What is Macra and why should you care?

What is MACRA and why should you care? The Medicare Access and CHIP Reauthorization Act of 2015 or MACRA repeals the Sustainable Growth Rate (SGR) Formula that has determined Medicare Part B reimbursement rates for physicians and replaces it with new ways of paying for care.

Is Macra ruining healthcare?

So, MACRA is seen as having no benefit but a lot of downside in income and daily operations. About the only other thing that could have brought these emotions about would come from the IRS, but this is worse in some ways, as it’s forcing changes in clinical operations for the purpose of checking a box to protect income.

What will Macra mean for US health care?

What is MACRA? MACRA is an acronym for the Medicare Access and CHIP Reauthorization Act of 2015. This legislation, which received bipartisan support from the U.S. Congress, is intended to ensure that physicians are paid fairly, that Medicare Part B costs are controlled and that healthcare is improved.

What does Macra mean for the future of healthcare?

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) is a law that reformed the Medicare payment system. MACRA repealed the Sustainable Growth Rate (SGR) formula used to update the Medicare Physician Fee Schedule (MPFS) and thereby determine physician reimbursement.

What is MACRA insurance?

When did MACRA change?

How much is Medicare Part B and Part D?

Why don't new Medicare cards have social security numbers?

What are the changes to Medicare Advantage?

Is Medicare Advantage an APM?

Does Medigap have a Part B deductible?

See more

About this website

What does MACRA mean for patients?

Medicare Access and CHIP Reauthorization Act of 2015Passed in 2015 with bipartisan support, MACRA (Medicare Access and CHIP Reauthorization Act of 2015) is U.S. healthcare legislation that provides a new framework for reimbursing clinicians who successfully demonstrate value over volume in patient care.

What is MACRA and what it means to providers?

The Medicare Access and CHIP Reauthorization Act (MACRA) is a law that significantly changed how the federal government pays physicians. Passage of the law permanently repealed the flawed sustainable growth rate (SGR) and set up the two-track Quality Payment Program (QPP) that emphasizes value-based payment models.

What is MACRA reimbursement?

MACRA is the Medicare Access and CHIP Reauthorization Act. MACRA replaces the current Medicare reimbursement schedule with a new pay-for-performance program that's focused on quality, value, and accountability.

What was the reason for MACRA?

In an effort to create a more permanent solution to “doc fixes,” MACRA was implemented in April 2015, repealing the Sustainable Growth Rate (SGR) and introducing the Quality Payment Program (QPP), rewarding Medicare providers for value over volume.

How does MACRA affect Medicare supplement plans?

MACRA refers to the Medicare Access and CHIP Reauthorization Act of 2015. This law prevents Medicare Supplement plans from covering the cost of the Medicare Part B deductible for newly eligible individuals, as of January 1, 2020.

What are the disadvantages of MACRA?

ConsIt's overly complex. ... Implementation is unreasonably fast. ... It hurts small practices. ... It eliminates the Sustainable Growth Formula and extends CHIP. ... It focuses on improved patient outcomes. ... It stresses improved use of technology.

Is MACRA voluntary or mandatory?

The PQRS program will be voluntary.

How does MACRA impact patient care?

In 2015 President Obama signed the Medicare Access and CHIP Reauthorization Act (MACRA) which repealed the Sustainable Growth Rate (SGR) mechanism for Medicare physician reimbursement and mandated that CMS develop alternative payment methodologies to “reward health care providers for giving better care not more just ...

Who uses MACRA?

The MACRA provides an exemption for those eligible clinicians that have low volumes of Medicare patients. CMS has the authority to adjust the threshold through rulemaking.

How do physicians feel about MACRA?

This shows that the majority of physicians are not in favor of transitioning to alternative payment models under MACRA legislation. The survey also showed that 74 percent of physicians feel that quality reporting is a burden and 79 percent are not in favor of linking payment with quality of care.

How will MACRA affect physicians and the healthcare system?

MACRA changes how the Centers for Medicare & Medicaid Services pays physicians who provide care to Medicare beneficiaries. It ties physician compensation to quality and encourages doctors to participate in alternative value-based payment models.

Does MACRA apply to all carriers offering Medicare supplement plans?

Therefore, MACRA does not close any blocks of plans. Those individuals who become eligible for Medicare prior to January 1, 2020, and who have coverage as defined in Plans C or F and F High Deductible, may keep the coverage under those plans.

What is the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA)?

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) is a law that reformed the Medicare payment system. MACRA repealed the Sustainable...

What is the Quality Payment Program (QPP) and how does it relate to MACRA?

The Quality Payment Program (QPP) is a payment reform initiative legally required by MACRA and created by the Centers for Medicare & Medicaid Servi...

What is the timeline for MACRA?

Instead of requiring eligible clinicians to fully participate in either the MIPS or an Alternative Payment Model (APM) in 2017, CMS extended the tr...

How will I be scored under MIPS?

For the 2017 performance year (2019 payment year), MIPS final scores are based on performance in the following categories (performance category wei...

How does MACRA affect me if I am in a large multi-specialty group?

Clinician groups have two options: Report as a group – In this case, all clinicians who bill under the stated group’s TIN will automatically be cou...

What are the reporting methods under MIPS?

The reporting requirements under MIPS are outlined in the table below. For data submissions methods, see How do I submit quality measures data? PER...

Can I participate in MIPS without an EHR?

The Promoting Interoperability performance category factors in meaningful use of a certified EHR for points calculation. An eligible clinician may...

Are resident physicians excluded from MIPS?

Resident physicians who are in their first year of Medicare billing are exempt from MIPS. These physicians will be eligible to participate in MIPS...

Are there any exemptions from MIPS?

Yes, there are several: Clinicians who are in their first year of billing Medicare. Clinicians who are not considered 'eligible'. Clinicians who do...

How will I be paid under an APM?

Advanced Alternate Payment Models (APMs) are a track of the Quality Payment Program that offer a 5 percent incentive to participants in return for...

Estimated impact of MACRA (2015) | CMS

Estimated Financial Effects of the Medicare Access and CHIP Reauthorization Act of 2015 (H.R. 2) On March 26, 2015, the House passed the Medicare Access and CHIP Reauthorization Act of

MACRA: MIPS & APMs | CMS

MACRA What's MACRA? The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) is a bipartisan legislation signed into law on April 16, 2015. MACRA created the Quality Payment Program that:

What is the purpose of MACRA?

MACRA aimed to: reduce Medicare spending and discourage unwarranted doctors’ appointments. increase the quality of care a person receives. make healthcare providers more accountable for the care they provide to individuals. Following MACRA, Medicare introduced new rules about paying and reimbursing doctors and other healthcare providers.

What is MACRA deductible?

Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund.

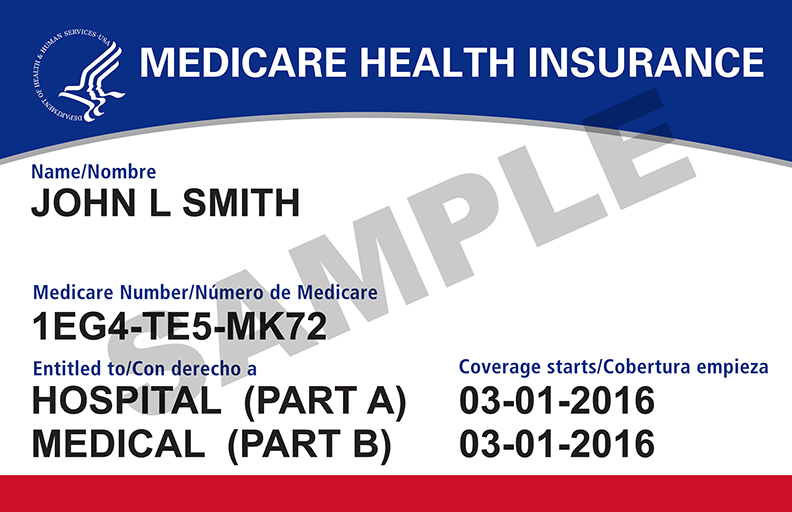

Why did MACRA change Medicare membership cards?

The reason for this was to remove an individual’s Social Security Number (SSN) from the membership card to protect their personal and claim data.

What are the most similar plans to Medicare?

The most similar are Medigap plans D, G, and N . A person can look for a Medigap plan on the Medicare website.

What is a Medigap plan?

Effect on Medigap plans. Private health insurance companies administer Medigap plans. The policies help cover out-of-pocket costs, such as deductibles, copayments, and coinsurance. Plan providers offer a range of 10 Medigap plans, all with varying levels of coverage. They typically include: the Part A deductible.

What is the MACRA premium for 2021?

MACRA and income brackets. Original Medicare’s Part B coverage has a standard premium of $148.50 in 2021. This premium applies to those with an individual income of $88,000 or below or a joint income of $176,000 or below.

What is a coinsurance for Medicare?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is MACRA in Medicare?

What's MACRA? The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) is a bipartisan legislation signed into law on April 16, 2015. MACRA created the Quality Payment Program that:

When will MACRA remove Social Security numbers?

Gives bonus payments for participation in eligible alternative payment models (APMs) MACRA also required us to remove Social Security Numbers (SSNs) from all Medicare cards by April 2019.

Who is affected by MACRA?

Only people newly eligible for Medicare on or after January 1, 2020. You are newly eligible for Medicare if you turn 65 on or after January 1, 2020, or become eligible for Medicare on or after January 1, 2020 due to disability or end-stage renal disease (ESRD).

What if I am already enrolled in the Tufts Medicare Preferred Supplement 1 plan?

If you enrolled in the Tufts Medicare Preferred Supplement 1 plan before January 1, 2020, you are not affected by MACRA and can continue to use your plan. You don’t need to take any action. Your plan or benefits will not be affected by MACRA.

What if I currently have a Tufts Medicare Supplement Plan through my Massachusetts employer?

MACRA does not affect Medicare Supplement plans offered by employer groups. If you have a Medicare Supplement plan through your employer or are on your spouse’s Medicare Supplement plan offered through your spouse’s employer, you aren’t affected.

Which plans can I enroll in if I am affected by MACRA?

If you are affected by MACRA you can enroll in Tufts Medicare Preferred Supplement Core plan now or Tufts Medicare Preferred Supplement 1A plan for an effective date of 1/1/2020.

What is MACRA in Medicare?

What Is MACRA? The Medicare Access and CHIP Reauthorization Act of 2015 ( MACRA) is a law that reformed the Medicare payment system. MACRA repealed the Sustainable Growth Rate (SGR) formula used to update the Medicare Physician Fee Schedule (MPFS) and thereby determine physician reimbursement.

Why is MACRA called the Permanent Doc Fix?

MACRA is known as the Permanent Doc Fix because it revised the flawed 1997 Balanced Budget Act ,which resulted in exorbitant reimbursement ...

How much does Medicare lose if you don't participate in MIPS?

CMS estimates that MIPS eligible clinicians who choose not to participate in MIPS lose an average 8.2% in Part B reimbursement. That amounts to a hefty sum when you consider an 8.2% loss on every Part B item and service billed by a provider. A potential annual Medicare reimbursement of $100,000, for example, becomes $82,000—minus $18,000 in much-needed revenue. So, here’s the $18,000 question:

What is Medicare Access and CHIP Reauthorization Act?

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) is a law that reformed the Medicare payment system. MACRA repealed the Sustainable Growth Rate (SGR) formula used to update the Medicare Physician Fee Schedule (MPFS) and thereby determine physician reimbursement.

What is CEHRT in healthcare?

Promoting Interoperability, formerly called Advancing Care Information, requires the meaningful use of certified electronic health record technology (CEHRT), which thereby continues the effort for the secure exchange of health information. The foremost intention driving this category, however, is to create a patient-driven healthcare system where patients have the information needed to become active healthcare consumers.

When is Medicare Part B payment adjustment received?

The payment adjustment is received in the payment year, two years after the performance year.

Can a clinician be excluded from Medicare?

An eligible clinician may be excluded from MIPS payment adjustments if the clinician is: A new Medicare-enrolled MIPS eligible clinician who has not, under any billing number or tax identifier, previously submitted a claim to Medicare as an individual or as part of a group.

What Is MACRA?

The main goal of the Medicare Access and CHIP Reauthorization Act (MACRA) has been to improve care for Medicare beneficiaries by rewarding health care practices that improve care while reducing costs.

How Does the Quality Payment Program Work?

The Quality Payment Program is an incentive program at the core of the Medicare Access and CHIP Reauthorization Act. This is the mechanism that changed and simplified how Medicare pays health care providers for the care they provide.

MACRA, Your Medicare Card and Identity Theft Protection

MACRA mainly affected the payment relationship between Medicare and health care providers. People on Medicare should have noticed few if any changes aside from one: MACRA also required Medicare to remove Social Security numbers from all Medicare cards.

What is MACRA law?

MACRA. The Medicare Access and CHIP Reauthorization Act (MACRA) MACRA: The Basics. The Medicare Access and CHIP Reauthorization Act (MACRA) is a law that significantly changed how the federal government pays physicians. Passage of the law permanently repealed the flawed sustainable growth rate (SGR) and set up the two-track Quality Payment Program ...

What is Medicare and CHIP reauthorization?

The Medicare and CHIP Reauthorization Act (MACRA) is a law that changed how the federal goverment pays physicians. A two-track Quality Payment Program (QQP) not in place emphasizes value-based payment models.

What is MACRA insurance?

Medigap is a supplemental insurance policy that helps cover some of the out-of-pockets costs leftover from Medicare coverage. Due to MACRA, Medigap Plan C and Plan F are no longer available to newly eligible Medicare enrollees.

When did MACRA change?

MACRA made several changes to both Medicare and the Children’s Health Insurance Program (CHIP). Most of these started between 2018 and 2020. There are several aims of MACRA, including: Major changes include new rules about the payments and reimbursements physicians receive from Medicare.

How much is Medicare Part B and Part D?

Both Medicare Part B and Part D (drug coverage) come with monthly premiums. Part B has a standard premium in 2021 of $148.50, while Part D premiums are based the plan you choose. However, you’ll pay more in premiums for both parts if you have a high income.

Why don't new Medicare cards have social security numbers?

The new cards don’t have social security numbers on them because this was a change required by MACRA. Other changes you might have noticed include: certain Medigap plans that are no longer available. Medicare Advantage plan changes. costs for Medicare Part B. costs for Medicare Part D.

What are the changes to Medicare Advantage?

However, there are some parts of MACRA that might make changes to Medicare Advantage, including: Merit-based incentive payment systems (MIPSs). Under MIPS, healthcare providers are reimbursed at a higher rate for providing high-quality care. Providers receive bonuses for meeting quality goals.

Is Medicare Advantage an APM?

Medicare-approved providers can choose the path in which they wish to participate. As MACRA continues to be rolled out, Medicare Advantage plans might be considered an APM. If this comes to pass, prices and plan offerings for Medicare Advantage might see some changes.

Does Medigap have a Part B deductible?

As a way of reaching this goal, MACRA regulations state that Medigap plans are no longer allowed to offer coverage for the Part B deductible.