A Medicare Private Fee-For-Service (PFFS) plan is a type of Medicare Advantage health plan offered by a private insurance company under contract to the Medicare program. The PFFS plan, rather than Medicare, largely determines how much it will pay for covered health-care services and how much members of the plan will pay.

Full Answer

Does Medicare Advantage offer much advantage?

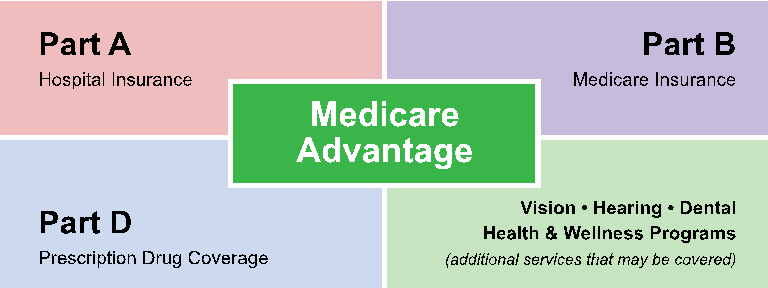

Medicare Advantage plans must offer everything Original Medicare covers except hospice care, which is still covered by Medicare Part A. Some Medicare Advantages plans offer extra benefits, such as prescription drug coverage, routine dental, routine vision, and wellness programs.

What does PFFS mean for Medicare?

PFFS stands for “Private Fee for Service,” and it is one type of Medicare Advantage plan. These plans, like all Medicare Advantage plans, are offered by private insurance companies contracted with Medicare, so the insurance company can determine what they will pay and what you will pay for your medical care.

What do you pay in a Medicare Advantage plan?

- Complete a new Medicare enrollment (unless you are in your initial or special enrollment period)

- Switch from Original Medicare to Medicare Advantage

- Enroll in a stand-alone Part D prescription drug plan (unless you are moving to Original Medicare from Medicare Advantage)

What is Medicare Advantage vs Medicare?

To start, Medicare Advantage provides a fixed set of options for you whereas Medicare provides you with a “buffet” style choice of options. For example, a 65-year-old has options regarding their health insurance plan/benefits.

What is a PFFS Medicare Advantage plan?

A Private Fee-For-Service (PFFS) plan is a Medicare Advantage (MA) health plan, offered by a State licensed risk bearing entity, which has a yearly contract with the Centers for Medicare & Medicaid Services (CMS) to provide beneficiaries with all their Medicare benefits, plus any additional benefits the company decides ...

What is the difference between original Medicare and PFFS plans?

Medicare PFFS (Private Fee-for-Service) plans Medicare PFFS plans differ in many ways from other Medicare Advantage plans. One significant difference is that the insurance company, not Medicare, determines how much it pays the provider and how much the beneficiary pays for a covered health service.

What does Pffs provide for?

NFS is an Internet Standard, client/server protocol developed in 1984 by Sun Microsystems to support shared, originally stateless, (file) data access to LAN-attached network storage. As such, NFS enables a client to view, store, and update files on a remote computer as if they were locally stored.

What is private fee-for-service plan?

A Medicare Private Fee-for-Service plan is a type of Medicare Advantage plan (Part C) administered by a private insurance company. The plan determines how much you must pay when you get care. Doctors decide whether to accept patients with PFFS plans.

Are prescription drugs covered in PFFS?

A PFFS is a type of Medicare Advantage plan, which often provides prescription drug coverage bundled into your plan. Check with the insurance company selling the PFFS plan to make sure prescription drugs are covered, unless you'd prefer to buy a separate Part D plan.

What percentage of the plan's payment schedule are private fee-for-service PFFS plans authorized to charge enrollees?

Costs. Because private insurance companies offer PFFS plans, the costs can vary between companies and locations. Medicare allows “balance billing,” which means that the PFFS plan providers can charge up to 15% of the total cost of deductibles, copayments, and other services.

What is a Medicare Advantage HMO Point of Service option?

What is an HMO-POS Medicare Advantage plan? An HMO-POS plan is a type of MA plan, and it stands for Health Maintenance Organization with a point-of-service option. It has a network of providers that members can use to receive care and services, and an HMO-POS plan will require you to select a PCP.

What is a private Medicare plan?

A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, with a few exclusions, for example, certain aspects of clinical trials which are covered by Original Medicare even though you're still in the plan.

How does a fee-for-service plan work?

Fee-for-service is a system of health insurance payment in which a doctor or other health care provider is paid a fee for each particular service rendered, essentially rewarding medical providers for volume and quantity of services provided, regardless of the outcome.

What to consider before deciding on a PFFS plan?

Another thing to consider before deciding on a PFFS plan is the network’s providers in your location. PFFS plans are only available where private organizations choose to offer them. If there is a particular provider that you are interested in seeing, you should contact their office to see if they accept the payment terms set by your PFFS plan.

What is Medicare Advantage Plan?

Medicare Advantage plans were created to solve the problem of large out-of-pocket expenses and gaps in coverage with Original Medicare. The Advantage program offers managed care that comes in several forms, including health maintenance organization (HMO) plans and preferred provider organization (PPO) plans. The organizations that offer these plans achieve savings by pooling healthcare resources into a network. Private Fee-for-Service (PFFS) plans are another kind of Medicare Advantage plan. Here are the basics of PFFS plans, according to the official U.S. government website for Medicare.

Is PFFS a good plan?

Whether or not PFFS plans are the right option for you depends on your use of medical services. If you anticipate that you will have few medical needs during the year, a PFFS plan is a good choice. This is because your costs are limited to your premium as well as the coinsurance or copayment for each service that you use.

Does PFFS cover drugs?

What about drug coverage? Some organizations offer drug coverage as part of their PFFS plan. However, if the plan you are considering does not cover drugs, you are can enroll in Medicare Part D, which is an insurance program that covers your drug costs in exchange for a premium.

What is PFFS plan?

Chapter 16a (PFFS Plan) of the Medicare Managed Care Manual. On May 27, 2011, CMS released a new Chapter 16a of the Medicare Managed Care Manual, "Private Fee-for-Service (PFFS) Plans.".

What is a private fee for service plan?

A Private Fee-For-Service (PFFS) plan is a Medicare Advantage (MA) health plan, offered by a State licensed risk bearing entity, which has a yearly contract with the Centers for Medicare & Medicaid Services (CMS) to provide beneficiaries with all their Medicare benefits, plus any additional benefits ...

What does PFFS mean?

PFFS stands for "Private Fee-for-Service." These plans provide Medicare benefits that can help cover out-of-pocket expenses not covered by Original Medicare (Parts A and B).

How many types of Medicare Advantage Plans are there?

There are five types of Medicare Advantage Plans: HMO, PPO, PFFS, SNP, and MSA. That's a lot of acronyms! Each of these types of Medicare Advantage plans is quite different, so you must understand each one.

What is Part A insurance?

Part A is your hospital insurance. You can think of this as your "room and board" for hospital stays. It offers coverage for inpatient hospital care, skilled nursing facility care, nursing home care, hospice, and home health care.

Does PFFS include dental insurance?

Like other Part C plans, PFFS may also offer additional benefits for dental care, vision, and health services. These are not included in your Original Medicare coverage.

Do PFFS plans require in-network providers?

PFFS plans, however, do not require their members to see only in-network health care providers.

Do you have to have a PCP for PFFS?

Members enrolled in a PFFS plan do not have to choose a primary care physician (PCP). Members also do not need to have a referral to see a specialist and may enjoy the same coverage outside of their network. These are all advantages unique to PFFS plans.

Do you have to stay in network for PFFS?

While not required to stay in-network for care, members with PFFS plans may end up paying more out-of-pocket if they receive care from a provider who will not accept the plan's payment terms. (There are even some PFFS plans that DO require their members to receive care from a specific network of providers except for in some cases of emergency treatment.)

How much does Medicare charge for PFFS?

Medicare allows “ balance billing ,” which means that the PFFS plan providers can charge up to 15% of the total cost of deductibles, copayments, and other services. In addition to a monthly premium that may be payable for a PFFS plan, a person will usually have to pay the Medicare Part B monthly premium.

What is PFFS insurance?

Private Fee-for-Service (PFFS) plans are one of four main types of Medicare Advantage policy that private insurance companies administer. The plans have specific rules relating to costs paid to healthcare providers. Private insurance companies offer Medicare Advantage plans to those who are eligible for Medicare benefits.

What is PFFS plan?

PFFS plans are another type of Medicare Advantage plan. A person who joins this plan can see a specialist without referrals, and they do not need to select a primary care physician (PCP). Individuals can visit any healthcare provider who agrees to accept the PFFS plan’s conditions and payment terms.

Why are HMO plans less expensive than Medicare Advantage plans?

Health Maintenance Organization (HMO) plans are usually less expensive than other Medicare Advantage plans because they use a network of contracted healthcare professionals, hospitals, and clinics. These service providers offer care to plan members at a discounted rate.

How much is PFFS 2021?

In 2021, the maximum out-of-pocket cost for PFFS plans is $7,550.

Why do people prefer PFFS?

Some individuals may prefer a PFFS plan because they do not have to choose a PCP, and they can see a specialist without a referral.

What is a preferred provider organization?

Preferred Provider Organization plans. Members typically use a network of health care providers, but they do not need to select a PCP to coordinate their care . A Preferred Provider Organization (PPO) plan usually provides benefits outside of the network with higher coinsurance or copayments.