What is line of Business (LOB)?

Line of business (LOB) is a general term that describes the related product or services a business or manufacturer offers. A company that manufactures solid-state disk drives, for example, might claim its LOB is data storage.

What is a line of business application?

So to answer your question: a LOB (Line of Business) Application is one which is used by a company that directly supports them in making or doing what they do. (So the company's HR application [usually] isn't a LOB App, but a CRM application [usually] is).

What does lifeline of business mean?

For example, a company that provides life insurance may be referred to as “a lifeline of business”. It is used in the insurance industry to refer to an insurer’s product line, or group of products that are typically grouped together for marketing purposes..

What does a line of Business Manager do?

LOB Line of Business Manager is responsible for managing the business in a specific line of business. They are accountable for achieving revenue goals and profitability targets, while meeting customer needs. The role may also be known as a product manager, account manager, or territory manages

What does line of business mean in healthcare?

Line of Business — a general classification of insurance industry business—for example, fire, life, health, liability.

What is lob for Medicare?

AcronymsAcronymTermCategoryLOCLevel of CareGeneral, Health CareLOCLines of CodeGeneral, IT OrganizationLOBLine of BusinessGeneralLMRPLocal Medical Review PolicyMedicare Beneficiary, Health Care6 more rows•May 14, 2006

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What are the three types of Medicare?

What are the parts of Medicare?Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.Medicare Part B (Medical Insurance) ... Medicare Part D (prescription drug coverage)

What is a PSP insurance plan?

PSPs are health plans financially sponsored by a provider (hospital, physician group, health system). We excluded from our analysis health plans which exclusively contract with certain providers but are not financially sponsored by them.

Is MCR Medicare?

Each year, Medicare Part A providers must submit an acceptable Medicare Cost Report (MCR) package to their Medicare Administrative Contractor (MAC) for the purposes of determining their Medicare reimbursable cost. The MCR package consists of a variety of cost report materials.

What are the 2 types of Medicare plans?

Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You can join a separate Medicare drug plan to get Medicare drug coverage (Part D). You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

What is the difference between commercial insurance and Medicare?

The basic difference between Medicare and commercial insurance is that Medicare is designed to absorb risk, serving individuals who have or may have costly and complex medical needs as well as the relatively healthy, whereas commercial insurance is required to protect its business interests by avoiding those most ...

What type of Medicare do I have?

Visit the Check Your Enrollment page on Medicare.gov, the official website for Medicare. Fill out the requested information, including your zip code, Medicare number, name, date of birth and your effective date for Medicare Part A coverage or Part B coverage.

What is the difference between Medicare A and B?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

What is Medicare A and B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers. Outpatient care.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is LOB, Line-of-Business?

Line-of-business (LOB) refers to the major function of an enterprise that delivers a product or service to customers. LOBs are the primary drivers of the business’s revenue and profit, and they serve as a framework for structuring companies.

Line of Business Examples

Line of business examples includes retail, manufacturing, and service industries.They may also have one for their research and development. they might have one that is more focused on human resources

Role of LOB Line of Business Manager

LOB Line of Business Manager is responsible for managing the business in a specific line of business. They are accountable for achieving revenue goals and profitability targets, while meeting customer needs. The role may also be known as a product manager, account manager, or territory manages

Line of Business in Insurance

Line of business is a term used in the insurance industry to describe an organization’s primary function. For example, a company that provides life insurance may be referred to as “a lifeline of business”.

How many people are covered by Medicare?

Over 10 million people in the U.S., including low-income seniors and younger people with significant disabilities , are covered by both Medicare and Medicaid. Medicare beneficiaries who receive Medicaid tend to have greater medical needs than Medicare beneficiaries alone. In fact, nearly 75 percent of these individuals have three or more chronic conditions, which require regular appointments, tests and medications. These members are known as Duals, and represent some of the most at-risk and needy individuals in society.

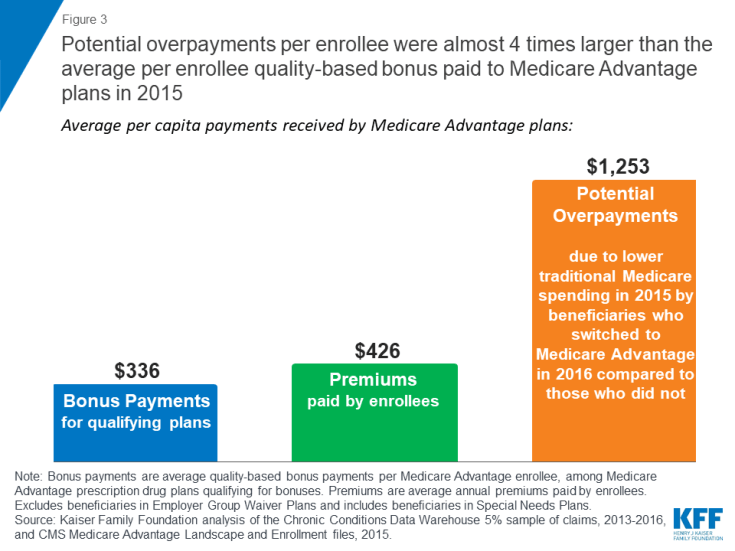

What is Medicare Advantage claim?

For Medicare Advantage, CMS requires hospitals to submit claims for inpatient services provided to Medicare beneficiaries who are enrolled in an Medicare Advantage plan, and “shadow claims” (or no pay claims) to their Medicare Administrative Contractor. These claims are submitted to request supplemental Indirect Medicare Education, Graduate Medical Education, and Nursing Allied Health Education payments and to properly report Medicare beneficiary days.