- Medicare Plan G is the most comprehensive coverage you can buy if you became eligible for Medicare after December 31, 2019.

- Plan G has essentially the same benefits as Plan F, except for the Part B deductible.

- Annual premiums for Medicare Plan G typically cost between $1,500 and $2,000.

Full Answer

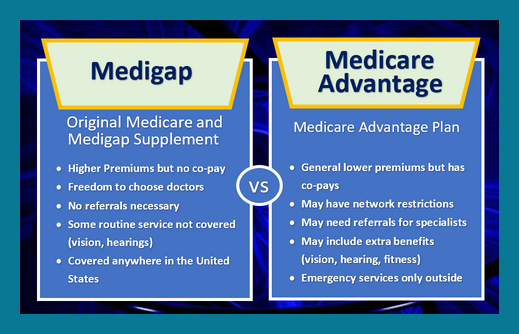

How much does a Medicare Advantage plan really cost?

Dec 03, 2021 · Medicare Plan G, a Medigap plan, pays for many of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Medicare Plan G, which is similar to Plan F, can be worth the cost if you expect significant medical bills during the year.

Which Medicare Advantage plan is the best?

Feb 19, 2020 · Medigap Plan G extends that coverage for up to 365 additional days once Original Medicare benefits are exhausted. For surgeries that require blood transfusion, Plan G pays for the first three pints. If a recipient requires skilled nursing care following an inpatient stay at a hospital, Plan G pays for the skilled nursing facility coinsurance charge.

Are there really any advantages to a Medicare Advantage plan?

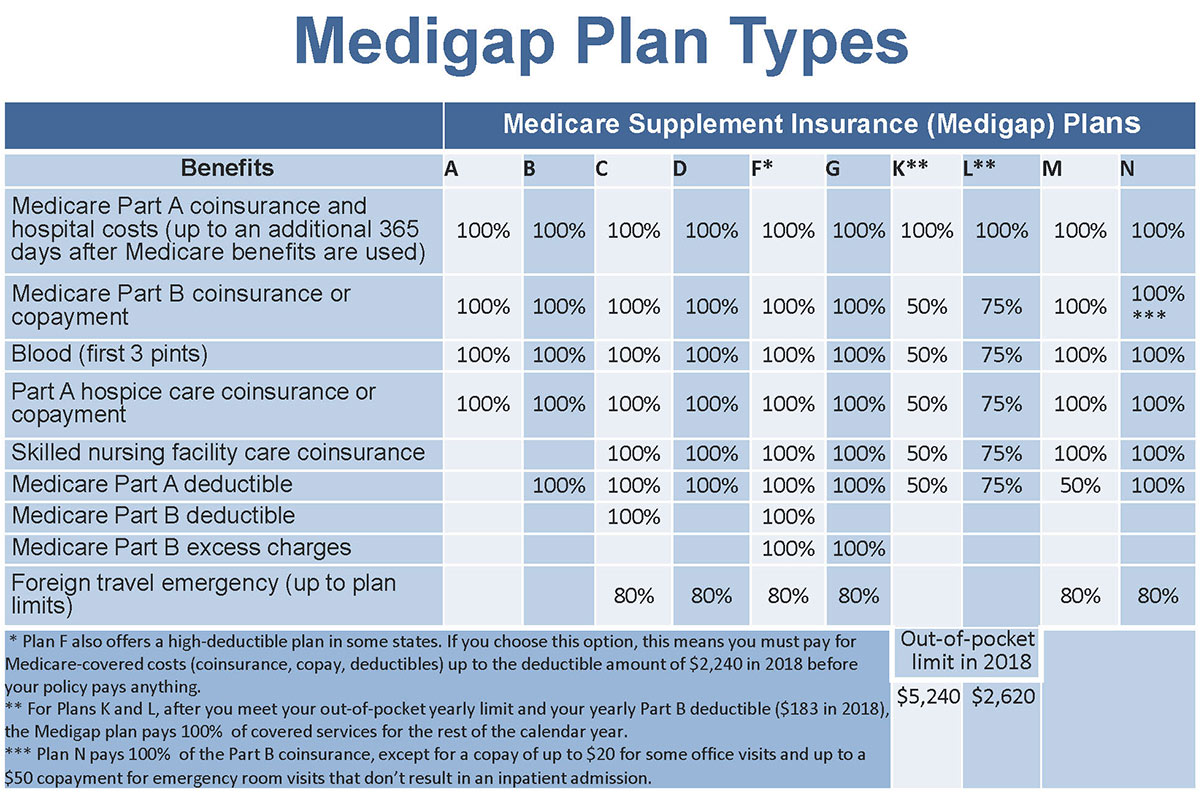

Feb 15, 2022 · Medicare Plan G is one of the standardized Medigap plans that covers more out-of-pocket Original Medicare (Part A and Part B) costs than other Medigap plans. Of the nine benefit areas included under Medicare Supplement Insurance, Plan G offers 100% coverage in seven areas and 80% coverage for foreign travel emergency care (which is the maximum …

How to select a Medicare Advantage plan?

Dec 07, 2021 · What Does Medicare Plan G Cover? Due to the phasing out of Medicare Plan F in 2020, Plan G (also known as Medigap Plan G) has become a popular choice among seniors to lower Medicare’s out-of-pocket expenses. As the table below shows, this is because Medicare Supplement Plan G offers comprehensive coverage over most of the basic benefits.

What is a Medicare plan G?

What Plan G does not cover?

What is the deductible for Plan G in 2022?

What is the deductible for Plan G in 2021?

What is the deductible for Plan G?

Why do doctors not like Medicare Advantage plans?

What is the difference between Plan G and high deductible plan G?

Does Medicare Part G cover prescriptions?

Who is eligible for high deductible plan G?

Does Medigap G have a deductible?

Are all Medigap plan G policies the same?

Does Medigap plan G pay Part A deductible?

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What is Medicare Plan G?

Plan G offers full coverage of the Part A deductible and the Part A coinsurance charges. Under Original Medicare, inpatient hospital stays are only covered for the first 90 days, with 60 lifetime reserve days available if recipients exceed ...

How long does Medicare plan G cover?

Under Original Medicare, inpatient hospital stays are only covered for the first 90 days, with 60 lifetime reserve days available if recipients exceed those 90 days. Medigap Plan G extends that coverage for up to 365 additional days once Original Medicare ...

How long is a hospital stay covered by Medicare?

Under Original Medicare, inpatient hospital stays are only covered for the first 90 days, with 60 lifetime reserve days available if recipients exceed those 90 days.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage plans can offer similar coverage options combined with prescription drug coverage, but recipients cannot enroll in both a Medicare Supplement ...

Does Medigap cover Part B?

Although it does not cover the Part B deductible, Plan G does cover costs related to Part B coinsurance or copayment charges.

How long does Medicare cover inpatient hospital stays?

Under Original Medicare, inpatient hospital stays are only covered for the first 90 days, with 60 lifetime reserve days available if recipients exceed those 90 days. Medigap Plan G extends that coverage for up to 365 additional days once Original Medicare benefits are exhausted.

What is Medicare Plan G?

Medicare Plan G can help give you greater cost certainty and protection from high out-of-pocket costs. Medicare Plan G value review: Medicare Plan G provides tremendous value as one of the more affordable Medigap plans offering among the most comprehensive coverage. We rate the value of Medicare Plan G as an “A+.”.

Is Medicare Supplement Plan F available?

Medicare Supplement Plan F is the only Medigap plan that offers more coverage than Plan G. However, Plan F is no longer available to new Medicare beneficiaries who became eligible for Medicare after January 1, 2020.

What is the deductible for Medicare Part B in 2021?

As previously mentioned, the only benefit area that is not covered by Plan G is the Medicare Part B deductible. However, the Part B deductible is only $203 per year in 2021. When you consider all of the out-of-pocket Medicare costs that are covered by Plan G, you may begin to appreciate the plan’s value.

How much is Medicare Part A deductible for 2021?

The Medicare Part A deductible for 2021 is $1,484 per benefit period, and you could potentially face multiple benefit periods within the same calendar year.

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

What is the deductible for 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is Medicare Plan G?

Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, we can probably help you on premiums by looking ...

What is Medicare Supplement Plan G?

Medicare Supplement Plan G covers your share of any medical benefit that Original Medicare covers, except for the outpatient deductible. So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, ...

Is Medicare Plan G the same as Plan F?

Medicare Plan G coverage is very similar to Plan F, which is no longer available for people who are new to Medicare on or after January 1st of 2021. Plan G offers great value for beneficiaries who are willing to pay a small annual deductible. After that, Plan G provides full coverage for all of the gaps in Medicare.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

Which is better, Plan F or Plan G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more than Plan G since it picks up the annual Part B deductible. COMPARE PLANS AND PRICING.

Does Medicare pay for inpatient hospital?

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay ...

Medicare Plan G Supplement Insurance Basics

Medicare Plan G is a subset of Medicare Supplement or Medigap insurance. Of the 10 plan types under the Medicare Supplement umbrella, Plan G is among the most popular.

Average Medicare Plan G Deductible Cost

Medicare Plan G policies generally don’t have a deductible, but some providers offer high deductible policies with low monthly premiums. In 2020, those policies require members to meet the $2,340 deductible before the policy kicks in to cover expenses. Remember, you still have to pay your Medicare Part B deductible of $198 (as of 2020).

FAQ: Fast Facts About Plan G

Plan G is designed to cover the gaps in Original Medicare coverage. It pays for your Medicare Part A coinsurance, copays, deductibles, and Medicare Part B coinsurance and copays. It does not cover the annual Medicare Part B deductible, which is $198 for 2020.

What does Medicare Supplement Plan G cover?

Plan G is a comprehensive Medigap policy. It pays for all of the following expenses in full:

Who is eligible to sign up for Medicare Supplement Plan G?

During Medigap open enrollment, you can purchase a Medigap policy for the first time. This is a 6-month term that begins the month you turn 65 and sign up for Medicare Part B.

Where can I get Medicare Supplement Plan G?

Private insurance firms sell Medigap policies. To get an idea of which plans are available in your area, visit Medicare’s search tool.

How much does Medicare Advantage cost?

Medicare Advantage plans typically have multiple copays with a maximum out-of-pocket cost limit of $4,000-$6,700/year. For years with high use of medical care including hospitalizations, the total cost (including premiums) of a Medicare Supplement Plan G approach will usually be less expensive.

What is the best Medicare Supplement Plan?

The simple answer is that a Medicare Supplement Plan G is the best option for most Medicare enrollees currently initially enrolling in a Medicare Supplement plan. (There is both a standard [low deductible] and a high deductible version of Plan G.

How much is Medicare Part B deductible in 2021?

Medicare Plan G with the standard (low) deductible has a $203 Medicare Part B deductible in 2021. This deductible amount is indexed to the inflation rate and will change annually. (Three states, Massachusetts, Minnesota, and Wisconsin, use a different system and the comments on this website don’t apply.) top of page.