How do coordination of benefits work?

Coordination of benefits (COB) COB works, for example, when a member's primary plan pays normal benefits and the secondary plan pays the difference between what the primary plan paid and the total allowed amount, or up to the higher allowed amount.

What does no coordination of benefits mean?

What does that mean? A. Non-duplication of benefits means that the secondary plan will not pay any benefit if the primary plan paid the same or more than what the secondary plan allows.Nov 19, 2019

How do I update my Medicare Coordination of benefits?

Call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627. TTY users can call 1-855-797-2627. Contact your employer or union benefits administrator. These situations and more are available at Medicare.gov/supple- ments-other-insurance/how-medicare-works-with-other-insurance.

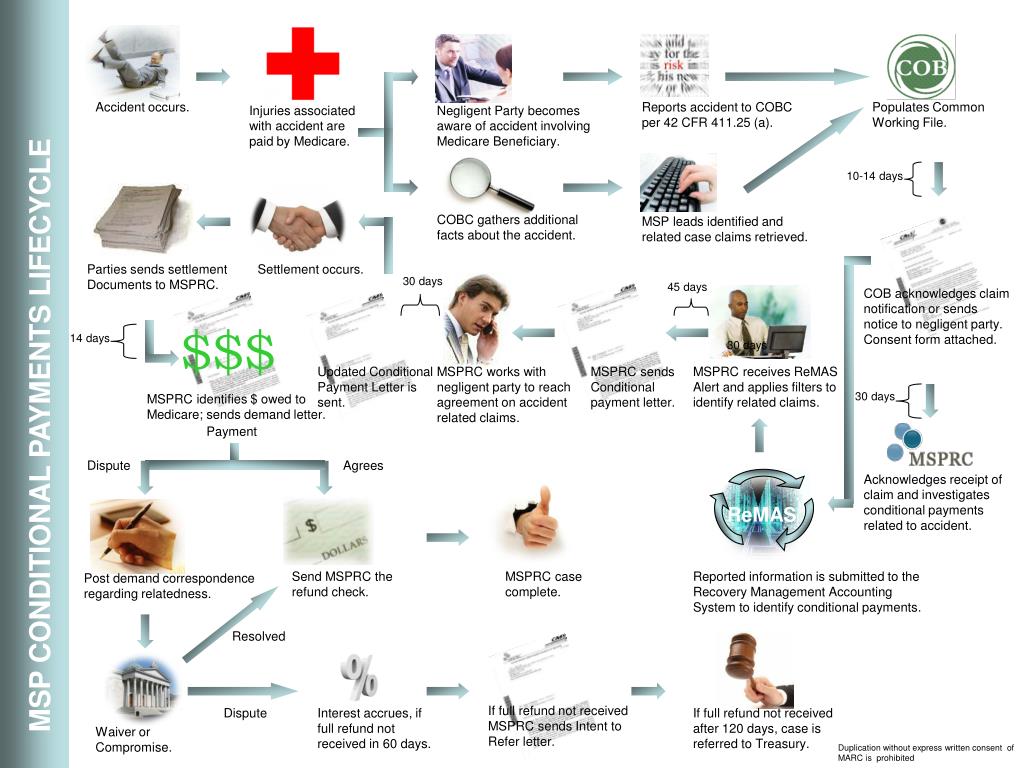

What is Medicare Secondary Payer Recovery?

§ 1395y(b)(7)&(8). a Medicare beneficiary for the purpose of preventing the mistaken payment of Medicare benefits. The Medicare Secondary Payer Recovery Contractor (“MSPRC”) protects the Medicare Trust Funds by recovering payments Medicare has made when another entity in fact had primary payment responsibility.

How is Medicare considered in determining coordination of benefits?

Coordination of benefits (COB) allows plans that provide health and/or prescription coverage for a person with Medicare to determine their respective payment responsibilities (i.e., determine which insurance plan has the primary payment responsibility and the extent to which the other plans will contribute when an ...Dec 1, 2021

What are the different types of coordination of benefits?

Understanding How Insurance Pays: Types of Coordination of Benefits or COBTraditional. ... Non-duplication COB. ... Maintenance of Benefits. ... Carve out. ... Dependents. ... When Does Secondary Pay? ... Allowable charge. ... Covered amount.

How do you calculate coordination of benefits?

Calculation 1: Add together the primary's coinsurance, copay, and deductible (member responsibility). If no coinsurance, copay, and/or deductible, payment is zero. Calculation 2: Subtract the COB paid amount from the Medicaid allowed amount. When the Medicaid allowed amount is less than COB paid, the payment is zero.

Do you have to coordinate benefits?

It is common for employees to be covered by more than one group insurance plan. This is typically achieved through a spouse or common-law partner's plan. When an individual is covered by more than one plan, coordination of benefits becomes a requirement to ensure everything runs smoothly between the two plans.Jul 28, 2020

Is Medicare primary or secondary to group insurance?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Does Medicare Secondary cover primary copays?

Medicare is often the primary payer when working with other insurance plans. A primary payer is the insurer that pays a healthcare bill first. A secondary payer covers remaining costs, such as coinsurances or copayments.

How do I access my Medicare Secondary Payer Recovery Portal?

This Web site can be accessed from the link: www.Medicare.gov. The beneficiary will enter their established Login ID and Password for that application in the Secure Sign In section of the web page.Dec 1, 2021

How far back can Medicare recoup payments?

3 calendar yearsFor Medicare overpayments, the federal government and its carriers and intermediaries have 3 calendar years from the date of issuance of payment to recoup overpayment. This statute of limitations begins to run from the date the reimbursement payment was made, not the date the service was actually performed.Jan 4, 2017

How to contact BCRC?

When to contact the BCRC: 1 To report employment changes, or any other insurance coverage information. 2 To report a liability, auto/no-fault, or workers’ compensation case. 3 To ask a general MSP question. 4 To ask a question regarding the MSP letters and questionnaires (i.e. Secondary Claim Development (SCD) questionnaire.) For more information, click the Reporting Other Health Insurance link.

What is the COB process?

The COB Process: Ensures claims are paid correctly by identifying the health benefits available to a Medicare beneficiary, coordinating the payment process, and ensuring that the primary payer, whether Medicare or other insurance, pays first. Shares Medicare eligibility data with other payers and transmits Medicare-paid claims to supplemental ...

What is BCRC in Medicare?

Benefits Coordination & Recovery Center (BCRC) - The BCRC consolidates the activities that support the collection, management, and reporting of other insurance coverage for beneficiaries. The BCRC takes actions to identify the health benefits available to a beneficiary and coordinates the payment process to prevent mistaken payment of Medicare benefits. The BCRC does not process claims, nor does it handle any GHP related mistaken payment recoveries or claims specific inquiries. The Medicare Administrative Contractors (MACs), Intermediaries and Carriers are responsible for processing claims submitted for primary or secondary payment.

What is a COB?

COB relies on many databases maintained by multiple stakeholders including federal and state programs, plans that offer health insurance and/or prescription coverage, pharmacy networks, and a variety of assistance programs available for special situations or conditions. Some of the methods used to obtain COB information are listed below:

What is a 111?

Section 111 of the Medicare, Medicaid, and SCHIP Extension Act of 2007 (MMSEA) – This law added mandatory reporting requirements for Group Health Plan (GHP) arrangements and for liability insurance, including self-insurance, no-fault insurance, and workers' compensation. Insurers are legally required to provide information.

What is Medicare investigation?

The investigation determines whether Medicare or the other insurance has primary responsibility for meeting the beneficiary's health care costs. Collecting information on Employer Group Health Plans and non-group health plans (liability insurance ...

What is CWF in insurance?

The CWF is a single data source for fiscal intermediaries and carriers to verify beneficiary eligibility and conduct prepayment review and approval of claims from a national perspective. It is the only place in the fee for service claims processing system where full individual beneficiary information is housed.

3. Send Consent to Release or Proof of Representation

If a medicare beneficiary wishes to allow Medicare to disclose information to someone else, they need to send MSPRC either (1) a Consent to Release or (2) Proof of Representation.

4. Medicare Will Send Out a Conditional Payment Letter

This letter should say how money Medicare has paid. Remember, Medicare calls this money “conditional payments.”

5. Send Medicare Final Settlement Details

Medicare needs the following information before it can finally close out a case: