3 things to know about Medicare Advantage plans:

- They are also known as Medicare Part C.

- They are an alternative way to get Medicare coverage through private insurance companies instead of the federal government.

- They provide the same benefits as Original Medicare and may include additional benefits such as dental, vision, prescription drug and wellness programs coverage.

Full Answer

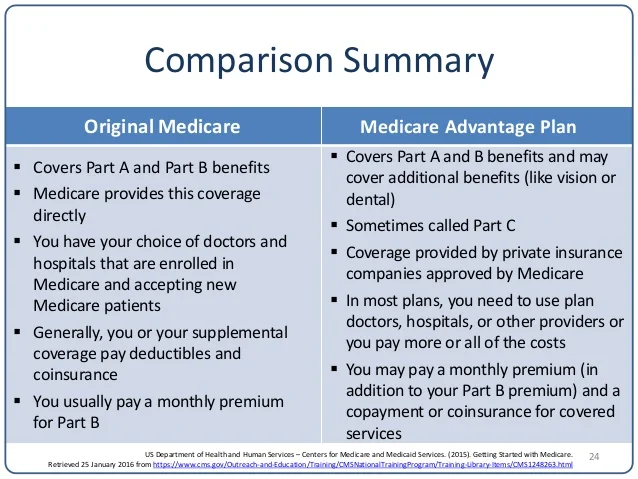

When to choose Original Medicare vs. Medicare Advantage?

You may want to choose between Original Medicare and Medicare Advantage for financial reasons, but you may also want to consider access to certain healthcare services. The important thing is to understand the differences between each type of Medicare before you commit yourself to a plan for the coming year.

Does Medicare Advantage offer much advantage?

Medicare Advantage plans must offer everything Original Medicare covers except hospice care, which is still covered by Medicare Part A. Some Medicare Advantages plans offer extra benefits, such as prescription drug coverage, routine dental, routine vision, and wellness programs.

Does Medicare Advantage save you money?

While you can save money with a Medicare Advantage Plan when you are healthy, if you get sick in the middle of the year, you are stuck with whatever costs you incur until you can switch plans ...

Does Medicare Advantage cost less than traditional Medicare?

UnitedHealth Group, for example, discovered that Medicare Advantage costs beneficiaries 40 percent less than traditional Medicare does.

What is the difference between a regular Medicare plan and an Advantage plan?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of- pocket costs than Original Medicare. In many cases, you'll need to use doctors who are in the plan's network.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the difference between Part B and Medicare Advantage?

Part B covers doctors' visits, and the accompanying Part A covers hospital visits. Medicare Part C, also called Medicare Advantage, is an alternative to original Medicare. It is an all-in-one bundle that includes medical insurance, hospital insurance, and prescription drug coverage.

What is the point of a Medicare Advantage plan?

A Medigap policy is private insurance that helps supplement Original Medicare. This means it helps pay some of the health care costs that Original Medicare doesn't cover (like copayments, coinsurance, and deductibles).

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What are the top 3 Medicare Advantage plans?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCMS ratingHumana5.03.6Blue Cross Blue Shield5.03.8Cigna4.53.8United Healthcare4.03.81 more row•Feb 25, 2022

Is Medicare Advantage cheaper than original Medicare?

The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county. However, MA plans that are able to keep their costs comparatively low are concentrated in a fairly small number of U.S. counties.

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Does Medicare Advantage cost more than Medicare?

Medicare spending for Medicare Advantage enrollees was $321 higher per person in 2019 than if enrollees had instead been covered by traditional Medicare. The Medicare Advantage spending amount includes the cost of extra benefits, funded by rebates, not available to traditional Medicare beneficiaries.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What are the advantages and disadvantages of Medicare Advantage plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What part of Medicare is free?

Part APart A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Why do you keep your Medicare card?

Keep your red, white, and blue Medicare card in a safe place because you’ll need it if you ever switch back to Original Medicare. Below are the most common types of Medicare Advantage Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is offered to people ages 65 and older and disabled adults who qualify. Plans are provided by Medicare-approved private insurance companies. Coverage is the same as Part A hospital, Part B medical coverage, and, usually, Part D prescription drug coverage, with the exception of hospice care.

When can I change my Medicare Advantage plan?

People can change their Medicare Advantage plans during a specified open enrollment period in the fall that typically spans from mid-October to early December. 8 9. Like other types of health insurance, each Medicare Advantage plan has different rules about coverage for treatment, patient responsibility, costs, and more.

What is the maximum Medicare deductible for 2021?

In 2021, the annual maximum is rising to $7,550, up from $6,700, although many plans have lower out-of-pocket caps. 11 The 2021 monthly premium and annual deductible for Medicare Part B are $148.50 and $203, respectively. 12.

Is Medicare available for people over 65?

Medicare is generally available for people age 65 or older, younger people with disabilities, and people with end-stage renal disease—permanent kidney failure requiring dialysis or transplant—or amyotrophic lateral sclerosi (ALS). 3 4 Medicare Advantage is a type of Medicare health plan offered by private companies that are Medicare-approved.

Does Medicare Advantage work with Medigap?

Medicare Advantage plans don't work with Medigap, which is also called Medicare Supplement Insurance. 2. The average monthly premium for a Medicare Advantage plan in 2021 is expected to drop 11% to about $21 from an average of $23.63 in 2020. 5 Private companies receive a fixed amount each month for Medicare Advantage plan care.

What Is Medicare Advantage?

Medicare Advantage (MA) plans all provide full coverage for inpatient and outpatient services, and many include prescription medication coverage.

What Does Medicare Advantage Pay For?

Part C providers are required by law to offer all of the benefits enrollees would otherwise have with Original Medicare Parts A and B. All of the same inpatient and outpatient services are included in any Part C package, though insurers may offer extra services some seniors are willing to shop for.

What Does Medicare Part C Cost?

The cost of Medicare Part C coverage may vary by location, the type of plan offered and by the plan’s coverage limits.

Enrollment Periods for Medicare Advantage

As with most Medicare coverage options, the first time most seniors can enroll in an MA plan is during their Initial Enrollment Period (IEP).

How to Find a Medicare Advantage Plan

Seniors interested in a Part C plan can find a list of Medicare Advantage plans and their plan details by comparing plans online or calling to speak with a licensed insurance agent.

What is Medicare Advantage?

Medicare Advantage (sometimes called Medicare Part C or MA) is a type of health insurance plan in the United States that provides Medicare benefits through a private-sector health insurer. In a Medicare Advantage plan, a Medicare beneficiary pays a monthly premium to a private insurance company ...

What is the difference between Medicare Advantage and Original Medicare?

From a beneficiary's point of view, there are several key differences between Medicare Advantage and Original Medicare. Most Medicare Advantage plans are managed care plans (e.g., PPOs or HMOs) with limited provider networks, whereas virtually every physician and hospital in the U.S. accepts Original Medicare.

What happens if Medicare bid is lower than benchmark?

If the bid is lower than the benchmark, the plan and Medicare share the difference between the bid and the benchmark ; the plan's share of this amount is known as a "rebate," which must be used by the plan's sponsor to provide additional benefits or reduced costs to enrollees.

How does capitation work for Medicare Advantage?

For each person who chooses to enroll in a Part C Medicare Advantage or other Part C plan, Medicare pays the health plan sponsor a set amount every month ("capitation"). The capitated fee associated with a Medicare Advantage and other Part C plan is specific to each county in the United States and is primarily driven by a government-administered benchmark/framework/competitive-bidding process that uses that county's average per-beneficiary FFS costs from a previous year as a starting point to determine the benchmark. The fee is then adjusted up or down based on the beneficiary's personal health condition; the intent of this adjustment is that the payments be spending neutral (lower for relatively healthy plan members and higher for those who are not so healthy).

How many people will be on Medicare Advantage in 2020?

Enrollment in the public Part C health plan program, including plans called Medicare Advantage since the 2005 marketing period, grew from zero in 1997 (not counting the pre-Part C demonstration projects) to over 24 million projected in 2020. That 20,000,000-plus represents about 35%-40% of the people on Medicare.

How much does Medicare pay in 2020?

In 2020, about 40% of Medicare beneficiaries were covered under Medicare Advantage plans. Nearly all Medicare beneficiaries (99%) will have access to at least one Medicare Advantage ...

How much has Medicare Advantage decreased since 2017?

Since 2017, the average monthly Medicare Advantage premium has decreased by an estimated 27.9 percent. This is the lowest that the average monthly premium for a Medicare Advantage plan has been since 2007 right after the second year of the benchmark/framework/competitive-bidding process.

What is a TAB plan?

#TAB#Medical Savings Account (MSA) plans—These plans combine a high-deductible health plan with a bank account. Medicare deposits money into the account (usually less than the deductible). You can use the money to pay for your health care services during the year. MSA plans don’t offer Medicare drug coverage. If you want drug coverage, you have to join a Medicare Prescription Drug Plan. For more information about MSAs, visit Medicare.gov/publications to view the booklet “Your Guide to Medicare Medical Savings Account Plans.”

Can you sell a Medigap policy if you already have a Medicare Advantage Plan?

If you already have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re disenrolling from your Medicare Advantage Plan to go back to Original Medicare.

What are the benefits of Medicare Advantage?

Some of those benefits might include: Medicare Part C plans can also offer additional benefits today, such as over-the-counter medications, transportation to and from doctor appointments, and adult daycare services.

What is Medicare Advantage Part C?

Find Plans. Find Plans. Summary: Medicare Part C, also known as Medicare Advantage, is an alternative way to get your Original Medicare benefits. These plans often offer additional coverage for services like prescription drugs, vision and dental care. Plans vary in terms of both cost and benefits.

What are the parts of Medicare?

There are four basic parts to Medicare. Part A and Part B make up Original Medicare. Part A covers care you receive while you are in the hospital. Part B helps pay for expenses, like doctor visits and some medical equipment. Medicare Part C is an alternative way to get your Original Medicare coverage.

When can I switch Medicare Advantage plans?

This period runs annually from January 1 to March 31. During this time, you can switch from one Medicare Advantage plan to another.

When do you enroll in Medicare?

This is the period when you first become eligible for Medicare. This enrollment period begins three months before the month you turn 65. It includes your birthday month and the three months following.

Is Medicare Part D a stand alone plan?

Medicare Part D is prescription drug coverage. You can have a stand-alone prescription drug plan with Original Medicare, or you might have a Medicare Advantage plan that includes prescription medication benefits.

There Are Legitimate Reasons To Consider The Plans But Certain Nuances Are Also A Huge Part Of The Conversation

First of all, it is very important to establish some basics around what Medicare Advantage is. Over a decade ago, Medicare Part C was approved as an option for beneficiaries. The fact that it is considered a part of Medicare makes it extra confusing. Medicare has four parts. Parts A and B make up traditional Medicare.

What Are The Different Medicare Part C Plans

The number of Medicare Advantage plans available to you will depend in part on where you live and how many companies offer coverage in your area.

What Does Medicare Part C Cost

The cost of Medicare Part C coverage may vary by location, the type of plan offered and by the plans coverage limits.

Think Before You Switch

So, Savage advised, “think very carefully before you switch out of traditional Medicare, which lets you see just about any doctor or go to any hospital.”

Selecting A Medigap Plan: Recent Changes Limit Choices

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states.

Medicare Part D Premiums

Medicare Part D prescription drug plan premiums may vary. The average Part D premium in 2022 is $47.59 per month .1

What Are My Costs

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance.