What does Irma stand for in Medicare?

- You married,

- You divorced, or your marriage was annulled,

- You became a widow or widower,

- You or your spouse stopped working or reduced work hours,

- You or your spouse lost income-producing property due to a disaster or other event beyond your control,

What does irmaa stand for in Medicare?

- Medicare. You can contact Medicare directly at 800-Medicare to get information on benefits, costs, and assistance programs like Medicare Savings Programs and Extra Help.

- SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

- SHIP. ...

- Medicaid. ...

Does irmaa adjust annually?

This amount is recalculated annually. The IRMAA surcharge will be added to your 2022 premiums if your 2020 income was over $91,000 (or $182,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

Does irmaa automatically adjust?

Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month.

How does Medicare Irmaa work?

An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium.

What income is Irmaa based on?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

What are the Irmaa brackets for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $222,000 but less than or equal to $276,000$297.00More than $276,000 but less than or equal to $330,000$386.10More than $330,000 but less than $750,000$475.20More than $750,000$504.9012 more rows•Dec 6, 2021

How do I stop paying Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

Does Social Security income count toward Irmaa?

Some examples of what counts as income towards IRMAA are: Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

Is Irmaa deducted from Social Security?

IRMAA is an extra charge added to your premium. If you are receiving Social Security benefits, the Part B premiums will be deducted from this payment. If you are not receiving Social Security benefits, you will pay the Part B premiums directly to Social Security.

How long does the Irmaa last?

The Social Security Administration (SSA) determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year when you pay the IRMAA. For example, Social Security would use tax returns from 2021 to determine your IRMAA in 2023.

How do I find my Irmaa?

If you need a replacement copy of your IRMAA letter you can obtain one from your local Social Security office, which can be located on the following website: www.socialsecurity.gov/onlineservices. This website can also be accessed to request a copy of the SSA-1099.

How are Irmaa brackets calculated?

IRMAA is based on your Modified Adjusted Gross Income (MAGI) from two years ago. In other words, the 2022 IRMAA brackets are based on your MAGI from 2020. If the 2020 amount is not available, your 2019 MAGI is used.

What percentage of Medicare beneficiaries pay Irmaa?

IRMAA affects less than 5% of people with Medicare, but those it does affect are often surprised or unclear about how it works.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What is the Income-Related Monthly Adjustment Amount for Medicare (IRMAA)?

Most enrollees have their Part B premium taken out of their Social Security check before the beneficiary gets the deposit. If you are not earning income benefits with Social Security, you will typically receive a bill. Those in the highest income bracket can pay considerably more for their Medicare Part B costs. Social Security will determine what you pay based on your modified adjusted gross income (MAGI), as reported by the IRS.

How does Social Security determine if you owe an IRMAA?

The Social Security Administration determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior. If you feel you’re higher Part B premium is incorrect, there are steps you can take to appeal IRMAA.

How to request a new initial determination for Medicare?

You can request a new initial determination by submitting a Medicare IRMAA Life-Changing Event form. You can also schedule an appointment with Social Security. Documentation will be required with either your correct income or of the life-changing event that caused your income to go down.

What happens if you appeal Medicare Part B?

If you have a successful appeal, Social Security will automatically correct your Medicare Part B premium amount. If you’re denied, they will provide instructions on how to appeal the denial to an Administrative Law Judge. While you are in the process of the appeal, you will continue to pay the higher Medicare Part B premium.

What is modified adjusted gross income?

Your Modified Adjusted Gross Income amount is made up of your total adjusted gross income in addition to any tax-exempt interest income. On your IRS Form 1040, these are line items 37 and 8b; if you are unsure of your MAGI, you can quickly figure it out by looking at your tax return records. Income examples that you may have reported on your tax return would include wages, dividends, alimony received, rental income, investment income, capital gains, farm income, and SSA benefits.

How to appeal an IRMAA?

If you want to appeal your IRMAA, you should visit the Social Security website for the form called Request for Reconsideration. The form will give you three options on how to appeal, with the easiest and most common way being a case review. Documentation is an essential thing in any appeal.

Does the IRS refund excess money?

Yes, the IRS will refund any excess amounts.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

How much are Part D IRMAA surcharges?

For Part D, the IRMAA amounts are added to the regular premium for the enrollee’s plan (Part D plans have varying prices, so the full amount, after the IRMAA surcharge, will depend on the plan).

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

What is the Medicare surcharge for 2021?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

Does delaying RMDs reduce IRMAA?

The reason this may be important is that it is possible that delaying receiving RMDs may also reduce IRMAA if your Modified Adjusted Gross Income is close to the limits stated in the Tables 1 and 2.

Is MAGI the same as IRMAA?

It’s important to understand that MAGI for calculating IRMAA isn’t the same as the normal MAGI that you might be accustomed to for non-healthcare purposes, nor is it exactly the same as MAGI for calculating premium tax credits and Medicaid/CHIP eligibility under the Affordable Care Act. Table 1 in this Congressional Research Service brief is useful in seeing how MAGI is determined for IRMAA calculations.

What Should I do if I don’t Believe I Should Pay IRMAA Medicare?

If you do not feel you should be required to pay an IRMAA, you may appeal the judgment. Let’s look at how this procedure works in more detail.

How much will IRMAA Charge Me for Medicare Part D?

It can be a little challenging to figure out the monthly premium for Medicare Part D plans. The company offering the policy will determine its price, and since there’s no standard, it could range from one program to another. But that’s not all! You also have to add surcharges into your calculations depending on how you filed taxes two years ago. The extra Medicare Part D premium is paid directly to Medicare rather than to your plan’s provider.

How Much is Medicare Part B Premium 2021?

The cost for Medicare Part B premium in 2021 is $148.50 per month, and an additional IRMAA surcharge may apply depending on your income. This surcharge amount varies based on how you filed taxes two years ago (IRS tax return information).

How does the SSA determine if there is an IRMAA?

The SSA use the tax return from the IRS to decide whether there is a reason for an IRMAA. A person’s income from 2 years prior determines the surcharge.

Who calculates IRMAA?

The Centers for Medicare & Medicaid Services ( CMS) calculate IRMAA and publish this amount yearly in the Federal Register. Once the IRMAA calculations are complete, CMS inform the Social Security Administration (SSA). The SSA determine whether a person must pay more than the standard premium.

How to request reconsideration of SSA determination?

The first step is to request a reconsideration of the determination. People can do this by calling the SSA at 800-772-1213.

What is the Medicare premium for 2021?

In 2021, the standard premium for Part B is $148.50. Medicare Part D premiums vary depending on the plan a person chooses. The amount of an individual’s Part B premium, Part D premium, or both, may change based on their modified adjusted gross income (MAGI), which their Internal Revenue Service (IRS) tax return will report.

What is Medicare Part B?

Medicare Part B pays outpatient doctor visits, provider services, durable medical equipment, and some home health care. Medicare Part C, also called Medicare Advantage. This policy combines the benefits of Medicare Part A and Part B. People pay a premium for Medicare Part B and for Medicare Advantage.

How many income levels are there in IRMAA?

The calculation for IRMAA covers five income levels. There are also three tax filing status levels. The charts below show the five different IRMAA levels for each of the three tax filing status levels for 2021. The examples use the tax year 2019.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap. These are policies that help pay out-of-pocket costs of original Medicare.

What is the Medicare IRMAA?

Medicare IRMAA (Income-Related Monthly Adjustment Amount) stipulates that higher income earners must pay more for Medicare Part B and Part D premiums. Here’s how it works. The standard premium for Medicare Part B is $148.50 in 2021. However, some people may receive a bill for more than that amount along with an IRMAA ...

How often does Medicare IRMAA change?

Because IRMAA is based on your reported income from two years prior, the amount you have to pay for a Medicare IRMAA is subject to change every year.

Why do Medicare beneficiaries have to pay a higher monthly premium?

Medicare beneficiaries who have to pay a higher monthly premium for their benefits because of IRMAA must do so because they are categorized as a higher income earner.

What is the IRMAA?

IRMAA was developed by the federal government as a means of strengthening the financial stability of the Medicare program. The government pays a majority share (around 75 percent) of the costs for Part B and Part D benefits, while beneficiaries contribute roughly 25 percent.

When was IRMAA enacted?

IRMAA was enacted for Medicare Part B premiums in 2003 as a provision of the Medicare Modernization Act. It was then expanded to Part D coverage in 2011 as part of the Affordable Care Act (ACA, also called Obamacare). IRMAA was developed by the federal government as a means of strengthening the financial stability of the Medicare program.

Do you get Social Security if you have Medicare?

You do not receive Social Security benefits. You receive Social Security benefits, but your Part B premiums are not directly deducted from your Social Security benefits. *If you are subject to a Part D IRMAA, you may be able to save money by enrolling in a Medicare Advantage plan that includes prescription drug coverage.

What is IRMAA?

IRMAA stands for Income Related Monthly Adjustment Amount. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years prior to determine if you owe an IRMAA in addition to your monthly premium.

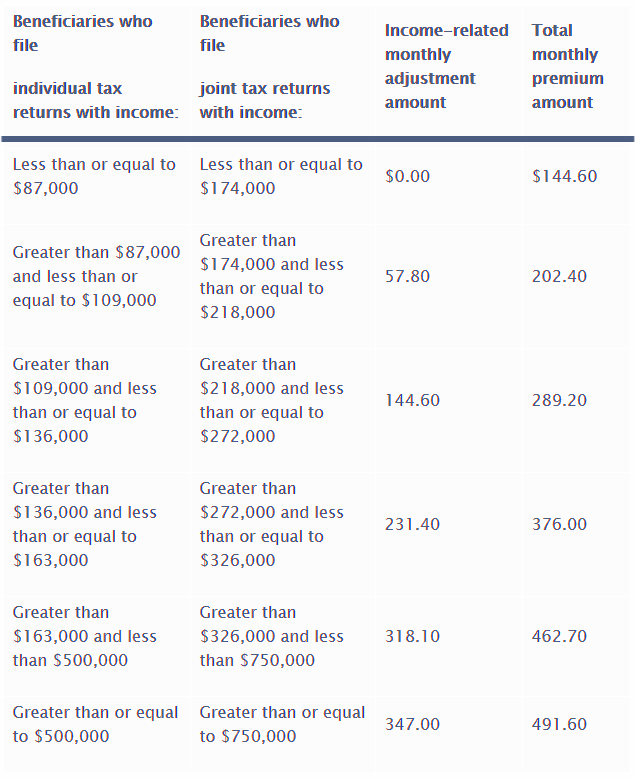

Medicare Costs in 2022

The standard Part B premium amount in 2022 has increased to $170.10. Most people pay the standard Part B premium amount. If your Modified Adjusted Gross Income (MAGI) as reported on your IRS tax return from 2 years ago is above the limits listed below, you’ll pay the standard premium amount and an IRMAA.

Ways to Avoid IRMAA Surcharges

The primary way to avoid IRMAA surcharges involves planning, specifically income planning . If your Medicare Part B will start at age 65, and the IRMAA calculation is a two-year look back, you need to start your income planning prior to age 63.

The Takeaway

IRMAA surcharges have come as a surprise to many people because in the two years prior to Medicare eligibility, there’s a lot going on. And you don’t hear much about IRMAA surcharges until you’re hit with one, which is exactly the wrong time to learn about them.

What is IRMAA in Medicare?

What is IRMAA? IRMAA is an extra charge added to your monthly premiums for Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage). The income surcharge doesn’t apply to Medicare Part A (hospital insurance) or Medicare Part C, also known as Medicare Advantage. IRMAA charges are based on your income.

How to reduce IRMAA?

Since your IRMAA is based on your income, many strategies for reducing it involve lowering your annual income. However, there are other steps you can take to avoid paying a higher IRMAA than you need to.

How to inform Medicare of a qualifying change?

To inform Medicare of a qualifying change, you’ll need to complete the Medicare Income-Related Monthly Adjustment Amount Life Changing Event form and either mail it or take it in person to your local SSA office.

What to do if you have a higher income on Medicare?

If you’re a Medicare beneficiary with a higher-than-average income, the Social Security Administration ( SSA) could tack an extra charge onto the Medicare premiums you pay each month.

How much will Medicare cost in 2021?

In 2021, most people pay for $148.50 per month for Medicare Part B. If your income is higher than those amounts, your premium rises as your income increases. For example, if your annual income in 2019 was more than $500,000 as a single taxpayer or more than $750,000 as a married couple, your 2021 Part B premium would be $504.90 for Medicare Part B ...

What are the things that qualify as life changing for Medicare?

The following events qualify as life changing for purposes of calculating an IRMAA: marriage. divorce. spouse’s death. reduced hours or loss of your job.

What is a reverse mortgage?

A reverse mortgage is where you can use the equity in your own home to pay for living expenses.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

What is the income used to determine IRMAA?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren’t included in the income for determining IRMAA. As if it’s not complicated enough for not moving the needle much, ...

How long does it take to pay Medicare premiums if income is higher than 2 years ago?

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

What percentage of Medicare premiums do Medicare beneficiaries pay?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

How many income brackets are there for IRMAA?

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay.

How much does Medicare cover?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with ...

How much does Medicare premium jump?

If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.