Medicare is the federal health insurance program for:

- People who are 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What's the Medicare approved amount?

Medicare-allowed amounts are public information set on an annual basis. There is a set fee schedule available at data.cms.gov that allows you to view what Medicare approves for procedure codes and services. Among Medicare providers, 99% agree to the Medicare-allowed amount as payment in full, regardless of the amount they bill Medicare.

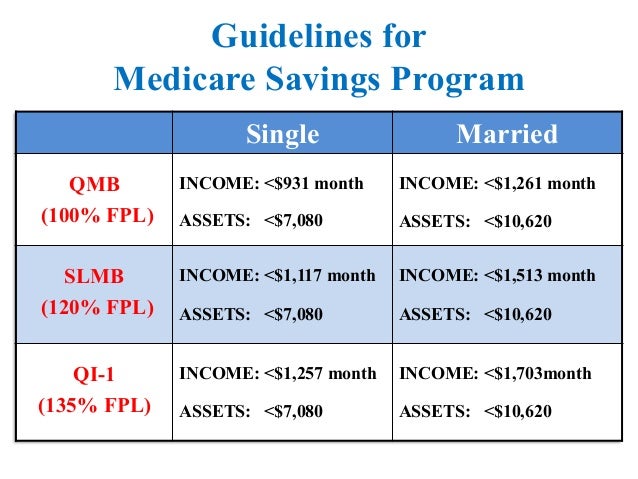

What are the guidelines for Medicare?

medicare allowable units. max allowables per month. pouches (codes vary) 60 units closed pouch. 20 units drainable pouch . 60 ea for closed pouches. 20 ea drainable bags. wafers (codes vary) 20 units. 20 wafers per month. a5120 skin prep wipes. 25 units. 25 ea per month. a4456 adhesive remover. 50 units. 1 bx/50 ea per month. a4367 ostomy belt. 1 unit. 1 ea per month. …

What is Medicare temporary allowance?

Nov 15, 2021 · Fee Schedules - General Information. A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis. CMS develops fee schedules for physicians, ambulance services, clinical ...

What are the reimbursement rates for Medicare?

Medicare reimbursement rates refer to the amount of money that Medicare pays to doctors and other health care providers when they provide medical services to a Medicare beneficiary. The Medicare reimbursement rate is also referred to by Medicare as the Medicare Physician Fee Schedule (MPFS). The payment schedule varies according to the service or item that is …

How do I find the Medicare allowable rate?

You can search the MPFS on the federal Medicare website to find out the Medicare reimbursement rate for specific services, treatments or devices. Simply enter the HCPCS code and click “Search fees” to view Medicare's reimbursement rate for the given service or item.Jan 20, 2022

What is the Medicare allowable for 99214?

A 99214 pays $121.45 ($97.16 from Medicare and $24.29 from the patient). For new patient visits most doctors will bill 99203 (low complexity) or 99204 (moderate complexity) These codes pay $122.69 and $184.52 respectively.

What is the 2021 Medicare conversion factor?

$34.8931This represents a 0.82% cut from the 2021 conversion factor of $34.8931. However, it also reflects an increase from the initial 2022 conversion factor of $33.5983 announced in the 2022 Medicare physician fee schedule final rule.Feb 7, 2022

What is the Medicare fee for 2021?

That is slightly less than the 2021 conversion factor of $34.8931, but more than the $33.59 that CMS planned to implement before S. 610 passed. The new conversion factor is included in updated spreadsheets on the CMS website. With the new conversion factor and other changes in S.Jan 3, 2022

How Much Does Medicare pay for 99214 in 2021?

$110.43By Christine Frey posted 12-09-2020 15:122021 Final Physician Fee Schedule (CMS-1734-F)Payment Rates for Medicare Physician Services - Evaluation and Management99214Office/outpatient visit est$110.4399215Office/outpatient visit est$148.3399417Prolng off/op e/m ea 15 minNEW CODE15 more rows•Dec 9, 2020

What percent of the allowable fee does Medicare pay the healthcare provider?

80 percentMedicare pays the physician or supplier 80 percent of the Medicare-approved fee schedule (less any unmet deductible). The doctor or supplier can charge the beneficiary only for the coinsurance, which is the remaining 20 percent of the approved amount.Jan 1, 2021

What is CMS Final Rule?

The Interoperability and Patient Access final rule (CMS-9115-F) put patients first by giving them access to their health information when they need it most, and in a way they can best use it.Dec 9, 2021

Has Medicare released the 2021 fee schedule?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

Did Medicare reimbursement go up in 2021?

In January 2021, CMS increased Medicare payments for outpatient E/M services an average of 8 percent for new patients and 35 percent for established patients.Jul 8, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What is not covered by Medicare?

Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.Jun 24, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Medicare Allowables

Below is a list of current Medicare allowable for ostomy supplies, urological supplies and wound care supplies . If you have any questions, reach out to our team today! We’re happy to help.

Wound Care Allowables

PLEASE NOTE: AMOUNT SENT IS BASED ON CHANGING FREQUENCY, NUMBER OF WOUNDS, AND DOCTORS ORDERS.

What is the Medicare Physician Fee Schedule?

The Medicare Physician Fee Schedule (MPFS) uses a resource-based relative value system (RBRVS) that assigns a relative value to current procedural terminology (CPT) codes that are developed and copyrighted by the American Medical Association (AMA) with input from representatives of health care professional associations and societies, including ASHA. The relative weighting factor (relative value unit or RVU) is derived from a resource-based relative value scale. The components of the RBRVS for each procedure are the (a) professional component (i.e., work as expressed in the amount of time, technical skill, physical effort, stress, and judgment for the procedure required of physicians and certain other practitioners); (b) technical component (i.e., the practice expense expressed in overhead costs such as assistant's time, equipment, supplies); and (c) professional liability component.

What are the two categories of Medicare?

There are two categories of participation within Medicare. Participating provider (who must accept assignment) and non-participating provider (who does not accept assignment). You may agree to be a participating provider (who does not accept assignment). Both categories require that providers enroll in the Medicare program.

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

When is the 2021 Medicare PFS final rule?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

What is the CY 2021 rule?

The calendar year (CY) 2021 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When will Medicare update payment policies?

This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022. This proposed rule proposes potentially misvalued codes and other policies affecting the calculation of payment rates. It also proposes to make certain revisions ...

What is the 2020 PFS rule?

The calendar year (CY) 2020 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When will CMS accept comments?

CMS will accept comments on the proposed rule until September 13, 2021, and will respond to comments in a final rule. The proposed rule can be downloaded from the Federal Register at: https://www.federalregister.gov/public-inspection.

When will Medicare update the PFS?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2019.

When Can I Get the Additional In-Home Payment for Administering the COVID-19 Vaccine?

You can get the additional payment for administering the COVID-19 vaccine in Medicare patients’ homes when either of these situations applies:

What Locations Qualify for the Additional In-Home Payment?

Many types of locations can qualify as a Medicare patient’s home for the additional in-home payment amount, such as:

What Other Restrictions Apply?

Medicare only pays the additional amount for administering the COVID-19 vaccine in the home if the sole purpose of the visit is to administer a COVID-19 vaccine. Medicare doesn’t pay the additional amount if you provide another Medicare service in the same home on the same date.

Standard 20% Co-Pay

- All Part B services require the patient to pay a 20% co-payment. The MPFS does not deduct the co-payment amount. Therefore, the actual payment by Medicare is 20% less than shown in the fee schedule. You must make "reasonable" efforts to collect the 20% co-payment from the beneficiary.

Non-Participating Status & Limiting Charge

- There are two categories of participation within Medicare. Participating provider (who must accept assignment) and non-participating provider (who does not accept assignment). You may agree to be a participating provider (who does not accept assignment). Both categories require that providers enroll in the Medicare program. You may agree to be a participating provider with …

Facility & Non-Facility Rates

- The MPFS includes both facility and non-facility rates. In general, if services are rendered in one's own office, the Medicare fee is higher (i.e., the non-facility rate) because the pratitioner is paying for overhead and equipment costs. Audiologists receive lower rates when services are rendered in a facility because the facility incurs overhead/equipment costs. Skilled nursing facilities are the …

Geographic Adjustments: Find Exact Rates Based on Locality

- You may request a fee schedule adjusted for your geographic area from the Medicare Administrative Contractor (MAC) that processes your claims. You can also access the rates for geographic areas by going to the CMS Physician Fee Schedule Look-Up website. In general, urban states and areas have payment rates that are 5% to 10% above the national average. Likewise, r…

Multiple Procedure Payment Reductions

- Under the MPPR policy, Medicare reduces payment for the second and subsequent therapy, surgical, nuclear medicine, and advanced imaging procedures furnished to the same patient on the same day. Currently, no audiology procedures are affected by MPPR.