Social Security has a tax rate of 6.2% and Medicare has a tax rate of 1.45%. In the example above, Bob’s Social Security taxes would be calculated as follows: One of the differences between Social Security and Medicare is that Social Security is taxed only on the first $127,200 of taxable wages, or $7,886.40 in taxes.

What percentage is Social Security and Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers.

Who is exempt from Social Security and Medicare withholding?

Who is exempt from Social Security and Medicare withholding? The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 ...

How to pay Social Security and Medicare taxes?

Understanding Employment Taxes

- Federal Income Tax. Employers generally must withhold federal income tax from employees' wages. ...

- Social Security and Medicare Taxes. ...

- Additional Medicare Tax. ...

- Federal Unemployment (FUTA) Tax. ...

- Self-Employment Tax. ...

How do you calculate Medicare taxes?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including:

- lowered premiums for Medicare Advantage plans

- lowered prescription drug costs

- closure of the Part D benefit gap, or “ donut hole ”

- inclusion of free vaccines

- inclusion of free preventative care services

- inclusion of free screenings for depression, heart disease, diabetes, and some cancers

- increased chronic care management programs

What is the Medicare tax limit for 2020?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

What is made up of Social Security taxes and Medicare taxes?

What is FICA? FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck.

What is the FICA tax rate for 2021?

7.65%For 2021, the FICA tax rate for employers is 7.65%—6.2% for OASDI and 1.45% for HI (the same as in 2020). 2021 updates. For 2021, an employee will pay: 6.2% Social Security tax on the first $142,800 of wages (maximum tax is $8,853.60 [6.2% of $142,800]), plus.

Is Social Security tax and Medicare tax federal taxes?

FICA is comprised of the following taxes: 6.2 percent Social Security tax; 1.45 percent Medicare tax (the “regular” Medicare tax); and....Calculating the medicare surtax withholding amount.Filing StatusThreshold AmountMarried filing jointly - COMBINED INCOME$250,000Married filing separately$125,0001 more row

Does everyone pay Medicare tax?

Who pays the Medicare tax? Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.

How much tax is taken off my paycheck?

Overview of California TaxesGross Paycheck$3,146Federal Income15.22%$479State Income4.99%$157Local Income3.50%$110FICA and State Insurance Taxes7.80%$24623 more rows

How do you calculate FICA and Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

What percentage of Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

Why was no federal income tax withheld from my paycheck 2021?

Reasons Why You Might Not Have Paid Federal Income Tax You Didn't Earn Enough. You Are Exempt from Federal Taxes. You Live and Work in Different States. There's No Income Tax in Your State.

Why is Medicare taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

What percent is Social Security tax?

6.2 percentSocial Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

What is the tax rate for Social Security?

6.20%NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the percentage of Social Security tax?

So, the total Social Security tax rate percentage is 12.4%. Only the employee portion of Social Security tax is withheld from your paycheck.

How much Medicare tax is withheld from paycheck?

There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000.

Do you have to file Medicare taxes if you are married?

If you’re married, you might not have enough Medicare taxes withheld. If you’re married filing jointly with earned income over $250,000, you’re subject to an additional tax. This also applies to married filing separately if your income is over $125,000.

How much is Medicare tax for 2021?

The amount increased to $142,800 for 2021. (For SE tax rates for a prior year, refer to the Schedule SE for that year). All your combined wages, tips, and net earnings in the current year are subject to any combination of the 2.9% Medicare part of Self-Employment tax, Social Security tax, or railroad retirement (tier 1) tax.

What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

What is Self-Employment Tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners.

What is Schedule C for self employed?

If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-emplo yment. If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total ...

Does the 1040 affect self employment?

This deduction only affects your income tax. It does not affect either your net earnings from self-employment or your self-employment tax. If you file a Form 1040 or 1040-SR Schedule C, you may be eligible to claim the Earned Income Tax Credit (EITC).

Is self employment tax included in Medicare?

Self-Employment Tax (Social Security and Medicare Taxes) It should be noted that anytime self-employment tax is mentioned, it only refers to Social Security and Medicare taxes and does not include any other taxes that self-employed individuals may be required to file. The list of items below should not be construed as all-inclusive.

Do you pay Medicare on your wages?

However, you must pay the 2.9% Medicare part of the SE tax on all your net earnings.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How Much Is the Medicare Tax Rate in 2021?

The 2021 Medicare tax rate is 2.9%. You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. Learn more.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What are the taxes that are withheld from paychecks?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax.

What is the additional tax rate for 2021?

The additional tax (0.9% in 2021) is the sole responsibility of the employee and is not split between the employee and employer.

How many parts are there in self employed tax?

The self-employed tax consists of two parts:

What is the Social Security tax rate?

The Social Security tax rate is the sum of the retirement, survivors, and disability insurance tax rate and the hospital insurance tax rate on the wages. The following chart shows the rates that apply to both employers and employees: 1 The Hiring Incentives to Restore Employment (HIRE) Act exempted employers from the employer’s share ...

Do employers pay Social Security taxes?

Employers and employees pay Social Security and Medicare taxes at the same rate on wages up to the maximum amounts creditable for each program for the year. (See � 1301 .) Certain employers did not pay Social Security Tax for qualified new hires for most of 2010. For 2011, employees paid Social Security tax at a lower rate than employers.

How much is Medicare payroll tax?

Medicare Payroll Tax. The Medicare payroll tax is 1.45% and is based on each employee's earnings without limit. The Medicare tax is withheld from each employee's earnings and is also matched by the employer. This makes the total Medicare tax equal to 2.9% on every dollar of earnings.

What is the Social Security payroll tax rate for 2020?

In the calendar year 2020, the Social Security payroll tax rate of 6.2% is applied to each employee's earnings up to the maximum of $137,700. The 6.2% that is withheld from the employee is also matched by the employer. As a result, the total Social Security tax in 2020 for an employee is equal to 12.4% of each employee's annual earnings up to a maximum earnings amount of $137,700.

What is the FICA rate?

FICA Payroll Tax. The combination of Social Security taxes and Medicare taxes is referred to as FICA. We often refer to the FICA tax rate as 7.65% (6.2% Social Security + 1.45% Medicare) of each employee's first $137,700 of annual earnings in 2020 and the first $142,800 of annual earnings in 2021. Each employee's earnings in excess ...

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

What is the Medicare tax rate if you make more than the threshold?

The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional Medicare tax of 0.9%.

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

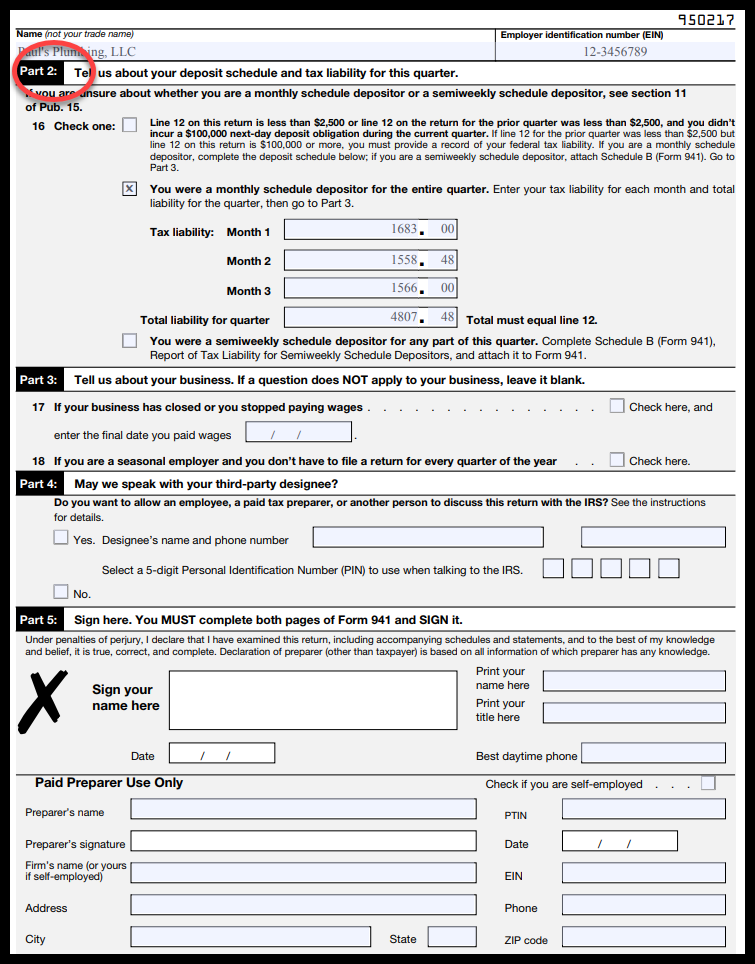

What is the most important tax to stay on top of and get correct?

FICA taxes are the most important tax to stay on top of and get correct. Not withhold or paying the correct amount of FICA taxes will result in serious consequences for the employer. All businesses must report FICA taxes quarterly to the IRS using Form 941.

What happens if you don't pay Social Security taxes?

If an employee makes more than the set $132,900, Social Security tax should not be withheld from their pay for any earning made above this amount. If you do not follow Social Security, Medicare, or FICA instruction carefully, you may end up either not deducting enough or too much.

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...

Do self employed pay Social Security taxes?

Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900. The employer must match the amount paid by the employee.

What are the tax rates for Social Security and Medicare?

Social Security has a tax rate of 6.2% and Medicare has a tax rate of 1.45%. In the example above, Bob’s Social Security taxes would be calculated as follows:

How much tax do you pay on Medicare?

There are no tax limits for Medicare. You will pay taxes at a rate of 1.45% on all of your taxable wages. In addition, employers are required to withhold Additional Medicare tax of 0.9% once taxable wages are over $200,000 for the year.

Why do Medicare and Social Security go hand in hand?

Social Security and Medicare taxes go hand in hand. One reason for this is because the taxable wages for these two taxes are generally the same. The taxable wages for Social Security and Medicare taxes are defined below:

What is the Social Security tax limit for 2017?

Social Security tax limit for 2017 is $7,886.40. One of the differences between Social Security and Medicare is that Social Security is taxed only on the first $127,200 of taxable wages, or $7,886.40 in taxes. Once you hit that limit, you will no longer be taxed for Social Security in 2017.

What are the big amounts that come out of our paychecks?

Some big amounts that come out of our paychecks are for Social Security and Medicare taxes. How are they calculated? Read on for a complete guide.

Is 401(k) income taxable?

For Social Security and Medicare, deferred income (401k, 403b, Simple IRA’s, etc.) is considered taxable and not subtracted from gross pay. Using Bob again as our example:

Is there a cap on Medicare taxes?

There is no Medicare cap, and employers are required to withhold an additional Medicare Tax of 0.9% for wages over $200,000. Now that we’ve covered Social Security and Medicare taxes, we’ll tackle state taxes in our next segment. Bookmark ( 0) Please login to bookmark. Username or Email Address.

What is the Social Security payroll tax rate for 2021?

The employer's Social Security payroll tax rate for 2021 (January 1 through December 31, 2021) is 6.2% of each employee's first $142,800 of wages, salaries, etc. (This amount is identical to the employee's Social Security tax that is withheld from the employee's wages, salaries, etc.) If an employee's wages, salaries, etc. are greater than $142,800, the amount in excess of $142,800 is not subject to the Social Security tax. Hence, the maximum amount of the employer's Social Security tax for each employee in 2021 is $8,853.60 (6.2% X $142,800).

What is the maximum Social Security tax for 2020?

exceed $137,700, the amount in excess of $137,700 is not subject to the Social Security tax. Hence, the maximum amount of the employer's Social Security tax for each employee in 2020 is $8,537.40 (6.2% X $137,700).

How much is Social Security 2020?

If an employee's 2020 wages, salaries, etc. exceed $137,700, the amount in excess of $137,700 is not subject to the Social Security tax.

Is $142,800 a Social Security amount?

If an employee's wages, salaries, etc. are greater than $142,800, the amount in excess of $142,800 is not subject to the Social Security tax.

Does an employer have to pay payroll tax on Social Security?

Since employees also have the Social Security payroll tax withheld from their wages, salaries, etc., the employer is in effect matching each employee's Social Security payroll tax. The employer must remit both the amounts withheld from employees' wages and the employer's matching amount to the U.S. government.