Qualified Medicare Beneficiary (QMB) is a Medicaid program for people who are already receiving Medicare benefits. The purpose of the program is to reduce the cost of medications and copays for doctors, hospitals, and medical procedures.

What if beneficiary is Medicaid recipient?

Medicaid recipients should contact a Medicaid planner as soon as possible upon knowledge they will be receiving, or have received, an inheritance. In fact, it is highly encouraged one do so prior to reporting the inheritance to the Medicaid agency. Professional Medicaid planners can assist Medicaid beneficiaries in many ways.

Does a Medicaid beneficiary have to pay back th?

You may find yourself no longer eligible for Medicaid and even have to pay back Medicaid for health care services rendered. It's important to understand how Medicaid works and your responsibilities as a Medicaid recipient.

Do Medigap payments go directly to the beneficiary?

Medigap payments go directly to the beneficiary. False. But occasionaly true if the the beneficiary submits for payments paid at time of service.

How to become a beneficiary?

Beneficiary Forms. You may complete 4 different beneficiary forms. If you are satisfied with the Order of Precedence you do not need to file any designations. If you do, it’s important to ensure your designations are current. A designation will still be valid even if your relationship or family situation has changed. Form (SF1152).

What is Medicare beneficiary?

Beneficiary means a person who is entitled to Medicare benefits and/or has been determined to be eligible for Medicaid.

Who are the primary beneficiaries of Medicare?

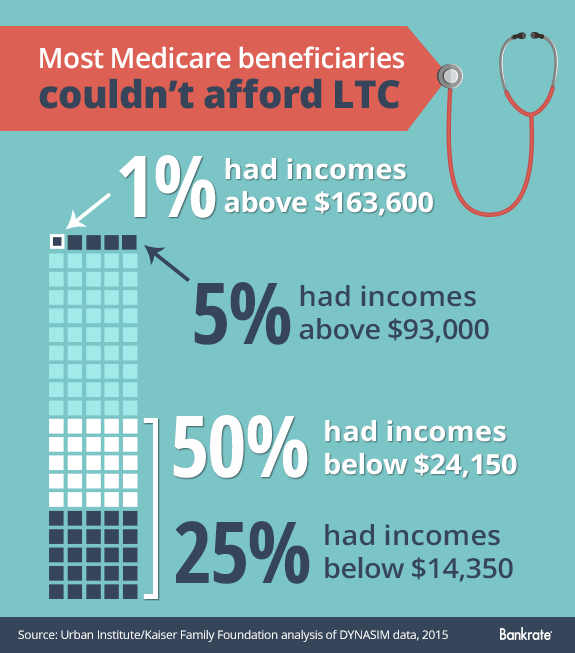

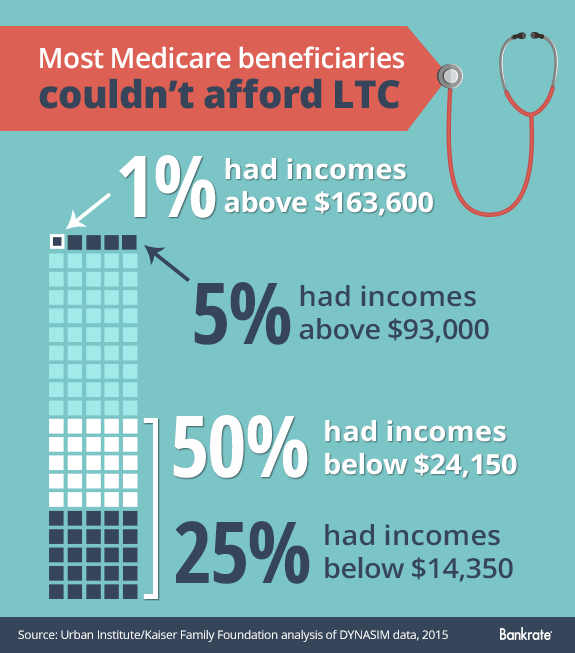

Most Medicare beneficiaries who receive Medicaid are female (60%), over age 65 (61%), and white (56%) (Figure 1). Medicare beneficiaries who receive Medicaid have low incomes and few assets and are typically poorer than other Medicare beneficiaries.

What is QMB stand for?

State of California—Health and Human Services Agency. QUALIFIED MEDICARE BENEFICIARY (QMB), SPECIFIED LOW-INCOME MEDICARE BENEFICIARY (SLMB), AND QUALIFYING INDIVIDUALS (QI) APPLICATION.

Does Medicare cover beneficiaries?

The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.

What is the difference between Medicare and Medicaid?

The difference between Medicaid and Medicare is that Medicaid is managed by states and is based on income. Medicare is managed by the federal government and is mainly based on age. But there are special circumstances, like certain disabilities, that may allow younger people to get Medicare.

When a patient is covered through Medicare and Medicaid which coverage is primary?

gov . Medicare pays first, and Medicaid pays second . If the employer has 20 or more employees, then the group health plan pays first, and Medicare pays second .

Is QMB the same as Medicare?

What Is The QMB Program? The QMB Program is a Medicare Savings Program (MSP) for people who have Medicare, but need help affording certain Medicare costs. QMB typically covers Medicare Part A and Part B premiums as well as deductibles, coinsurance, and copayments.

Can you have Medicare and Medicaid?

Medicare-Medicaid Plans Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They're called Medicare-Medicaid Plans.

What does QMB without Medicare dollars mean?

This means that if you have QMB, Medicare providers should not bill you for any Medicare-covered services you receive.

What is the meaning of beneficiary details?

Definition: In life insurance, the beneficiary is the person or entity entitled to receive the claim amount and other benefits upon the death of the benefactor or on the maturity of the policy. Description: Generally, a beneficiary is a person who receives benefit from a particular entity (say trust) or a person.

What's the difference between dependent and beneficiary?

A dependent is a person who is eligible to be covered by you under these plans. A beneficiary can be a person or a legal entity that is designated by you to receive a benefit, such as life insurance.

How many Medicare beneficiaries are there?

Description: The number of people enrolled in Medicare varied by state. There were a total of 64.4 million Medicare beneficiaries in 2019.

What happens when Medicare beneficiaries have other health insurance?

When a Medicare beneficiary has other insurance (like employer group health coverage), rules dictate which payer is responsible for paying first. Please review the Reporting Other Health Insurance page for information on how and when to report other health plan coverage to CMS.

What is Medicare for seniors?

Medicare is a health insurance program designed to assist the nation's elderly to meet hospital, medical, and other health costs. Medicare is available to most individuals 65 years of age and older.

What is the CMS?

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that manages Medicare. When a Medicare beneficiary has other health insurance or coverage, each type of coverage is called a "payer.". "Coordination of benefits" rules decide which one is the primary payer (i.e., which one pays first). To help ensure that claims are paid ...

How long does it take for Medicare to pay a claim?

When a Medicare beneficiary is involved in a no-fault, liability, or workers’ compensation case, his/her doctor or other provider may bill Medicare if the insurance company responsible for paying primary does not pay the claim promptly (usually within 120 days).

Does Medicare pay a conditional payment?

In these cases, Medicare may make a conditional payment to pay the bill. These payments are "conditional" because if the beneficiary receives an insurance or workers’ compensation settlement, judgment, award, or other payment, Medicare is entitled to be repaid for the items and services it paid.

Can a trust pay a beneficiary?

With either example, AGED as the Trustee may use the money in the trust to pay bills and expenses for the individual (known as the beneficiary), as long as the expenses are for the sole benefit of the beneficiary, and are not paid for by government benefits. Examples of bills paid from the trust include, but are not limited to, mortgage, rent, facility bills, utilities, repairs, auto insurance, auto payment, etc. However, the trust cannot pay the beneficiary directly, as this could disqualify them from the QMB program.

Does Medicare pay for hospital visits?

No copays for doctors, hospital visits, or medical procedures for Medicare approved expenses.

Does Medicaid count overage?

Setting up a Pooled Trust allows you to place your over income and/or over asset (or both) into the trust, making this overage no longer “countable” for Medicaid purposes. This means that while Medicaid acknowledges your total income and/or assets, they deduct the income and/or assets placed into the trust from the total, so that it no longer counts against you.

What is QMB in Medicare?

The Qualified Medicare Beneficiary ( QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.

Can a QMB payer pay Medicare?

Billing Protections for QMBs. Federal law forbids Medicare providers and suppliers, including pharmacies, from billing people in the QMB program for Medicare cost sharing. Medicare beneficiaries enrolled in the QMB program have no legal obligation to pay Medicare Part A or Part B deductibles, coinsurance, or copays for any Medicare-covered items ...

Which pays first, Medicare or Medicaid?

Medicare pays first, and. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. pays second.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

What is not covered by Medicare?

Offers benefits not normally covered by Medicare, like nursing home care and personal care services

Does Medicare have demonstration plans?

Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They’re called Medicare-Medicaid Plans. These plans include drug coverage and are only in certain states.

Does Medicare cover health care?

If you have Medicare and full Medicaid coverage, most of your health care costs are likely covered.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. . If you have Medicare and full Medicaid, you'll get your Part D prescription drugs through Medicare.

Can you get medicaid if you have too much income?

Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid. The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid. In this case, you're eligible for Medicaid because you're considered "medically needy."

What are other Medicare and Medicaid assistance programs?

QMB is not the only program available to dual-eligible beneficiaries. Others include:

How does Medicaid QMB work?

In addition to covering Medicare premiums for eligible QMB recipients, one of the benefits of the QMB program is having protection from improper billing. Improper billing refers to when health care providers inappropriately bill a beneficiary for deductibles, copayments or coinsurance.

What is QMB insurance?

The QMB program helps pay for the full cost of Medicare Part A and Part B premiums along with complete coverage of deductibles, copayments and coinsurance. QMB offers the most comprehensive coverage of the programs available to dual-eligible beneficiaries.

What does QMB mean in Medicare?

QMB stands for “Qualified Medicare Beneficiary” and is a cost assistance program designed to help individuals who are eligible for both Medicare and Medicaid, a circumstance that is known as “dual eligibility.”

What is a dual eligible special needs plan?

This is a particular type of Medicare Advantage plan with a benefits package that is tailored to the needs of those with the limited income and resources common among Medicaid recipients.

Do you have to be on Medicare to qualify for QMB?

You must be eligible for both Medicare and Medicaid to be eligible for QMB benefits. While Medicare’s eligibility requirements are federally mandated, each state may set its own qualifying restrictions for Medicaid.

Does QMB cover Medicaid?

The QMB improper billing protection even extends to health care providers who do not accept Medicaid. That means QMB members may receive care from a provider who does not accept Medicaid and still receive protection from deductibles, copayments and coinsurance.

What other Medicare Savings Programs are there?

SLMB is just one of the available Medicare Savings Programs. Others include:

What is SLMB in Medicare?

The Specified Low-income Medicare Beneficiary (SLMB) program is a type of Medicare Savings Program designed to help qualified beneficiaries – many of whom also have Medicaid – pay their Medicare Part B premiums.

Who sells dual eligible special needs plans?

Dual-eligible Special Needs Plans and other Medicare Advantage plans are sold by private insurance companies. For help comparing plans, you can look at plans online or call to speak with a licensed insurance agent for information about eligibility and enrollment.

Is there Medicaid assistance for Medicare Advantage beneficiaries?

Individuals who qualify for both Medicare and Medicaid are considered “dual eligible” and may qualify for a certain type of Medicare Advantage plan called a Special Needs Plan. And one particular type of Special Needs Plan is a Dual Eligible Special Needs Plan (D-SNP).

What is qualified Medicare Beneficiary?

The Qualified Medicare Beneficiary program works to help cover Medicare Part A and Part B premiums, as well as the costs of coinsurance, copayments, and deductibles. All of these costs can add up quickly, especially if you require a variety of different medical services. This program is able to provide full payment of both ...

What is the difference between Medicare and Medicaid?

Original Medicare is available to individuals 65 years of age or older and individuals with certain disabilities. Medicaid insurance caters to individuals with low income and provides an affordable, government-funded healthcare option for this demographic. The QMB program has specific income requirements that must be met, ...

What does QMB mean for medicaid?

What Does Medicaid QMB Cover? Medicaid QMB, which stands for Qualified Medicare Beneficiary , is a program designed specifically for individuals that qualify for both Medicare and Medicaid coverage and that are financially unstable.

Is Medigap covered by QMB?

It is important to note that if you are currently using a Medigap plan, the premiums associated with it are not covered by the QMB program. In addition, you should also be aware that states can impose laws specific to Medicaid, Medicare, and QMB programs.

Can you be billed for Medicare Part A and Part B?

This means that you should not be billed for any approved care you receive under Medicare Part A or Part B that is received at a Medicare-approved facility by an approved provider. There should be no major exceptions to this other than the restrictions on care that Original Medicare puts in place.

Do you have to accept Medicare and QMB?

They must accept Medicare and QMB payment for their services and recognize this payment as being the full amount of the cost of service . Improper billing protections prevent individuals using the QMB program from being responsible for any cost-sharing expenses, no matter their origin.

What information is on my Medicare card?

There is additional important information located on your Medicare card for you and your doctor. This includes your name and sex. Additionally, it states whether you have Medicare Part A (inpatient hospital) and Medicare Part B (outpatient medical), and lists the dates that Part A and B first started.

What is a B1 beneficiary?

B1 is for a husband of a primary beneficiary at age 62 or over. B2 is for a young wife with a child in her care, B3 is for an aged wife over the age of 62 who is a second claimant. B5 is also a second claimant wife, but they are under the age of 62 and have a child in their care.

What do I do if I lose my Medicare card with my number on it?

If damaged, lost or stolen, you can request a new Medicare card from Social Security.

What do the codes following my Social Security number mean?

Some people still keep and use the original copy of their red, white, and blue Medicare card containing their Social Security number.

What happens if you lose your Medicare card?

If you lose your Medicare card with your number on it, you can request that the Social Security Administration replace your card at no charge. The Medicare Beneficiary Identifier is for claims, billing and identification purposes.

What is a MBI number?

Formerly, the MBI was the Medicare Claim Number, but it contained a beneficiary’s Social Security number. For identity protection, the MBI replaces it.

What does it mean when you have an A on your Social Security card?

If you have an A on your card, it means that you are the primary beneficiary. That means you earned Medicare insurance based on your working history and tax credits.

What is estate recovery for Medicaid?

For individuals age 55 or older, states are required to seek recovery of payments from the individual's estate for nursing facility services, home and community-based services, and related hospital and prescription drug services.

Can you recover Medicaid from a deceased spouse?

States may not recover from the estate of a deceased Medicaid enrollee who is survived by a spouse, child under age 21, or blind or disabled child of any age. States are also required to establish procedures for waiving estate recovery when recovery would cause an undue hardship.

Can Medicaid be liens on property?

States may impose liens for Medicaid benefits incorrectly paid pursuant to a court judgment. States may also impose liens on real property during the lifetime of a Medicaid enrollee who is permanently institutionalized, except when one of the following individuals resides in the home: the spouse, child under age 21, blind or disabled child of any age, or sibling who has an equity interest in the home. The states must remove the lien when the Medicaid enrollee is discharged from the facility and returns home.