Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

What is the average cost of Medicare Part D?

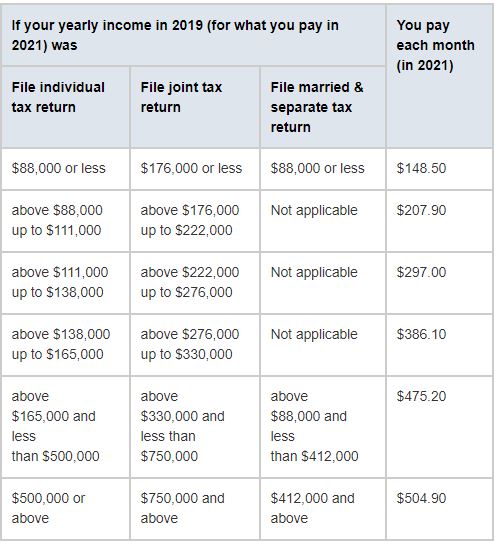

May 20, 2021 · Medicare with Melissa Income-Related Monthly Adjustment Amount or IRMAA is a surcharge that high-income people will pay in addition to their monthly premium. Social Security sets income brackets that determine your (or you and your spouse) IRMAA. Determination is based on the income you reported on your IRS tax returns two years prior.

What are the rules of Medicare Part D?

Nov 13, 2021 · For 2022, beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Part D – pay a surcharge that’s added to their Part B and Part D premiums. IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part …

What is the average cost of Part D?

The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011. IRMAA payments go directly to Medicare, even if you pay monthly …

What is included in Medicare Part?

IRMAA is a consideration with two parts of Medicare — Part B and Part D. Part B of Original Medicare, commonly referred to as medical insurance, features a standard monthly premium that changes each year ($170.10 in 2022). Medicare Part D, which is drug coverage offered by private insurance companies, has a monthly premium that varies from plan to plan.

Do I have to pay Irmaa Part D?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

What is the Irmaa for Part D in 2020?

D. IRMAA tables of Part D Prescription Drug coverage premium year for three previous premium yearsIRMAA Table2020More than $326,000 but less than o $750,000$70.00 + Plan premiumMore than or equal to $750,000$76.40 + Plan premiumMarried filing separatelyMore than $87,000 but less than $413,000$70.00 + Plan premium12 more rows•Dec 6, 2021

What is the Part D Irmaa for 2021?

How much are Part D IRMAA surcharges?Table 2. Part D – 2021 IRMAAIndividualJointMonthly Premium$91,000 or less$182,000 or lessYour Premium> $91,000 – $114,000> $182,000 – $228,000$12.40 + Plan Premium> $114,000 – $142,000> $228,000 -$284,000$32.10 + Plan Premium3 more rows

How much is the Part D Irmaa?

What are the income brackets for IRMAA Part D and Part B?SingleMarried Filing JointlyPart D IRMAA$88,000 or less$176,000 or less$0 + your plan premium$165,001 and under $500,000$330,001 and under $750,000$70.70 + your plan premium$500,000 or above$750,000 and above$77.10 + your plan premium3 more rows

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

Is Irmaa deducted from Social Security?

The IRMAA amount is typically deducted from your monthly Social Security (SSA) or Railroad Retirement Board benefits each month.Dec 20, 2021

Is Part D deducted from Social Security?

You can have your Part C or Part D plan premiums deducted from Social Security. You'll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.Dec 1, 2021

Are Part D premiums deducted from Social Security?

If you are getting Medicare Part C (additional health coverage through a private insurer) or Part D (prescriptions), you have the option to have the premium deducted from your Social Security benefit or to pay the plan provider directly.

What is the Medicare Part D Irmaa for 2022?

The standard premium for Medicare Part B in 2022 is $170.10 per month. Part D premiums are sold by private insurers so there is no “standard” premium. The average premium for a standalone Part D prescription drug plan in 2022 is $47.59 per month.Feb 15, 2022

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Is Part D Irmaa is paid directly to Medicare?

Part D IRMAA must be paid directly to Medicare—not your plan or employer. It's your responsibility to pay it even if your employer or a third party (e.g., retirement system) pays your Part D plan premiums.Oct 4, 2021

How do I stop Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).Dec 21, 2021

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What is IRMAA?

The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

What are the income brackets for IRMAA Part D and Part B?

The income brackets for both IRMAA for Medicare Part B and Medicare Part D are the same in 2021. They’re based on your 2019 tax returns.

How do I pay my IRMAA Part D and the Medicare IRMAA for Part B?

Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month.

What is Medicare Part D IRMAA?

Can I Avoid Medicare Part D IRMAA? Medicare Part D IRMAA stands for Income-Related Monthly Adjustment Amounts that affects higher income beneficiaries. Basically, the government is making you pay more for being successful.

Who Gets Affected by the Part D IRMAA?

After addressing the question, ‘What is Medicare Part D IRMAA?’, the next question is who gets affected or who gets to pay the Part D IRMAA.

How Do You Know if You Have Part D IRMAA?

Aside from the income bracket indicated above, policy holders who have Part D IRMAA will be notified by the Social Security Administration if they are part of this adjustment or not. This is determined every year in line with the Modified Adjusted Gross Income as indicated by your two-year income tax return report.

How Do You Pay Your Part D IRMAA?

Generally, most people have their Part D IRMAA deducted from their Social Security benefits. However, if you aren’t a recipient of Social Security benefits or the amount of your benefit is not enough to pay for Part D IRMAA, the CMS will directly bill you.

How can I avoid IRMAA?

Can I Avoid Medicare Part D IRMAA? If Medicare has your income correct then you cannot avoid IRMMA. What you CAN do is adjust your insurance plan premium to offset the extra cost you have to pay with IRMMA.