What's on a pay stub?

What’s On A Pay Stub? Personal and Check information includes your personal information, filing status (single or married), as well as the withholding number, according to your IRS form W-4. The earnings section shows your earnings from the pay period and includes overtime.

Do insurance contributions show up on pay stubs?

If you have insurance provided by your employer, your insurance contributions will show up on each pay stub. Sometimes an entry may be labeled “pretax,” which indicates that you are paying for that insurance before you are taxed and won’t have to pay tax on that amount.

What are some common pay stub deduction codes?

Common pay stub deduction codes include the self-explanatory 401K for retirement savings contributions and 401K ER, which refers to an employer’s contribution if the employee receives a company match. However, this is by no means an exhaustive list.

How can I get a copy of my pay stubs?

If you want to see your pay stubs, your employer can generate them and email them to you, give them to you directly, or make them available on a secure company website for employees. Ask about these options if you don’t currently receive a pay stub.

Why am I being charged for Medicare on my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

Is Medicare deducted from paycheck?

The Medicare tax is one of the federal taxes withheld from your paycheck if you're an employee or that you are responsible for paying yourself if you are self-employed.

When did Medicare start being deducted from paychecks?

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though it's still below the Social Security tax rate.

What are the 5 mandatory deductions from your paycheck?

Mandatory Payroll Tax DeductionsFederal income tax withholding.Social Security & Medicare taxes – also known as FICA taxes.State income tax withholding.Local tax withholdings such as city or county taxes, state disability or unemployment insurance.Court ordered child support payments.

Why was Social Security not taken out of my paycheck?

After your earnings exceed the taxable maximum for that year at a given job, Social Security taxes will stop being withheld and you will notice a bump in your paychecks. "Once you bump up against the $142,800, then the net amount of your paycheck just increases," Clark says.

How much can you give to a couple without reporting?

Married couples, as two individuals, may give a total of $20,000 to as many people as they want every year without reporting it to the IRS.

Do you have to report a gift of $10,000?

However, if a $10,000 or $20,000 gift is made in cold cash, the recipient will be required to complete a currency transaction report--and then only if she tries to deposit it in the bank in one lump sum.

Does Medicare tax continue after Social Security?

But for wage earners in higher income brackets, the Medicare tax will continue long after the Social Security tax is satisfied. There Are Ways to Give Without Reporting It.

Can you deduct Medicare and Social Security separately?

A: Many employers are separately itemizing payroll deductions for Social Security and Medicare, rather than lumping them together as a single Social Security deduction. Why? Because beginning this year, Medicare taxes will be assessed on earnings up to $125,000 per year, nearly twice the $53,400 subject to Social Security taxes.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

What deductions are on pay stubs?

Common pay stub deductions include federal and state income tax, as well as Social Security. These federal and state withholdings account for much of the difference between your gross income and net income. There may be other deductions as well, depending on the programs that you sign up for with your employer.

What is a paycheck stub?

A paycheck stub summarizes how your total earnings were distributed. The information on a paystub includes how much was paid on your behalf in taxes, how much was deducted for benefits, and the total amount that was paid to you after taxes and deductions were taken.

What taxes are deducted from paycheck?

In a payroll period, the taxes deducted from a paycheck typically include Social Security and Medicare taxes , otherwise known as FICA (Federal Insurance Contributions Act). The following taxes and deductions are what you can expect to see on your paycheck, explained in detail below.

What is withholding on a paycheck?

Withholding refers to the money that your employer is required to take out of your paycheck on your behalf. This includes federal and state income tax payments, Social Security, Unemployment Insurance, and Worker’s Comp.

How often do you have to get paychecks in Colorado?

Colorado state law, for example, requires that employees recieve paystubs from their employers at least once a month, which must list gross and net wages, as well as all deductions. Learn more about US paycheck law by state.

What is employer paid benefits?

Employer Paid Benefits. This is the portion of your benefits paid by your employer, not deductions from your earnings.

How much money is withheld from federal taxes?

The amount of money withheld for federal taxes depends on the amount of money that you earn and the information that you gave your employer when you filled out a W-4 form, or Employee’s Withholding Allowance Certificate.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.

What is periodic payment?

The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is the ACA premium tax rate?

It works out to a rate of 0.9%, and employers do not have to match it, but it's not applicable to all taxpayers.

When does Medicare tax apply?

All income is subject to Medicare taxation, but the Additional Medicare Tax does not apply until after your income reaches a certain threshold: $200,000 for individual taxpayers in 2021 and 2022. 3 1

What are the deductions on W-2?

Most W-2 employees' pay stubs detail the taxes and deductions that are taken from their gross pay. You'll almost certainly see two items among these deductions, in addition to federal and state or local income taxes: Social Security and Medicare taxes.

What is the purpose of FICA tax?

The bulk of the FICA tax revenue goes to funding the U.S. government's Social Security trusts. These trusts are solely designated to fund the programs administered by the Social Security Administration, including: Retirement benefits. Survivor benefits.

How are FICA taxes paid?

How FICA Taxes Are Paid. You, the employee, pay half the FICA taxes, which is what you see deducted on your pay stub. Your employer must match these amounts and pay the other half to the government separately at regular intervals. 1 2.

Where does FICA money go?

The remainder of FICA tax money collected from your paycheck and from your employer goes to the Medicare program, which funds healthcare costs for older people and younger Americans with disabilities. The Medicare taxes collected from current wage earners and their employers are used to pay for hospital and medical care costs incurred by current Medicare beneficiaries. Any excess tax revenue is accounted for in a designated Medicare trust fund.

Can you deduct Medicare taxes from your paycheck?

An Additional Medicare Tax can be deducted from some employees’ pay as well. After federal and state income taxes, Social Security and Medicare, or FICA taxes, make up the bulk of taxes that are routinely withheld from your paychecks.

What are the items on a pay stub?

Additional Items that May Appear on Your Paycheck Stub 1 Insurance Deductions: Monthly payments for such types of insurance as health (medical and dental), and life insurance. 2 Retirement Plan Contributions: Plans such as 401 (K) or 403 (B) retirement savings plans. 3 Leave Time: Including vacation hours or sick hours. Most employers will detail how many hours have been used to date and how many hours are remaining for the calendar year. 4 Childcare Assistance: If offered by your employer, this amount may appear on each paycheck as a pre-tax benefit. 5 Important Notices: Employers often use a portion of the paycheck stub to communicate important pieces of information to their employees such as wage increases or notifications about tax filings.

Why do employers use paycheck stubs?

Important Notices: Employers often use a portion of the paycheck stub to communicate important pieces of information to their employees such as wage increases or notifications about tax filings.

What is the other part of your paycheck called?

But if you find yourself living paycheck to paycheck and need to improve your money management skills, you need to pay close attention to the other perforated portion of your paycheck, called the paycheck stub (also known as the explanation statement.)

What does a year to date paycheck stub show?

Year-to-date (for pay and deductions): The year-to-date fields on your paycheck stub show how much you have paid toward a particular withholding at any point in the calendar year. This can be useful when budgeting for monthly expenses or long-term goals.

How often is a pay period?

A pay period is determined by your employer , but is typically weekly, bi-weekly (every two weeks), semi-monthly (twice per month), or monthly. This figure does not factor in tax withholdings. Net Pay: Includes the amount of income that you actually take home after all withholdings have been applied.

What happens if your retirement plan is not calculated correctly?

If a calculation is incorrect, the issue may reappear on every paycheck. Also, you may not be making the best choice for a retirement plan contribution, or losing money if your earnings are not calculated properly. It is ultimately your responsibility to ensure that you are being properly compensated.

What is an insurance deduction?

Insurance Deductions: Monthly payments for such types of insurance as health (medical and dental), and life insurance.

What is included in a pay stub?

Your pay stub contains three main sections: how much you are being paid, the taxes you are paying, and any other deductions that are being made. Of these sections, the deductions relating to taxes (particularly FICA) are generally the most confusing. Other common deductions are for different types of insurance, such as life, medical, and dental, ...

What is the first thing on your pay stub?

The amount you are being paid for the current pay period —whether it's weekly, biweekly, twice monthly, or monthly—generally comes first on your pay stub and is the most straightforward figure to understand.

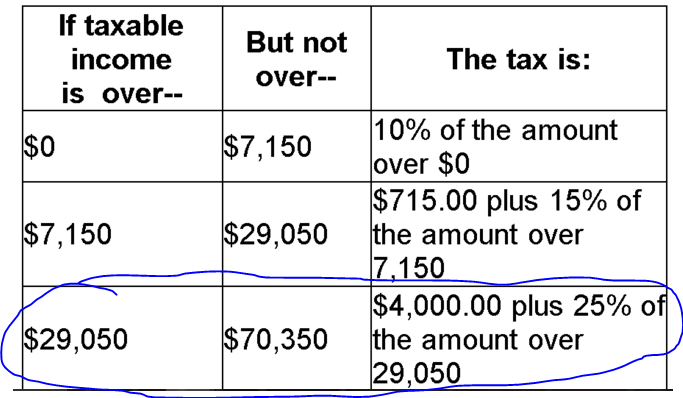

How to calculate federal tax?

The basic calculation is this: Your employer reports your annual salary as well as the number of dependents you report on your W-4 form to the federal government. The Internal Revenue Service (IRS) then works out an estimate of how much federal income tax you should pay for a given year and divides this by the number of paychecks you will receive (generally 12, 24, or 26). They will then deduct this amount from each paycheck. The same process applies to hourly employees—if you are paid hourly, your employer will estimate your monthly income, and you will have a percentage of your pay withheld for federal income tax. 3

How much tax do you pay if you are self employed?

Just as with Social Security, you must pay both portions if you’re self-employed. 5. If you’re self-employed, then you have to pay a self-employment tax of 15.3%. This figure derives from FICA taxes—12.4% for Social Security and 2.9% for Medicare. 7.

Why is it important to research every obscure term on your pay stub?

Because of variations like these, it’s difficult to give a complete overview of what will appear on everyone’s pay stub. Therefore, it’s important to research every obscure term that appears on your stub to make sure you understand what it means and why it’s there. If you have questions about any terms, the best place to start is with your HR department. The IRS has also created a glossary of tax terms to help out. 10

Why is it so hard to get a pay stub?

This is often the most complicated part of a pay stub because of the variety of taxes that different people have to pay. The amount of taxes you pay depends largely on where you live, how many dependents you have, and where you are paid.

What do you see in the hourly pay section?

If you work by the hour, your hourly rate and the number of hours you worked for the pay period will be listed. You may also see overtime hours. If you earn an annual salary, you'll see your salary for the pay period and possibly bonuses.

What are the parts of a pay stub?

The Parts of Your Pay Stub. 1. Period Start/End. This is important because it determines how the other numbers are calculated. Typically, if you are a salaried worker, this range will be over a month. If you’re an hourly employee, then this date will be over a week or 2 weeks, depending on your company’s pay period.

What happens if you take out too much tax on a nurse pay stub?

If too much tax is taken out, then you will get a big refund and if too little is taken out, you will potentially owe taxes. Reader Favorites.

What is a flex spending plan?

HSA and flex are accounts that you contribute your pre-taxed money (i.e., money that has not been taxed) for healthcare-related expenses.

How long does it take to get an hourly pay check?

If you’re an hourly employee, then this date will be over a week or 2 weeks, depending on your company’s pay period.

What is Social Security payment?

Payment into the social security system. The employee puts in 6.2% of their gross income into the system, and the employer matches it and also pays into the system ( source ). Social security provides benefits to current recipients such as retired workers who also paid into the system ( source ). 8.

What happens if you get paid twice a month?

Example: if you get paid twice a month, your premium would be divided by two and that amount will come out each pay period.

How to calculate salary per year?

If you’re on salary, then it would be your salary per year divided by the number of pay periods you have in a given year.

How does Social Security determine Medicare surcharges?

The Social Security Administration determines your Medicare surcharges based on your modified adjusted gross income (MAGI) from two years ago.

How to avoid Medicare surcharges?

You might be able to avoid paying some of the Medicare surcharges by enrolling in a Medicare Advantage plan (Part C) or a Medigap policy. Most people are better off having one of these policies to close the Medicare coverage gaps. Work with a professional to create a cost-effective plan if you only enroll in Original Medicare.

Why did Medicare never reach my pocket?

You watched as somewhere around 15% of your paycheck never reached your pocket, because the federal government took it for Social Security and Medicare payments. 1.

How much does Medicare cost for retirees?

That drives monthly healthcare costs higher, but for most people, standard Medicare costs just $148.50 per month. For your Part B premiums, the federal government—thanks in part to your decades of deductions—pays 75% of the cost.

How much extra do you pay for a part B?

Paying extra is something you might be able to avoid, but there’s good news hidden in these extra charges. First, here’s how the charges break down: If you’re married and make $176,000 to $222,000 jointly or $88,000 to $111,000 as an individual, you’ll pay an extra $59.40 monthly for Part B and $12.30 extra for Part D.

Does Medicare cover all of your medical expenses?

Once you reach retirement, you’re a little more accepting of those decades of deductions, because you'll receive full health insurance at next to no cost—especially compared to what you may have paid while you were working. To be fair, Original Medicare alone likely isn’t enough to cover all of your healthcare needs.

Can you pay Medicare surcharges next year?

, You may pay this year but not next year Because surcharges are determined yearly.