When is the deadline for Medicare Part D?

Last week, CMS announced proposed rules seeking to increase consumer protections and reduce health care disparities in Medicare Advantage (MA) and Part D, with a strong emphasis on individuals who are dually eligible for Medicare and Medicaid.

When to enroll in Part D?

You can enroll in Medicare Part D during any of these times:

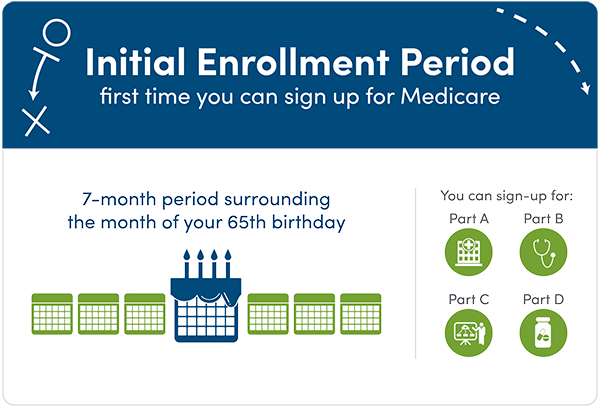

- Initial Enrollment Period

- Annual Election Period

- Medicare Advantage Open Enrollment Period

- Five Star Special Enrollment Period

- Special Enrollment Period

Do I need to enroll in Medicare Part D?

When Can I Enroll in Part D? Part D coverage is an optional part of the Medicare program, so you will need to enroll in it in order to take advantage of benefits. This is beneficial in allowing Medicare recipients to control their healthcare spending and direct their own medical choices. In most cases, you can enroll in Part D coverage within a seven-month time period that covers the months before, during and after reaching Medicare eligibility at age 65.

When is Medicare Part D open enrollment?

Medicare Advantage ... stand-alone Medicare Part D Prescription Drug plan Jeanet Reyes-Cordero, director of Medicare Growth at Advocate Aurora Health, further explains why Medicare Advantage enrollees need to understand this key enrollment period.

Can you enroll in Medicare Part D at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

What and when is initial enrollment period?

Initial Enrollment Period – a 7-month period when someone is first eligible for Medicare. For those eligible due to age, this period begins 3 months before they turn 65, includes the month they turn 65, and ends 3 months after they turn 65.

What is Part D initial coverage?

Initial Coverage Your plan pays for a portion of each prescription drug you purchase, as long as that medication is covered under the plan's formulary (list of covered drugs). You pay the other portion, which is either a copayment (a set dollar amount) or coinsurance (a percentage of the drug's cost).

Can I add Part D during open enrollment?

If you do not enroll in Part D during your IEP, you can also enroll in or make changes to Part D coverage during the Fall Open Enrollment Period—but you may have a late enrollment penalty if you are using Fall Open Enrollment to enroll in Part D for the first time.

What does initial enrollment mean?

More Definitions of Initial Enrollment Period Initial Enrollment Period means the period of time during which an eligible person may enroll under this Plan.

What are Medicare enrollment periods?

When you first become eligible for Medicare, you can join a plan. Open Enrollment Period. From October 15 – December 7 each year, you can join, switch, or drop a plan. Your coverage will begin on January 1 (as long as the plan gets your request by December 7).

What is the initial coverage limit Medicare Part D?

$4,430The Initial Coverage Limit (ICL) will go up from $4,130 in 2021 to $4,430 in 2022. This means you can purchase prescriptions worth up to $4,430 before entering what's known as the Medicare Part D Donut Hole, which has historically been a gap in coverage.

How do I avoid the Medicare Part D donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

Can you switch Part D plans anytime?

When Can You Change Part D Plans? You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

How many enrollment periods are there for Medicare Part D?

There are three different enrollment periods for Medicare Part D. Each one is unique to you, the beneficiary. It’s important to understand these enrollment periods to avoid late penalties that will stay with you forever.

What is a special enrollment period?

Life happens for everyone; Special Enrollment Periods are for when certain situations or events happen in life. SEPs give you chances to make changes to your Part D plan or Medicare Advantage plan.

When is the AEP period?

Each fall the Annual Election Period runs from October 15th through December 7th. AEP is commonly mistaken for the Open Enrollment Period.

When does IEP end?

Everyone’s Initial Enrollment Period is different, it’s specific to your 65th birthday month. Your IEP starts 3 months before your 65th birthday and ends 3 months after your birthday month.

What is an AEP?

AEP is commonly mistaken for the Open Enrollment Period. During AEP, members can openly make changes to their current coverage. This includes enrolling in a Part D drug plan or switching from one Part D plan to another Part D plan that better suits your medical needs.

How to apply for medicare?

Signing up for Medicare 1 Apply on the Social Security website 2 Visit your local Social Security office 3 Call Social Security at 1-800-772-1213 (TTY: 1-800-325-0778) 4 If you worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772 5 Complete an Application for Enrollment in Part B (CMS-40B)

What is Medicare Advantage?

Medicare Advantage is an alternative to Original Medicare. It allows you to receive Medicare benefits from a private insurance company. Many Medicare Advantage plans also provide additional benefits such as dental, vision and prescription drug coverage. You can enroll in a Medicare Advantage plan during your IEP or during ...

Do you have to pay a penalty for Medicare Part B?

However, if you decide later that you do want Medicare Part B, you may have to pay a penalty for as long as you have it. You may also be eligible to sign up during a Special Enrollment Period if you are eligible. If you don’t sign up during your Initial Enrollment Period and don’t qualify for special enrollment, ...

Does Medicare Part D cover prescription drugs?

Medicare Part D prescription drug plans can cover many retail prescription drugs, which Original Medicare (Part A and Part B) doesn't typically cover. You can enroll in a Medicare Part D plan during your Initial Enrollment Period. If you don't sigh up for Medicare prescription drug coverage when you're first eligible, ...

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

Avoid Late Penalties By Signing Up During this Time

Lorraine Roberte is an insurance writer for The Balance. As a personal finance writer, her expertise includes money management and insurance-related topics. She has written hundreds of reviews of insurance products.

How Medicare Initial Enrollment Works

There are four different parts of Medicare— Part A and Part B (known as Original Medicare), Part C (Medicare Advantage plans), and Part D (Medicare prescription drug coverage). Plus, you can get Medicare supplement insurance, also known as Medigap, to help pay for costs that Original Medicare doesn’t cover.

When Is Medicare Initial Enrollment?

The Medicare initial enrollment period lasts for seven months. It begins three months before the month of your 65th birthday, and includes your birth month and the three months that follow your birth month.

When Does Medicare Coverage Start?

If you qualify for premium-free Part A, your coverage begins the month you turn 65. If you have to pay a premium for Part A, your coverage starts when Part B coverage starts, following the table below. The month you sign up matters, as it impacts when your coverage begins. 1 2

Medicare Parts You Can Enroll In

Original Medicare (Parts A and B) is managed by the federal government, while Medicare Advantage plans and Part D prescription drug plans are managed by insurance companies.

What if You Miss Initial Enrollment?

If you miss your initial enrollment period, there are a few other opportunities you have to join Medicare:

Am I automatically enrolled in Medicare once I turn 65?

If you’ve been getting Social Security benefits or benefits from the Railroad Retirement Board for at least four months before your 65th birthday, you will be automatically enrolled in Medicare Parts A and B when you turn 65. 14

Initial Enrollment Period

Your Initial Enrollment Period (IEP) occurs when you turn 65 and lasts for seven months. It begins three months before your birth month and extends through the three months following your birth month.

The Annual Open Enrollment Period

From October 15 through December 7, you are able to make changes your Medicare Part D Prescription Drug Plan. You are also able to join or change to a Medicare Advantage Plan with or without prescription drug coverage. You can add, drop, or change prescription drug plans during this annual enrollment period.

Special Enrollment Period

There are Special Enrollment Periods for people with extenuating circumstances, when changes can be made to Medicare Advantage and Medicare Prescription Drug Plans outside of the aforementioned enrollment periods. There are different rules about when you can make these changes and what changes can be made.

When does Part D start?

Your IEP runs from February 1 to August 31. The date when your Part D coverage begins depends on when you sign up: Enrolling during the first three months of the IEP means coverage begins the first day of the fourth month.

How long does an IEP last?

Your Part D IEP is usually the same as your Medicare IEP: the seven-month period that includes the three months before, the month of , and the three months following your 65th birthday. For example, let’s say you turn 65 in May. Your IEP runs from February 1 to August 31.

What happens if you turn 65 and have Medicare?

Are eligible for Extra Help. Note: If you are enrolled in Medicare because of a disability and currently pay a premium penalty, once you turn 65 you will no longer have to pay the penalty.

How many enrollment periods are there for Medicare Advantage?

There are 2 separate enrollment periods each year. See the chart below for specific dates.

What are the special enrollment periods?

When certain events happen in your life, like if you move or lose other insurance coverage, you may be able to make changes to your Medicare health and drug coverage. These chances to make changes are called Special Enrollment Periods. Rules about when you can make changes and the type of changes you can make are different for each Special Enrollment Period.

What is the late enrollment penalty for Medicare?

The late enrollment penalty is an amount that’s permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there’s a period of 63 or more days in a row when you don’t have Medicare drug coverage or other creditable prescription drug coverage. Creditable prescription drug coverage is coverage (for example, from an employer or union) that’s expected to pay, on average, at least as much as Medicare’s standard prescription drug coverage. If you have a penalty, you’ll generally have to pay it for as long as you have Medicare drug coverage. For more information about the late enrollment penalty, visit Medicare.gov, or call 1‑800‑MEDICARE (1‑800‑633‑4227). TTY users can call 1‑877‑486‑2048.