Here are the Part A coinsurance amounts for 2020:

- Days 1 – 60: $0

- Days 61 – 90: $352

- Days 90 – lifetime reserve days: $704 per day until you have used up your lifetime reserve days (you get 60 lifetime reserve days over the course of your life); ...

- Skilled nursing facility coinsurance: $176

How many days will Medicare pay for rehab?

Nov 08, 2019 · In 2020, beneficiaries must pay a coinsurance amount of $352 per day for the 61 st through 90 th day of a hospitalization ($341 in 2019) in a benefit period and $704 per day for lifetime reserve days ($682 in 2019). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be …

What is Medicare coinsurance amount?

Jan 19, 2020 · The 2020 rates for coinsurance reflect an increase over 2019 by $11 per day for hospitalization from days 61 through day 90 and an increase of $22 for each day that a lifetime reserve day is used. While these aren’t tremendous increases, they can add up over time.

Are there deductibles for Medicare?

Nov 29, 2021 · Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items.

How to check Medicare deductible?

Medicare coinsurance is the share of the medical costs that you pay after you’ve reached your deductibles. ... Last medically reviewed on April 24, 2020. 6 sources collapsed.

What is the Medicare coinsurance amount for 2022?

Daily Coinsurance Costs for Medicare Part A in 2022 You pay $0 coinsurance for first 20 days and $194.50 for days 21 to 100. You are responsible for all costs from day 101 and beyond.

What is the coinsurance for Medicare Part B?

Coinsurance is when you and your health care plan share the cost of a service you receive based on a percentage. For most services covered by Part B, for example, you pay 20% and Medicare pays 80%.

Is there coinsurance for Medicare?

Coinsurance refers to a percentage of the Medicare-approved cost of your health care services that you're expected to pay after you've paid your plan deductibles. For Medicare Part A (inpatient coverage), there's no coinsurance until you've been hospitalized for more than 60 days in a benefit period.

What is the Medicare Part A coinsurance rate for 2020?

Part A Deductible and Coinsurance Amounts for Calendar Years 2020 and 2021 by Type of Cost Sharing20202021Daily coinsurance for 61st-90th Day$352$371Daily coinsurance for lifetime reserve days$704$742Skilled Nursing Facility coinsurance$176.00$185.501 more row•Nov 6, 2020

Who is responsible for coinsurance?

Let's say your health insurance plan's allowed amount for an office visit is $100 and your coinsurance is 20%. If you've paid your deductible: You pay 20% of $100, or $20. The insurance company pays the rest. If you haven't met your deductible: You pay the full allowed amount, $100.

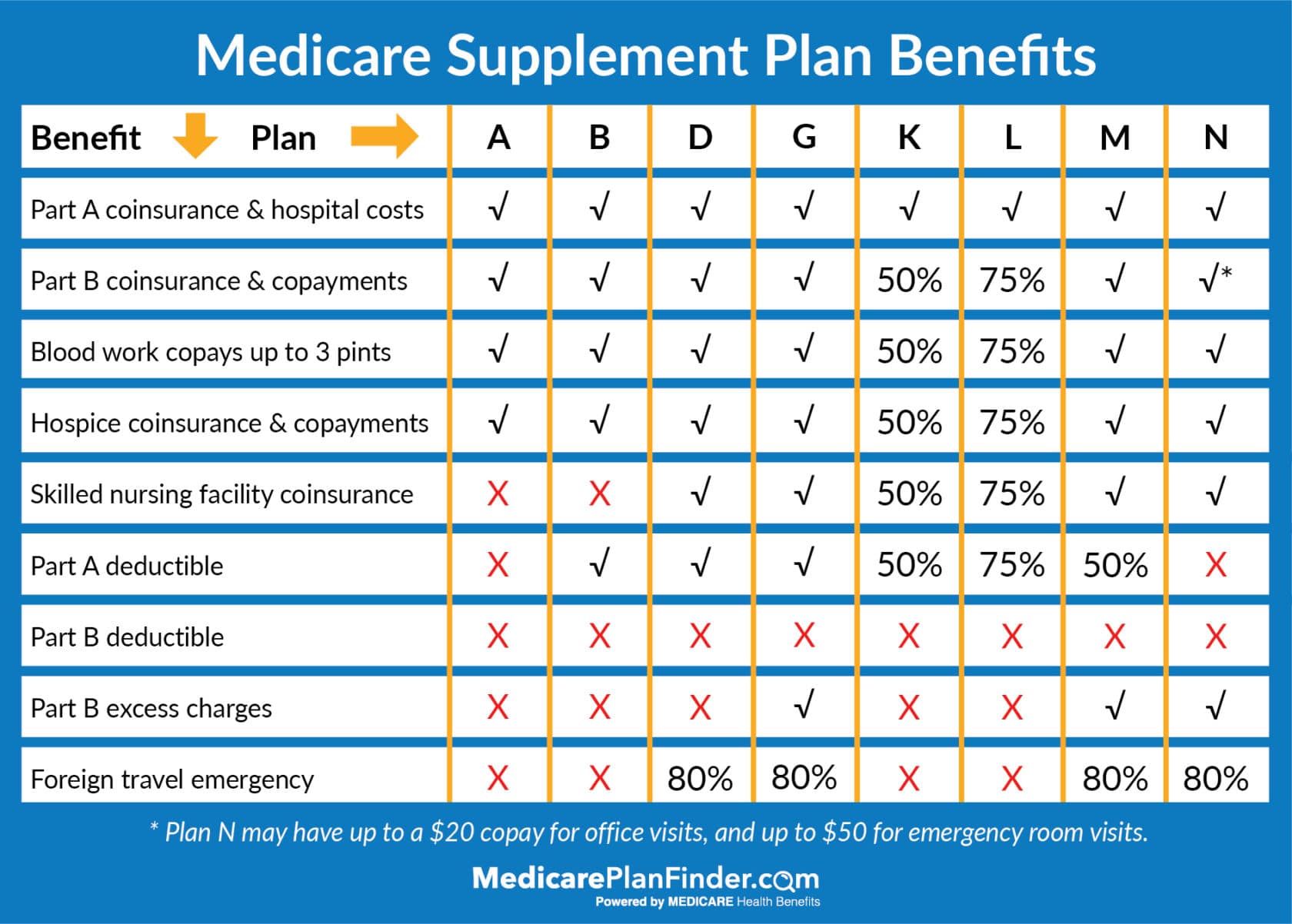

Does Medigap cover Part B coinsurance?

All Medigap plans provide Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted. Medicare Part B coinsurance or copayment are fully provided by Plans A, B, C, D, F, G, M, and N.Sep 1, 2021

Does AARP pay Medicare coinsurance?

AARP Medicare Supplement Plan A It covers 100% of the following benefits: Coinsurance payments for inpatient hospital care (After you've used up your Part A benefits, Plan A will cover up to 365 additional days.)Jan 4, 2022

Does AARP cover Medicare coinsurance?

Like all Medigap plans, AARP plans are designed to cover some of the gaps in Medicare coverage, such as copays, coinsurance, and deductibles. Each plan varies in terms of coverage and cost.

What are the Irmaa for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

What changes are coming to Medicare in 2021?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.Nov 22, 2021

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What are 2021 Medicare premiums?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much is coinsurance for 2020?

When considering the increase in coinsurance amounts, you’ll also need to factor in premium increases. In 2020, your last tax return and filing status will determine the bracket in which you are placed. For many individuals, married or not, the monthly premium required in order to maintain Medicare coverage is $144.60, but it can reach as high as $491.60 per month. Deductible rates are also on the rise in 2020 as most Medicare members will see an increase of around $13 that needs to be met prior to benefits applying to healthcare costs. Once again, this is where it pays to discuss your individual situation with a Medicare expert who can explain your options and possibly point you in the direction of plans that make sense for your financial and healthcare needs.

What changes will Medicare see in 2020?

Medicare recipients in 2020 will see some changes to the way that Medicare structures its financial requirements, and this includes the recipient’s co-insurance liability . If you depend on Medicare for healthcare, contact your plan manager to discuss your current and anticipated healthcare needs so that you can fully understand how changes in 2020 ...

What is coinsurance in insurance?

Coinsurance is the fee that is passed on to the recipient after a deductible has been met and premiums are current. This differs from a co-payment in that co-pays are generally flat fees that stay the same regardless of deductible or premium amounts.

How much is coinsurance for hospitalization?

Afterward, for an additional 30 days, the recipient will be charged a coinsurance amount of $352 per day.

Can you take advantage of additional savings with Medicare?

Additional Savings May Be Available. If you’re having a hard time meeting your financial obligations to Medicare for coverage, you may be able to take advantage of additional savings through dual-enrollment with Medicaid.

How much is Medicare Part B 2021?

Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth of Part B-covered services for the year. After reaching his Part B deductible, the remaining $97 of his bill is covered in part by Medicare, though John will be required to pay a coinsurance cost. Medicare Part B requires beneficiaries ...

What percentage of Medicare coinsurance is covered by Part B?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items. The Medicare-approved amount is a predetermined amount ...

What is a copayment in Medicare?

Copayment, or copay, is another term you’ll see used in relation to Medicare cost-sharing . A copay is like coinsurance, except for one difference: While coinsurance typically involves a percentage of the total medical bill, a copayment is generally a flat fee. For example, Part B of Medicare uses coinsurance, which is 20 percent in most cases.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are optional plans sold by private insurers that offer some coverage for certain out-of-pocket Medicare costs , such as coinsurance, copayments and deductibles.

What is the most important thing to know about Medicare?

There are a number of words and terms related to the way Medicare works, and one of the most important ones to know is coinsurance.

Does Medicare Advantage include coinsurance?

Medicare Advantage plans typically include coinsurance. Many Medicare beneficiaries choose to get their benefits through a privately-sold Medicare Advantage plan (Medicare Part C), which provides the benefits of Original Medicare combined into one plan.

Does Medigap cover coinsurance?

In exchange for paying a monthly premium to belong to the plan, a Medigap plan can help cover the cost of your Medicare coinsurance and/or your deductibles. If John from our above example had a Medigap plan that covered his Part B deductible and coinsurance, he may have owed nothing for his doctor’s appointment.

How much will Medicare pay in 2021?

If you have Medicare Part A and are admitted to a hospital as an inpatient, this is how much you’ll pay for coinsurance in 2021: Days 1 to 60: $0 daily coinsurance. Days 61 to 90: $371 daily coinsurance. Day 91 and beyond: $742 daily coinsurance per each lifetime reserve day (up to 60 days over your lifetime)

How much is Medicare Part B coinsurance?

With Medicare Part B, after you meet your deductible ( $203 in 2021), you typically pay 20 percent coinsurance of the Medicare-approved amount for most outpatient services and durable medical equipment.

What is Medicare supplement?

Medicare supplement or Medigap plans cover various types of Medicare coinsurance costs. Here’s a breakdown of what Medigap plans cover in terms of Part A and Part B coinsurance. Plan A and Plan B cover: Part A coinsurance and hospital costs up to 365 days after you’ve used up your Medicare benefits. Part A hospice coinsurance.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is coinsurance in Medicare?

Coinsurance. Unlike flat-fee copays, coinsurance is a percentage of the price of service you’ll pay. For example, after you have paid the Medicare Part B (medical insurance) deductible for the year ($198 in 2020), you will be required to pay 20 percent of each service covered by Part B, and Medicare pays the remaining 80 percent.

How much is Medicare coinsurance?

For Medicare Part A (hospital insurance), coinsurance is a set dollar amount that you pay for covered days spent in the hospital. Here are the Part A coinsurance amounts for 2020: Days 1 – 60: $0. Days 61 – 90: $352. Days 90 – lifetime reserve days: $704 per day until you have used up your lifetime reserve days ...

What is the copay for Part D?

Copays in Part D are when you pay a flat fee (for example, $10) for all drugs in a certain tier. Generic drugs usually have a lower copay amount than brand-name drugs. Coinsurance in Part D means that you pay a percentage of the drug’s cost (for example, 25 percent). Catastrophic coverage in Part D for 2020 is $6,350.

How much can you pay out of pocket with Medicare?

Original Medicare – No out-of-pocket limit. Medicare Advantage – No Medicare Advantage plan can have a maximum out-of-pocket limit higher than $6,700, but many plans charge the full $6,700 amount. Medigap – Some Medigap plans pay the Part A deductible and coinsurance so that your out-of-pocket costs don’t get too high.

What is the maximum out of pocket limit for healthcare?

The maximum out-of-pocket limit (MOOP) is the dollar amount beyond which your plan will pay for 100 percent of your healthcare costs. Copays and coinsurance payments go toward this limit, but monthly premiums do not. The 2020 maximum out-of-pocket limits are:

How long does Medicare Part A benefit last?

A benefit period in Part A begins on the first day you are admitted to the hospital and ends after you have spent 60 consecutive days out of the hospital . Some Medicare Advantage and Part D prescription drug plans come with an annual deductible as well. Check with your individual plan to find out.

How much is catastrophic coverage for 2020?

Catastrophic coverage in Part D for 2020 is $6,350. Once you pay this amount out of pocket, you will pay the copay on your prescription drugs, or 5 percent coinsurance, whichever is greater. Read your benefits summary carefully to see how your plan handles copays, coinsurance, and deductibles so you won’t be hit with any surprises.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.