How to calculate Magi Medicare?

To find your MAGI, take your AGI and add back:

- Any deductions you took for IRA contributions and taxable Social Security payments 18

- Excluded foreign income 5

- Interest from EE savings bonds used to pay for higher education expenses 19

- Losses from a partnership 20

- Passive income or loss

- Rental losses 21

- The exclusion for adoption expenses 22

How is Medicare Magi calculated?

- Compute your AGI - you can use the AGI calculator to do this swiftly.

- Input your AGI into the MAGI calculator - once you input a figure, the calculator begins to sum up your MAGI. ...

- Input only the necessary adjustments - we've already summarised what adjustments to add in Number (6) of the how to calculate MAGI section above. ...

What does Magi stand for in Medicaid?

What does MAGI mean?

- MAGI stands for M odified A djusted G ross I ncome

- MAGI-based budgeting is used to calculate a person's household size and income, using federal income tax rules and a tax filer's family size to determine eligibility for Medicaid

- The MAGI Medicaid program started January 1, 2014, as part of the Affordable Care Act (ACA)

Does Medicaid use Magi?

Marketplace Eligibility is based on annual MAGI while Medicaid / CHIP is based on current monthly income. In many states, Medicaid/CHIP can be based on projected MAGI for the rest of the calendar year. If you are applying for Medicaid make sure to check with your state Marketplace or state Medicaid office.

How do I calculate Magi for Medicare?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.

What is the Magi for Medicare for 2021?

For 2021, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000. To find coverage for the things that Medicare does not cover, start shopping with eHealth.

What does Magi mean for Medicare?

Modified Adjusted Gross IncomeThe figure used to determine eligibility for premium tax credits and other savings for Marketplace health insurance plans and for Medicaid and the Children's Health Insurance Program (CHIP).

What is the Medicare MAGI for 2020?

In 2020, the adjustment amount ranges from $12.20 to $76.40.

How do I calculate Magi?

To calculate your MAGI:Add up your gross income from all sources.Check the list of “adjustments” to your gross income and subtract those for which you qualify from your gross income. ... The resulting number is your AGI.More items...

What is the Magi for Medicare for 2022?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

Who is eligible for Magi?

MAGI POPULATIONS Pregnant women; Dependent children under the age of 19; Parents/caretaker relatives of children under 19; Applicants 65 and over, as well as applicants with Medicare, are typically budgeted as non-MAGI.

Is Social Security income counted in Magi?

Social Security income includes Social Security Disability Insurance (SSDI), retirement income, and survivor's benefits. These forms of income are counted in MAGI, even when not taxable.

How do I reduce my Magi?

You can reduce your MAGI by earning less money, but a lot of people prefer to look for deductions instead. Consider the available deductions on your tax return that are above the line that shows your AGI (this used to be Line 37 on the regular 1040; it's now Line 11).

How do you calculate Magi for Irmaa?

That means your 2021 premiums and IRMAA determinations are calculated based on MAGI from your 2019 federal tax return. MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).

At what income level do my Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

What is MAGI in tax?

MAGI can be defined as your household’s adjusted gross income with any tax-exempt interest income and certain deductions added back. 5 The Internal Revenue Service (IRS) uses MAGI to establish if you qualify for certain tax benefits. Most notably, MAGI determines: If you can contribute to a Roth IRA 2.

Why is AGI important?

Calculate Your AGI (or Find It on Your Tax Return) Your adjusted gross income (AGI) is important because it’s the total taxable income calculated before itemized or standard deductions, exemptions, and credits are taken into account. 13 It dictates how you can use various tax credits and exemptions.

What is the MAGI for Roth IRA?

To contribute to a Roth IRA, your MAGI must be below the limits specified by the IRS. If you’re within the income threshold, the actual amount you can contribute is also determined by your MAGI. If your MAGI exceeds the allowed limits, your contributions are phased out. 2

Is MAGI the same as AGI?

Yes, MAGI and AGI can be the same. For many people, the list of deductions that need to be added back to AGI in order to calculate MAGI will not be relevant. For instance, those who did not earn any foreign income would have no reason to use that deduction and would not add back those earnings to their AGI.

Can you deduct IRA contributions?

For example, you can contribute to a traditional IRA no matter how much money you earn. 7 However, you can’t deduct those contributions when you file your tax return if your MAGI exceeds limits set by the IRS and you and/or your spouse have a retirement plan at work. 1.

Can I take a deduction if my spouse is not covered by a plan at work?

If neither spouse is covered by a plan at work, you can take the full deduction, up to the amount of your contribution limit. However, if either spouse has a plan at work, your deduction could be limited. 8. Here's a rundown of traditional IRA income limits for 2019: 8 1. Traditional IRA Income Limits.

Is alimony considered gross income?

There are two scenarios in which alimony payments are not considered gross income. The first is if your divorce agreement was executed after 2018. The second is if your divorce agreement was executed before 2019 but later modified to expressly state that such payments are not deductible for the payer. 14.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

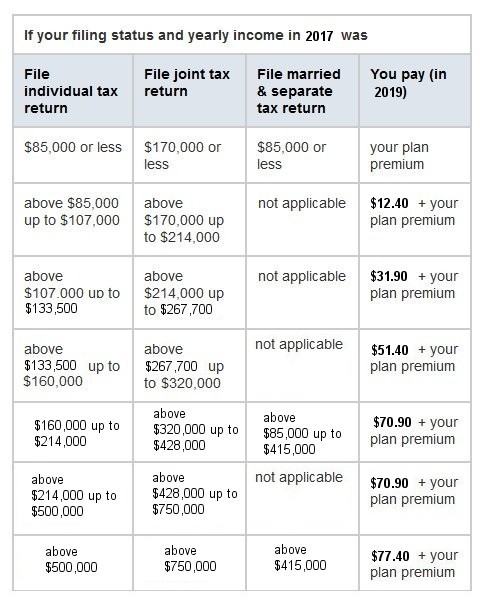

What happens if your MAGI is greater than $88,000?

If you file your taxes using a different status, and your MAGI is greater than $88,000, you’ll pay higher premiums (see the chart below, Modified Adjusted Gross Income (MAGI), for an idea of what you can expect to pay).

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

What is MAGI income?

MAGI is a methodology used to determine household composition and calculate the countable income when determining eligibility for Medicaid or Children's Health Insurance Premium (CHIP) medical. The MAGI income methodology is based on the Internal Revenue Service (IRS) tax filing status of the applicant.

What is a maggi?

MAGI-based medical refers to Medicaid and Children's Health Insurance Premium (CHIP) coverage for individuals who are relatable to Medicaid/CHIP if they are: A child under age of 19, Pregnant, A custodial parent/caretaker, or. An eligible adult between ages 19 and 65 whose income is below the Federal Poverty Level ...

Can you receive medical assistance while in jail?

When a client is active or approved under some medical coverage groups while incarcerated, they can still be eligible to receive medical assistance in a suspended status. For more information, see Suspended Medical – State Bill (SB 6430).

What is the MAGI for health insurance?

The tax credits will cover the rest. The “household income” figure here is your modified adjusted gross income (MAGI). Your MAGI is a measure used by the IRS to determine if you are eligible to use certain deductions, credits (including premium tax credits), or retirement plans. The percentage of income you must pay for individual health insurance ...

How to calculate MAGI?

According to Internal Revenue Code ( (d) (2) (B)), you should add the following to your AGI to determine your MAGI: 1 Any amount excluded from gross income in section 911 (Foreign earned income and housing costs for qualified individuals) 2 Any amount of interest received or accrued by the taxpayer during the taxable year which is exempt from tax 3 Any amount equal to the portion of the taxpayer’s social security benefits (as defined in Section 86 (d)) which is not included in gross income under section 86 for the taxable year. (Any amount received by the taxpayer by reason of entitlement to a monthly benefit under title II of the Social Security Act, or a tier 1 railroad retirement benefit.)

How to calculate adjusted gross income?

Calculating your adjusted gross income. Once you have gross income, you "adjust" it to calculate your AGI by subtracting qualified deductions from your gross income. Adjustments can include items like some contributions to IRAs, moving expenses, alimony paid, self-employment taxes, and student loan interest.

What is a Social Security interest exemption?

Any amount of interest received or accrued by the taxpayer during the taxable year which is exempt from tax. Any amount equal to the portion of the taxpayer’s social security benefits (as defined in Section 86 (d)) which is not included in gross income under section 86 for the taxable year.

What is gross income?

Your gross income (GI) is the money you earned through wages/salary, interests, dividends, rental and royalty income, capital gains, business income, farm income, unemployment, and alimony received. This is the basis for your AGI calculation.

Do premium tax credits work with ICHRA?

Note: Premium tax credits work with the qualified small employer health reimbursement arrangement ( QSEHRA ), but you must report your HRA allowance amount to avoid tax penalties. They do not work with an individual coverage HRA ( ICHRA ).

Is MAGI the same as AGI?

Most people don’t have any of the income just described so their MAGI is the same as their AGI. Once you know your MAGI, you can shop the ACA marketplace or your state exchange for plans. These sites will ask for your MAGI and household size, then calculate tax credits for you.

What is MAGI Medicaid?

MAGI (Modified Adjusted Gross Income) is the new methodology for determining household composition, household size, as well as how income is counted to evaluate eligibility for MAGI Medicaid . The MAGI methodology basically follows the same rules as when a household files their federal income taxes and is based on the adjusted gross income (taxable income) that a filing unit reports on their federal income tax return with certain modifications, thus modified adjusted gross income – “MAGI”. Income thresholds were expanded up to a minimum of 138% of the federal poverty levels (FPL) for the MAGI Medicaid population, and could be higher depending on the applicant. In addition, the asset test was eliminated under the ACA for the MAGI groups. And immigration criteria follow the federal Medicaid immigration criteria, for the most part. For more information, see below, Qualifying for MAGI Medicaid.

What are the MAGI populations?

The MAGI population groups include the following: Pregnant women; Dependent children under the age of 19; Parents/caretaker relatives of children under 19; Applicants 65 and over, as well as applicants with Medicare, are typically budgeted as non-MAGI. However, if such an applicant is a parent/caretaker relative ...

What is Medicaid for low income?

Medicaid is a health benefit for low-income population groups, which includes the aged, blind, disabled, parents/caretaker relatives with dependent children, pregnant women, children, as well as low-income singles/child less couples. The Affordable Care Act (ACA) defined these population groups as either MAGI or non-MAGI.

What is MAGI on taxes?

The MAGI methodology basically follows the same rules as when a household files their federal income taxes and is based on the adjusted gross income (taxable income) that a filing unit reports on their federal income tax return with certain modifications, thus modified adjusted gross income – “MAGI”.

Does MAGI need to renew?

MAGI recipient s will renew through the NY State of Health Marketplace, unless they are subsequently transferred back to the local district because they receive certain Medicaid services, as listed above. For more information, see below, Medicaid Renewal for MAGI Recipients.

Does NYS Medicaid cover non-disabled adults?

Expansion of the Medicaid benefit to cover non-disabled adults ages 19 through 64 who do not have dependent children. Please note that NYS had covered this population prior to the implementation of the ACA through a waiver from the federal government.

Is Medicaid the same as MAGI?

The Medicaid Benefit Package. In NYS, the Medicaid benefit package is the same for both the MAGI and the non-MAGI population groups, see above, Description of Medicaid, Benefit Package.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is the difference between AGI and MAGI?

Therefore, the differences between AGI and MAGI are: AGI is your gross income minus all eligible "above-the-line" tax adjustments, while MAGI is your AGI with some of those adjustments added back. There is one set calculation to determine your AGI, whereas calculating your MAGI differs depending on which adjustments you add back in ...

What is MAGI calculator?

MAGI calculator helps you estimate your modified adjusted gross income to determine your eligibility for certain tax benefits and government-subsidized health programs and whether you can make tax-deductible contributions to an individual retirement account or contribute to a Roth IRA. Essentially, your MAGI is a 'modification' of your AGI.

What is MAGI in tax?

Essentially, your MAGI is a 'modification' of your AGI. You 'modify' your AGI by adding back some of the adjustments or expenses that you initially deducted. These 'adjusted' incomes ensure that you don't pay taxes on every cent you earn, i.e. your gross income. MAGI is calculated differently for different situations.

Where to find your AGI on your tax return?

You can't find your MAGI on your tax return, but you can find your AGI on line 8b of your Form 1040.

Is MAGI higher than gross income?

The good thing is that they use your MAGI income, not your gross income, which is usually much higher than your MAGI. So it's good to calculate your MAGI even though you worry that you're not eligible because you 'earn too much,' you might still qualify for the benefit.

When you need to add any other adjustment to income, can you use the advanced mode?

When you need to add any other adjustment to income, you can use the advanced mode to bring up more options that you may require. Understanding MAGI calculations can be the critical difference in qualifying for a Roth account or a government-subsidized health insurance plan when you file your taxes.

Do you have to pay back the overpaid subsidy?

You will have to pay back all or part of the overpaid subsidy, depending on your income. But when you know the relevant modified adjusted gross income (MAGI) calculation for a specific tax benefit, you can determine how to take advantage of it and save money on your taxes. Oghenekaro Elem.