A Medicare benefit period is how Medicare measures and pays for your care when you’re an inpatient at a hospital or skilled nursing facility. Over the course of your benefit period, the amount you may need to pay for your care will vary.

Full Answer

What is a Medicare payment amount?

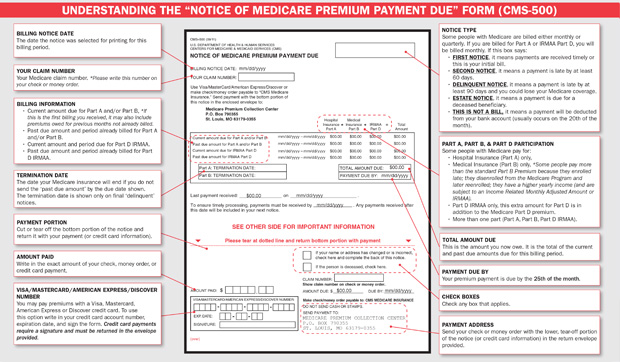

Medicare Part B (Medical Insurance) premium deducted automatically from their Social Security benefit payment (or Railroad Retirement Board benefit payment). If you don't get benefits from Social Security (or the Railroad Retirement Board), you'll get a premium bill from Medicare. Get a sample of the Medicare bill.

What does Medicare mean on my paycheck?

Apr 06, 2022 · Medicare is the federal health insurance program for people: Age 65 or older. Under 65 with certain disabilities. Any age with end-stage renal disease. This is permanent kidney failure requiring dialysis or a kidney transplant. Medicare has four parts: Part A is hospital insurance. Part B is medical insurance.

How do Medicare payment systems work?

Apr 02, 2020 · The Medicare tax is an automatic payroll deduction that your employer collects from every paycheck you receive. The tax is applied to regular earnings, tips, and bonuses. The tax is collected from all employees regardless of their age.

What do you mean by Medicare prepayment?

CMS started the Outpatient Prospective Payment System (OPPS) under section 1833(t) of the Social Security Act to pay: Medicare Part B hospital outpatient items and services; Medicare Part B inpatient hospital services when Medicare can’t pay under Part A because a patient exhausted their Part A benefits or they aren’t entitled to them

What do Medicare benefits mean?

What is the meaning of Medicare payment?

Where does Medicare payment come from?

What Medicare benefit adds money to Social Security?

Why is Medicare sending me a bill?

Why is my Medicare bill so high?

Does Medicare come out of your Social Security check?

How much does Medicare take out of Social Security in 2021?

Are Medicare premiums deducted from Social Security?

Is there really a $16728 Social Security bonus?

Is Medicare Part A and B free?

How do you qualify to get 144 back from Medicare?

Medicare Eligibility, Applications, and Appeals

Find information about Medicare, how to apply, report fraud and complaints.What help is available?Medicare is the federal health insurance program...

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 to the Social Secur...

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.EligibilityPrescript...

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:Log into your MyMedicare.gov account and reque...

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.Original Medica...

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Medicare Eligibility, Applications and Appeals

Find information about Medicare, how to apply, report fraud and complaints.

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 ( PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA ( 1-800-772-1213) to get this form.

Do you have a question?

Ask a real person any government-related question for free. They'll get you the answer or let you know where to find it.

What is Medicare tax?

The Medicare tax is an automatic payroll deduction that your employer collects from every paycheck you receive. The tax is applied to regular earnings, tips, and bonuses. The tax is collected from all employees regardless of their age.

What is the tax rate for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income. Your employer also pays a matching Medicare tax based on your paycheck. There are two ways that you may see the Medicare payroll deduction applied to your paycheck.

When was Medicare enacted?

When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act (FICA) are to support both your Social Security and Medicare benefits programs.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

How long does Medicare cover inpatient hospital care?

The inpatient hospital benefit covers 90 days of care per episode of illness with an additional 60-day lifetime reserve.

What is a physician order?

The physician order meets 42 CFR Section 412.3 (b), which states: A qualified, licensed physician must order the patient’s admission and have admitting privileges at the hospital as permitted by state law. The physician is knowledgeable about the patient’s hospital course, medical plan of care, and current condition.

What is Medicare Part A and Part B?

Medicare Part A and Part B are designed to cover inpatient and outpatient expenses. Part A is designed specifically for inpatient stays in hospitals, skilled nursing facilities, and hospice care.

How much is Medicare Part B deductible?

In addition to the premium payments, Medicare Part B also requires an annual deductible to be met. In 2020, the deductible is set to $198. You will need to pay this amount completely out of pocket before Medicare will begin covering your services. Once you have met your deductible, you will then pay a coinsurance of 20 percent ...

What is the deductible for Medicare Part B 2020?

In addition to the premium payments, Medicare Part B also requires an annual deductible to be met. In 2020, the deductible is set to $198. You will need to pay this amount completely out of pocket before Medicare will begin covering your services.

How much is the 2020 Medicare deductible?

In 2020, the deductible is set to $198. You will need to pay this amount completely out of pocket before Medicare will begin covering your services. Once you have met your deductible, you will then pay a coinsurance of 20 percent of the Medicare-approved amount.

How much coinsurance do you pay for Medicare?

Once you have met your deductible, you will then pay a coinsurance of 20 percent of the Medicare-approved amount. This amount is pre-set by Medicare and sets a limit as to the maximum amount they will pay for a service.

What is covered under Part B?

Injections, physical therapy, or other modalities are also often covered under Part B as they are used to treat a condition. Durable medical equipment required after an injury, procedure, or diagnosis is also covered.

What is medically necessary?

Medically necessary services may also include clinical research studies, such as sleep studies, to evaluate your breathing patterns or to diagnose a condition, such as sleep apnea. Ambulance rides also fall under the category of medically necessary services covered by Part B. Preventive services are those that are used to help prevent an illness ...

How long does Medicare pay for care?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days ...

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

How long do you stay in the hospital after being discharged?

You’re in the hospital for about 10 days and then are discharged home. Unfortunately, you get sick again 30 days after you were discharged. You go back to the hospital and require another inpatient stay.

How long can you use your lifetime reserve days?

After 90 days, you’ll start to use your lifetime reserve days. These are 60 additional days beyond day 90 that you can use over your lifetime. They can be applied to multiple benefit periods. For each lifetime reserve day used, you’ll pay $742 in coinsurance.