- Medicare managed care plans are offered by private companies that have a contract with Medicare.

- These plans work in place of your original Medicare coverage.

- Many managed care plans offer coverage for services that original Medicare doesn’t.

- Medicare managed care plans are often known as Medicare Part C or Medicare Advantage plans.

What makes a good Medicaid managed care plan?

- Medicaid Encounter Data System (MEDS) III Data Dictionary (PDF) Change Log

- Provider Network Data Dictionary (PDF) Change Log

- MRT 1458: Medicaid Managed Care Supplemental Information and Updates

- Questions & Answers on the Elimination of Direct Marketing Related to Contract Provisions (Section 11, Appendices D & P)

- Medicaid Prenatal Care Standards

What is the best Medicare plan?

They are here to talk about their 5 star medicare plans available to switch your current plan or during the election periods throughout the year. As independent agents, Deb and Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers.

What is the purpose of a managed care plan?

- The ability of utilization management and incentives to control service use.

- The increased importance of the health characteristics of the enrollees in driving costs and premiums.

- The inability of managed care to control system costs, as health care expenditures have continued to rise rapidly with the widespread adoption of managed care.

What Medicare plans does Humana offer?

Medicare plans offered by Humana include Medicare Advantage plans, stand-alone Medicare Part D Prescription Drug Plans, and Medicare Supplement plans, also called Medigap plans. Here’s an overview of each of these types of coverage. What Medicare Advantage plans are available from Humana?

What is the difference between Medicare and managed Medicare?

Medicare care managed care plans are an optional coverage choice for people with Medicare. Managed care plans take the place of your original Medicare coverage. Original Medicare is made up of Part A (hospital insurance) and Part B (medical insurance). Plans are offered by private companies overseen by Medicare.

What is a managed plan?

Managed care plans are a type of health insurance. They have contracts with health care providers and medical facilities to provide care for members at reduced costs. These providers make up the plan's network. How much of your care the plan will pay for depends on the network's rules.

What is the difference between Medicare fee for service and Medicare managed care?

Under the FFS model, the state pays providers directly for each covered service received by a Medicaid beneficiary. Under managed care, the state pays a fee to a managed care plan for each person enrolled in the plan.

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is an example of a managed care plan?

A good example of a managed care plan is an HMO (Health Maintenance Organization). HMOs closely manage your care. Your cost is lowest with an HMO. You are limited to seeing providers in a small local network, which also helps keep costs low.

What is the biggest advantage of a managed care plan?

The primary advantage of managed care is that it provides health care solutions for people whenever they want to speak with a medical provider. Immediate services can be rendered, allowing people to take their care into their own hands with a reasonable level of certainty.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is Medicare Advantage cheaper than original Medicare?

The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county. However, MA plans that are able to keep their costs comparatively low are concentrated in a fairly small number of U.S. counties.

Can I have Original Medicare and Medicare Advantage at the same time?

If you're in a Medicare Advantage Plan (with or without drug coverage), you can switch to another Medicare Advantage Plan (with or without drug coverage). You can drop your Medicare Advantage Plan and return to Original Medicare. You'll also be able to join a Medicare drug plan.

What are the top 3 Medicare Advantage plans?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCMS ratingHumana5.03.6Blue Cross Blue Shield5.03.8Cigna4.53.8United Healthcare4.03.81 more row•Feb 25, 2022

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

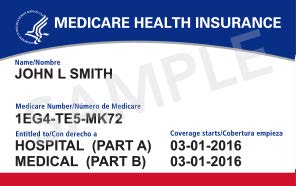

What are the two types of Medicare plans?

Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You can join a separate Medicare drug plan to get Medicare drug coverage (Part D). You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

What is Medicare managed care?

Medicare care managed care plans are an optional coverage choice for people with Medicare. Managed care plans take the place of your original Medicare coverage. Original Medicare is made up of Part A (hospital insurance) and Part B (medical insurance). Plans are offered by private companies overseen by Medicare.

What is a Medigap plan?

A Medigap plan, also known as Medicare supplement insurance, is optional coverage you can add to original Medicare to help cover out-of-pocket costs. Medigap plans can help you pay for things like: coinsurance costs. copayments. deductibles. These aren’t a type of managed care plan.

What is Medicare Advantage?

Sometimes referred to as Medicare Part C or Medicare Advantage, Medicare managed care plans are offered by private companies. These companies have a contract with Medicare and need to follow set rules and regulations. For example, plans must cover all the same services as original Medicare.

What is an HMO plan?

Health Maintenance Organization Point of Service (HMO-POS). An HMO-POS plan works with a network, like all HMO plans. The difference is that an HMO-POS plan allows you to get certain services from out-of-network providers — but you’ll likely pay a higher cost for these services than if you see an in-network provider.

How much does Medicare cost in 2021?

Most people receive Part A without paying a premium, but the standard Part B premium in 2021 is $148.50. The cost of your managed care plan will be on top of that $148.50.

What is a PPO provider?

Preferred Provider Organization (PPO). A PPO also works with a network. However, unlike with an HMO, you can see providers who aren’t part of your network. Your out-of-pocket cost to see those providers will be higher, though, than if you see an in-network provider.

What is an HMO?

Health Maintenance Organization (HMO). An HMO is a very common health plan type that works with a network. You’ll need to see providers who are part of your plan’s network to get your care covered. An exception is made for emergency care; this will be covered even if you go to an out-of-network provider.

What is Medicare managed care?

A Medicare managed care plan is a type of Medicare Advantage plan. Learn what managed care plans are and how they could be a good fit for you. A Medicare managed care plan is one type of Medicare Advantage plan. The term “managed care plan” generally refers to HMO (health maintenance organization), PPO (preferred provider organization) ...

What are the different types of Medicare plans?

Types of Medicare managed care plans 1 Health maintenance organization (HMO)#N#In a Medicare HMO plan, you use a primary care physician to coordinate your care, and you receive services from a network of health care providers that partner with your plan. 2 Preferred provider organization (PPO)#N#In a Medicare PPO plan, you may or may not use a primary care physician, and you are typically not required to get a referral to see a specialist. You’ll have a network of providers from which to choose .You will generally can receive at least some coverage when receiving care outside of the network of providers, though your health care services may cost more than if you received them from a provider within your plan network. 3 Point of service (POS)#N#You can use a primary care physician in a Point of Service plan, as you would with an HMO plan. But as with a PPO plan, you can go outside of the plan network and still receive some coverage for services, though you may pay higher out-of-pocket costs than if you selected an in-network provider.

What is a HMO plan?

Health maintenance organization (HMO) In a Medicare HMO plan, you use a primary care physician to coordinate your care, and you receive services from a network of health care providers that partner with your plan. Preferred provider organization (PPO)

What doctor do you see on a managed care plan?

As a member of a managed care plan, a beneficiary will typically see a primary care physician for any illnesses, injuries or conditions. When possible, the primary care physician will treat the patient.

How to contact Medicare Advantage?

For more information about managed care plans or other types of Medicare Advantage plans, including plan benefits, eligibility, enrollment and availability, contact a licensed insurance agent by calling. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 24 hours a day, 7 days a week.

Is there less uncertainty about a beneficiary's costs for care in a managed care plan?

There’s less uncertainty about a beneficiary’s costs for care in a managed care plan, provided they stay within the assigned network for qualified services.

Can you use a primary care physician in a point of service plan?

But as with a PPO plan, you can go outside of the plan network and still receive some coverage for services, though you may pay higher out-of-pocket costs than if you selected an in-network provider.

Medicare Vs Medicaid: Whats The Difference

Understand the differences between Medicare and Medicaid and find out if you can qualify for both.

Types Of Medicare Managed Care Plans

Moreover, care plans are private health insurance companies that Medicare-approves. Plans offer care from a specific network of providers at a lower overall cost. Medicare divides managed care plans into different plan types. Classifying each by using acronyms such as HMO, PFFS, PPO, or HMO-POS.

Opting For Part A Only

Some people choose only to have Medicare Part A coverage so that they dont have to pay the monthly premiums for Medicare Parts B and D. If you still have insurance through a current employer , you can add the other parts later with no penalty.

How The Programs Differ

Medicare is an insurance program while Medicaid is a social welfare program.

How Can I Find Which Medicare Advantage Plans Are Available In My Area

Im available to help you understand your options. If you prefer, you can request information via email or schedule a phone call at your convenience by clicking one of the links below. To view some plans you may be eligible for, use the Compare Plans button below.

Medicare Advantage Managed Care Plans: Beneficiary Protections

The plan cannot charge more than a $50 copayment for visits to the emergency room.

Medicare Advantage Plans May Cost You Less

If you enroll in a Medicare Advantage plan, you continue to pay your Medicare Part B premium and you may pay an additional premium. The insurer determines the Medicare Advantage plans premium, which can vary from one Medicare Advantage plan to another. Some Medicare Advantage plans may have premiums as low as $0.

What is managed care plan?

The term “managed care” is used to describe a type of health care focused on helping to reduce costs, while keeping quality of care high.

How does managed care work?

The primary way in which managed care plans work is by establishing provider networks. A provider network serves plan members over a certain geographic area in which the health plan is available. The providers in these networks agree to offer their services at reduced costs. Your health plan pays more of the cost of your care if you see providers ...

What is HMO insurance?

Health Maintenance Organization (HMO) manages care by requiring you to see network providers, usually for a much lower monthly premium. HMOs also often require you to see a PCP before going elsewhere, and do not cover you to see providers outside the network. Preventive care is covered at 100%.

What is no cost preventive care?

No-cost preventive care is a big incentive for plan members to try and maintain good health. Primary Care Providers (PCP): Your health plan may require you to choose a PCP if you don’t already have one. You may be required to see your PCP first before going to any other doctor or specialist.

What is preventive care incentive?

Preventive care incentives: Managed care plans typically focus on making preventive care a priority. Most preventive services, such as annual check-ups, routine screenings, and certain vaccines, are covered at 100% by your health plan.

What are some examples of managed care?

They are examples of managed care: Provider networks: Health insurance companies contract with groups of providers to offer plan members reduced rates on care and services. These networks can include doctors, specialists, hospitals, labs, and other health care facilities. Some health plans require you to use the plan’s provider network ...

What is managed care organization?

A managed care organization or MCO is a health care company or a health plan that is focused on managed care as a model to limit costs, while keeping quality of care high.

What is Medicare Advantage Plan?

Individuals who have traditional Medicare, or a Medicare Advantage plan that does not include prescription drug coverage, who want Part D coverage, must purchase it separately. This is called a “stand-alone” Prescription Drug Plan (PDP). A Medicare Advantage plan that includes both health and drug coverage is referred to as a Medicare Advantage ...

How to contact Medicare in MA?

Individuals can obtain help and a list of MA plans in their area from their State Health Insurance Assistance Program (SHIP), the Medicare helpline (1-800-633-4227) , or the Medicare website ( www.Medicare.gov ).

What is a medicaid supplement?

Medigap plans (also known as Medicare Supplement Insurance), are private health insurance plans that help pay for the "gaps" in payment for Medicare-covered care left by traditional Medicare; these include copayments, coinsurance, and deductibles. In many cases, someone with traditional Medicare must purchase a separate Part D drug plan as well as a Medigap plan to supplement their Medicare benefits. Medigap policies do not work with MA plans and it is illegal for anyone to sell an MA enrollee a Medigap policy unless they are switching to traditional Medicare.

What should be identified in MA preventive services?

All preventive services and extra benefits should be identified, as well as any limitations associated with visits or services. Determine where you are required to go for regular, non-urgent care. Check into the MA plan's physicians to determine if your physicians are in the plan’s network.

Does Medicare have a cap on out-of-pocket expenses?

You may also have to pay for deductibles, coinsurance and copays. Traditional Medicare has no out-of-pocket maximum or cap on what you may spend on health care. With traditional Medicare, you will have to purchase Part D drug coverage and a Medigap plan separately (if you choose to purchase one). Medicare Advantage.

Can you appeal a Medicare decision?

Regardless of how you receive your Medicare benefits you always have the right to appeal unfavorable decisions regarding coverage of your services. However, timeframes and deadlines differ depending on whether you have traditional Medicare or a Medicare Advantage plan.

Do you need to buy a Medigap plan?

Some beneficiaries have employer or union coverage that pays costs that traditional Medicare does not cover; those who do not may need to buy a Medigap plan. Other individuals may be eligible for Medicaid that can also cover such costs and may not need Medigap.