantage

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

What is Medicare Advantage?

En español | The Medicare Advantage program (Part C) gives people an alternative way of receiving their Medicare benefits. The program consists of many different health plans (typically HMOs and PPOs) that are regulated by Medicare but run by private insurance companies. Plans usually charge monthly premiums (in addition to the Part B premium), ...

When can Medicare Advantage plans change?

Medicare Advantage plans can change their costs (premiums, deductibles, copays) every calendar year. To be sure of getting your best deal, you can compare plans in your area during the Open Enrollment period (Oct. 15 to Dec. 7) and, if you want, switch to another one for the following year.

Does Medicare have a monthly premium?

Plans usually charge monthly premiums ( in addition to the Part B premium), although some plans in some areas are available with zero premiums. These plans must offer the same Part A and Part B benefits that Original Medicare provides, and most plans include Part D prescription drug coverage in their benefit packages.

What is the purpose of a Medicare wellness exam?

The purpose of the Medicare annual wellness exam is to develop or update your personalized prevention plan and perform a health risk assessment.

What is Medicare annual wellness exam?

The Medicare annual wellness exam is a free health benefit that includes a personalized prevention plan. Taking advantage of this important benefit can help beneficiaries take proactive steps to stay healthy.

Why do we do wellness exams?

That’s because the wellness exam gives you an opportunity to get personalized health advice. You can talk about any healthcare concerns you may have, ask questions about your medications, talk about changes to your diet or exercise routine and more.

What are the risks of a syringe?

It also assesses other aspects of your health, such as: 1 Psychosocial risks (e.g., depression/life satisfaction, stress, anger, loneliness/social isolation, pain, and fatigue) 2 Behavioral risks (e.g., tobacco use, physical activity, nutrition and oral health, alcohol consumption, sexual health, motor vehicle safety and home safety) 3 Activities of daily living (e.g., dressing, feeding, toileting, bathing, grooming, physical ambulation including balance and your risk of falls)

Is the annual wellness exam covered by Medicare?

However, you may still have questions about the purpose of the exam and how it can help you. For instance, it’s important to know that the annual wellness exam is covered in full by Medicare, but it’s not the same as a routine physical exam, which isn’t covered by Medicare. This article answers some of the most common questions about ...

What is Medicare Part A?

Medicare Part A covers things like inpatient hospitalization and skilled nursing care , and Medicare Part B provides coverage for outpatient care when it comes to doctor’s visits and treatments at clinics or testing at a lab.

What is a wellness visit under Medicare?

During a wellness visit under Medicare, patients will have the chance to discuss any changes to existing conditions that have previously been documented, and the physician will review medical history to ensure that the patient is still in need of any prescribed medications.

Why do we need a wellness visit?

The truth is, scheduling an annual doctor’s visit to assess your health, often referred to as a wellness visit, is just as important to do when you’re feeling fine as it is when you’re feeling under the weather. These visits provide your physician the chance to discuss any healthcare concerns you may have, and they also give you ...

What is a physical exam?

During a physical, your doctor carries out a physical exam of your major systems, takes measurements, documents any changes and reviews concerns. During a wellness visit, there is typically no examination that takes place other than a general inspection of the body.

What is preventive health plan?

A doctor may also provide the patient with a preventive health plan designed to encourage healthy lifestyle choices. This plan may detail dietary changes or weight loss exercises, smoking or alcohol cessation information, a list of support groups or therapeutic care providers and more.

Can you bring up a medical concern during a wellness visit?

During a wellness visit, you may bring up a medical concern which prompts a physical exam, and during a physical, you may discuss wellness concerns, but the two are billed as separate types of visits.

Do wellness visits include treatment?

While wellness visits usually do not include any type of treatment in the doctor’s office unless an emergency occurs, patients are often directed to make a follow-up appointment for further screening if the wellness visit brings to light concerns that need to be addressed in detail.