Your income must be less than Illinois' income limits. If your income is equal to or less than $981 per month for a single person or up to $1,328 per month for a couple, you may qualify for Medicaid to pay all of your Medicare cost sharing.

How to determine eligibility for Medicaid in Illinois?

Mar 15, 2022 · - $3,000 for the first 2 people, plus $50 for each additional person.

What is the annual income limit for Medicaid?

Mar 25, 2022 · Effective April 2021 – March 2022, the medically needy income limit (MNIL) in IL is $1,073 / month for an individual and $1,452 / month for a couple. The “spenddown” amount is the difference between one’s monthly income and the MNIL. It can be thought of as a deductible.

What's the income level requirement to qualify for Medicaid?

Oct 04, 2020 · Income limits: The income limit is $1,063 a month if single and $1,437 a month if married (and both spouses are applying). If only one spouse needs Medicaid, the income limit for single applicants is used – and usually only the applicant’s income is counted.

What are the income guidelines for Medicaid?

Nov 16, 2021 · Most people will pay the standard amount for their Medicare Part B premium. However, you’ll owe an IRMAA if you make more than $91,000 in a given year. For Part D, you’ll pay the premium for the...

What are the income limits for Medicaid 2020 Illinois?

Illinois offers Medicaid coverage for people with disabilities with income up to 100% of the federal poverty level (monthly income of $1,012 for an individual) and non-exempt resources (assets) of no more than $2,000 (for one person).

What is the highest income to qualify for Medicaid in Illinois?

Who is eligible for Illinois Medicaid?Household Size*Maximum Income Level (Per Year)1$18,7552$25,2683$31,7824$38,2954 more rows

Who qualifies for Illinois Medicare?

age 65 or olderMedicare is a federal health insurance program for the following: Participants age 65 or older. Participants under age 65 with certain disabilities. Participants of any age with End-Stage Renal Disease (ESRD)

How do I know if I qualify for Medicaid in Illinois?

1-800-842-1461. To use the automated system, you must have the individual's Medicaid Recipient Identification Number (RIN) and the date of service for which you need eligibility information.

What is the income limit for Medicaid in Illinois 2021?

Individuals with income up to 138 percent of the federal poverty level (monthly income of $1,366/individual, $1,845/couple) can be covered.

What is the monthly income limit for food stamps in Illinois?

Supplemental Nutrition Assistance Program Effective October 2021 Maximum Monthly Income AllowableNumber of People in Your HouseholdMaximum Gross Monthly IncomeMaximum Gross Monthly Income (Age 60 and Over or Disabled)1$ 1,771$ 2,1472$ 2,396$ 2,9033$ 3,020$ 3,6604$ 3,644$ 4,4177 more rows

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Can you have both Medicare and Medicaid in Illinois?

Illinois residents who are eligible for Medicare and Medicaid coverage and benefits can get it all through Humana Gold Plus® Integrated Medicare-Medicaid in Illinois. Through Humana Gold Plus Integrated, your Medicare and Medicaid coverage and benefits are combined into one plan—PLUS you get prescription drug coverage.Jan 1, 2022

Do I automatically get Medicare when I turn 65?

You automatically get Medicare when you turn 65 Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

What is the difference between Medicare and Medicaid?

Medicare is a federal program that provides health coverage if you are 65+ or under 65 and have a disability, no matter your income. Medicaid is a state and federal program that provides health coverage if you have a very low income.

Does Medicaid cover dental in Illinois?

Adult Medicaid recipients in Illinois can now receive coverage for preventive dental services, which include regular exams and teeth cleanings.Jul 5, 2018

How long does it take to get Medicaid in Illinois?

How long does the State have to process my medical application? The law requires the State to process medical applications as follows: 60 days - Medical assistance for persons requiring a disability determination. 45 days - Medical assistance for all others.

Does Illinois help with my Medicare premiums?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In...

Who’s eligible for Medicaid for the aged, blind and disabled in Illinois?

Medicare covers a wide range of services – including hospitalization, physician services, and prescription drugs – but Original Medicare doesn’t co...

Where can Medicare beneficiaries get help in Illinois?

State Health Insurance Assistance Program (SHIP) You can receive free volunteer Medicare counseling is available by contacting Illinois’s State Hea...

How do I apply for Medicaid in Illinois?

Medicaid is administered by the Department of Human Services (DHS) in Illinois. You can use this website to apply for Medicaid AABD or an MSP in Il...

What is Medicaid in Illinois?

The program is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages. That being said, this page is focused on Medicaid eligibility, specifically for Illinois residents, aged 65 and over, and specifically for long term care, whether that be at home, in a nursing home or in assisted living.

What income is counted for Medicaid?

Examples include employment wages, alimony payments, pension payments, Social Security Disability Income, Social Security Income, IRA withdrawals, and stock dividends.

How much can a spouse retain in 2021?

For married couples, as of 2021, the community spouse (the non-applicant spouse of a nursing home Medicaid applicant or a Medicaid waiver applicant) can retain up to a maximum of $109,560 of the couple’s joint assets, as the chart indicates above.

What is the CSMNA in Illinois?

Specific to IL, it is called a Community Spouse Maintenance Needs Allowance and is abbreviated as CSMNA. In 2021, the CSMNA is $2,739 / month. This means applicant spouses are able to transfer their income, or a portion of their income, to their non-applicant spouses to bring their monthly income up to this level.

What is regular Medicaid?

3) Regular Medicaid / Aged Blind and Disabled – is an entitlement (all persons who meet the eligibility requirements are able to receive benefits) and is provided at home or adult day care.

What are countable assets?

Countable assets include cash, stocks, bonds, investments, IRAs, credit union, savings, and checking accounts, and real estate in which one does not reside. However, for Medicaid eligibility, there are many assets that are considered exempt (non-countable).

What is institutional Medicaid?

1) Institutional / Nursing Home Medicaid – is an entitlement (anyone who is eligible will receive assistance) & is provided only in nursing homes. 2) Medicaid Waivers / Home and Community Based Services – Limited number of participants. Provided at home, adult day care or in assisted living.

How much income do you need to qualify for Medicaid in Illinois?

In Illinois, applicants can qualify for Medicaid HCBS with incomes up to $2,349 for single applicants and $4,626 a month for married couples. In Illinois in 2020, spousal impoverishment rules allow the spouses of Medicaid recipients to keep between $2,155 and $3,216 per month. Applicants for LTSS must have no more than $595,000 in home equity.

What is the asset limit for MSP in Illinois?

MSP asset limits: Illinois uses the federal asset limits for QMB, SLMB and QI – which is $7,860 if single and $11,800 if married. The QDWI asset limit is $4,000 if living alone and $6,000 if living with others.

What percent of Medicare beneficiaries lived at home in 2015?

In fact, 20 percent of Medicare beneficiaries who lived at home received some assistance with LTSS in 2015, and the portion of enrollees needing these services will increase as the population ages.

How much can you keep on your medicare?

Enrollees can keep a $30 personal needs allowance and money to pay for health insurance premiums (such as Medicare Part B and Medigap ). Assets limits: The asset limit is $2,000 if single and $3,000 if married (and both spouses are applying).

What is Medicare Savings Program?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In Washington, D.C., this program pays for Medicare Part B premiums, Medicare Part A and B cost-sharing, and – in some cases – Part A premiums. Qualified Medicare Beneficiary (QMB): The income limit is ...

What is HCBS in Medicaid?

Every state’s Medicaid program covers community-based long-term services, which are provided in an enrollee’s home, adult day care center, or another community setting. Programs that pay for these services are called Home and Community Based Services (HCBS ) waivers because recipients continue living in the community, rather than entering a nursing home.

What is Medicaid ABD in Illinois?

In Illinois, Medicaid ABD is called Aid to the Aged, Blind and Disabled (AABD). Income eligibility: The income limit is $1,063 a month if single and $1,437 a month if married. Asset limits: The asset limit is $2,000 if single and $3,000 if married. Back to top.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much is Medicare Part B 2021?

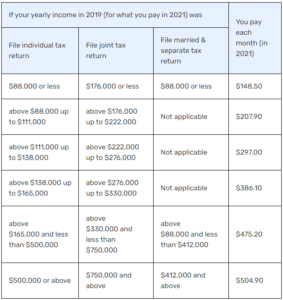

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

What are Medicare cost sharing expenses?

Medicare cost sharing expenses are Medicare premiums (Part A - hospital insurance, Part B – medical insurance), deductibles and coinsurance amounts.

How do I apply for Medicaid payment of my Medicare cost sharing?

You may apply at your local Department of Human Services (DHS) Family Community Resource Center (FCRC). If you apply for cash or medical assistance, we will also decide if you qualify for help to pay your Medicare costs.

Do I have to go to the local FCRC to apply for Medicaid to pay my Medicare premiums, deductibles and coinsurance amounts?

No, you do not have to go to your local FCRC to apply. You may apply online on at ABE.illinois.gov, you may request an application by mail or telephone. The application may be downloaded from the HFS Medical Forms page. Look for Form 2378M, Application for Payment of Medicare Premiums, Deductibles and Coinsurance.

How will I find out if I qualify?

We will send you a notice to tell you if you can get help with your Medicare cost sharing expenses. If you do not qualify, we will also send a notice and tell you why not. You may appeal our decision.

How much does Medicare pay for Part D?

If you earn more than $88,000 but less than $412,000, you’ll pay $70.70 on top of your plan premium. If you earn $412,000 or more, you’ll pay $77.10 in addition to your plan premium. Medicare will bill you for the additional Part D fee every month.

What is the income limit for QDWI?

You must meet the following income criteria if you want to enroll in your state’s QDWI program: Individuals must have a monthly income of $4,339 or less and a $4,000 resource limit. A married couple’s monthly income must be less than $5,833. A married couple’s resource limit must be less than $6,000.

What is SLMB in Medicare?

SLMB, or Specified Low-Income Medicare Beneficiary. If you earn less than $1,296 per month and have less than $7,860 in assets, you may be eligible for SLMB. Married couples must make less than $1,744 per month and have less than $11,800 in debt to qualify. This plan covers your Part B premiums.

What happens if you retire in 2020 and only make $65,000?

Loss of income from another source. If you were employed in 2019 and earned $120,000 but retired in 2020 and now only make $65,000 from benefits, you may want to challenge your IRMAA. To keep track of your income fluctuations, fill out the Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event form.

How much do you have to pay in taxes if you make more than $412,000 a year?

If you earn more than $412,000 per year, you’ll have to pay $504.90 per month in taxes. Part B premiums will be cut off directly from your Social Security or Railroad Retirement Board benefits. Medicare will send you a fee every three months if you do not receive either benefit.

How much will Part D cost in 2021?

Through the Extra Help program, prescriptions can be obtained at a significantly reduced cost. In 2021, generic drugs will cost no more than $3.70, while brand-name prescriptions will cost no more than $9.20.

How much do you have to pay for Part B?

If this is the case, you must pay the following amounts for Part B: If you earn less than $88,000 per year, you must pay $148.50 per month. If you earn more than $88,000 but less than $412,000 per year, you must pay $475.20 per month.

What are the expenses that go away when you receive Medicaid at home?

When persons receive Medicaid services at home or “in the community” meaning not in a nursing home through a Medicaid waiver, they still have expenses that must be paid. Rent, mortgages, food and utilities are all expenses that go away when one is in a nursing home but persist when one receives Medicaid at home.

How long does it take to get a medicaid test?

A free, non-binding Medicaid eligibility test is available here. This test takes approximately 3 minutes to complete. Readers should be aware the maximum income limits change dependent on the marital status of the applicant, whether a spouse is also applying for Medicaid and the type of Medicaid for which they are applying.

Is income the only eligibility factor for Medicaid?

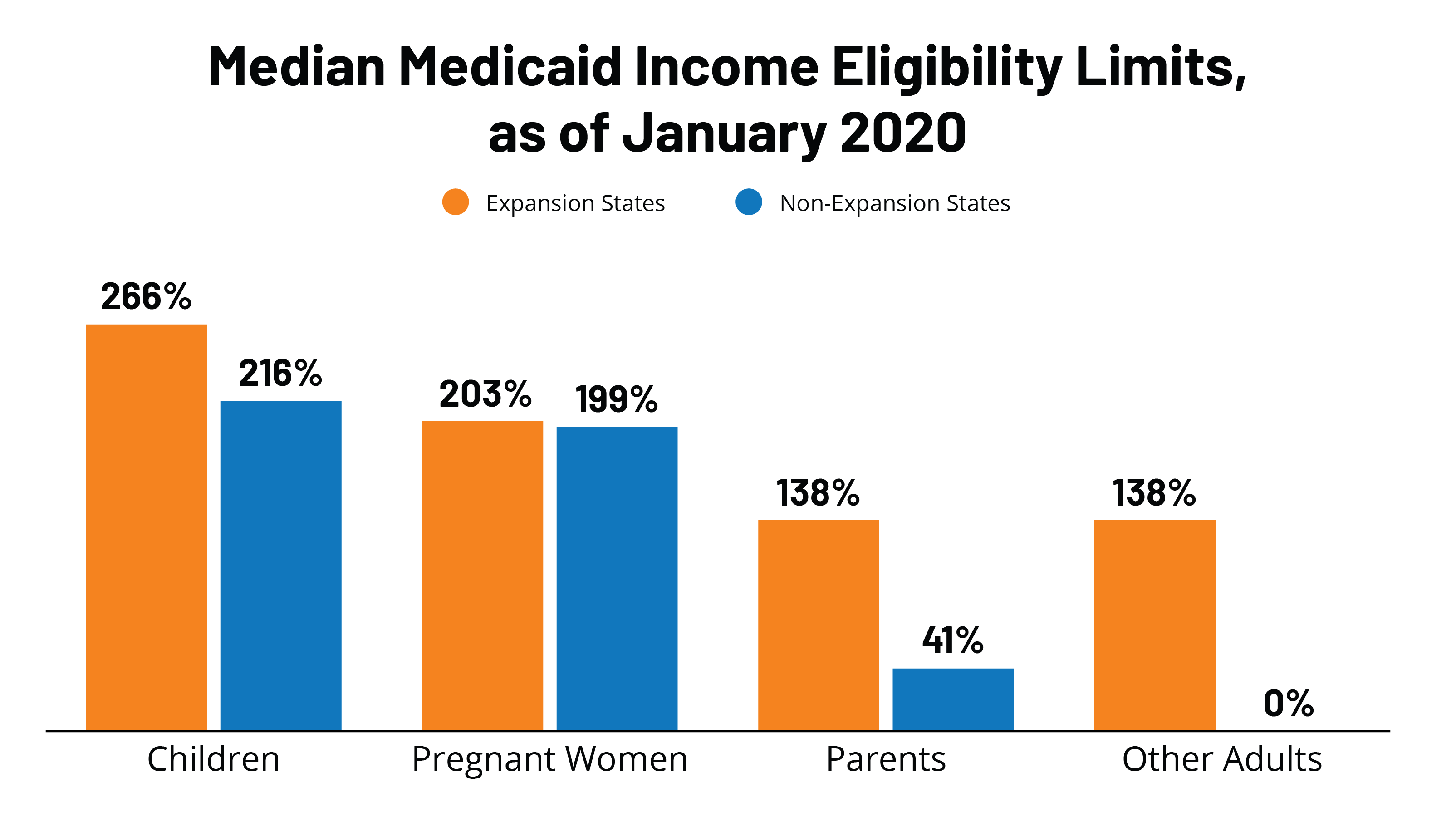

Medicaid Eligibility Income Chart by State – Updated Mar. 2021. The table below shows Medicaid’s monthly income limits by state for seniors. However, income is not the only eligibility factor for Medicaid long term care, there are asset limits and level of care requirements.