The income requirements for Medicare savings programs in 2021 are summarized in the following table:

| Medicare savings program | Individual monthly income limit | Married couple monthly income limit | Individual resource limit | Married couple resource limit |

| QMB | $1,094 | $1,472 | $7,970 | $11,960 |

| SLMB | $1,308 | $1,762 | $7,970 | $11,960 |

| QI | $1,469 | $1,980 | $7,970 | $11,960 |

| QDWI | $4,379 | $5,892 | $4,000 | $6,000 |

Full Answer

What are the monthly income limits for Medicare savings programs?

Qualified Medicare Beneficiary (QMB) Gross monthly income limits: 100% Federal Poverty Level, or FPL, + $20** Most states: $1,153 – Individual $1,546 – Couple Asset limits: $8,400 – Individual $12,600 – Couple Specified Low-income Medicare Beneficiary (SLMB) Gross monthly income limits: 120% FPL + $20

What is a Medicare savings program?

This means that you could be eligible for an MSP with assets totaling $8,400 for individuals and $12,600 for couples. MSP limits appear lower than Extra Help limits because they do not automatically include burial funds.

How do I qualify for Medicare savings programs?

Qualifying for a Medicare Savings Program. The 2020 MSP Program income limits are approximately as follows: QMB: Under $1,061 per individual or $1,430 per couple. SLMB: Under $1,269 per individuals or $1,711 per couple. QI: Under $1,426 per individual or $1,923 per couple.

What are the income limits for Qualified Medicare beneficiaries?

Nov 16, 2021 · Most people will pay the standard amount for their Medicare Part B premium. However, you’ll owe an IRMAA if you make more than $91,000 in a given year. For Part D, you’ll pay the premium for the...

What are the Medicare income brackets for 2020?

2022If your yearly income in 2020 (for what you pay in 2022) wasFile individual tax returnFile joint tax returnabove $91,000 up to $114,000above $182,000 up to $228,000above $114,000 up to $142,000above $228,000 up to $284,000above $142,000 up to $170,000above $284,000 up to $340,0003 more rows

How much money can you have in the bank if your on Medicare?

You may have up to $2,000 in assets as an individual or $3,000 in assets as a couple.

Is Medicare based on income or assets?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Does Medicare look into your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

What assets are exempt from Medicare?

Other exempt assets include pre-paid burial and funeral expenses, an automobile, term life insurance, life insurance policies with a combined cash value limited to $1,500, household furnishings / appliances, and personal items, such as clothing and engagement / wedding rings.Dec 14, 2021

Is Social Security considered income for Medicare?

For purposes of the Medicare Prescription Drug Discount Card, we have defined “income” as money received through retirement benefits from Social Security, Railroad, the Federal or State Government, or other sources, and benefits received for a disability or as a veteran, plus any other sources of income that would be ...

What is modified adjusted gross income for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage.

Does Social Security count as income?

While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.Jan 28, 2019

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

How many types of MSPs are there?

There are four kinds of MSPs. Each type of MSP is tailored to different needs and circumstances. Qualified Medicare Beneficiary (QMB) Programs pay most of your out-of-pocket costs. These costs include deductibles, copays, coinsurance, and Part B premiums. A QMB will also pay the premium for Part A if you haven’t worked 40 quarters.

What states have QI?

If you live in any of the following states, please note the differences in program names: 1 Alaska: QI is called SLMB Plus 2 Connecticut: QI is called ALMB 3 Maryland: QI is called SLMB II 4 North Carolina: QMB, SLMB, and QI are called MQB, MQB-B, and MBQ-E, respectively 5 Nebraska: Federal QMB is replaced with full Medicaid; SLMB and QI are both referred to as QMB 6 New Hampshire: QI is called SLMB-135 7 Oregon: SLMB and QI are called SMB and SMF respectively 8 Wisconsin: QI is called SLMB Plus

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

What is balance billing?

Balance billing refers to the cost for a service that remains after Medicare pays. If you’re a QMB, your providers should not be billing you directly for the balance after Medicare pays them for your service. Yet, if you’re an SLMB or a QI, there is no rule against your doctor’s office sending you a bill for the balance of your service.

What is countable resource?

The term countable resources mean any money in bank accounts (checking or savings), stocks, and bonds. Your home, one car, a burial plot, up to $1,500 already saved for burial expenses, and personal belongings aren’t included when countable resources are considered.

Does QMB pay for Part A?

A QMB will also pay the premium for Part A if you haven’t worked 40 quarters. Those who qualify for the QMB program are also automatically eligible for the Extra Help program for prescription drugs. Specified Low-Income Medicare Beneficiary (SLMB) Programs pay your Part B premium.

What is extra help for Medicare?

Extra Help is the federal program that helps with Part D prescription drug costs if you meet the income and asset requirements. This change helps more people become eligible for MSPs and was a result of the Medicare Improvements for Patients and Providers Act (MIPPA). In 2021, the asset limits for full Extra Help are $9,470 for individuals ...

What states do not have asset limits for MSPs?

* Alabama, Arizona, Connecticut, Delaware, Mississippi, New York, Oregon, Vermont, and the District of Columbia do not have asset limits for MSPs (as of January 2019).

Why is the MSP limit lower than the extra help limit?

MSP limits appear lower than Extra Help limits because they do not automatically include burial funds. This means that the $1,500 disregard for MSP eligibility typically will not apply unless you prove that you have set aside these funds in a designated account or in a pre-paid burial fund.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) is designed to cover all or part of Medicare out-of-pocket expenses that encumber Medicare recipients who live within limited financial means.

What is a Medicare summary notice?

You will also receive a Medicare Summary Notice (MSN), which is proof of being in the program and shows the healthcare provider you should not be billed for services, deductibles, coinsurance or copayments. An exception is outpatient prescriptions.

Is the cutoff point higher for people who earn an income?

States may establish their own threshold of income and resources, and may apply a different calculation to decide if someone is eligible. Additionally, the cutoff point may be higher for people who earn an income. Reaching out for help.

Is Medicare cost prohibitive?

The cost of Medicare benefits in the form of premiums, coinsurance, copayments and deductibles can raise concerns about affordability, especially when you are on a limited income. For Medicare recipients under a certain income and asset level, Medicare benefits can be cost prohibitive.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is a medical savings account?

Medical Savings Account (MSA): The second part is a special type of savings account. The Medicare MSA Plan deposits money into your account. You can use money from this savings account to pay your health care costs before you meet the deductible.

What is Medicare MSA?

What's a Medicare MSA Plan? Medicare works with private insurance companies to offer you ways to get your health care coverage. These companies can choose to offer a consumer-directed Medicare Advantage Plan, called a Medicare MSA Plan. These plans are similar to Health Savings Account Plans available outside of Medicare.

What is MSA plan?

Medicare MSA Plans combine a high-deductible insurance plan with a medical savings account that you can use to pay for your health care costs. A type of Medicare health plan offered by a private company that contracts with Medicare.

Does MSA cover extra?

In addition, some Medicare MSA plans may cover extra. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. Contact plans in your area for more information on what extra benefits they cover, if any.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . The plan will only begin to cover your costs once you meet a high yearly. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , which varies by plan.

Does Medicare cover MSA?

Medicare MSA Plans don't cover Medicare Part D prescription drugs. If you join a Medicare MSA Plan and need drug coverage, you'll have to join a Medicare Prescription Drug Plan. To find available plans in your area, you can: Visit the Medicare Plan Finder. Call us at 1-800-MEDICARE (1-800-633-4227).

What is the extra help program?

This program will help you pay all the premiums, deductibles, and coinsurance for a Medicare Part D prescription drug plan.

How to cut Medicare costs?

You can also cut your Medicare costs by applying for Medicaid, enrolling in PACE, or purchasing a Medigap policy.

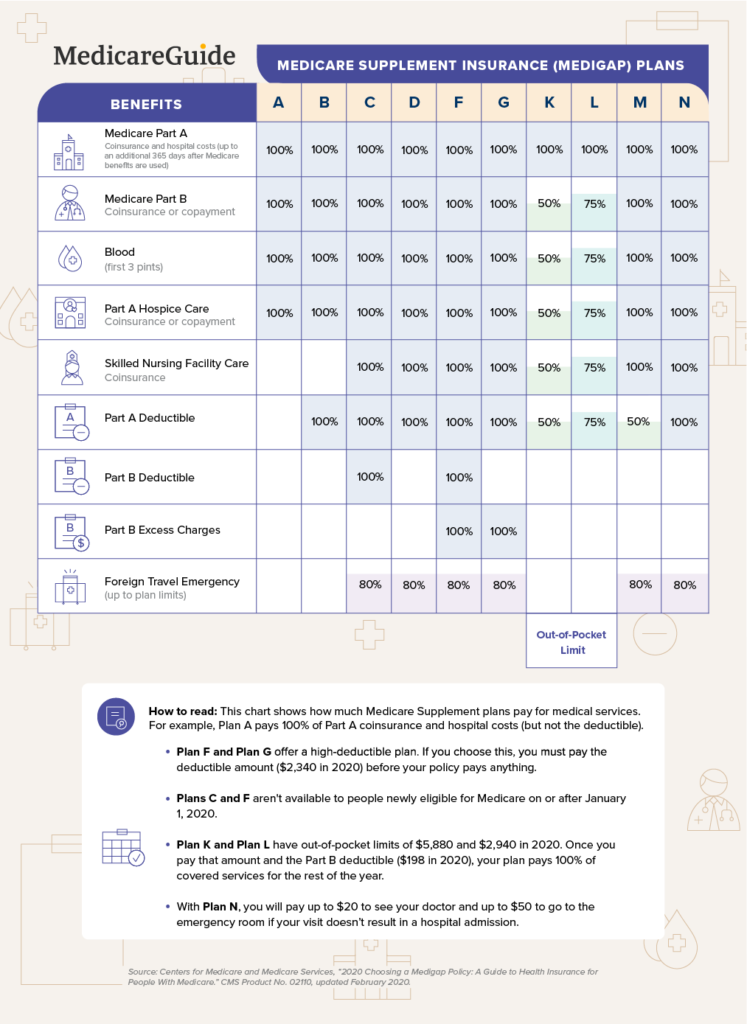

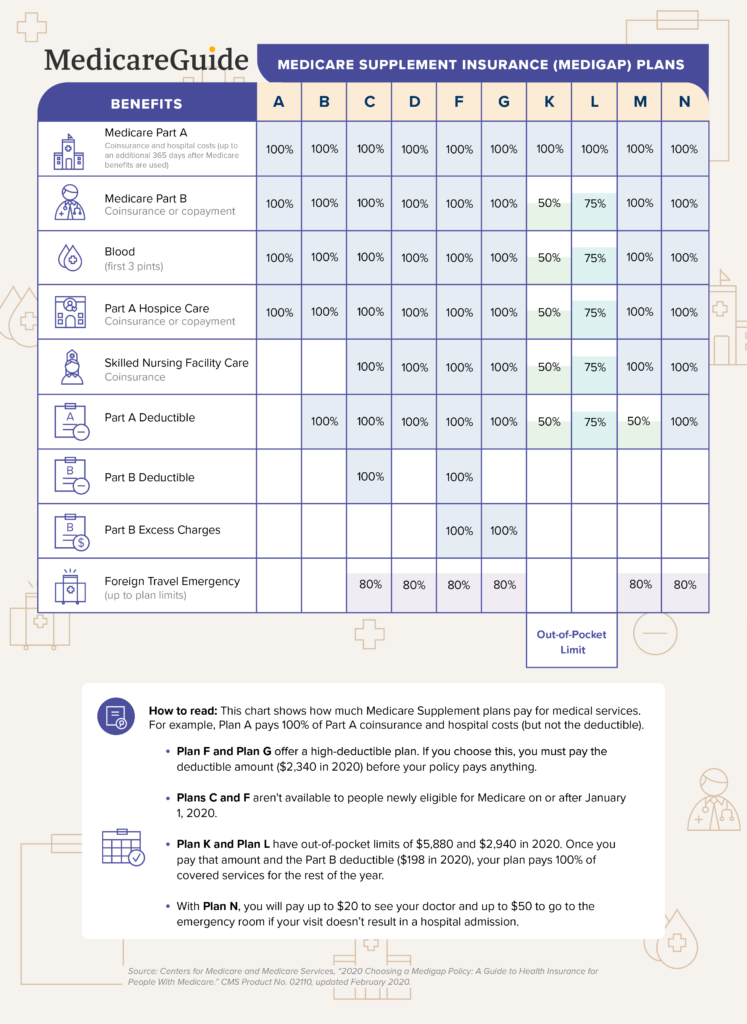

What is a Medigap plan?

Medigap plans are private insurance policies that help you pay your Medicare costs , including copays, coinsurance, and deductibles. You can choose from among 10 plans, and each plan offers the same coverage nationwide.

What is Medicare savings?

Medicare savings programs help people with lower income pay their Medicare Part A and Part B premiums, deductibles, copays, and coinsurance. To qualify, your monthly income must be at or below a certain limit for each program, and your household resources cannot exceed certain limits.

What to do if medicaid denies application?

If Medicaid denies your application, you may be able to file an appeal. Here are some steps you can take to apply for a Medicare savings program: Familiarize yourself with the kinds of questions you may be asked when you apply. The form is available in multiple languages.

What to do if you are wrongly billed for a service?

If you are wrongly billed for a healthcare service, make sure the doctor knows you’re in the QMB program. Then, contact Medicare to let them know you’re being billed for the service. You must qualify. To qualify for the QDWI program, you must be disabled, working, and under 65 years old.

What documents are needed to apply for Medicare?

Before you begin applying, gather supporting documents such as your Social Security and Medicare cards, proof of your address and citizenship, bank statements, IRA or 401k statements, tax returns, Social Security awards statements, and Medicare notices.

How does Medicare work?

Medicare works with private insurance companies to offer you ways to get your health care coverage. These companies can choose to offer a consumer-directed Medicare Advantage Plan, called a Medicare Medical Savings Account (MSA) Plan. This type of plan combines a high-deductible health insurance plan with a medical savings account that you can use to pay for your health care costs. Medicare MSA Plans give you freedom to control your health care dollars and provide you with important coverage against high health care costs.

What rights do you have with Medicare?

As a person with Medicare, you have certain rights. One of these is the right to a fair process to appeal decisions about your health care payment of services.

What is Medicare MSA?

Medicare MSA Plans (offered by private companies) are Medicare Advantage Plan options . Medicare MSA Plans are similar to Health Savings Account plans available outside of Medicare. If you choose a Medicare MSA Plan, you’re still in Medicare and you will still have Medicare rights and protections.

What is assignment in Medicare?

Assignment—An agreement by your doctor or other supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance.

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.