Code K0553 describes a supply allowance used with a therapeutic CGM device. The supply allowance includes all items necessary for the use of the device and includes, but is not limited to: CGM sensor, CGM transmitter, home BGM and related BGM supplies (test strips, lancets, lancing device, calibration solutions) and batteries.

Full Answer

What are the requirements for Bill code k0553?

In order to bill code K0553, the supplier must have previously delivered quantities of supplies that are sufficient to last for one (1) full month, thirty (30) days, following the DOS on the claim. Suppliers must monitor usage of supplies.

Does Medicare reimburse for CGM devices billed as k0554?

To be eligible for Medicare reimbursement, all CGM devices billed as K0554 must have received coding verification review by the Pricing, Data Analysis and Coding (PDAC) contractor and be listed on the Product Classification List (PCL) for HCPCS code K0554.

What is the CPT code for DME Mac k0553?

Durable Medical Equipment for Medicare Administrative Contractors (DME MACs) K0553 is a valid 2021 HCPCS code for Supply allowance for therapeutic continuous glucose monitor (cgm), includes all supplies and accessories, 1 month supply = 1 unit of service or just “ Ther cgm supply allowance ” for short, used in Other medical items or services.

What is a Medicare Part B premium?

Part B premiums. Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is included in K0553?

K0553 is a valid 2022 HCPCS code for Supply allowance for therapeutic continuous glucose monitor (cgm), includes all supplies and accessories, 1 month supply = 1 unit of service or just “Ther cgm supply allowance” for short, used in Other medical items or services.

How often can K0553 be billed?

monthlyBilling for code K0553 or A4238 may continue on a monthly basis as long as sufficient supplies remain to last for one (1) full month, thirty (30) days, as previously described.

Who qualifies for continuous glucose monitoring?

You must live with diabetes. You have to manage your diabetes with multiple (three or more) daily insulin injections (MDI) or an insulin pump. You must require frequent insulin self-adjustment based on the CGM or finger sticks. You must have seen a medical professional in person within 6 months prior to ordering the ...

Is K0553 a DME?

The addition of these codes (K0553 and K0554) will facilitate Durable Medical Equipment (DME) MAC claims processing for therapeutic CGMs. Make sure that your billing staffs are aware of these two new codes.

Does Medicare pay for CGM?

Yes. The Dexcom G6 Continuous Glucose Monitoring (CGM) System is covered by Medicare for patients who meet the Medicare coverage criteria. Medicare coverage for therapeutic CGM includes certain beneficiaries who have either type 1 or type 2 diabetes and intensively manage their insulin.

Is a glucose meter considered DME?

Glucometers, test strips, and lancets are classified as durable medical equipment (DME).

Does Medicare Part B cover CGM?

Supply allowance for therapeutic continuous glucose monitor (CGM), includes all supplies and accessories. Medicare Part B covers the same type of blood glucose testing supplies for people with diabetes whether or not they use insulin.

Does Type 2 diabetes need continuous glucose monitoring?

Most people with type 2 diabetes do not require self-monitoring of blood glucose, and unnecessary monitoring not only wastes money but can negatively impact quality of life.

What is a good blood sugar level in the morning?

What should your blood sugar be when you wake up? Whenever possible, aim to keep your glucose levels in range between 70 and 130 mg/dL in the morning before you eat breakfast, and between 70 and 180 mg/dL at other times.

What is the CPT code for blood glucose monitor?

A. Yes, providers should continue to use CPT code 95251 for the analysis and interpretation of continuous glucose monitor (CGM) data. CPT code 95250 is used for the initial training and set-up of the CGM.

What is the CPT code for dexcom g6?

Do services associated with CPT code 95251 need to be provided face-to-face?

How do I bill Medicare CGM?

Call 877-549-9181 for assistance. I. Currently, Medicare pays for professional CGM billed under CPT codes 95250 and 95251 in all 50 states.

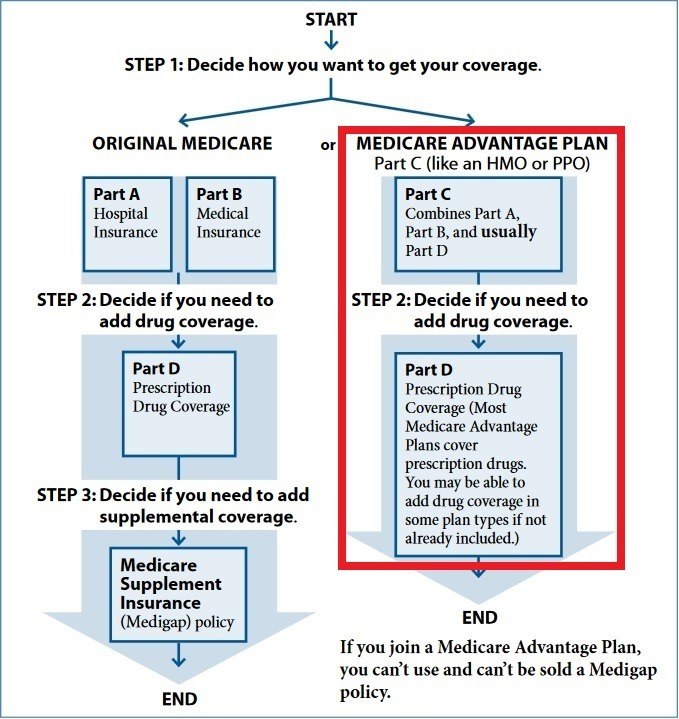

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What does Medicare Part B cover?

Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, ...

What is Part B insurance?

Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Background

On December 28, 2021, the Centers for Medicare & Medicaid Services (CMS) published a final rule in the Federal Register that, in part, addressed the classification and payment of continuous glucose monitors (CGMs) under the Medicare Part B benefit for durable medical equipment (DME).

Non-Adjunctive CGM Devices and Supplies

Existing HCPCS codes K0554 (RECEIVER (MONITOR), DEDICATED, FOR USE WITH THERAPEUTIC GLUCOSE CONTINUOUS MONITOR SYSTEM) and K0553 (SUPPLY ALLOWANCE FOR THERAPEUTIC CONTINUOUS GLUCOSE MONITOR (CGM), INCLUDES ALL SUPPLIES AND ACCESSORIES, 1 MONTH SUPPLY = 1 UNIT OF SERVICE) describe non-adjunctive CGM receivers and the associated monthly supplies and accessories.

Adjunctive CGM Devices

There are no devices on the United States market that function as stand-alone adjunctive CGM devices. Current technology for adjunctive CGM devices operates in conjunction with an insulin pump.

Adjunctive CGM Supplies and Accessories

Effective for claims with dates of service on or after April 1, 2022, CMS is creating the following HCPCS code to represent supplies used with an adjunctive CGM device that operates in conjunction with an insulin pump:

Modifiers

Suppliers are reminded that the use of the CG, KF and KX modifiers are required, as appropriate, with the HCPCS codes describing both adjunctive and non-adjunctive CGM devices and the associated supply allowance codes.