Why has Medicare spending increased so much?

That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy. Medicare finances an array of health services.

How much will Medicare spending increase between 2019 and 2029?

Between 2019 and 2029, net Medicare spending is also projected to grow as a share of the federal budget—from 14.3 percent to 18.3 percent—and the nation’s economy—from 3.0 percent to 4.1 percent of gross domestic product (GDP).

What is driving the growth in Medicare spending?

The aging of the population, growth in Medicare enrollment due to the baby boom generation reaching the age of eligibility, and increases in per capita health care costs are leading to growth in overall Medicare spending.

What is the impact of Medicare on the economy?

Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and 39 percent of all home health spending. In 2020, Medicare provided benefits to 19 percent of the population.

What are Medicare expenditures?

Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE. Private health insurance spending declined 1.2% to $1,151.4 billion in 2020, or 28 percent of total NHE.

What does Medicare spend the most on?

Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2017, 30 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physician services.

What is one of the reasons why Medicare costs have been rising?

The aging of the population, growth in Medicare enrollment due to the baby boom generation reaching the age of eligibility, and increases in per capita health care costs are leading to growth in overall Medicare spending.

How does Medicare affect the economy?

In addition to financing crucial health care services for millions of Americans, Medicare benefits the broader economy. The funds disbursed by the program support the employment of millions of workers, and the salaries paid to those workers generate billions of dollars of tax revenue.

How much did Medicare cost in 1970?

In 1970, some 7.5 billion U.S. dollars were spent on the Medicare program in the United States. Almost fifty years later, this figure stood at some 796.2 billion U.S. dollars. This statistic depicts total Medicare spending from 1970 to 2019.

What is Medicare coverage?

Increasing Medicare coverage. Medicare is the federal health insurance program in the U.S. for the elderly and those with disabilities. In the U.S., the share of the population with any type of health insurance has increased to over 90 percent in the past decade.

How much will Alzheimer's cost in 2020?

In 2020, Alzheimer's disease was estimated to cost Medicare and Medicaid around 206 billion U.S. dollars in care costs; by 2050, this number is projected to climb to 777 billion dollars.

When did Medicare per capita increase?

Between 2000 and 2011, Medicare per capita spending grew faster for beneficiaries ages 90 and older than for younger beneficiaries over age 65, both including and excluding spending on the Part D prescription drug benefit beginning in 2006.

How much did Medicare spend in 2011?

Average Medicare per capita spending in 2011 more than doubled between age 70 ($7,566) and age 96 ($16,145). The increase in Medicare per capita spending as beneficiaries age can be partially, but not completely, explained by the high cost of end-of-life care.

Why is the analysis focusing on Medicare beneficiaries over age 65 rather than younger adults who qualify for Medicare?

The analysis focuses on Medicare beneficiaries over age 65 rather than younger adults who qualify for Medicare because of a permanent disability to develop a better understanding of the relationship between Medicare spending and advancing age. This study examines patterns of Medicare spending among beneficiaries in traditional Medicare rather ...

What percentage of Medicare beneficiaries were enrolled in 2011?

Because we lack comparable data for the 25 percent of beneficiaries enrolled in Medicare Advantage in 2011, it is not possible to assess whether patterns of service use and spending in traditional Medicare apply to the Medicare population overall. More information about the data, methods, and limitations can be found in the Methodology.

Is Medicare spending data available for all people?

The analysis excludes beneficiaries who are age 65 because some of these beneficiaries are enrolled for less than a full year; therefore, a full year of Medicare spending data is not available for all people at this year of age. The analysis focuses on Medicare beneficiaries over age 65 rather than younger adults who qualify for Medicare because ...

Will population aging affect health care?

According to the Congressional Budget Office, population aging is expected to account for a larger share of spending growth on the nation’s major health care programs through 2039 than either “excess spending growth” or subsidies for the coverage expansions provided under the Affordable Care Act. 2. To inform discussions about Medicare’s role in ...

Does Medicare increase as you age?

As the U.S. population ages, the increase in the number of people on Medicare and the aging of the Medicare population are expected to increase both total and per capita Medicare spending. The increase in per capita spending by age not only affects Medicare, but other payers as well.

Overview of Medicare Spending

Medicare is currently the nation’s second-largest social insurance program. Last year, Medicare insured 62.6 million Americans, including 54.1 million seniors and 8.5 million disabled beneficiaries under 65. Annual expenditures totaled $926 billion.

Projections for Medicare Spending

Trustees estimate that spending for Medicare Part A could climb from 1.7% to 2.2% by 2045. On the other hand, Trustees predict that Part B and Part D will grow at an even faster rate. According to the report, over the next seven years, spending for Part B will grow from 2.0% to 3.6%.

What is the Future of Government Spending on Medicare?

The debate over the $3.5 trillion infrastructure bill continues. It’s unknown how Congress plans to control Medicare spending in the future. However, Democrats want to expand Medicare coverage in the near future to include dental, vision, and hearing benefits.

When will Medicare increase?

As increasing numbers of the baby boom population born between 1946 and 1964 reach Medicare age, that program is projected to experience its highest-ever rate of spending growth among healthcare payers—7.6%—between 2019 and 2028.

What does CMS estimate for future increases in healthcare spending?

CMS estimates as well as other projections of future increases in U.S. health spending assume that the current structure of the healthcare sector generally will continue; these projections also take into account external developments that impact costs.

How much is Medicare spending in 2019?

Medicare represented 21% of total NHE in 2019; it accounted for the largest share of federal healthcare spending, a total of $799.4 billion. CMS projects that Medicare spending will grow 7.6% annually between 2019 and 2029. Medicaid accounted for $613.5 billion, 16% of NHE in 2019.

How much will healthcare spending increase in 2028?

15 CMS projects that U.S. healthcare spending will grow at a rate 1.1% faster than that of the annual GDP and is expected to increase from 17.7% of the GDP in 2019 to 19.7% by 2028.

How much is Medicaid in 2019?

Medicaid accounted for $613.5 billion, 16% of NHE in 2019. That same year, private health insurance spending amounted to $1,195.1 billion, 31% of NHE, and out-of-pocket expenditures were $406.5 billion, 11% of NHE.

What are the factors that affect healthcare prices?

Internal factors: prices, administration, and anti-competitive trends. Factors internal to the healthcare system also affect increasing prices. Prices and administrative costs. Analyses of increasing healthcare spending generally cite prices as the leading cause.

How much will healthcare cost in 2028?

By 2028, U.S. healthcare spending will reach $6.2 trillion and account for almost 20% of the GDP. The complexity of the health sector and the political clout of major groups challenge cost-cutting efforts.

What percentage of Medicare is hospital expenditure?

Hospital expenses are the largest single component of Medicare’s spending, accounting for 40 percent of the program’s spending. That is not surprising, as hospitalizations are associated with high-cost health episodes. However, the share of spending devoted to hospital care has declined since the program's inception.

What is Medicare budget?

Budget Basics: Medicare. Medicare is an essential health insurance program serving millions of Americans and is a major part of the federal budget. The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

What percentage of Medicare is home health?

Medicare is a major player in our nation's health system and is the bedrock of care for millions of Americans. The program pays for about one-fifth of all healthcare spending in the United States, including 32 percent of all prescription drug costs and 39 percent of home health spending in the United States — which includes in-home care by skilled nurses to support recovery and self-sufficiency in the wake of illness or injury. 4

How much of Medicare was financed by payroll taxes in 1970?

In 1970, payroll taxes financed 65 percent of Medicare spending.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

How much did prescription drug spending increase in 2019?

Prescription drug spending increased 5.7% to $369.7 billion in 2019, faster than the 3.8% growth in 2018. The largest shares of total health spending were sponsored by the federal government (29.0 percent) and the households (28.4 percent). The private business share of health spending accounted for 19.1 percent of total health care spending, ...

How much did hospital expenditures grow in 2019?

Hospital expenditures grew 6.2% to $1,192.0 billion in 2019, faster than the 4.2% growth in 2018. Physician and clinical services expenditures grew 4.6% to $772.1 billion in 2019, a faster growth than the 4.0% in 2018. Prescription drug spending increased 5.7% to $369.7 billion in 2019, faster than the 3.8% growth in 2018.

How much did the NHE increase in 2019?

NHE grew 4.6% to $3.8 trillion in 2019, or $11,582 per person, and accounted for 17.7% of Gross Domestic Product (GDP). Medicare spending grew 6.7% to $799.4 billion in 2019, or 21 percent of total NHE. Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE.

What was the per person spending for 2014?

In 2014, per person spending for male children (0-18) was 9 percent more than females. However, for the working age and elderly groups, per person spending for females was 26 and 7 percent more than for males. For further detail see health expenditures by age in downloads below.

How much did Utah spend on health care in 2014?

In 2014, per capita personal health care spending ranged from $5,982 in Utah to $11,064 in Alaska. Per capita spending in Alaska was 38 percent higher than the national average ($8,045) while spending in Utah was about 26 percent lower; they have been the lowest and highest, respectively, since 2012.

How much did Medicaid spend in 2019?

Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE. Private health insurance spending grew 3.7% to $1,195.1 billion in 2019, or 31 percent of total NHE. Out of pocket spending grew 4.6% to $406.5 billion in 2019, or 11 percent of total NHE.

Which region has the lowest health care spending per capita?

In contrast, the Rocky Mountain and Southwest regions had the lowest levels of total personal health care spending per capita ($6,814 and $6,978, respectively) with average spending roughly 15 percent lower than the national average.

Why are healthcare costs rising?

One reason for rising healthcare costs is government policy. Since the inception of Medicare and Medicaid —programs that help people without health insurance—providers have been able to increase prices. Still, there's more to rising healthcare costs than government policy.

What are the factors that affect the cost of healthcare?

A JAMA study found five factors that affect the cost of healthcare: a growing population, aging seniors, disease prevalence or incidence, medical-service utilization, and service price and intensity.

How much of healthcare costs are chronic diseases?

Chronic diseases constitute 85% of healthcare costs, and more than half of all Americans have a chronic illness. 2 9 . Demand for medical services has increased because of Medicare and Medicaid, resulting in higher prices.

Why is healthcare so expensive?

Healthcare gets more expensive when the population expands —as people get older and live longer. Therefore, it’s not surprising that 50% of the increase in healthcare spending comes from increased costs for services, especially inpatient hospital care.

How much does healthcare cost in the US?

Healthcare costs in the U.S. have been rising for decades and are expected to keep increasing. The U.S. spent more than $3.8 trillion on healthcare in 2019 and was expected to exceed $4 trillion in 2020, according to a study by the Peterson and Kaiser Foundations. A JAMA study found five factors that affect the cost of healthcare: ...

Why is it so hard to know the cost of healthcare?

Thanks to a lack of transparency and underlying inefficiency, it’s difficult to know the actual cost of healthcare. Most people know the cost of care is going up, but with few details and complicated medical bills, it’s not easy to know what you're getting for the price.

What was the biggest increase in spending in the JAMA study?

The authors of the JAMA study point to diabetes as the medical condition responsible for the greatest increase in spending over the study period. The increased cost of diabetes medications alone was responsible for $44.4 billion of the $64.4 billion increase in costs to treat that disease. 4

Summary

- Medicare, the federal health insurance program for nearly 60 million people ages 65 and over and younger people with permanent disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the m…

Health

- In 2017, Medicare spending accounted for 15 percent of the federal budget (Figure 1). Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2016, 29 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physician services.

Cost

- In 2017, Medicare benefit payments totaled $702 billion, up from $425 billion in 2007 (Figure 2). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 47 percent to 42 percent, sp…

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

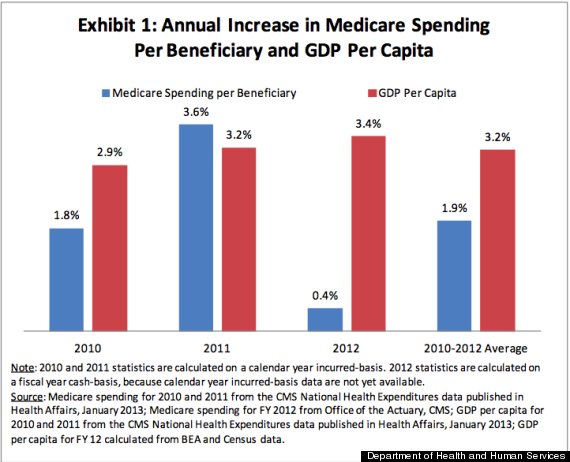

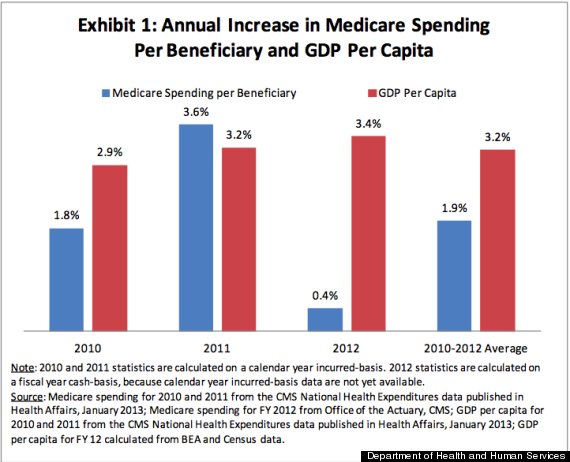

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future increases in spending under Part B and …

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…